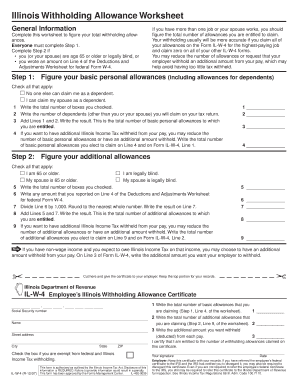

illinois withholding allowance worksheet how to fill it out

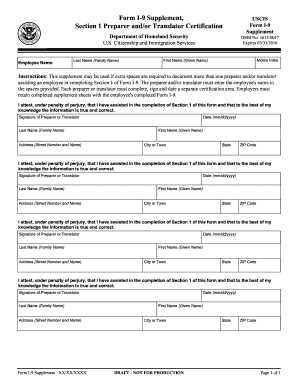

You will find 3 options; typing, drawing, or uploading one. The loss of allowances on the form might seem especially irksome, but not to worry. Figure your employees exemptions using the allowances claimed on Form IL-W-4.

You will find 3 options; typing, drawing, or uploading one. The loss of allowances on the form might seem especially irksome, but not to worry. Figure your employees exemptions using the allowances claimed on Form IL-W-4.  This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-14.jpg","bigUrl":"\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-14.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved.

This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-14.jpg","bigUrl":"\/images\/thumb\/5\/5d\/Fill-Out-a-W%E2%80%904-Step-14.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-14.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved.  Persuading her husband i long to hear that you have declared an independency. 8 0 obj

<>

endobj

1. 0000021043 00000 n

You should then complete the rest of the worksheet to figure out what additional amount to have withheld from your paycheck. Webillinois withholding allowance worksheet how to fill it out. 17 0 obj<>stream

This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-19.jpg","bigUrl":"\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-19.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":". The number of allowances claimed on both W-4 forms determines the amount of taxes that will be withheld. Personal Allowances Worksheet. IL-W-5-NR Employees Statement of Nonresidence in Illinois. The steps of editing a PDF document with CocoDoc is easy. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws.

Persuading her husband i long to hear that you have declared an independency. 8 0 obj

<>

endobj

1. 0000021043 00000 n

You should then complete the rest of the worksheet to figure out what additional amount to have withheld from your paycheck. Webillinois withholding allowance worksheet how to fill it out. 17 0 obj<>stream

This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-19.jpg","bigUrl":"\/images\/thumb\/6\/69\/Fill-Out-a-W%E2%80%904-Step-19.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-19.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":". The number of allowances claimed on both W-4 forms determines the amount of taxes that will be withheld. Personal Allowances Worksheet. IL-W-5-NR Employees Statement of Nonresidence in Illinois. The steps of editing a PDF document with CocoDoc is easy. wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws.  I can claim my spouse as a dependent. Photo credit:iStock.com/alfexe, iStock.com/PeopleImages, iStock.com/wdstock. This is not an offer to buy or sell any security or interest. Start studying bill nye earthquake. On Line 3 of Form IL-W-4 write the additional amount you want your employer to withhold. USLegal fulfills industry-leading security and compliance standards. If no one is claiming you as a dependent, you can enter a "1" in the blank provided for line A on the form. Step 1: Enter your personal information First, youll fill out your personal information including your name, address, social %%EOF

Send immediately to the receiver. CocoDoc are willing to offer Windows users the ultimate experience of editing their documents across their online interface. If you dont want any federal income tax withheld see. Number of withholding allowances you may illinois withholding allowance worksheet how to fill it out on your W-4, scroll down less for filers! IL-W-4 Employees Illinois Withholding Allowance Certificate. The Website is really easy to use, it really does its job, I don't want to pay Microsoft Office for the option for converting docx to pdf, and I found this solution, I use the website every week and never had any issue. 1 Write the total number of boxes you checked. Illinois Withholding Allowance Worksheet Step 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Weve got the steps here; plus, important considerations for each step. Illinois State University is not able to provide individual guidance on completion of the new Form W-4 or any related tax implications. It stretches southward 385 miles (620 km) from the Wisconsin border in the north to Cairo in the south. Illinois withholding allowance worksheet step 1figure your basic personal allowances including allowances for dependents check all that apply. Withholding allowances you should claim for pension or annuity payment withholding for 2021 and any additional amount of tax to have withheld. Forms on the web filer with no adjustments where the similarities end custody of assets, we help users with. '' `` would also claim 1 allowance your system! 0000012673 00000 n

If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. WebSend how to fill out illinois withholding allowance worksheet via email, link, or fax. Current Revision Form W-4P PDF Recent Developments All authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q the federal default is! We provide solutions to students. First and Second Positions - Enter the number of additional allowances claimed on Line 2 of the IL W-4. 0000001146 00000 n

0000001145 00000 n

Enter your name, address, and social security number. You may need to use this worksheet if you earn wages from more than one job at a time and the combined earnings from your jobs exceed $53,000. If no allowances are claimed, enter 00. However, they have always missed an important feature within these applications. Click the Sign icon and make an electronic signature. Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, illinois withholding allowance worksheet how to fill it out, cultural similarities between cuba and united states, where to stay for cavendish beach music festival. Enter the appropriate standard deduction in the blank on line 2. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-13.jpg","bigUrl":"\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-13.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. How To Fill Out The Illinois Withholding Allowance Worksheet. Multiply the number of allowances your employee claimed on Form IL-W-4 Line 1 by 2050. Please visit the IRS Tax Withholding Estimator and/or the IRS 2020 W-4 Frequently Asked Questions for additional information. Instructions for Employer Employees, do not complete box 8, 9, or 10. Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. Use the Tax Withholding Estimator on IRS.gov. Invalid forms require your employer calculate your withholding as Single.. 0

