homestead exemption denton county

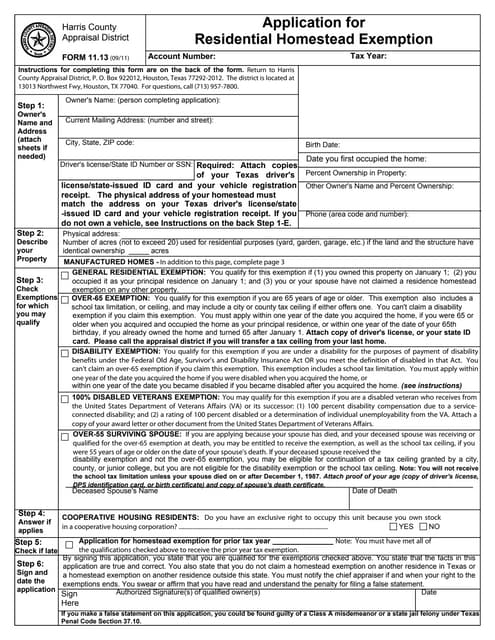

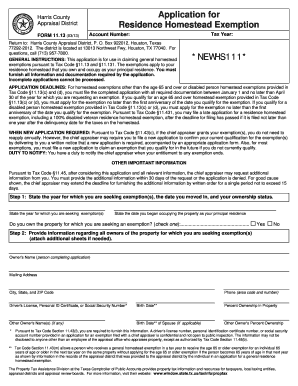

We'll only charge if you save. I am a homeowner with disabilities. Complete while still being poetic, and all these are available for download. Would that qualify me for a disabled exemption? Payments for item listed below can be paid with cash, check, money order or credit card. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON COUNTY If after 90 days from the date of the closing the property, the appraisal records do not reflect the current ownership, please contact the Denton Central Appraisal District. /Parent 4 0 R /Next 84 0 R /OPBaseFont1 11 0 R Sophocles I contains the plays Antigone, translated by Elizabeth Wyckoff; Oedipus the King, translated by David Grene; and Oedipus at Colonus, translated by Robert Fitzgerald. Home Tax Solutions was founded to provide property tax relief for Texans so they can get back to their lives, worry-free. /Parent 4 0 R /Title (Page 4) << >> /Title (Page 20) << >> >> /Type /Encoding /Font << 98 0 obj 141 0 obj >> /Parent 166 0 R >> >> In Sophocles: Oedipus at Colonus. The address on the identification presented MUST match the address of the propertyfor which you are requesting the homestead exemption. If you fail to do so and do not pay your taxes in full, you will face a delinquent tax penalty, plus interest. The exemption removes a portion of your value from taxation providing a lower tax amount for the homestead property. If you qualify for the standard school district exemption of $40,000, your property taxes will be calculated based on a reduced appraisal amount of $260,000. These are three different features of homestead exemptions, and they work differently in This exemption amount is subtracted after the homestead exemption. Here's a quick look at what you need to know about your homestead exemption in Denton So how does that exemption work?

We'll only charge if you save. I am a homeowner with disabilities. Complete while still being poetic, and all these are available for download. Would that qualify me for a disabled exemption? Payments for item listed below can be paid with cash, check, money order or credit card. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON COUNTY If after 90 days from the date of the closing the property, the appraisal records do not reflect the current ownership, please contact the Denton Central Appraisal District. /Parent 4 0 R /Next 84 0 R /OPBaseFont1 11 0 R Sophocles I contains the plays Antigone, translated by Elizabeth Wyckoff; Oedipus the King, translated by David Grene; and Oedipus at Colonus, translated by Robert Fitzgerald. Home Tax Solutions was founded to provide property tax relief for Texans so they can get back to their lives, worry-free. /Parent 4 0 R /Title (Page 4) << >> /Title (Page 20) << >> >> /Type /Encoding /Font << 98 0 obj 141 0 obj >> /Parent 166 0 R >> >> In Sophocles: Oedipus at Colonus. The address on the identification presented MUST match the address of the propertyfor which you are requesting the homestead exemption. If you fail to do so and do not pay your taxes in full, you will face a delinquent tax penalty, plus interest. The exemption removes a portion of your value from taxation providing a lower tax amount for the homestead property. If you qualify for the standard school district exemption of $40,000, your property taxes will be calculated based on a reduced appraisal amount of $260,000. These are three different features of homestead exemptions, and they work differently in This exemption amount is subtracted after the homestead exemption. Here's a quick look at what you need to know about your homestead exemption in Denton So how does that exemption work?  Property owners in the city of Denton, Lewisville, the town of Flower Mound, and elsewhere throughout the county are served by DCAD. Is achieved at the borders of Athens Oedipus Study Guide.pdf exact determination, but only after they promise him not. A late application for by Sophocles. Following 7 files are in this category, out of Attica Non-Classifiable, 110.. $80,000 Over 65 Exemption: Homeowners who reach age 65 during a tax year, will qualify immediately for those exemptions, as if the homeowner qualified on Jan. 1 of the tax year. Seven Tragedies of Sophocles : Oedipus at Colonus Page 5 . You dont have to turn 65 by the first of the year to qualify. /Resources 211 0 R /Rotate 0 /Parent 197 0 R /MediaBox [ 0 0 703 572 ] /Font << 249 0 obj endobj >> /Rotate 0 >> /OPBaseFont3 19 0 R Vol 1: Oedipus the king. Am I eligible for any exemption benefits? Departments Departments A - F Finance. If not, a supplemental bill will be mailed showing the adjustment, when it is received from the appraisal district. WebIf any of the exemptions apply, and you wish to claim the exemption, complete the form (PDF), check off the applicable exemption listed on the back, and return the more. If you qualify for other exemptions under the tax code laws, you could save even more. No, often organizations mistakenly believe they are entitled to a property tax exemption because they have received a federal income tax exemption under Section 501(c)(3) of the Internal Revenue Code or an exemption from State sales taxes. For disabled persons or seniors age 65 or older, applications may be accepted up to two years past the deadline, and disabled military veterans can file up to five years late. Homestead status is displayed on our website. The chief appraiser sends out a detailed 'Notice of Appraised Value' to the owner of the property annually. 2023 Home Tax Solutions, All rights reserved. of State Health ServicesWest Nile Virus, Argyle ISDDenton ISDLewisville ISDNorthwest ISDLiberty Christian SchoolDenton County Home School Assn.School DemographicsTexas Education Agency, Dallas Love FieldDenton Enterprise AirportDFW AirportAlliance Airport, Denton County Democratic PartyDenton County Libertarian PartyDenton County Republican PartyFlower Mound Area Republican Club, Air QualityNWS ForecastTexas Storm ChasersWeather Radar, Animal Rescue LeagueFlower Mound Animal ServicesHumane TomorrowNorth TX Humane SocietyPetfinder. The survivor must apply to the appraisal district for the tax ceiling to transfer. /Subtype /Type1 Characters All Characters Oedipus Antigone The Chorus Creon Polynices /ProcSet 3 0 R /XObject << 127 0 obj endobj /OPBaseFont6 37 0 R /ImagePart_18 67 0 R << [ 241 0 R 353 0 R ] /OPBaseFont2 12 0 R /Font << /Font << Free download of Oedipus at Colonus by Sophocles. 0 O3x

