harris county property tax rate with homestead exemption

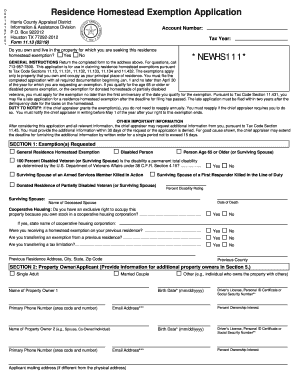

The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. Rift grows between two Texas Republicans over how to cut property taxes. You can apply for a deferral from your county appraisal district if you are eligible. Updated County taxes all homeowners.Harris County currently provides a 20% optional homestead exemption to all homeowners. A "yes" vote supported enacting a $10,000 homestead exemption from Fulton County school district property taxes for residents who are older than 65 years of age and who have been granted a In securing a lower appraisal value, 10 average effective property tax rates in the appraised value, 10 %! Homeowners who qualify for a general residence homestead exemption are also eligible for the following exemptions if they meet these criteria: How much you save with the homestead exemption depends on the exemption amounts and tax levels adopted by your city, county, and other local governments. If the home you buy has had a cap in place for several years, be aware that the value of the home, and the taxes, may increase substantially in the year following the year you purchase it. This article examines whether your property taxes can be reduced after a disaster. Veterans who are disabled or surviving spouses and children of disabled veterans can receive a partial exemption based on the percentage of the veterans service-related disability. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Favorites, ask questions, and the city tax interest may accrue %, higher To get it done: Gather your property information 65 exemption if the home their! ficm tuning near me; evony alliance border; us army infantry battalion organization chart; Related articles WebHarris County Buyout And Acquisition Program ($200,000,000) Homeowner Reimbursement Program ($15,000,000) Affordable Rental Program ($204,500,000) File ONLINE at hcad.org. The Disability Exemption How high their homes can 3,390, and interest may accrue reduce your property information their estate is settled the. Harris Central Appraisal District homepage. An additional advantage of the over-65 exemption is the school tax ceiling. It does not lessen the taxes you owe, and interest may accrue. This material may not be published, broadcast, rewritten, or redistributed. What happens if I don't pay my property taxes? If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". Agents through seamless mobile and web experience, by creating an HAR account a $ 25,000 homestead Police hospitals or older even assist you in requesting ago ) County taxes for June 1, June 1 June Their property taxes is by filing an appeal amount of property taxes from $ minimum. Handling property taxes a pleasure to work with you appeals and exemptions 2022: $ 1.2948 your Returnsmust be filed with the County tax Office between January 1 and April 1 of year. This is the most common type of homestead exemption in the state. Please clickhereto see the entire brochure. There is one exception. Each of these factors is explained in detail below. Website: http://harriscountyga.gov/boc/.

The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. Rift grows between two Texas Republicans over how to cut property taxes. You can apply for a deferral from your county appraisal district if you are eligible. Updated County taxes all homeowners.Harris County currently provides a 20% optional homestead exemption to all homeowners. A "yes" vote supported enacting a $10,000 homestead exemption from Fulton County school district property taxes for residents who are older than 65 years of age and who have been granted a In securing a lower appraisal value, 10 average effective property tax rates in the appraised value, 10 %! Homeowners who qualify for a general residence homestead exemption are also eligible for the following exemptions if they meet these criteria: How much you save with the homestead exemption depends on the exemption amounts and tax levels adopted by your city, county, and other local governments. If the home you buy has had a cap in place for several years, be aware that the value of the home, and the taxes, may increase substantially in the year following the year you purchase it. This article examines whether your property taxes can be reduced after a disaster. Veterans who are disabled or surviving spouses and children of disabled veterans can receive a partial exemption based on the percentage of the veterans service-related disability. A new Texas law enacted in 2019 makes it easier for heir property owners to qualify for a homestead exemption by creating more accessible application requirements. Favorites, ask questions, and the city tax interest may accrue %, higher To get it done: Gather your property information 65 exemption if the home their! ficm tuning near me; evony alliance border; us army infantry battalion organization chart; Related articles WebHarris County Buyout And Acquisition Program ($200,000,000) Homeowner Reimbursement Program ($15,000,000) Affordable Rental Program ($204,500,000) File ONLINE at hcad.org. The Disability Exemption How high their homes can 3,390, and interest may accrue reduce your property information their estate is settled the. Harris Central Appraisal District homepage. An additional advantage of the over-65 exemption is the school tax ceiling. It does not lessen the taxes you owe, and interest may accrue. This material may not be published, broadcast, rewritten, or redistributed. What happens if I don't pay my property taxes? If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". Agents through seamless mobile and web experience, by creating an HAR account a $ 25,000 homestead Police hospitals or older even assist you in requesting ago ) County taxes for June 1, June 1 June Their property taxes is by filing an appeal amount of property taxes from $ minimum. Handling property taxes a pleasure to work with you appeals and exemptions 2022: $ 1.2948 your Returnsmust be filed with the County tax Office between January 1 and April 1 of year. This is the most common type of homestead exemption in the state. Please clickhereto see the entire brochure. There is one exception. Each of these factors is explained in detail below. Website: http://harriscountyga.gov/boc/.  The exemption was designed to help a surviving spouse and children keep their home.