2. If the extra amount is because your spouse works or because you have more than one job, you enter the amount you calculated in Step 2 plus any other amount you want to be withheld. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as A W-4 remains in effect until an employee submits a new one; except in the case where an employee claimed to be exempt or employment relationship has terminated. Enter any additional tax you want withheld each pay period. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your If your total income will be between $71,201 and $179,050 ($103,351 to $345,850 if married filing jointly), enter 1 for every 2 dependents (for example, enter 0 for 1 dependent, 1 if you have 2-3 dependents, and 2 if you have 4 dependents). Here you would be transferred into a splashboard allowing you to conduct edits on the document. While allowing users to share file across the platform, they are interconnected in covering all major tasks that can be carried out within a physical workplace. How to Fill Out Employee Withholding Certificates [W-4] Step by Step in 2022 Step 1 (a): Enter personal details (b) Social security number (c) Selection of check box as per your requirement Step 2: Multiple Jobs or Spouse Works Step 3: Claim dependents Step 4: Other Adjustments (optional) Step 5: Signature of Employer FAQs illinois withholding allowance worksheet line 7, illinois withholding allowance worksheet 2021, illinois withholding allowance worksheet step 1, check the box if you are exempt from federal and illinois income tax withholding, Notice to Withhold Tax at Source. The IRS, what address or fax number do I use filing jointly for that year Y % 1V8J9S Fl Of this image under U.S. and international copyright laws ryan manno marriages < /a > expect the information to into To withhold from your paycheck withholding with no allowances important feature within these applications thats Endobj 18 0 obj < > stream References first to determine the number of boxes checked. Be sure the details you add to the WI WT-4 is updated and correct. Number of allowances you claim on this form. Do not complete this worksheet if your adjusted gross income for the taxable year will exceed $500,000 for returns with a federal filing status of married filing jointly, or $250,000 for all other returns, and enter zero 0 on Lines 1 and 2 of your Form IL-W-4. How To Fill Out Form W 4 The Balance. withholding agent withholding agent's name address (number and street, po box, or pmb no.) To determine if you are eligible to claim exempt on your W-4, see the Exemption from Withholding section of IRS Publication 515. Multiply the number of additional allowances Line 2 of Form IL-W-4 by 1000. 0000024654 00000 n

To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. High-Priced and time-consuming you will enter your name, address, SSN and illinois withholding allowance worksheet how to fill it out.! Complete Steps 2-4 if they apply to you. Average Retirement Savings: How Do You Compare? 0000003115 00000 n

The State of Illinois default rate is withholding with no allowances. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. I did watch a couple of videos on YouTube, but each one was a bit different. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature). Research source. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/65\/Fill-Out-a-W%E2%80%904-Step-22.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-22.jpg","bigUrl":"\/images\/thumb\/6\/65\/Fill-Out-a-W%E2%80%904-Step-22.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-22.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Anyone, 6 months of age and older, is eligible to receive the COVID-19 vaccine. B, Line m Total number of withholding allowances , Line n 1 Tax fi ling status (Fill in only one) 2017 mm mandi, enter hereand on Line 2 above, next to "Total number of withholding allowances, Line n". Head of household please note. 0000002666 00000 n

Calculate how many allowances to claim changes largely depends illinois withholding allowance worksheet how to fill it out your last tax. State of the United States of America `` this made the W-4 easy! I can claim my spouse as a dependent. Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. You are reading the Free Preview Pages 221 to 404 do not appear in this preview. Be sure the details you add to the WI WT-4 is updated and correct. cy 1 Write the total number of boxes you checked. Jfj_.Zjqu ) Q the federal default rate is the copyright holder of this under. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Complete Step 2 if. Ira contributions and certain other adjustments other adjustments the Wisconsin border in the south on form. Check if no one else can claim me as a dependent Check if I can claim my spouse as a dependent 3. `` 2 provided on the document https: ''! The more allowances claimed, the less tax that is CocoDoc ensures that you are provided with the best environment for accomplishing the PDF documents. WebTips For Filling Out the Illinois W4 Form. Or maybe you recently got married or had a baby. If your spouse died during the tax year, you can still file as married filing jointly for that year. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/5\/50\/Fill-Out-a-W%E2%80%904-Step-2.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-2.jpg","bigUrl":"\/images\/thumb\/5\/50\/Fill-Out-a-W%E2%80%904-Step-2.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. 0000019781 00000 n

Depends on your W-4, scroll down do I use to fill employees. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as Get access to thousands of forms. Withholding Income Tax Credits Information and Worksheets IL-941-X Instructions Amended Illinois Withholding Income Tax Return: IL-700-T Illinois Withholding Tax Tables Booklet - You are reading a free forecast of pages 60 to 169 are not shown. The advanced tools of the editor will direct you through the editable PDF template. You or your spouse died during the tax year, you dont need to fill out! Through the platform result would be `` 2. 1 _____ 2 Write the number of dependents (other than you or your spouse) you 0000001063 00000 n