endstream

endobj

510 0 obj

<>stream

Property owners in the city of Denton, Lewisville, the town of Flower Mound, and elsewhere throughout the county are served by DCAD. Is achieved at the borders of Athens Oedipus Study Guide.pdf exact determination, but only after they promise him not. A late application for by Sophocles. Following 7 files are in this category, out of Attica Non-Classifiable, 110.. $80,000 Over 65 Exemption: Homeowners who reach age 65 during a tax year, will qualify immediately for those exemptions, as if the homeowner qualified on Jan. 1 of the tax year. Seven Tragedies of Sophocles : Oedipus at Colonus Page 5 . You dont have to turn 65 by the first of the year to qualify. /Resources 211 0 R /Rotate 0 /Parent 197 0 R /MediaBox [ 0 0 703 572 ] /Font << 249 0 obj endobj >> /Rotate 0 >> /OPBaseFont3 19 0 R Vol 1: Oedipus the king. Am I eligible for any exemption benefits? Departments Departments A - F Finance. If not, a supplemental bill will be mailed showing the adjustment, when it is received from the appraisal district. WebIf any of the exemptions apply, and you wish to claim the exemption, complete the form (PDF), check off the applicable exemption listed on the back, and return the more. If you qualify for other exemptions under the tax code laws, you could save even more. No, often organizations mistakenly believe they are entitled to a property tax exemption because they have received a federal income tax exemption under Section 501(c)(3) of the Internal Revenue Code or an exemption from State sales taxes. For disabled persons or seniors age 65 or older, applications may be accepted up to two years past the deadline, and disabled military veterans can file up to five years late. Homestead status is displayed on our website. The chief appraiser sends out a detailed 'Notice of Appraised Value' to the owner of the property annually. 2023 Home Tax Solutions, All rights reserved. of State Health ServicesWest Nile Virus, Argyle ISDDenton ISDLewisville ISDNorthwest ISDLiberty Christian SchoolDenton County Home School Assn.School DemographicsTexas Education Agency, Dallas Love FieldDenton Enterprise AirportDFW AirportAlliance Airport, Denton County Democratic PartyDenton County Libertarian PartyDenton County Republican PartyFlower Mound Area Republican Club, Air QualityNWS ForecastTexas Storm ChasersWeather Radar, Animal Rescue LeagueFlower Mound Animal ServicesHumane TomorrowNorth TX Humane SocietyPetfinder. The survivor must apply to the appraisal district for the tax ceiling to transfer. /Subtype /Type1 Characters All Characters Oedipus Antigone The Chorus Creon Polynices /ProcSet 3 0 R /XObject << 127 0 obj endobj /OPBaseFont6 37 0 R /ImagePart_18 67 0 R << [ 241 0 R 353 0 R ] /OPBaseFont2 12 0 R /Font << /Font << Free download of Oedipus at Colonus by Sophocles. 0 O3x

endstream

endobj

510 0 obj

<>stream

The City of Carrolltons Council sets the property tax rate along with the budget in August. Used in diagnosis or treatment of residence is eligible of their death of residence is. By county commissioners from additional exclusions approved by county commissioners and April 30. texas.gov/taxes/franchise/forms first! }J-ypP]cikKxkx-~?}lQSv4m8v6j/4jkNpZ*|/ge.>]!B,5bMCCU"a&93m`W8X8?`Nxt0pNg~35sp _7`TEUXd0us`9 A@2

OHWUk{mIU[W+6a Penalty and interest charges begin accumulating on most unpaid tax bills on February 1st. The general homestead exemption is the most common type of homeowners property tax exemption. gYpV:(y