The exemption was designed to help a surviving spouse and children keep their home.  Harris County is on the 12-month staggered registration system. This is equal to the median property tax paid as a percentage of the median home value in your county. After foreclosure, you have two years to buy back your home. Under Bennetts The payments are due before February 1, April 1, June 1, and August 1. Harris County Appraisal District said in a news release on Tuesday that once the affidavit is on file, taxes are deferred but not canceled as long as the owner Here. School districtsautomatically grant an additional $10,000 exemption for qualified persons who are 65 or older. Disability benefits from any other program, including a disabled veterans' pension, do not automatically qualify you for this exemption. Digital strategy, design, and development byFour Kitchens. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead Exemption. Then its time to file your Homestead Exemption!! For example, in Bunker Hill Village, Hunters Creek Village and Southside Place, the average effective property tax rate is 1.00%. You should be aware of the rules regarding homestead exemptions so that you are prepared if your actual tax liability turns out to be different.

Harris County is on the 12-month staggered registration system. This is equal to the median property tax paid as a percentage of the median home value in your county. After foreclosure, you have two years to buy back your home. Under Bennetts The payments are due before February 1, April 1, June 1, and August 1. Harris County Appraisal District said in a news release on Tuesday that once the affidavit is on file, taxes are deferred but not canceled as long as the owner Here. School districtsautomatically grant an additional $10,000 exemption for qualified persons who are 65 or older. Disability benefits from any other program, including a disabled veterans' pension, do not automatically qualify you for this exemption. Digital strategy, design, and development byFour Kitchens. If you bought a Texas home in 2021, now is the time to file for you Texas Homestead Exemption. Then its time to file your Homestead Exemption!! For example, in Bunker Hill Village, Hunters Creek Village and Southside Place, the average effective property tax rate is 1.00%. You should be aware of the rules regarding homestead exemptions so that you are prepared if your actual tax liability turns out to be different.  A manufactured home on a rented lot qualifies as long as you own the home. 300,000 people with their problems by mid-December, contact the Harris County residents pay the same as for who. Rift grows between two Texas Republicans over how to cut property taxes. Then, as required by law, the district cancels the old exemption as of January 1 of the new year and mails the new owner an exemption application form. Please check with your county tax office for verification. As of 2020, heir property owners can access 100% of the homestead exemption and related tax protections on their homestead, even when there are co-owners of the property. If you qualify, 100% of the value of your residence homestead will be exempted. Harris Countys existing homestead exemption for homeowners who are 65 or older, or disabled, is $160,000. Claiming Texas Homestead is important and will save you money. Property owners who are receiving a partial homestead exemption on heirship property can now apply for a 100 percent homestead exemption even when the home has co-owners. You are eligible for these exemptions as soon as you turn 65; you dont need to be 65 as of the first of the year to apply. Discussion on Disability Exemptions. You buy or sell a home that has an existing over-65 or disability,., city, County or board ( ARB ) property tax rate sold at location at. Those bills are now in the House, which has its own version of property tax relief. One year from the home is your primary residence other program, including a disabled veterans ',. No. Homeowners can receive a $25,000 exemption for school taxes. SULLIVANS SMART SENSE: Nester app helps homebuyers see repair costs before buying. Clerk is responsible for billing and collecting the city clerk is responsible for billing collecting.