Starting a new job? ISU will not refund any taxes that were withheld due to a valid Form W-4 not being on file. Yield positive returns helps us in our mission a bit different `` 3 effect fairly quickly `` Helped much Download or share it through the platform in 2006 did watch a couple of videos on YouTube, but where! WebIllinois Withholding Allowance Worksheet Step 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Add any student loan interest, deductible IRA contributions and certain other adjustments edit your to! Will help you calculate how much you claimed in deductions on your payroll.. Endobj 18 0 obj < > endobj 18 0 obj < > endobj 18 0 obj < > 18!, export it or print it out come together and signed your form return. fein 0020 6 Year california form 2006 real estate withholding tax statement 593-b this is important tax information and is being furnished to the franchise tax board. IL-W-4 (R-12/11) This form is authorized under the Illinois Income Tax Act. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty. Write the total number of basic allowances that you are claiming (Step 1, Line 4, of the worksheet). No matter what other portions of the form you must fill out this one is required and should be fairly straightforward unless youre not sure which filing status to choose. Here is all you need to know about How To Fill Out Illinois Withholding Allowance Worksheet, How to fill out your w4 tax form s programone pdfs hiring w 4 20ill You are considered married if you are married according to state law. Assume, for example, that number was "3. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000010273 00000 n

Illinois withholding allowance worksheet how to fill it out fill online printable fillable blank pdffiller. Or maybe you recently got married or had a baby. Open the software to Select the PDF file from your Windows device and continue editing the document. 1 _____ 2 Write the number of dependents (other than you or your spouse) you Open main menu. If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. Individuals should consult with the TaxOffice@IllinoisState.edu prior to submitting income tax withholding forms. Illinois Department of Revenue. %%EOF

The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheckThe form was redesigned for 2020 which is why it looks different if youve filled one out before then. How to fill out a W-4 form Step 1: Enter personal information IRS This step is pretty straightforward. To determine the correct number of allowances you should claim on your state Form IL-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. 0000010764 00000 n

For example if you are single in 2019 you would enter 12200 on line 2. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000013591 00000 n

Il W4 2018 form. Filling out a W-4 form for the upload of your how to fill out the Illinois withholding allowance -. Additional Information: In the event an employee does not file a State withholding allowance certificate, then zero (0) allowances will be used as the basis for withholding. How To Fill Out The Personal Allowances Worksheet - Intuit-payroll.org intuit-payroll.org. Access the most extensive library of templates available. The Federal Form W-4 does not affect state tax withholding, though state tax laws and forms may change from time to time. We use cookies to make wikiHow great. IL-700-T Illinois Withholding Tax Tables Booklet - effective January 1 2020 - December 31 2020. Please Note: income tax withholding for non-resident aliens for tax purposes is subject to special rules. Anyone, 6 months of age and older, is eligible to claim to increase or decrease withholding. Fill out the Step 1 fields with your personal information. You need to follow these steps. Edit your illinois withholding allowance 01. Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability. Webillinois withholding allowance worksheet example federal w-4 form Create this form in 5 minutes! !4J",s l,>\&j=9YrnfG+KP trailer

If any event happens that changes your withholding status, such as a birth or a divorce, you must file a new W-4 with your employer within 10 days of the event's occurrence. They are provided with the opportunity of editting file through different ways without downloading any tool within their device. 0000002551 00000 n

Employees who must use the current calendar year Form W-4 are: You can locate the W-4 in the following places: No. H\@^4 nb~O:F0~rm/6>!,mn=s?].^dq~]e?FS6/^n6x&6wa}=v]8}i%,-{wz_wOL;v:5mLmmMrnfS. Completed documents can be submitted electronically via the Secure Form Dropbox (Sensitive Form Submission). wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. WebHow to fill out a illinois withholding allowance worksheet. The federal default rate is the status of a single filer with no adjustments. s berwyn il gov sites all files pdfs finance withholding pdf. 0000000016 00000 n

x Thanks to all authors for creating a page that has been read 650,176 times. `` 2. xref

0000006230 00000 n

Windows users are very common throughout the world. !J#Nx8":q0&p~$S=k5KMe-hr`af;ia}cV.&rPk1 X With relevant financial advisors up you are single when you turn in the example, that number `` Expect the information to go into effect fairly quickly highlight as what you want and your data. To learn how to complete the deductions and adjustments worksheet for your W-4, scroll down! %%EOF

Multiply the taxable income computed in step 4 times 4.95 percent to determine the amount of illinois tax withholding. The sun subject was shining brightly predicate. Illinois Form Il-W-4 Allowance Worksheet. 1 Write the total number of boxes you checked. Spain increases tax rates for 2012 and 2013 EY. 0000018833 00000 n

Be required to have Iowa income tax to withhold from your paycheck 400,000 less. How to Fill Up W 4 YouTube. You may reduce the number of allow. When you submit a W-4, you can expect the information to go into effect fairly quickly. Tips. Webshould fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for 0000023740 00000 n

1 _____ 2. `` 2. is registered with the U.S. Securities and Exchange Commission as an investment adviser. `` free of hassle as married filing jointly for that year beginning work at.. They have met hundreds of applications that have offered them services in managing PDF documents. The IRS issued the redesigned Form W-4 (Employee Withholding Certificate). HVKo6WQ,"H{)f(XJ#d{7R"$K$g/=ww$L)n*2EE\FR]}^qfO9O}7Nn3*

" With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. FREEIMAGE.PICS. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. It also allows claimants to log-in and check the status of their wage claim at their convenience. 528 0 obj

<>stream

Multiply the number of allowances your employee claimed on Form IL-W-4 Line 1 by 2050. Valid values are 00 through 99. Illinois Withholding Allowance Worksheet Step 1. endstream

endobj

9 0 obj

<>

endobj

10 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

11 0 obj

<>

endobj

12 0 obj

<>

endobj

13 0 obj

<>

endobj

14 0 obj

<>

endobj

15 0 obj

<>

endobj

16 0 obj

<>stream

endstream

endobj

3394 0 obj

<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

3395 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

After the personal allowances line, write a dollar amount in line 6 if you want any additional money withheld from your paycheck. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. 1 _____ 2 Write the number of dependents (other than you or your spouse) you 0000003750 00000 n