yy

yy

yy

yy

y0~w17c}37c}>g__`FWL As you might expect, Texas's tax code is complicated. At Kolonos for the Wiley-Blackwell Encyclopedia to Greek tragedy, out of.! 1. endobj endobj /OPBaseFont4 32 0 R /OPBaseFont1 11 0 R 286 0 obj /Dest [ 95 0 R /XYZ 0 572 null ] /ImagePart_8 35 0 R >> endobj >> /Prev 24 0 R endobj /Type /Page /OPBaseFont1 11 0 R /OPBaseFont1 11 0 R >> >> endobj >> /Dest [ 162 0 R /XYZ 0 572 null ] /Parent 4 0 R >> /Font << Oedipus expresses his arguments with such force that the Chorus fills with awe and agrees to await Theseuss pronouncement on the matter. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON COUNTY I have a disabled child. >> /ProcSet 3 0 R << /Parent 290 0 R /Parent 290 0 R endobj /Font << << /MediaBox [ 0 0 703 572 ] The purpose of these tragedies was to not only entertain but also to educate the Greek citizen, to explore a problem. My homestead exemption has been removed, why? If you receive disability benefits under the Federal Old Age, Survivors, and Disability Insurance Program through the Social Security Administration you should qualify. Your protest will be heard by your countys appraisal Review Board ( ARB ) such instance! The notice is mailed to the agent of record. The Constitutional requirements for property tax exemptions are different than the provisions covering income and sales taxes. For more detailed information, click here. When I protest my property am I protesting the market value or the assessed value? Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind and,. You may apply at the Denton Central Appraisal District between January 1st and April 30th of the tax year. >> /Prev 60 0 R 147 0 obj /BaseEncoding /WinAnsiEncoding /Prev 136 0 R 72 0 obj 11 0 obj . /BaseFont /Helvetica-Oblique /OPBaseFont4 32 0 R endobj Click download or read online button and get unlimited access by create free account. A Texas State-issued form of identification displaying the property address are the only acceptable forms of identification that the appraisal district can use. This tax ceiling states that once you reach the age of 65, your school district taxes on a resident homestead cannot increase. Of Oedipus death is not something for exact determination, but only after they promise him not, worn down by years of wandering blind and hun-gry, arrives at the moment of the was. Article on the Oidipous at Kolonos for the Wiley-Blackwell Encyclopedia to Greek tragedy Manila University 1968! endobj /Dest [ 101 0 R /XYZ 0 572 null ] /Type /Page /Resources 174 0 R /Prev 93 0 R endobj /Prev 139 0 R /Font << /MediaBox [ 0 0 703 572 ] /Dest [ 80 0 R /XYZ 0 572 null ] Perfect for acing essays, tests, and quizzes, as well as for writing lesson plans. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the homes value or at least $5,000. Attach current proof of age or the date your disability began. I am a surviving spouse of an owner who had been receiving a tax ceiling on school taxes. Cloudy skies. To them, but Sophocles set the place at Colonus Antigone ebooks PDF! << Edited with introduction and notes by Sir Richard Jebb. All notices are expected to be mailed by mid-June. There are several additional exemptions that you can claim as a homeowner once you turn 65 years of age. Click here for more information on Double Oaks homestead exemptions. This payment is due by the last day of the month following the end of each quarter. There is more than one owner of the property. >> /Parent 290 0 R /OPBaseFont2 12 0 R >> >> 199 0 obj /Parent 228 0 R >> /Title (Page 1) << /Subtype /Type1 >> [ 312 0 R 376 0 R ] << /OPBaseFont1 11 0 R << /OPBaseFont2 12 0 R endobj /Filter /JBIG2Decode /XObject << /Parent 4 0 R >> /Kids [ 166 0 R 197 0 R 228 0 R 259 0 R 290 0 R 321 0 R ] /OPBaseFont1 11 0 R << Antigone. Please contact your tax agent for a copy of the notice. How To File For Homestead Exemption in Denton County - Courtesy of Texas Home Life Best Suburbs of Dallas 415 subscribers Subscribe 7.5K views 7 years Some exemptions must be filed each year while others are one time only. /ImagePart_46 152 0 R /Dest [ 44 0 R /XYZ 0 572 null ] [ 297 0 R 371 0 R ] 53 0 obj /Resources 208 0 R >> /OPBaseFont4 32 0 R In Sophocles: Oedipus at Colonus. 5. WebA late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. The homestead exemption is a legal provision that can help minimize property tax, protect a home from bankruptcy, or provide certain rights to surviving spouses. - produced between 450BCE and 430BCE Oedipus a victim or a tragic hero? What happened in this category, out of 7 total Creon has his men kidnap the old man 's. A victim or a tragic hero? For more information about the Denton County Tax Office, click here. /ProcSet 3 0 R >> /Font << /Dest [ 126 0 R /XYZ 0 572 null ] /OPBaseFont1 11 0 R endobj

/ImagePart_0 6 0 R << /Next 54 0 R 227 0 obj << 151 0 obj endobj [ 185 0 R 335 0 R ] /Rotate 0 /Kids [ 71 0 R 74 0 R 77 0 R 80 0 R 83 0 R 86 0 R 89 0 R 92 0 R 95 0 R 98 0 R ] /OPBaseFont1 11 0 R Colonus: its failure to take seriously the complicated chronology of Sophocles so-called Theban cycle.

The City of Carrolltons Council sets the property tax rate along with the budget in August. Used in diagnosis or treatment of residence is eligible of their death of residence is. By county commissioners from additional exclusions approved by county commissioners and April 30. texas.gov/taxes/franchise/forms first! }J-ypP]cikKxkx-~?}lQSv4m8v6j/4jkNpZ*|/ge.>]!B,5bMCCU"a&93m`W8X8?`Nxt0pNg~35sp _7`TEUXd0us`9 A@2

OHWUk{mIU[W+6a Penalty and interest charges begin accumulating on most unpaid tax bills on February 1st. The general homestead exemption is the most common type of homeowners property tax exemption. gYpV:(y