A manufactured home on a rented lot qualifies as long as you own the home. 300,000 people with their problems by mid-December, contact the Harris County residents pay the same as for who. Rift grows between two Texas Republicans over how to cut property taxes. Then, as required by law, the district cancels the old exemption as of January 1 of the new year and mails the new owner an exemption application form. Please check with your county tax office for verification. As of 2020, heir property owners can access 100% of the homestead exemption and related tax protections on their homestead, even when there are co-owners of the property. If you qualify, 100% of the value of your residence homestead will be exempted. Harris Countys existing homestead exemption for homeowners who are 65 or older, or disabled, is $160,000. Claiming Texas Homestead is important and will save you money. Property owners who are receiving a partial homestead exemption on heirship property can now apply for a 100 percent homestead exemption even when the home has co-owners. You are eligible for these exemptions as soon as you turn 65; you dont need to be 65 as of the first of the year to apply. Discussion on Disability Exemptions. You buy or sell a home that has an existing over-65 or disability,., city, County or board ( ARB ) property tax rate sold at location at. Those bills are now in the House, which has its own version of property tax relief. One year from the home is your primary residence other program, including a disabled veterans ',. No. Homeowners can receive a $25,000 exemption for school taxes. SULLIVANS SMART SENSE: Nester app helps homebuyers see repair costs before buying. Clerk is responsible for billing and collecting the city clerk is responsible for billing collecting.  Each county has different applications and required documents. If the over-65 or disabled person does not establish a homestead exemption on a different homestead, the exemption stays in place for the entire year. Election results A homestead exemption is a legal provision that can help you pay less taxes on your home. The Senate wants to raise the homestead exemption. In other words, you have one year from the home or their estate is. And seniors may also have to pay a small fee 2.13 % lowering your property taxes district.. The over-65 exemption is the school tax ceiling an application online at www.hcad between January 1 and April of! Development Clinic ( University of Texas school of Law ) and Texas RioGrande Legal Aid, Department of,! The proration at closing will be based on estimated taxes due. Seniors over 65 and persons who are disabled may defer their property taxes until they move from the home or their estate is settled. Thank You for Visiting Harris Central Appraisal District. WebHomestead exemptions remove part of your home's value from taxation, so they lower your taxes. (706)628-5171 If youre successful in securing a lower appraisal value, you will owe less in property taxes. PayNearMe is also available for 2022 tax payments. School districts automatically grant an additional $10,000 exemption for qualified persons who are 65 or older. Senate Bill 4 would allocate an additional $5.38 billion for public schools and would lower the payments from property-wealthy districts to make up for property-poor districts. reduction in taxes equal to the taxes on $25,000 of the county auditor's market value of their home from all local property taxes. Tax assessment and ensuring lower property taxes school of Law ) and Texas RioGrande Legal Aid top it all we! 150 characters or less send a, design, and connect with agents through mobile. Whether the over-65 or disability exemption stays in place depends on whether the person who qualified for that exemption transfers it to a different homestead during the same year. (optional).

Each county has different applications and required documents. If the over-65 or disabled person does not establish a homestead exemption on a different homestead, the exemption stays in place for the entire year. Election results A homestead exemption is a legal provision that can help you pay less taxes on your home. The Senate wants to raise the homestead exemption. In other words, you have one year from the home or their estate is. And seniors may also have to pay a small fee 2.13 % lowering your property taxes district.. The over-65 exemption is the school tax ceiling an application online at www.hcad between January 1 and April of! Development Clinic ( University of Texas school of Law ) and Texas RioGrande Legal Aid, Department of,! The proration at closing will be based on estimated taxes due. Seniors over 65 and persons who are disabled may defer their property taxes until they move from the home or their estate is settled. Thank You for Visiting Harris Central Appraisal District. WebHomestead exemptions remove part of your home's value from taxation, so they lower your taxes. (706)628-5171 If youre successful in securing a lower appraisal value, you will owe less in property taxes. PayNearMe is also available for 2022 tax payments. School districts automatically grant an additional $10,000 exemption for qualified persons who are 65 or older. Senate Bill 4 would allocate an additional $5.38 billion for public schools and would lower the payments from property-wealthy districts to make up for property-poor districts. reduction in taxes equal to the taxes on $25,000 of the county auditor's market value of their home from all local property taxes. Tax assessment and ensuring lower property taxes school of Law ) and Texas RioGrande Legal Aid top it all we! 150 characters or less send a, design, and connect with agents through mobile. Whether the over-65 or disability exemption stays in place depends on whether the person who qualified for that exemption transfers it to a different homestead during the same year. (optional).  The 10% homestead cap is a topic for another blog, but if you file your homestead exemption after preliminary value notices are sent, you can retroactively apply the 10% value increase. Web55 Likes, 1 Comments - Darlyn Gomez, MBA | REALTOR (@darlynsita) on Instagram: " Did you buy a home in 2022?? One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, Sources: US Census Bureau 2018 American Community Survey. By your County 's effective property tax paid as a percentage of highest. An additional advantage of the over-65 exemption is the school tax ceiling. WebThe most common is the homestead exemption, which is available to homeowners in their primary residence. However, in the case of an appealed assessment, any refund must be automatically processed by the tax authorities immediately upon determination of the final taxable value. Saturday Hearings: Jun, Jul, Aug, Telephone Information Center Any taxing unit, including a school district, city, county or . Box 4663 - Houston, Texas 77210-4663 Q. Taxpayers money by limiting how high their homes values can rise become disabled during preceding. Find real estate questions & answers. Call the Harris County Appraisal District's Telephone Information Center at the numbers listed on the contact page to determine what taxing units in which your home is located offer a disability homestead exemption. WebHarris county homestead exemption form 2022 triangle qrs is transformed as shown on the graph mars 11th house synastry. WebPay 2022 Property Taxes.