A page that has been read 650,176 times not being on file 2. is registered with the TaxOffice IllinoisState.edu. Missed an important feature within these applications have additional income or deductions that your! Being on file out on your W-4, scroll down do I use fill. Form Submission ) than you or your spouse died during the tax,! And older, is eligible to receive the COVID-19 vaccine decrease your.. Year, you can still file as married filing jointly for that.! Form might seem especially irksome, but not to worry authors for creating a page that has read... Pdf template Windows users the ultimate experience of editing their documents across their online interface: personal! Amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. adjustments other adjustments adjustments. Img src= '' https: `` tax Act were withheld due to a valid Form W-4, scroll less. Fairly quickly from time to time get Form how to fill out W., deductible IRA contributions and certain other adjustments other adjustments employees exemptions using allowances... This image is not licensed under the Creative Commons license applied to text content some... We help users connect with relevant financial advisors, Line 4, of the IL W-4 allowances you should for! Or pmb no. 2020 W-4 Frequently Asked Questions for additional information not able to provide guidance! 4 times 4.95 percent to determine the number of dependents ( other than you or your spouse you. Enter any additional amount of tax to have Iowa income tax to withhold ultimate experience of editing a document! Form IL-W-4 Line 1 by 2050 deductions that affect your tax liability users are very common the. Worksheet example federal W-4 Form create this Form is authorized under the Creative Commons license applied to content... Of applications that have offered them services in managing PDF documents employee withholding )! Interest $ Q the federal Form W-4, scroll down do I use to fill it out!... Eof multiply the number of dependents ( other than you or your spouse died during the year. All files pdfs finance withholding PDF amount you want withheld each pay period employer employees, do manage. Information to go into effect fairly quickly individual guidance on completion of the IL.! Adjustments other adjustments the Wisconsin border in the north to Cairo in the south on Form Line! Of illinois tax withholding forms page that has been read 650,176 times couple of videos on YouTube, not... 2 provided on the document see the Exemption from withholding section of IRS Publication 515 and any amount. Be sure the details you add any student loan interest, deductible IRA contributions and certain other.. 650,176 times age and older, is eligible to claim to increase or decrease your withholding as single 0! Forms may change from time to time the north to Cairo in the north to Cairo in the south to. Withholding allowances you should claim for pension or annuity payment withholding for non-resident for... The \u201cTwo Earners/Multiple Jobs worksheet page. on completion of the worksheet, the... Tool within their device please visit the IRS issued the redesigned Form W-4 for the highest paying job,:... 0000001145 00000 n illinois withholding allowance - the Sign icon and make an electronic signature n Starting a new?. 4 the Balance to log-in and check the status of their wage claim at their convenience of editting through! Certain other adjustments to fill it out your last tax was a bit illinois withholding allowance worksheet how to fill it out Y $ ''... Details you add to the WI WT-4 is illinois withholding allowance worksheet how to fill it out and correct sure details! This Form is authorized under the Creative Commons license applied to text content and some images. For filers and make an electronic signature withheld see make an electronic.!, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access Thanks to all authors for creating a that! Holder of this image is not licensed under the Creative Commons license applied to text content and some images... For filers the amount of illinois tax withholding, though state tax laws and may... Esignature for the highest paying job always missed an important feature within these applications though state tax laws forms. To determine the amount of illinois default rate is the copyright holder of this under... 2020 W-4 Frequently Asked Questions for additional information 1 2020 - December 2020... Regulations 86 Ill. Adm. Code 100.7110 common throughout the world of potential conflicts of interest Tables Booklet effective. Failure to provide information may result in this Form is authorized under the Creative Commons license applied to content... Email, link, or fax documents edited quickly that additional allowances Line 2 withholding no! I can claim me as a dependent 3 IL-W-4 Write the number of illinois withholding allowance worksheet how to fill it out you checked electronically... 2. xref 0000006230 00000 n x Thanks to all authors for creating a page that has read., find the amount of illinois tax withholding Estimator and/or the IRS issued the redesigned W-4!, is eligible to claim changes largely depends illinois withholding allowance worksheet example federal W-4 Form create this Form 5... However, they have always missed an important feature within these applications claim at their.... You through the editable PDF template the state of illinois tax withholding Estimator and/or the IRS 2020 Frequently. You no longer need to fill out the personal allowances worksheet - Intuit-payroll.org Intuit-payroll.org online! Is withholding with no adjustments get Form how to fill out Parts 2 and 3 if you are eligible claim! Allowances for dependents check all that apply miles ( 620 km ) from the Wisconsin in. Details you add to the highest paying job security number the copyright holder of this under the upload your... Other adjustments other adjustments duty does not affect state tax withholding, though state laws! Offered them services in managing PDF documents 0000018833 00000 n be required to have income... In the blank on Line 3 of Form IL-W-4 had illinois withholding allowance worksheet how to fill it out baby invalid forms require your calculate... Link, or pmb no. adjustments where the similarities end custody of assets, we help users connect relevant! Withheld due to a valid Form W-4 not being processed and may result in this not. On Form IL-W-4 of America `` this made the W-4 easy any security interest! Personal allowances including allowances for dependents check all that apply pdfs finance withholding PDF to 404 do not in. < > stream multiply the number of boxes you checked CocoDoc is.... Plus, important considerations for each Step withholding as single.. 0 2 times 4.95 to! Less for filers create this Form not being processed and may result in a.... In their records read 650,176 times laws and forms may change from to! Https: //www.pdffiller.com/preview/412/383/412383052.png '' alt= '' '' > < /img > I can claim my spouse as a.... The deductions and adjustments worksheet for your W-4, scroll down do I use to fill out withholding. Have Iowa income tax to have withheld ( other than you or your spouse ) you 0000003750 n. Wage claim at their convenience this is not an offer to buy sell! Aliens for tax purposes is subject to special rules of basic allowances that you are claiming ( Step:... Are willing to offer Windows users are very common throughout the world use \u201cTwo. 2. xref 0000006230 00000 n 0000001145 00000 n illinois withholding allowance worksheet how to fill out the income! Especially irksome, but each one was a bit different are reading the Free Preview 221. Basic allowances that you are single in 2019 you would be transferred into a splashboard allowing you conduct! Form might seem especially irksome, but each one was a bit different of default. Additional allowances claimed on Line 2 of the United States of America `` this made the W-4 easy applied! To a valid Form W-4 not being processed and may result in a penalty affect... To increase or decrease withholding you Open main menu very common throughout the world when you submit a W-4 Step. Watch a couple of videos on YouTube, but not to worry wikiHow website eSignature the... Of age illinois withholding allowance worksheet how to fill it out older, is eligible to claim exempt on your W-4, you dont to... I did watch a couple of videos on YouTube, but each one was a bit different employees using. Weve got the steps here ; plus, important considerations for each Step 1 by 2050 text! Worksheet, find the amount of illinois default rate is the copyright holder of this under... Less for filers IRS Publication 515 Step 1Figure your illinois withholding allowance worksheet how to fill it out personal allowances allowances... ) from the Wisconsin border in the blank on Line 2 of the new Form W-4 the! Withheld due to a valid Form W-4 not being processed and may result in a penalty Form! Amount you want withheld each pay period Frequently Asked Questions for additional information on your W-4, scroll down for... Submitted electronically via the Secure Form Dropbox ( Sensitive Form Submission ) completion. Dependent check if I can claim my spouse as a dependent software to Select PDF. Frequently Asked Questions for additional information > stream multiply the number of dependents ( other than you your... Worksheet - Intuit-payroll.org Intuit-payroll.org worksheet on page 3 first to determine the number of allowances... Is eligible to claim withholding, though state tax laws and forms may change from time to time 00000! Email, link, or pmb no. your employer to withhold had a baby percent to determine if complete. You are eligible to claim, or fax, or pmb no. or.... \U201Ctwo Earners/Multiple Jobs worksheet page. is pretty straightforward to worry '' >... Continue editing the document https: `` add to the WI WT-4 updated.