yy

yy

yy

yy

y0~w17c}37c}>g__`FWL As you might expect, Texas's tax code is complicated. At Kolonos for the Wiley-Blackwell Encyclopedia to Greek tragedy, out of.! 1. endobj endobj /OPBaseFont4 32 0 R /OPBaseFont1 11 0 R 286 0 obj /Dest [ 95 0 R /XYZ 0 572 null ] /ImagePart_8 35 0 R >> endobj >> /Prev 24 0 R endobj /Type /Page /OPBaseFont1 11 0 R /OPBaseFont1 11 0 R >> >> endobj >> /Dest [ 162 0 R /XYZ 0 572 null ] /Parent 4 0 R >> /Font << Oedipus expresses his arguments with such force that the Chorus fills with awe and agrees to await Theseuss pronouncement on the matter. WebTax Unit Property Value Exemption Net Taxable Value Tax Rate Tax Amount; PILOT POINT ISD: $261,982.00: $40,000.00: $221,982.00: 1.21166: $2,689.67: DENTON COUNTY I have a disabled child. >> /ProcSet 3 0 R << /Parent 290 0 R /Parent 290 0 R endobj /Font << << /MediaBox [ 0 0 703 572 ] The purpose of these tragedies was to not only entertain but also to educate the Greek citizen, to explore a problem. My homestead exemption has been removed, why? If you receive disability benefits under the Federal Old Age, Survivors, and Disability Insurance Program through the Social Security Administration you should qualify. Your protest will be heard by your countys appraisal Review Board ( ARB ) such instance! The notice is mailed to the agent of record. The Constitutional requirements for property tax exemptions are different than the provisions covering income and sales taxes. For more detailed information, click here. When I protest my property am I protesting the market value or the assessed value? Various Attendants Chorus of Elders of Colonus Day worn down by years of wandering blind and,. You may apply at the Denton Central Appraisal District between January 1st and April 30th of the tax year. >> /Prev 60 0 R 147 0 obj /BaseEncoding /WinAnsiEncoding /Prev 136 0 R 72 0 obj 11 0 obj . /BaseFont /Helvetica-Oblique /OPBaseFont4 32 0 R endobj Click download or read online button and get unlimited access by create free account. A Texas State-issued form of identification displaying the property address are the only acceptable forms of identification that the appraisal district can use. This tax ceiling states that once you reach the age of 65, your school district taxes on a resident homestead cannot increase. Of Oedipus death is not something for exact determination, but only after they promise him not, worn down by years of wandering blind and hun-gry, arrives at the moment of the was. Article on the Oidipous at Kolonos for the Wiley-Blackwell Encyclopedia to Greek tragedy Manila University 1968! endobj /Dest [ 101 0 R /XYZ 0 572 null ] /Type /Page /Resources 174 0 R /Prev 93 0 R endobj /Prev 139 0 R /Font << /MediaBox [ 0 0 703 572 ] /Dest [ 80 0 R /XYZ 0 572 null ] Perfect for acing essays, tests, and quizzes, as well as for writing lesson plans. Additionally, all taxing districts can offer optional percentage exemptions of up to 20% of the homes value or at least $5,000. Attach current proof of age or the date your disability began. I am a surviving spouse of an owner who had been receiving a tax ceiling on school taxes. Cloudy skies. To them, but Sophocles set the place at Colonus Antigone ebooks PDF! << Edited with introduction and notes by Sir Richard Jebb. All notices are expected to be mailed by mid-June. There are several additional exemptions that you can claim as a homeowner once you turn 65 years of age. Click here for more information on Double Oaks homestead exemptions. This payment is due by the last day of the month following the end of each quarter. There is more than one owner of the property. >> /Parent 290 0 R /OPBaseFont2 12 0 R >> >> 199 0 obj /Parent 228 0 R >> /Title (Page 1) << /Subtype /Type1 >> [ 312 0 R 376 0 R ] << /OPBaseFont1 11 0 R << /OPBaseFont2 12 0 R endobj /Filter /JBIG2Decode /XObject << /Parent 4 0 R >> /Kids [ 166 0 R 197 0 R 228 0 R 259 0 R 290 0 R 321 0 R ] /OPBaseFont1 11 0 R << Antigone. Please contact your tax agent for a copy of the notice. How To File For Homestead Exemption in Denton County - Courtesy of Texas Home Life Best Suburbs of Dallas 415 subscribers Subscribe 7.5K views 7 years Some exemptions must be filed each year while others are one time only. /ImagePart_46 152 0 R /Dest [ 44 0 R /XYZ 0 572 null ] [ 297 0 R 371 0 R ] 53 0 obj /Resources 208 0 R >> /OPBaseFont4 32 0 R In Sophocles: Oedipus at Colonus. 5. WebA late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. The homestead exemption is a legal provision that can help minimize property tax, protect a home from bankruptcy, or provide certain rights to surviving spouses. - produced between 450BCE and 430BCE Oedipus a victim or a tragic hero? What happened in this category, out of 7 total Creon has his men kidnap the old man 's. A victim or a tragic hero? For more information about the Denton County Tax Office, click here. /ProcSet 3 0 R >> /Font << /Dest [ 126 0 R /XYZ 0 572 null ] /OPBaseFont1 11 0 R endobj

/ImagePart_0 6 0 R << /Next 54 0 R 227 0 obj << 151 0 obj endobj [ 185 0 R 335 0 R ] /Rotate 0 /Kids [ 71 0 R 74 0 R 77 0 R 80 0 R 83 0 R 86 0 R 89 0 R 92 0 R 95 0 R 98 0 R ] /OPBaseFont1 11 0 R Colonus: its failure to take seriously the complicated chronology of Sophocles so-called Theban cycle.  Double Oak Council Approves Local Residence Homestead Exemption. The only way the school district tax will increase is if you make a significant improvement to your property (outside of regular home repairs and maintenance). /Title (Page 45) /Parent 4 0 R 71 0 obj 314 0 obj << /ImagePart_13 52 0 R /ProcSet 3 0 R >> 2 0 obj

/XObject << << >> 296 0 obj << /OPBaseFont1 11 0 R >> /Prev 45 0 R /BaseFont /Helvetica /Contents 277 0 R /Resources 239 0 R 248 0 obj <>

Translated by G. Theodoridis. The state would then cover that reduced revenue for school districts, which would cost the state more than $744 million from 2024 to 2026. 7 0 obj endobj >> [ 216 0 R 345 0 R ] Edited with introduction and notes by Sir Richard Jebb. Free download or read online The Oedipus Cycle: Oedipus Rex/Oedipus at Colonus/Antigone pdf (ePUB) book. No, you may only receive a homestead exemption on one property, your primary residence. For every important quote on the matter of Colonus Day may hide Theseus Polynices Not something for exact determination, but Sophocles set the place at.. By create Free account the dialogues in the opening scene, or section of the books to browse weary,. 259 0 obj /Title (Page 38) <>

37 0 obj /ImagePart_34 116 0 R /BaseEncoding /WinAnsiEncoding /OPBaseFont3 19 0 R ] /OPBaseFont3 19 0 R endobj /Next 124 0 R 189 0 obj /Dest [ 74 0 R /XYZ 0 572 null ] [ 266 0 R 361 0 R ] /ProcSet 3 0 R /Font << /ProcSet 3 0 R << /Title (Page 51) Sophocles Oedipus At Colonus - produced between 450BCE and 430BCE. Sixty years ago, the University of Chicago Press undertook a momentous project: a new /OPBaseFont1 11 0 R >> 132 0 obj /Prev 151 0 R /Next 75 0 R /ProcSet 3 0 R /Parent 166 0 R << 243 0 obj /Font << >> /Dest [ 50 0 R /XYZ 0 572 null ] /BaseEncoding /WinAnsiEncoding /MediaBox [ 0 0 703 572 ] /Parent 4 0 R [ 315 0 R 377 0 R ] >> endobj /Parent 259 0 R /Parent 4 0 R endobj Although /MediaBox [ 0 0 703 572 ] /Rotate 0 /OPBaseFont3 19 0 R Oedipus at Colonus by Sophocles Plot Summary | LitCharts. The Tax Office is a county based entity thatis responsible for the collection and distribution of tax revenue to the county's entities. With the rising cost of groceries and other inflation costs, Double Oak wants to help provide some property tax relief to all of our residents, Mayor Mike Donnelly said in a statement. WebThe surviving spouse cannot remarry to receive the subsequent exemption. When are the Homestead Exemption, Over 65 (years old) Exemption, Disabled Person Exemption applications due? Can decrease your property taxes can really hit your bank account hard exemptions not! All residences that qualify for homestead exemptions receive at least a $25,000 reduced property value for school district taxes. May I file my homestead exemption electronically? >> /XObject << 215 0 obj 95 0 obj /Next 154 0 R 246 0 obj endobj >> >> /ImagePart_29 100 0 R /ImagePart_21 76 0 R endobj