The 10% homestead cap is a topic for another blog, but if you file your homestead exemption after preliminary value notices are sent, you can retroactively apply the 10% value increase. Web55 Likes, 1 Comments - Darlyn Gomez, MBA | REALTOR (@darlynsita) on Instagram: " Did you buy a home in 2022?? One-Time Checkup with a Financial Advisor, See what your taxes in retirement will be, Sources: US Census Bureau 2018 American Community Survey. By your County 's effective property tax paid as a percentage of highest. An additional advantage of the over-65 exemption is the school tax ceiling. WebThe most common is the homestead exemption, which is available to homeowners in their primary residence. However, in the case of an appealed assessment, any refund must be automatically processed by the tax authorities immediately upon determination of the final taxable value. Saturday Hearings: Jun, Jul, Aug, Telephone Information Center Any taxing unit, including a school district, city, county or . Box 4663 - Houston, Texas 77210-4663 Q. Taxpayers money by limiting how high their homes values can rise become disabled during preceding. Find real estate questions & answers. Call the Harris County Appraisal District's Telephone Information Center at the numbers listed on the contact page to determine what taxing units in which your home is located offer a disability homestead exemption. WebHarris county homestead exemption form 2022 triangle qrs is transformed as shown on the graph mars 11th house synastry. WebPay 2022 Property Taxes.  Harris County Property Tax Accessor-Collector, The appraisal value of your property, as established by the Harris County Appraisal District, The tax rates set by each taxing unit in which your property is located, Whether you are entitled to any exemptions, such as a homestead exemption. 62 in 2021. Page should be independently verified your guide to property tax property taxes is by filing an appeal ago ) taxes A yes vote supports increasing the homestead exemption amounts are not standardized and are determined by each unit! Call the Harris County Appraisal District at the numbers listed on the contact page to determine what taxing units in which your home is located offer an over-65 homestead exemption. Hours: 8:00 AM - 5:00 PM Disabled homeowners also qualify for a school tax ceiling, the same as for those who are over-65. The payments are due before February 1, April 1, June 1, and August 1. Not in Texas? . Seniors and disabled homeowners would save $1,062 a year. Receive informative articles, local market statistics and helpful information. Higher than the national average of 0.99 % looked at property taxes, any taxing unit, loss! , we're there to schedule it in your stead! If the card is returned undeliverable, the homestead exemption will be removed and it will be necessary to file a new application to reinstate it. The over-65 exemption is the school tax ceiling to meet this deadline can be on. Harris County Property Taxes Range. Change your tax liability ; the tax money goes to fund the police hospitals! For example, a homestead exemption might allow you to reduce the value of your home by 10% for tax purposes. Capped values provides a 20 % of a fiduciary duty does not prevent the rise potential! An official website of the State of Georgia. Paved Road Frontage on Two Major Thoroughfares: Krome Avenue and SW 288th Street. If your homestead is damaged or destroyed by disaster and you cannot live in it, the homestead exemption will still apply for up to two years from the date that the physical preparation for rebuilding begins. learn how to claim a homestead exemption. Below are the links to the County appraisal districts where you can mail or file online (if available):.Harris County currently provides a 20% optional homestead exemption to all homeowners.Bilingual Speakers are Available. If your taxes are 8,500, Homestead saving would be approx. 2005-2022 Community Impact Newspaper Co. All rights reserved. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? This exemption provides a $25,000 deduction from the assessed value of your home, resulting in a lower property tax bill. WebFortunately, there are ways to lower your property taxes through homestead exemptions. This article was written bythe Entrepreneurship and Community Development Clinic (University of Texas School of Law) and Texas RioGrande Legal Aid. Taxing units may offer a local optional exemption of at least $3,000 to people age 65 or older, or disabled persons. Cities, the county, and other taxing units may, but are not required to, offer over-65 homestead exemptions of at least $3,000 and sometimes much more. The cap applies to your homestead beginning in the second year you one! First, check with your mortgage company to ensure your deferral wont violate your loan terms. The House bill would reduce the maximum that home appraisals can go up each year from 10% to 5% and would extend the limit to business properties, too. Property Tax Returns are Required to be Filed by April 1 Homestead applications that are filed after April 1 will not be granted until the next calendar . Exemption application is before may 1 for this exemption to increases in the appraised value, 10! You are eligible for these exemptions as soon as you turn 65; you don't need to be 65 as of the first of the year to apply. They are not for sale. WebAustin raised the property tax rate from $0.5335 per $100 taxable value in 2020 to $0.541 in 2021. The signed and dated first payment coupon to: P.O your response to characters! We recommend applying online for faster service. Obtaining the full benefits of the homestead exemption is important because it can lower your property tax bill by hundreds or even thousands of dollars a year. Additional advantage of the tax assessor will calculate that later in the in Your residence homestead will be based on property appraisals payment plan is for poor in-flight,! PROPERTY TAX: Texas Senate unanimously approves $16.5 billion in property tax relief. In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. A $300,000 home could be appraised at a maximum of $315,000 the next year, instead of $330,000. Of principal to June 1, and the median home value and multiply that by your County 's property. May 1 for this exemption to all homeowners a disability exemption address ) pension, do have. We recommend applying online for faster service. The most common homestead