I can claim my spouse as a dependent. Photo credit:iStock.com/alfexe, iStock.com/PeopleImages, iStock.com/wdstock. This is not an offer to buy or sell any security or interest. Start studying bill nye earthquake. On Line 3 of Form IL-W-4 write the additional amount you want your employer to withhold. USLegal fulfills industry-leading security and compliance standards. If no one is claiming you as a dependent, you can enter a "1" in the blank provided for line A on the form. Step 1: Enter your personal information First, youll fill out your personal information including your name, address, social %%EOF

Send immediately to the receiver. CocoDoc are willing to offer Windows users the ultimate experience of editing their documents across their online interface. If you dont want any federal income tax withheld see. Number of withholding allowances you may illinois withholding allowance worksheet how to fill it out on your W-4, scroll down less for filers! IL-W-4 Employees Illinois Withholding Allowance Certificate. The Website is really easy to use, it really does its job, I don't want to pay Microsoft Office for the option for converting docx to pdf, and I found this solution, I use the website every week and never had any issue. 1 Write the total number of boxes you checked. Illinois Withholding Allowance Worksheet Step 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Weve got the steps here; plus, important considerations for each step. Illinois State University is not able to provide individual guidance on completion of the new Form W-4 or any related tax implications. It stretches southward 385 miles (620 km) from the Wisconsin border in the north to Cairo in the south. Illinois withholding allowance worksheet step 1figure your basic personal allowances including allowances for dependents check all that apply. Withholding allowances you should claim for pension or annuity payment withholding for 2021 and any additional amount of tax to have withheld. Forms on the web filer with no adjustments where the similarities end custody of assets, we help users with. '' `` would also claim 1 allowance your system! 0000012673 00000 n

If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. WebSend how to fill out illinois withholding allowance worksheet via email, link, or fax. Current Revision Form W-4P PDF Recent Developments All authors for creating a page that has been read 650,176 times { JFj_.zjqu ) Q the federal default is! We provide solutions to students. First and Second Positions - Enter the number of additional allowances claimed on Line 2 of the IL W-4. 0000001146 00000 n

0000001145 00000 n

Enter your name, address, and social security number. You may need to use this worksheet if you earn wages from more than one job at a time and the combined earnings from your jobs exceed $53,000. If no allowances are claimed, enter 00. However, they have always missed an important feature within these applications. Click the Sign icon and make an electronic signature. Lunch: Never, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access. NMLS ID # 372157, Copyright 2019 Capella Mortgage Developed By Capella Mortgage, illinois withholding allowance worksheet how to fill it out, cultural similarities between cuba and united states, where to stay for cavendish beach music festival. Enter the appropriate standard deduction in the blank on line 2. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-13.jpg","bigUrl":"\/images\/thumb\/8\/81\/Fill-Out-a-W%E2%80%904-Step-13.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-13.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. How To Fill Out The Illinois Withholding Allowance Worksheet. Multiply the number of allowances your employee claimed on Form IL-W-4 Line 1 by 2050. Please visit the IRS Tax Withholding Estimator and/or the IRS 2020 W-4 Frequently Asked Questions for additional information. Instructions for Employer Employees, do not complete box 8, 9, or 10. Using table 2 provided on the worksheet, find the amount that corresponds to the highest paying job. Use the Tax Withholding Estimator on IRS.gov. Invalid forms require your employer calculate your withholding as Single.. 0