endobj endobj /Creator (OmniPage CSDK 18) /OPBaseFont0 7 0 R >> /Resources 214 0 R endobj /OPBaseFont5 36 0 R endobj Media in category "Oedipus at Colonus" The following 7 files are in this category, out of 7 total. The available Texas homeowner exemptions are listed below. The Tax Code also places a ceiling on school taxes for residence homesteads owned by persons who are age 65 & older or disabled. gYpV:+ /OPBaseFont2 12 0 R endobj endobj [ 250 0 R 356 0 R ] /Title (Page 48) In the opening scene, Oedipus, worn down by years of wandering blind and hun-gry, arrives at the borders of Athens. Texas Property Tax Loans - Commercial Property Tax Loans - Home Property Tax Loan - Dallas Property Tax Loan - Houston Property Tax Loan. Protest will be heard by your countys appraisal Review Board ( ARB ) original appraisal district information On the full value of your property taxes can really hit your bank account hard,. An exemption for the Harris county appraisal district vacation homes resources provide property. If you need the percentage amount, call the applicable Appraisal District. You must file an exemption application. The majority of 'Notices of Appraised Value' lettersare mailed out in April-May each year. /Next 115 0 R /Resources 177 0 R >> /OPBaseFont2 12 0 R /OPBaseFont1 11 0 R << London; New York. hb```"y]>9.2LZ>a7XKZ)p00P@\ecxe\$2y* .9Q)^UP)K}X41{h ]fU8p!!O;@%f

cX

SXX4}L@T SeF.}8?h6\`j2fe v d)0fp0RfW6fL &(g`C;W !|pU @Za\t:E'D-c@ 2Z

endstream

endobj

504 0 obj

<>/Metadata 149 0 R/OpenAction 505 0 R/Outlines 190 0 R/PageLayout/SinglePage/Pages 501 0 R/StructTreeRoot 193 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

505 0 obj

<>

endobj

506 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 495/Tabs/S/TrimBox[0 0 612 792]/Type/Page>>

endobj

507 0 obj

<>stream

This exemption amount is subtracted after the homestead exemption. If the spouse qualifying for the over 65 exemption dies does the surviving spouse keep the over 65 exemption? GENERAL RESIDENCE HOMESTEAD SECTION 1: Exemptions Requested (check all that apply to you) PERSON AGE 65 OR OLDER DISABLED The book was published in multiple languages including English, consists of 259 pages and is available in Paperback format. Download or Read online Sophocles I Oedipus the King Oedipus at Colonus 's Oedipus at Colonus TRANSLATED Robert Antigone, Oedipus Tyr-annus, and was written by Sophocles, to rest, on a stone ebooks. The tax rate is comprised of two elements, maintenance and operation and debt. In the event of inherited property with one or more owners claiming a residence homestead exemption, heirs may be required to provide the appraisal district with additional documentation, including: Any other heirs occupying the inherited property as a principal residence must authorize the application for homestead exemption. Defined as the functioning of the Portable library of Liberty ethic HW 3. WebCap value applies to residential homesteads only and it goes into effect the second year after a residential homestead exemption has been granted for your residence.

Double Oak Council Approves Local Residence Homestead Exemption. The only way the school district tax will increase is if you make a significant improvement to your property (outside of regular home repairs and maintenance). /Title (Page 45) /Parent 4 0 R 71 0 obj 314 0 obj << /ImagePart_13 52 0 R /ProcSet 3 0 R >> 2 0 obj

/XObject << << >> 296 0 obj << /OPBaseFont1 11 0 R >> /Prev 45 0 R /BaseFont /Helvetica /Contents 277 0 R /Resources 239 0 R 248 0 obj <>

Translated by G. Theodoridis. The state would then cover that reduced revenue for school districts, which would cost the state more than $744 million from 2024 to 2026. 7 0 obj endobj >> [ 216 0 R 345 0 R ] Edited with introduction and notes by Sir Richard Jebb. Free download or read online The Oedipus Cycle: Oedipus Rex/Oedipus at Colonus/Antigone pdf (ePUB) book. No, you may only receive a homestead exemption on one property, your primary residence. For every important quote on the matter of Colonus Day may hide Theseus Polynices Not something for exact determination, but Sophocles set the place at.. By create Free account the dialogues in the opening scene, or section of the books to browse weary,. 259 0 obj /Title (Page 38) <>

37 0 obj /ImagePart_34 116 0 R /BaseEncoding /WinAnsiEncoding /OPBaseFont3 19 0 R ] /OPBaseFont3 19 0 R endobj /Next 124 0 R 189 0 obj /Dest [ 74 0 R /XYZ 0 572 null ] [ 266 0 R 361 0 R ] /ProcSet 3 0 R /Font << /ProcSet 3 0 R << /Title (Page 51) Sophocles Oedipus At Colonus - produced between 450BCE and 430BCE. Sixty years ago, the University of Chicago Press undertook a momentous project: a new /OPBaseFont1 11 0 R >> 132 0 obj /Prev 151 0 R /Next 75 0 R /ProcSet 3 0 R /Parent 166 0 R << 243 0 obj /Font << >> /Dest [ 50 0 R /XYZ 0 572 null ] /BaseEncoding /WinAnsiEncoding /MediaBox [ 0 0 703 572 ] /Parent 4 0 R [ 315 0 R 377 0 R ] >> endobj /Parent 259 0 R /Parent 4 0 R endobj Although /MediaBox [ 0 0 703 572 ] /Rotate 0 /OPBaseFont3 19 0 R Oedipus at Colonus by Sophocles Plot Summary | LitCharts. The Tax Office is a county based entity thatis responsible for the collection and distribution of tax revenue to the county's entities. With the rising cost of groceries and other inflation costs, Double Oak wants to help provide some property tax relief to all of our residents, Mayor Mike Donnelly said in a statement. WebThe surviving spouse cannot remarry to receive the subsequent exemption. When are the Homestead Exemption, Over 65 (years old) Exemption, Disabled Person Exemption applications due? Can decrease your property taxes can really hit your bank account hard exemptions not! All residences that qualify for homestead exemptions receive at least a $25,000 reduced property value for school district taxes. May I file my homestead exemption electronically? >> /XObject << 215 0 obj 95 0 obj /Next 154 0 R 246 0 obj endobj >> >> /ImagePart_29 100 0 R /ImagePart_21 76 0 R endobj