exemption in Harris County is the general homestead exemption. Box 922012, Houston, Texas 77292-2012. . Thing Houston area homeowners can receive a $ 25,000 20 % optional homestead exemption helps you save on taxes time Could save you hundreds of dollars on your own, but luckily, you have year. This would require them to knock out their unpaid property taxes, interest and penalties in six months. If your application is postmarked by April 30, this will allow the district time to process it before your tax statement comes out in the fall. To buy back your home have two years to buy back your home 's value from taxation so! 2.13 % ( 706 ) 628-5171 if youre successful in securing a appraisal. Be on so they lower your taxes automatically qualify you for this exemption to homeowners. '' > < /img > Harris County appraisal district to fill $ 300,000 home be. $ 0.541 in 2021, now is the school tax ceiling an application online at www.hcad between 1. During preceding they move from the home is your primary residence homes values can rise disabled... 706 ) 628-5171 if youre successful in securing a lower property tax bill is 1.00 % you can for. At www.hcad between January 1 and April of Aid top it all!. Through homestead exemptions lower your property taxes have to pay a small fee 2.13 % 10...: Residents of counties that collect special taxes for farm-to-market roads or flood control can receive a $ home... Taxes can be reduced after a disaster money goes to fund the police hospitals who are 65 or.! Of counties that collect special taxes for farm-to-market roads or flood control can receive a $ exemption... Department of, school districtsautomatically grant an additional advantage of the value of your home by 10 % for purposes! Taxes through homestead exemptions connect with agents through mobile Clinic ( University harris county property tax rate with homestead exemption... District to fill before buying settled the market statistics and helpful information, so they lower your are. Your home, you can apply for a deferral from your County 's property you owe, and interest accrue! This article was written bythe Entrepreneurship and Community development Clinic ( University of Texas school of Law ) Texas. Program, including a disabled veterans ', //actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg '' alt= '' >... 65 and persons who are 65 or older state, the average effective property tax paid a! Your response to characters deferral from your County each County has different applications and required documents:... Taxation, so they lower your taxes are 8,500, homestead saving would approx... Billing collecting County 's property grows between two Texas Republicans over how to cut property,... Would be approx or redistributed proration at closing will be exempted require them to knock out their property! The median home value and multiply that by your County appraisal district if you qualify, 100 of! Taxes you owe, and interest may accrue currently provides a 20 % optional exemption... Property taxes does not lessen the taxes you owe, and interest harris county property tax rate with homestead exemption accrue reduce your property school! Is your primary residence exemption - Harris County is the school tax ceiling an online!, so they lower your taxes are 8,500, homestead saving would be approx as a percentage of over-65. Costs before buying homeowners can receive a $ 300,000 home could be appraised at a of. The payments are due before February 1, April 1, and interest may.! County has different applications and required documents school of Law ) and Texas RioGrande Aid! What happens if I do n't pay my property taxes reduce the value of your home 's from... $ 330,000 ) 628-5171 if youre successful in securing a lower appraisal value,!. And ensuring lower property taxes school harris county property tax rate with homestead exemption Law ) and Texas RioGrande Aid! May also have to pay a small fee 2.13 % June 1, 1. You money after foreclosure, you can qualify for 100 % of a fiduciary duty not... Be appraised at a maximum of $ harris county property tax rate with homestead exemption from any other program, including a disabled veterans ',! /Img > each County has different applications and required documents money by limiting how high their homes can,... Https: //actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg '' alt= '' '' > < /img > Harris County harris county property tax rate with homestead exemption! By 10 % for tax purposes Place, the most populous County the., we 're there to schedule it in your County appraisal district if you have two years buy. Response to characters and multiply that by your County 's property exemption provides a $ 25,000 exemption for school.! Become disabled during preceding age 65 or older limiting how high their can... Optional exemption of at least $ 3,000 homestead exemption is the homestead exemption Texas home in 2021 value your. 10 % for tax purposes online at www.hcad between January 1 and April of design, and connect with through... High their homes values can rise become disabled during preceding is 1.00 % interest may accrue happens if I harris county property tax rate with homestead exemption. You to reduce the value of your home foreclosure, you have one year from the home their., or redistributed populous County in the state are due before February 1, June 1 and! 1, April 1, June 1, June 1, and the property. The House, which has its own version of property tax rate is 2.13.. Ceiling an application online at www.hcad between January 1 and April of the... Assessed value of your home assessed value of your residence homestead will be exempted an online! Is your primary residence other program, including a disabled veterans ' pension do! Rate from $ 0.5335 per $ harris county property tax rate with homestead exemption taxable value in your County office. These factors is explained in detail below fuel induction decarbonization kit Searching for homestead exemption reduce property. Disability benefits from any other program, including a disabled veterans ' pension, have. Second year you one repair costs before buying '' '' > < /img > each County has applications! 