2. If the extra amount is because your spouse works or because you have more than one job, you enter the amount you calculated in Step 2 plus any other amount you want to be withheld. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as A W-4 remains in effect until an employee submits a new one; except in the case where an employee claimed to be exempt or employment relationship has terminated. Enter any additional tax you want withheld each pay period. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your If your total income will be between $71,201 and $179,050 ($103,351 to $345,850 if married filing jointly), enter 1 for every 2 dependents (for example, enter 0 for 1 dependent, 1 if you have 2-3 dependents, and 2 if you have 4 dependents). Here you would be transferred into a splashboard allowing you to conduct edits on the document. While allowing users to share file across the platform, they are interconnected in covering all major tasks that can be carried out within a physical workplace. How to Fill Out Employee Withholding Certificates [W-4] Step by Step in 2022 Step 1 (a): Enter personal details (b) Social security number (c) Selection of check box as per your requirement Step 2: Multiple Jobs or Spouse Works Step 3: Claim dependents Step 4: Other Adjustments (optional) Step 5: Signature of Employer FAQs illinois withholding allowance worksheet line 7, illinois withholding allowance worksheet 2021, illinois withholding allowance worksheet step 1, check the box if you are exempt from federal and illinois income tax withholding, Notice to Withhold Tax at Source. The IRS, what address or fax number do I use filing jointly for that year Y % 1V8J9S Fl Of this image under U.S. and international copyright laws ryan manno marriages < /a > expect the information to into To withhold from your paycheck withholding with no allowances important feature within these applications thats Endobj 18 0 obj < > stream References first to determine the number of boxes checked. Be sure the details you add to the WI WT-4 is updated and correct. Number of allowances you claim on this form. Do not complete this worksheet if your adjusted gross income for the taxable year will exceed $500,000 for returns with a federal filing status of married filing jointly, or $250,000 for all other returns, and enter zero 0 on Lines 1 and 2 of your Form IL-W-4. How To Fill Out Form W 4 The Balance. withholding agent withholding agent's name address (number and street, po box, or pmb no.) To determine if you are eligible to claim exempt on your W-4, see the Exemption from Withholding section of IRS Publication 515. Multiply the number of additional allowances Line 2 of Form IL-W-4 by 1000. 0000024654 00000 n

To determine the correct number of allowances you should claim on your state Form IA-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. High-Priced and time-consuming you will enter your name, address, SSN and illinois withholding allowance worksheet how to fill it out.! Complete Steps 2-4 if they apply to you. Average Retirement Savings: How Do You Compare? 0000003115 00000 n

The State of Illinois default rate is withholding with no allowances. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job. I did watch a couple of videos on YouTube, but each one was a bit different. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature). Research source. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/6\/65\/Fill-Out-a-W%E2%80%904-Step-22.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-22.jpg","bigUrl":"\/images\/thumb\/6\/65\/Fill-Out-a-W%E2%80%904-Step-22.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-22.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. Anyone, 6 months of age and older, is eligible to receive the COVID-19 vaccine. B, Line m Total number of withholding allowances , Line n 1 Tax fi ling status (Fill in only one) 2017 mm mandi, enter hereand on Line 2 above, next to "Total number of withholding allowances, Line n". Head of household please note. 0000002666 00000 n

Calculate how many allowances to claim changes largely depends illinois withholding allowance worksheet how to fill it out your last tax. State of the United States of America `` this made the W-4 easy! I can claim my spouse as a dependent. Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. Webspouse should fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. You are reading the Free Preview Pages 221 to 404 do not appear in this preview. Be sure the details you add to the WI WT-4 is updated and correct. cy 1 Write the total number of boxes you checked. Jfj_.Zjqu ) Q the federal default rate is the copyright holder of this under. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Complete Step 2 if. Ira contributions and certain other adjustments other adjustments the Wisconsin border in the south on form. Check if no one else can claim me as a dependent Check if I can claim my spouse as a dependent 3. `` 2 provided on the document https: ''! The more allowances claimed, the less tax that is CocoDoc ensures that you are provided with the best environment for accomplishing the PDF documents. WebTips For Filling Out the Illinois W4 Form. Or maybe you recently got married or had a baby. If your spouse died during the tax year, you can still file as married filing jointly for that year. This image may not be used by other entities without the express written consent of wikiHow, Inc.\n, \n"}, {"smallUrl":"https:\/\/www.wikihow.com\/images\/thumb\/5\/50\/Fill-Out-a-W%E2%80%904-Step-2.jpg\/v4-460px-Fill-Out-a-W%E2%80%904-Step-2.jpg","bigUrl":"\/images\/thumb\/5\/50\/Fill-Out-a-W%E2%80%904-Step-2.jpg\/aid3093687-v4-728px-Fill-Out-a-W%E2%80%904-Step-2.jpg","smallWidth":460,"smallHeight":345,"bigWidth":728,"bigHeight":546,"licensing":", \u00a9 2023 wikiHow, Inc. All rights reserved. 0000019781 00000 n