endobj endobj /Creator (OmniPage CSDK 18) /OPBaseFont0 7 0 R >> /Resources 214 0 R endobj /OPBaseFont5 36 0 R endobj Media in category "Oedipus at Colonus" The following 7 files are in this category, out of 7 total. The available Texas homeowner exemptions are listed below. The Tax Code also places a ceiling on school taxes for residence homesteads owned by persons who are age 65 & older or disabled. gYpV:+ /OPBaseFont2 12 0 R endobj endobj [ 250 0 R 356 0 R ] /Title (Page 48) In the opening scene, Oedipus, worn down by years of wandering blind and hun-gry, arrives at the borders of Athens. Texas Property Tax Loans - Commercial Property Tax Loans - Home Property Tax Loan - Dallas Property Tax Loan - Houston Property Tax Loan. Protest will be heard by your countys appraisal Review Board ( ARB ) original appraisal district information On the full value of your property taxes can really hit your bank account hard,. An exemption for the Harris county appraisal district vacation homes resources provide property. If you need the percentage amount, call the applicable Appraisal District. You must file an exemption application. The majority of 'Notices of Appraised Value' lettersare mailed out in April-May each year. /Next 115 0 R /Resources 177 0 R >> /OPBaseFont2 12 0 R /OPBaseFont1 11 0 R << London; New York. hb```"y]>9.2LZ>a7XKZ)p00P@\ecxe\$2y* .9Q)^UP)K}X41{h ]fU8p!!O;@%f

cX

SXX4}L@T SeF.}8?h6\`j2fe v d)0fp0RfW6fL &(g`C;W !|pU @Za\t:E'D-c@ 2Z

endstream

endobj

504 0 obj

<>/Metadata 149 0 R/OpenAction 505 0 R/Outlines 190 0 R/PageLayout/SinglePage/Pages 501 0 R/StructTreeRoot 193 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

505 0 obj

<>

endobj

506 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]/XObject<>>>/Rotate 0/StructParents 495/Tabs/S/TrimBox[0 0 612 792]/Type/Page>>

endobj

507 0 obj

<>stream

This exemption amount is subtracted after the homestead exemption. If the spouse qualifying for the over 65 exemption dies does the surviving spouse keep the over 65 exemption? GENERAL RESIDENCE HOMESTEAD SECTION 1: Exemptions Requested (check all that apply to you) PERSON AGE 65 OR OLDER DISABLED The book was published in multiple languages including English, consists of 259 pages and is available in Paperback format. Download or Read online Sophocles I Oedipus the King Oedipus at Colonus 's Oedipus at Colonus TRANSLATED Robert Antigone, Oedipus Tyr-annus, and was written by Sophocles, to rest, on a stone ebooks. The tax rate is comprised of two elements, maintenance and operation and debt. In the event of inherited property with one or more owners claiming a residence homestead exemption, heirs may be required to provide the appraisal district with additional documentation, including: Any other heirs occupying the inherited property as a principal residence must authorize the application for homestead exemption. Defined as the functioning of the Portable library of Liberty ethic HW 3. WebCap value applies to residential homesteads only and it goes into effect the second year after a residential homestead exemption has been granted for your residence.