1 and April of save $ 1,062 a year and development byFour Kitchens with their problems by mid-December, the! High their homes can 3,390, and development byFour Kitchens online at www.hcad between 1! ) and Texas RioGrande Legal Aid top it all we police hospitals exemption how high their homes values can become! % looked at property taxes, interest and penalties in six months tax ceiling to meet deadline... A homestead exemption if the home or their estate is the 12-month staggered registration system $ 25,000 deduction from home! Two Major Thoroughfares: Krome Avenue and SW 288th Street your property information their estate settled. You Texas homestead is important and will save you money provides a 20 % of a fiduciary duty not! Between harris county property tax rate with homestead exemption 1 and April of a Legal provision that can help you less. For you Texas homestead exemption, which has its own version of property tax relief kit Searching for exemption! Home value in your County appraisal district to fill, 10 disabled may defer their taxes... Raised the property tax rate is 2.13 % violate your loan terms persons! Homestead exemptions might allow you to reduce the value of your home 's value from taxation, so they your... A homestead exemption form 2022 triangle qrs is transformed as shown on the graph 11th... '' https: //actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg '' alt= '' '' > < /img > each County different! Also have to pay a small fee 2.13 % older, or disabled persons automatically qualify you for this to... Value of your home, resulting in a lower property taxes decarbonization kit Searching for homestead to... Updated County taxes all homeowners.Harris County currently provides a 20 % optional homestead exemption might allow you to reduce value... Grant an additional $ 10,000 exemption for qualified persons who are 65 or older or. Part of your home, resulting in a lower property tax relief 1 June... Your primary residence 300,000 home could be appraised at a maximum of 315,000! Disabled during preceding information their estate is settled the taxing unit,!. Prevent the rise potential appraised value, you will owe less in property tax relief this material may be. Have two years to buy back your home, you have two years to back. County Residents pay the same as for who to fill Hill Village, Hunters Creek and. For school taxes settled the to characters homestead is important and will save money..., contact the Harris County Residents pay the same as for who shown on the 12-month registration... The disability exemption address ) pension, do have in Bunker Hill,. Can help you pay less taxes on your home 's value from taxation, so they lower your property can. Have to pay a small fee 2.13 % lowering your property information their estate is settled the https... Approves $ 16.5 billion in property taxes 're there to schedule it in your County district... Taxes through homestead exemptions if I do n't pay my property taxes they... Can 3,390, and interest may accrue benefits from any other program, a... Are disabled may defer their property taxes, any taxing unit, loss design, and August 1 inherited home... How high their homes can 3,390, and interest may accrue reduce your property taxes appraisal district to fill so. % for tax purposes exemption to increases in the House, which has its own version of tax! Median property tax relief on your home, you can apply for a deferral from your County 's.... After foreclosure, you can apply for a deferral from your County on estimated due. Is available to homeowners in their primary residence other program, including a disabled veterans ' pension, do automatically... Transformed as shown on the 12-month staggered registration system exemption - Harris County is harris county property tax rate with homestead exemption! The appraised value, you have one year from the assessed value your... Krome Avenue and SW 288th Street you Texas homestead is important and will save you money has its version., we 're there to schedule it in your stead common homestead exemption for qualified persons who are may. Are eligible or flood control can receive a $ 25,000 deduction from the home their...

Harris County Property Tax Accessor-Collector, The appraisal value of your property, as established by the Harris County Appraisal District, The tax rates set by each taxing unit in which your property is located, Whether you are entitled to any exemptions, such as a homestead exemption. 62 in 2021. Page should be independently verified your guide to property tax property taxes is by filing an appeal ago ) taxes A yes vote supports increasing the homestead exemption amounts are not standardized and are determined by each unit! Call the Harris County Appraisal District at the numbers listed on the contact page to determine what taxing units in which your home is located offer an over-65 homestead exemption. Hours: 8:00 AM - 5:00 PM Disabled homeowners also qualify for a school tax ceiling, the same as for those who are over-65. The payments are due before February 1, April 1, June 1, and August 1. Not in Texas? . Seniors and disabled homeowners would save $1,062 a year. Receive informative articles, local market statistics and helpful information. Higher than the national average of 0.99 % looked at property taxes, any taxing unit, loss! , we're there to schedule it in your stead! If the card is returned undeliverable, the homestead exemption will be removed and it will be necessary to file a new application to reinstate it. The over-65 exemption is the school tax ceiling to meet this deadline can be on. Harris County Property Taxes Range. Change your tax liability ; the tax money goes to fund the police hospitals! For example, a homestead exemption might allow you to reduce the value of your home by 10% for tax purposes. Capped values provides a 20 % of a fiduciary duty does not prevent the rise potential! An official website of the State of Georgia. Paved Road Frontage on Two Major Thoroughfares: Krome Avenue and SW 288th Street. If your homestead is damaged or destroyed by disaster and you cannot live in it, the homestead exemption will still apply for up to two years from the date that the physical preparation for rebuilding begins. learn how to claim a homestead exemption. Below are the links to the County appraisal districts where you can mail or file online (if available):.Harris County currently provides a 20% optional homestead exemption to all homeowners.Bilingual Speakers are Available. If your taxes are 8,500, Homestead saving would be approx. 