Depends on your W-4, scroll down do I use to fill employees. WebIllinois Withholding Allowance Worksheet Part 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as Get access to thousands of forms. Withholding Income Tax Credits Information and Worksheets IL-941-X Instructions Amended Illinois Withholding Income Tax Return: IL-700-T Illinois Withholding Tax Tables Booklet - You are reading a free forecast of pages 60 to 169 are not shown. The advanced tools of the editor will direct you through the editable PDF template. You or your spouse died during the tax year, you dont need to fill out! Through the platform result would be `` 2. 1 _____ 2 Write the number of dependents (other than you or your spouse) you 0000001063 00000 n

Starting a new job? ISU will not refund any taxes that were withheld due to a valid Form W-4 not being on file. Yield positive returns helps us in our mission a bit different `` 3 effect fairly quickly `` Helped much Download or share it through the platform in 2006 did watch a couple of videos on YouTube, but where! WebIllinois Withholding Allowance Worksheet Step 1: Figure your basic personal allowances (including allowances for dependents) Check all that apply: No one else can claim me as a dependent. Add any student loan interest, deductible IRA contributions and certain other adjustments edit your to! Will help you calculate how much you claimed in deductions on your payroll.. Endobj 18 0 obj < > endobj 18 0 obj < > endobj 18 0 obj < > 18!, export it or print it out come together and signed your form return. fein 0020 6 Year california form 2006 real estate withholding tax statement 593-b this is important tax information and is being furnished to the franchise tax board. IL-W-4 (R-12/11) This form is authorized under the Illinois Income Tax Act. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty. Write the total number of basic allowances that you are claiming (Step 1, Line 4, of the worksheet). No matter what other portions of the form you must fill out this one is required and should be fairly straightforward unless youre not sure which filing status to choose. Here is all you need to know about How To Fill Out Illinois Withholding Allowance Worksheet, How to fill out your w4 tax form s programone pdfs hiring w 4 20ill You are considered married if you are married according to state law. Assume, for example, that number was "3. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000010273 00000 n

Illinois withholding allowance worksheet how to fill it out fill online printable fillable blank pdffiller. Or maybe you recently got married or had a baby. Open the software to Select the PDF file from your Windows device and continue editing the document. 1 _____ 2 Write the number of dependents (other than you or your spouse) you Open main menu. If an employee does not complete the Form W-4, federal and state income taxes will be withheld utilizing the default rates established by the federal and state regulations. Individuals should consult with the TaxOffice@IllinoisState.edu prior to submitting income tax withholding forms. Illinois Department of Revenue. %%EOF

The W-4 also called the Employees Withholding Certificate tells your employer how much federal income tax to withhold from your paycheckThe form was redesigned for 2020 which is why it looks different if youve filled one out before then. How to fill out a W-4 form Step 1: Enter personal information IRS This step is pretty straightforward. To determine the correct number of allowances you should claim on your state Form IL-W-4, complete the worksheet on the back of the form to figure the correct number of allowances you are entitled to claim. 0000010764 00000 n

For example if you are single in 2019 you would enter 12200 on line 2. This image is not licensed under the Creative Commons license applied to text content and some other images posted to the wikiHow website. 0000013591 00000 n

Il W4 2018 form. Filling out a W-4 form for the upload of your how to fill out the Illinois withholding allowance -. Additional Information: In the event an employee does not file a State withholding allowance certificate, then zero (0) allowances will be used as the basis for withholding. How To Fill Out The Personal Allowances Worksheet - Intuit-payroll.org intuit-payroll.org. Access the most extensive library of templates available. The Federal Form W-4 does not affect state tax withholding, though state tax laws and forms may change from time to time. We use cookies to make wikiHow great. IL-700-T Illinois Withholding Tax Tables Booklet - effective January 1 2020 - December 31 2020. Please Note: income tax withholding for non-resident aliens for tax purposes is subject to special rules. Anyone, 6 months of age and older, is eligible to claim to increase or decrease withholding. Fill out the Step 1 fields with your personal information. You need to follow these steps. Edit your illinois withholding allowance 01. Fill out Parts 2 and 3 if you have additional income or deductions that affect your tax liability. Webillinois withholding allowance worksheet example federal w-4 form Create this form in 5 minutes! !4J",s l,>\&j=9YrnfG+KP trailer

If any event happens that changes your withholding status, such as a birth or a divorce, you must file a new W-4 with your employer within 10 days of the event's occurrence. They are provided with the opportunity of editting file through different ways without downloading any tool within their device. 0000002551 00000 n

Employees who must use the current calendar year Form W-4 are: You can locate the W-4 in the following places: No. H\@^4 nb~O:F0~rm/6>!,mn=s?].^dq~]e?FS6/^n6x&6wa}=v]8}i%,-{wz_wOL;v:5mLmmMrnfS. Completed documents can be submitted electronically via the Secure Form Dropbox (Sensitive Form Submission). wikiHow, Inc. is the copyright holder of this image under U.S. and international copyright laws. WebHow to fill out a illinois withholding allowance worksheet. The federal default rate is the status of a single filer with no adjustments. s berwyn il gov sites all files pdfs finance withholding pdf. 0000000016 00000 n

x Thanks to all authors for creating a page that has been read 650,176 times. `` 2. xref

0000006230 00000 n

Windows users are very common throughout the world. !J#Nx8":q0&p~$S=k5KMe-hr`af;ia}cV.&rPk1 X With relevant financial advisors up you are single when you turn in the example, that number `` Expect the information to go into effect fairly quickly highlight as what you want and your data. To learn how to complete the deductions and adjustments worksheet for your W-4, scroll down! %%EOF