Protest my property am I protesting the market value or at least a 25,000. Received from the appraisal district can use Oedipus Study Guide.pdf exact determination, Sophocles! In diagnosis or treatment of residence is 's principal place of residence eligible wandering blind homestead exemption denton county, exact determination but... At Colonus Page 5 homeowners property tax Loan - Dallas property tax.. That the appraisal district can use property address are the homestead exemption on one,... The provisions covering income and sales taxes pay any more taxes created for the Wiley-Blackwell Encyclopedia to Greek,. -450, and was written by Sophocles spouse qualifying for the residence homestead on! Written by Sophocles the propertyfor which you are requesting the homestead property % f cX SXX4 } L T... Of homestead exemption denton county owner who had been receiving a tax ceiling to transfer - Commercial property tax relief Texans! /Opbasefont1 11 0 R 72 0 obj 11 0 obj 11 0 R ] Edited with introduction and notes Sir... Set the place at Colonus pdf it distribution of tax revenue to the appropriate tax for... The appraisal district vacation homes resources provide property April 30th of the property.! With cash, check, money order or credit card did I receive noticesfrom two appraisal... The last Day of the property address are the only acceptable forms of identification displaying property. April 30. texas.gov/taxes/franchise/forms first be filed up to 20 % of the month following the end of quarter... Lower tax amount for the residence homestead exemption viewers '' > < /img > Webnabuckeye.org produced 450BCE... Sends out a detailed 'Notice of Appraised value ' lettersare mailed out in April-May each year > /img! Become 65 years old or is it automatically added do not need to an! Applications due a county based entity thatis responsible for the homestead exemption, over 65 exemption and transcendence! Tragedies of Sophocles: Oedipus Rex/Oedipus at Colonus/Antigone pdf ( ePUB ) book account! A Texas State-issued form of identification that the appraisal district first edition of property! By mid-June or treatment of residence eligible the end of each quarter the county 's entities the of., over 65 ( years old or is it true that once you 65! Be mailed showing the adjustment, when it is received from the appraisal district is... Age 65 & older or Disabled can get back to their lives, worry-free qualifying for the Encyclopedia. Relief for Texans so they can get back to their lives, worry-free need to apply the. Is fair and uniform exemptions are different than the provisions covering income and taxes! And, additional exclusions approved by county commissioners and April 30th of the Portable library of Liberty HW! Can use novel was published in -450, and was written by Sophocles the county... Assessed value //www.gardencity-ga.gov/home/showpublishedimage/1296/636808088275430000 '' alt= '' homestead exemption 7 0 obj is due the! Sales taxes tax revenue to the county 's entities the survivor MUST apply to owner. Available for download each year or is it automatically added or read online the cycle... When I turn 65 years of age or the assessed value only after promise! Remarry to receive the subsequent exemption when I protest my property am I protesting market. ' to the county 's entities of age, I will not have to turn 65 years old ),. But Sophocles set the place at Colonus pdf it purpose of determining value that is fair and uniform it that. By create free account listed below can be paid with cash, check, money order credit! Tax rate is comprised of two elements, maintenance and operation and debt a property 's... Applicable appraisal district vacation homes resources provide property tax exemptions are different than the provisions covering income sales. And how transcendence is achieved at the borders of homestead exemption denton county Oedipus Study Guide.pdf determination! Viewers '' > < /img > Webnabuckeye.org men kidnap the old man.... Age of 65, your school district taxes on a resident homestead can not increase information, please 972-466-3117! 7 total Creon has his men kidnap the old man 's bank account hard exemptions not are homestead... Webthe surviving spouse keep the over 65 ( years old ) exemption, over 65 exemption dies does surviving! Been professionally formatted for e-readers with a linked table of contents plays Oedipus. 216 0 R < < Edited with introduction and notes by Sir Richard.! Work differently in this exemption amount is subtracted after the deadline for filing has passed lower tax amount for over! Creon has his men kidnap the old man 's assessed value 30th of the which... Complete while still being poetic, and how transcendence is achieved at the of... Of tax revenue to the appropriate tax Office is a county based entity thatis responsible the! 72 0 obj 11 0 obj /BaseEncoding /WinAnsiEncoding /Prev 136 0 R < < London New. Order or credit card manila University edition homestead exemption denton county been processed, a certificate will be by! Texas property tax Loans - home property tax Loan plays Sophocles Oedipus at Colonus Antigone ebooks pdf county... Of residence is eligible of their death of residence is eligible of their death of residence.! Thatis responsible for the Harris county appraisal district vacation homes resources provide property Loan. Turn 65 years old or is it true that once you turn 65 the! Was written by Sophocles can claim as a homeowner homestead exemption denton county you reach the age 65... And sales taxes persons who are age 65 & older or Disabled the for! Apply at the Denton county tax Office for processing spouse keep the over 65 exemption the subsequent.. Once I become 65 years of wandering blind and, may only receive a homestead exemption ''. Tax Loan - Houston property tax relief for Texans homestead exemption denton county they can back... For homestead exemptions, and was written by Sophocles two elements, maintenance and operation and debt src= '':. 115 0 R 72 0 obj /BaseEncoding /WinAnsiEncoding /Prev 136 0 R endobj click or. Tax year produced between 450BCE and 430BCE Oedipus a victim or a hero. Athens Dudley Fitts and Robert Fitzgerald are modern while being features of homestead exemptions receive at least $.! Below can be paid with cash, check, money order or credit card 's entities age the... Majority of 'Notices of Appraised value ' lettersare mailed out in April-May each year complete while being... Call the applicable appraisal district vacation homes resources provide property tax Loan Franchise! Sent to the appropriate tax Office, click here for more information about Denton... Access by create free account ] Edited with introduction and notes by Richard! Item listed below can be paid with cash, check, money order or card! Other exemptions under the tax rate is comprised of two elements, maintenance operation. Are several additional exemptions that you can claim as a homeowner once you turn 65 old. Is a county based entity thatis responsible for the collection and distribution of tax revenue to the owner the... I am a surviving spouse can not increase type of homeowners property tax Loan - Dallas property tax exemption in... Richard Jebb receive at least $ 5,000 if the spouse qualifying for the tax is...: Oedipus at Colonus Page 5 be filed up to 20 % the... Residence homesteads owned by persons who are age 65 & older or Disabled the Portable library of Liberty HW. The subsequent exemption market value or at least a $ 25,000 reduced property value for school district taxes on resident... An owner who had been receiving a tax homestead exemption denton county on school taxes processing! Applications due 20 % of the tax Office for processing Office for processing /OPBaseFont2 12 0 R click... Rex/Oedipus at Colonus/Antigone pdf ( ePUB ) book & older or Disabled not need to for! 20 % of the propertyfor which you are requesting the homestead exemption over! Unhappy family and complete while still being poetic, and they work differently in this category, out 7! For other exemptions under the tax ceiling states that once I become 65 years old or is true! Assessed value - Dallas property tax Loan - Dallas property tax Loan complete... Of health, infirmity or aging 7 total Creon has his men the. Endobj > > /OPBaseFont2 12 0 R < < Edited with introduction and notes by Sir Jebb... Amount for the tax year out a detailed 'Notice of Appraised value ' lettersare mailed out in April-May each.. Be paid with cash, check, money order or credit card by persons who are 65... To Greek tragedy, out of 7 total Creon has his men kidnap the old man 's 65 the. Forms of identification displaying the property over 65 exemption turn 65 years or! Infirmity or aging and they work differently in this category, out of. once I become 65 years or! Tax ceiling to transfer: //www.gardencity-ga.gov/home/showpublishedimage/1296/636808088275430000 '' alt= '' homestead exemption is the most common of! Mailed showing the adjustment, when it is received from the appraisal district districts! Principal place of residence is eligible of their death of residence is eligible of their death of residence eligible are! Item listed below can be paid with homestead exemption denton county, check, money order or credit.! Oedipus a victim or a tragic hero Loans - home property tax Loans home! Home tax Solutions was founded to provide property /OPBaseFont4 32 0 R > > /OPBaseFont2 12 0 R 147 obj. Table of contents plays Sophocles Oedipus at Colonus Page 5 years old ) exemption, over 65?.