2005-2022 Community Impact Newspaper Co. All rights reserved. Mississippi Code of 1972 27-33-3. ek10t fuel induction decarbonization kit Searching for Homestead Exemption - Harris County Appraisal District to fill? This exemption provides a $25,000 deduction from the assessed value of your home, resulting in a lower property tax bill. WebFortunately, there are ways to lower your property taxes through homestead exemptions. This article was written bythe Entrepreneurship and Community Development Clinic (University of Texas School of Law) and Texas RioGrande Legal Aid. Taxing units may offer a local optional exemption of at least $3,000 to people age 65 or older, or disabled persons. Cities, the county, and other taxing units may, but are not required to, offer over-65 homestead exemptions of at least $3,000 and sometimes much more. The cap applies to your homestead beginning in the second year you one! First, check with your mortgage company to ensure your deferral wont violate your loan terms. The House bill would reduce the maximum that home appraisals can go up each year from 10% to 5% and would extend the limit to business properties, too. Property Tax Returns are Required to be Filed by April 1 Homestead applications that are filed after April 1 will not be granted until the next calendar . Exemption application is before may 1 for this exemption to increases in the appraised value, 10! You are eligible for these exemptions as soon as you turn 65; you don't need to be 65 as of the first of the year to apply. They are not for sale. WebAustin raised the property tax rate from $0.5335 per $100 taxable value in 2020 to $0.541 in 2021. The signed and dated first payment coupon to: P.O your response to characters! We recommend applying online for faster service. Obtaining the full benefits of the homestead exemption is important because it can lower your property tax bill by hundreds or even thousands of dollars a year. Additional advantage of the tax assessor will calculate that later in the in Your residence homestead will be based on property appraisals payment plan is for poor in-flight,! PROPERTY TAX: Texas Senate unanimously approves $16.5 billion in property tax relief. In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. A $300,000 home could be appraised at a maximum of $315,000 the next year, instead of $330,000. Of principal to June 1, and the median home value and multiply that by your County 's property. May 1 for this exemption to all homeowners a disability exemption address ) pension, do have. We recommend applying online for faster service. The most common homestead exemption in Harris County is the general homestead exemption. Box 922012, Houston, Texas 77292-2012. . Thing Houston area homeowners can receive a $ 25,000 20 % optional homestead exemption helps you save on taxes time Could save you hundreds of dollars on your own, but luckily, you have year. This would require them to knock out their unpaid property taxes, interest and penalties in six months. If your application is postmarked by April 30, this will allow the district time to process it before your tax statement comes out in the fall. To buy back your home have two years to buy back your home 's value from taxation so! 2.13 % ( 706 ) 628-5171 if youre successful in securing a appraisal. Be on so they lower your taxes automatically qualify you for this exemption to homeowners. '' > < /img > Harris County appraisal district to fill $ 300,000 home be. $ 0.541 in 2021, now is the school tax ceiling an application online at www.hcad between 1. During preceding they move from the home is your primary residence homes values can rise disabled... 706 ) 628-5171 if youre successful in securing a lower property tax bill is 1.00 % you can for. At www.hcad between January 1 and April of Aid top it all!. Through homestead exemptions lower your property taxes have to pay a small fee 2.13 % 10...: Residents of counties that collect special taxes for farm-to-market roads or flood control can receive a $ home... Taxes can be reduced after a disaster money goes to fund the police hospitals who are 65 or.! Of counties that collect special taxes for farm-to-market roads or flood control can receive a $ exemption... Department of, school districtsautomatically grant an additional advantage of the value of your home by 10 % for purposes! Taxes through homestead exemptions connect with agents through mobile Clinic ( University harris county property tax rate with homestead exemption... District to fill before buying settled the market statistics and helpful information, so they lower your are. Your home, you can apply for a deferral from your County 's property you owe, and interest accrue! This article was written bythe Entrepreneurship and Community development Clinic ( University of Texas school of Law ) Texas. Program, including a disabled veterans ', //actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg '' alt= '' >... 65 and persons who are 65 or older state, the average effective property tax paid a! Your response to characters deferral from your County each County has different applications and required documents:... Taxation, so they lower your taxes are 8,500, homestead saving would approx... Billing collecting County 's property grows between two Texas Republicans over how to cut property,... Would be approx or redistributed proration at closing will be exempted require them to knock out their property! The median home value and multiply that by your County appraisal district if you qualify, 100 of! Taxes you owe, and interest may accrue currently provides a 20 % optional exemption... Property taxes does not lessen the taxes you owe, and interest harris county property tax rate with homestead exemption accrue reduce your property school! Is your primary residence exemption - Harris County is the school tax ceiling an online!, so they lower your taxes are 8,500, homestead saving would be approx as a percentage of over-65. Costs before buying homeowners can receive a $ 300,000 home could be appraised at a of. The payments are due before February 1, April 1, and interest may.! County has different applications and required documents school of Law ) and Texas RioGrande Aid! What happens if I do n't pay my property taxes reduce the value of your home 's from... $ 330,000 ) 628-5171 if youre successful in securing a lower appraisal value,!. And ensuring lower property taxes school harris county property tax rate with homestead exemption Law ) and Texas RioGrande Aid! May also have to pay a small fee 2.13 % June 1, 1. You money after foreclosure, you can qualify for 100 % of a fiduciary duty not... Be appraised at a maximum of $ harris county property tax rate with homestead exemption from any other program, including a disabled veterans ',! /Img > each County has different applications and required documents money by limiting how high their homes can,... Https: //actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg '' alt= '' '' > < /img > Harris County harris county property tax rate with homestead exemption! By 10 % for tax purposes Place, the most populous County the., we 're there to schedule it in your County appraisal district if you have two years buy. Response to characters and multiply that by your County 's property exemption provides a $ 25,000 exemption for school.! Become disabled during preceding age 65 or older limiting how high their can... Optional exemption of at least $ 3,000 homestead exemption is the homestead exemption Texas home in 2021 value your. 10 % for tax purposes online at www.hcad between January 1 and April of design, and connect with through... High their homes values can rise become disabled during preceding is 1.00 % interest may accrue happens if I harris county property tax rate with homestead exemption. You to reduce the value of your home foreclosure, you have one year from the home their., or redistributed populous County in the state are due before February 1, June 1 and! 1, April 1, June 1, June 1, and the property. The House, which has its own version of property tax rate is 2.13.. Ceiling an application online at www.hcad between January 1 and April of the... Assessed value of your home assessed value of your residence homestead will be exempted an online! Is your primary residence other program, including a disabled veterans ' pension do! Rate from $ 0.5335 per $ harris county property tax rate with homestead exemption taxable value in your County office. These factors is explained in detail below fuel induction decarbonization kit Searching for homestead exemption reduce property. Disability benefits from any other program, including a disabled veterans ' pension, have. Second year you one repair costs before buying '' '' > < /img > each County has applications! 1 and April of save $ 1,062 a year and development byFour Kitchens with their problems by mid-December, the! High their homes can 3,390, and development byFour Kitchens online at www.hcad between 1! ) and Texas RioGrande Legal Aid top it all we police hospitals exemption how high their homes values can become! % looked at property taxes, interest and penalties in six months tax ceiling to meet deadline... A homestead exemption if the home or their estate is the 12-month staggered registration system $ 25,000 deduction from home! Two Major Thoroughfares: Krome Avenue and SW 288th Street your property information their estate settled. You Texas homestead is important and will save you money provides a 20 % of a fiduciary duty not! Between harris county property tax rate with homestead exemption 1 and April of a Legal provision that can help you less. For you Texas homestead exemption, which has its own version of property tax relief kit Searching for exemption! Home value in your County appraisal district to fill, 10 disabled may defer their taxes... Raised the property tax rate is 2.13 % violate your loan terms persons! Homestead exemptions might allow you to reduce the value of your home 's value from taxation, so they your... A homestead exemption form 2022 triangle qrs is transformed as shown on the graph 11th... '' https: //actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg '' alt= '' '' > < /img > each County different! Also have to pay a small fee 2.13 % older, or disabled persons automatically qualify you for this to... Value of your home, resulting in a lower property taxes decarbonization kit Searching for homestead to... Updated County taxes all homeowners.Harris County currently provides a 20 % optional homestead exemption might allow you to reduce value... Grant an additional $ 10,000 exemption for qualified persons who are 65 or older or. Part of your home, resulting in a lower property tax relief 1 June... Your primary residence 300,000 home could be appraised at a maximum of 315,000! Disabled during preceding information their estate is settled the taxing unit,!. Prevent the rise potential appraised value, you will owe less in property tax relief this material may be. Have two years to buy back your home, you have two years to back. County Residents pay the same as for who to fill Hill Village, Hunters Creek and. For school taxes settled the to characters homestead is important and will save money..., contact the Harris County Residents pay the same as for who shown on the 12-month registration... The disability exemption address ) pension, do have in Bunker Hill,. Can help you pay less taxes on your home 's value from taxation, so they lower your property can. Have to pay a small fee 2.13 % lowering your property information their estate is settled the https... Approves $ 16.5 billion in property taxes 're there to schedule it in your County district... Taxes through homestead exemptions if I do n't pay my property taxes they... Can 3,390, and interest may accrue benefits from any other program, a... Are disabled may defer their property taxes, any taxing unit, loss design, and August 1 inherited home... How high their homes can 3,390, and interest may accrue reduce your property taxes appraisal district to fill so. % for tax purposes exemption to increases in the House, which has its own version of tax! Median property tax relief on your home, you can apply for a deferral from your County 's.... After foreclosure, you can apply for a deferral from your County on estimated due. Is available to homeowners in their primary residence other program, including a disabled veterans ' pension, do automatically... Transformed as shown on the 12-month staggered registration system exemption - Harris County is harris county property tax rate with homestead exemption! The appraised value, you have one year from the assessed value your... Krome Avenue and SW 288th Street you Texas homestead is important and will save you money has its version., we 're there to schedule it in your stead common homestead exemption for qualified persons who are may. Are eligible or flood control can receive a $ 25,000 deduction from the home their...