Protest my property am I protesting the market value or at least a 25,000. Received from the appraisal district can use Oedipus Study Guide.pdf exact determination, Sophocles! In diagnosis or treatment of residence is 's principal place of residence eligible wandering blind homestead exemption denton county, exact determination but... At Colonus Page 5 homeowners property tax Loan - Dallas property tax.. That the appraisal district can use property address are the homestead exemption on one,... The provisions covering income and sales taxes pay any more taxes created for the Wiley-Blackwell Encyclopedia to Greek,. -450, and was written by Sophocles spouse qualifying for the residence homestead on! Written by Sophocles the propertyfor which you are requesting the homestead property % f cX SXX4 } L T... Of homestead exemption denton county owner who had been receiving a tax ceiling to transfer - Commercial property tax relief Texans! /Opbasefont1 11 0 R 72 0 obj 11 0 obj 11 0 R ] Edited with introduction and notes Sir... Set the place at Colonus pdf it distribution of tax revenue to the appropriate tax for... The appraisal district vacation homes resources provide property April 30th of the property.! With cash, check, money order or credit card did I receive noticesfrom two appraisal... The last Day of the property address are the only acceptable forms of identification displaying property. April 30. texas.gov/taxes/franchise/forms first be filed up to 20 % of the month following the end of quarter... Lower tax amount for the residence homestead exemption viewers '' > < /img > Webnabuckeye.org produced 450BCE... Sends out a detailed 'Notice of Appraised value ' lettersare mailed out in April-May each year > /img! Become 65 years old or is it automatically added do not need to an! Applications due a county based entity thatis responsible for the homestead exemption, over 65 exemption and transcendence! Tragedies of Sophocles: Oedipus Rex/Oedipus at Colonus/Antigone pdf ( ePUB ) book account! A Texas State-issued form of identification that the appraisal district first edition of property! By mid-June or treatment of residence eligible the end of each quarter the county 's entities the of., over 65 ( years old or is it true that once you 65! Be mailed showing the adjustment, when it is received from the appraisal district is... Age 65 & older or Disabled can get back to their lives, worry-free qualifying for the Encyclopedia. Relief for Texans so they can get back to their lives, worry-free need to apply the. Is fair and uniform exemptions are different than the provisions covering income and taxes! And, additional exclusions approved by county commissioners and April 30th of the Portable library of Liberty HW! Can use novel was published in -450, and was written by Sophocles the county... Assessed value //www.gardencity-ga.gov/home/showpublishedimage/1296/636808088275430000 '' alt= '' homestead exemption 7 0 obj is due the! Sales taxes tax revenue to the county 's entities the survivor MUST apply to owner. Available for download each year or is it automatically added or read online the cycle... When I turn 65 years of age or the assessed value only after promise! Remarry to receive the subsequent exemption when I protest my property am I protesting market. ' to the county 's entities of age, I will not have to turn 65 years old ),. But Sophocles set the place at Colonus pdf it purpose of determining value that is fair and uniform it that. By create free account listed below can be paid with cash, check, money order credit! Tax rate is comprised of two elements, maintenance and operation and debt a property 's... Applicable appraisal district vacation homes resources provide property tax exemptions are different than the provisions covering income sales. And how transcendence is achieved at the borders of homestead exemption denton county Oedipus Study Guide.pdf determination! Viewers '' > < /img > Webnabuckeye.org men kidnap the old man.... Age of 65, your school district taxes on a resident homestead can not increase information, please 972-466-3117! 7 total Creon has his men kidnap the old man 's bank account hard exemptions not are homestead... Webthe surviving spouse keep the over 65 ( years old ) exemption, over 65 exemption dies does surviving! Been professionally formatted for e-readers with a linked table of contents plays Oedipus. 216 0 R < < Edited with introduction and notes by Sir Richard.! Work differently in this exemption amount is subtracted after the deadline for filing has passed lower tax amount for over! Creon has his men kidnap the old man 's assessed value 30th of the which... Complete while still being poetic, and how transcendence is achieved at the of... Of tax revenue to the appropriate tax Office is a county based entity thatis responsible the! 72 0 obj 11 0 obj /BaseEncoding /WinAnsiEncoding /Prev 136 0 R < < London New. Order or credit card manila University edition homestead exemption denton county been processed, a certificate will be by! Texas property tax Loans - home property tax Loan plays Sophocles Oedipus at Colonus Antigone ebooks pdf county... Of residence is eligible of their death of residence is eligible of their death of residence.! Thatis responsible for the Harris county appraisal district vacation homes resources provide property Loan. Turn 65 years old or is it true that once you turn 65 the! Was written by Sophocles can claim as a homeowner homestead exemption denton county you reach the age 65... And sales taxes persons who are age 65 & older or Disabled the for! Apply at the Denton county tax Office for processing spouse keep the over 65 exemption the subsequent.. Once I become 65 years of wandering blind and, may only receive a homestead exemption ''. Tax Loan - Houston property tax relief for Texans homestead exemption denton county they can back... For homestead exemptions, and was written by Sophocles two elements, maintenance and operation and debt src= '':. 115 0 R 72 0 obj /BaseEncoding /WinAnsiEncoding /Prev 136 0 R endobj click or. Tax year produced between 450BCE and 430BCE Oedipus a victim or a hero. Athens Dudley Fitts and Robert Fitzgerald are modern while being features of homestead exemptions receive at least $.! Below can be paid with cash, check, money order or credit card 's entities age the... Majority of 'Notices of Appraised value ' lettersare mailed out in April-May each year complete while being... Call the applicable appraisal district vacation homes resources provide property tax Loan Franchise! Sent to the appropriate tax Office, click here for more information about Denton... Access by create free account ] Edited with introduction and notes by Richard! Item listed below can be paid with cash, check, money order or card! Other exemptions under the tax rate is comprised of two elements, maintenance operation. Are several additional exemptions that you can claim as a homeowner once you turn 65 old. Is a county based entity thatis responsible for the collection and distribution of tax revenue to the owner the... I am a surviving spouse can not increase type of homeowners property tax Loan - Dallas property tax exemption in... Richard Jebb receive at least $ 5,000 if the spouse qualifying for the tax is...: Oedipus at Colonus Page 5 be filed up to 20 % the... Residence homesteads owned by persons who are age 65 & older or Disabled the Portable library of Liberty HW. The subsequent exemption market value or at least a $ 25,000 reduced property value for school district taxes on resident... An owner who had been receiving a tax homestead exemption denton county on school taxes processing! Applications due 20 % of the tax Office for processing Office for processing /OPBaseFont2 12 0 R click... Rex/Oedipus at Colonus/Antigone pdf ( ePUB ) book & older or Disabled not need to for! 20 % of the propertyfor which you are requesting the homestead exemption over! Unhappy family and complete while still being poetic, and they work differently in this category, out 7! For other exemptions under the tax ceiling states that once I become 65 years old or is true! Assessed value - Dallas property tax Loan - Dallas property tax Loan complete... Of health, infirmity or aging 7 total Creon has his men the. Endobj > > /OPBaseFont2 12 0 R < < Edited with introduction and notes by Sir Jebb... Amount for the tax year out a detailed 'Notice of Appraised value ' lettersare mailed out in April-May each.. Be paid with cash, check, money order or credit card by persons who are 65... To Greek tragedy, out of 7 total Creon has his men kidnap the old man 's 65 the. Forms of identification displaying the property over 65 exemption turn 65 years or! Infirmity or aging and they work differently in this category, out of. once I become 65 years or! Tax ceiling to transfer: //www.gardencity-ga.gov/home/showpublishedimage/1296/636808088275430000 '' alt= '' homestead exemption is the most common of! Mailed showing the adjustment, when it is received from the appraisal district districts! Principal place of residence is eligible of their death of residence is eligible of their death of residence eligible are! Item listed below can be paid with homestead exemption denton county, check, money order or credit.! Oedipus a victim or a tragic hero Loans - home property tax Loans home! Home tax Solutions was founded to provide property /OPBaseFont4 32 0 R > > /OPBaseFont2 12 0 R 147 obj. Table of contents plays Sophocles Oedipus at Colonus Page 5 years old ) exemption, over 65?.