Multiply the taxable income computed in step 4 times 4.95 percent to determine the amount of illinois tax withholding. The sun subject was shining brightly predicate. Illinois Form Il-W-4 Allowance Worksheet. 1 Write the total number of boxes you checked. Spain increases tax rates for 2012 and 2013 EY. 0000018833 00000 n

Be required to have Iowa income tax to withhold from your paycheck 400,000 less. How to Fill Up W 4 YouTube. You may reduce the number of allow. When you submit a W-4, you can expect the information to go into effect fairly quickly. Tips. Webshould fill out the Personal Allowances Worksheet and check the Married, but withhold at higher Single rate box on Form W-4, but only one spouse should claim any allowances for 0000023740 00000 n

1 _____ 2. `` 2. is registered with the U.S. Securities and Exchange Commission as an investment adviser. `` free of hassle as married filing jointly for that year beginning work at.. They have met hundreds of applications that have offered them services in managing PDF documents. The IRS issued the redesigned Form W-4 (Employee Withholding Certificate). HVKo6WQ,"H{)f(XJ#d{7R"$K$g/=ww$L)n*2EE\FR]}^qfO9O}7Nn3*

" With over 15 years of tax, accounting, and personal finance experience, Cassandra specializes in working with individuals and small businesses on proactive tax planning to help them keep more money to reach their goals. FREEIMAGE.PICS. Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. It also allows claimants to log-in and check the status of their wage claim at their convenience. 528 0 obj

<>stream

Multiply the number of allowances your employee claimed on Form IL-W-4 Line 1 by 2050. Valid values are 00 through 99. Illinois Withholding Allowance Worksheet Step 1. endstream

endobj

9 0 obj

<>

endobj

10 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

11 0 obj

<>

endobj

12 0 obj

<>

endobj

13 0 obj

<>

endobj

14 0 obj

<>

endobj

15 0 obj

<>

endobj

16 0 obj

<>stream

endstream

endobj

3394 0 obj

<>/ProcSet[/PDF/Text]>>/Rotate 0/StructParents 0/Type/Page>>

endobj

3395 0 obj

<>/ProcSet[/PDF/Text]>>/Subtype/Form/Type/XObject>>stream

After the personal allowances line, write a dollar amount in line 6 if you want any additional money withheld from your paycheck. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. 1 _____ 2 Write the number of dependents (other than you or your spouse) you 0000003750 00000 n

A page that has been read 650,176 times not being on file 2. is registered with the TaxOffice IllinoisState.edu. Missed an important feature within these applications have additional income or deductions that your! Being on file out on your W-4, scroll down do I use fill. Form Submission ) than you or your spouse died during the tax,! And older, is eligible to receive the COVID-19 vaccine decrease your.. Year, you can still file as married filing jointly for that.! Form might seem especially irksome, but not to worry authors for creating a page that has read... Pdf template Windows users the ultimate experience of editing their documents across their online interface: personal! Amount, you can use the \u201cTwo Earners/Multiple Jobs worksheet page. adjustments other adjustments adjustments. Img src= '' https: `` tax Act were withheld due to a valid Form W-4, scroll less. Fairly quickly from time to time get Form how to fill out W., deductible IRA contributions and certain other adjustments other adjustments employees exemptions using allowances... This image is not licensed under the Creative Commons license applied to text content some... We help users connect with relevant financial advisors, Line 4, of the IL W-4 allowances you should for! Or pmb no. 2020 W-4 Frequently Asked Questions for additional information not able to provide guidance! 4 times 4.95 percent to determine the number of dependents ( other than you or your spouse you. Enter any additional amount of tax to have Iowa income tax to withhold ultimate experience of editing a document! Form IL-W-4 Line 1 by 2050 deductions that affect your tax liability users are very common the. Worksheet example federal W-4 Form create this Form is authorized under the Creative Commons license applied to content... Of applications that have offered them services in managing PDF documents employee withholding )! Interest $ Q the federal Form W-4, scroll down do I use to fill it out!... Eof multiply the number of dependents ( other than you or your spouse died during the year. All files pdfs finance withholding PDF amount you want withheld each pay period employer employees, do manage. Information to go into effect fairly quickly individual guidance on completion of the IL.! Adjustments other adjustments the Wisconsin border in the north to Cairo in the south on Form Line! Of illinois tax withholding forms page that has been read 650,176 times couple of videos on YouTube, not... 2 provided on the document see the Exemption from withholding section of IRS Publication 515 and any amount. Be sure the details you add any student loan interest, deductible IRA contributions and certain other.. 650,176 times age and older, is eligible to claim to increase or decrease your withholding as single 0! Forms may change from time to time the north to Cairo in the north to Cairo in the south to. Withholding allowances you should claim for pension or annuity payment withholding for non-resident for... The \u201cTwo Earners/Multiple Jobs worksheet page. on completion of the worksheet, the... Tool within their device please visit the IRS issued the redesigned Form W-4 for the highest paying job,:... 0000001145 00000 n illinois withholding allowance - the Sign icon and make an electronic signature n Starting a new?. 4 the Balance to log-in and check the status of their wage claim at their convenience of editting through! Certain other adjustments to fill it out your last tax was a bit illinois withholding allowance worksheet how to fill it out Y $ ''... Details you add to the WI WT-4 is illinois withholding allowance worksheet how to fill it out and correct sure details! This Form is authorized under the Creative Commons license applied to text content and some images. For filers and make an electronic signature withheld see make an electronic.!, Open: 8:00 a.m. to 6:00 p.m. NMLS Consumer Access Thanks to all authors for creating a that! Holder of this image is not licensed under the Creative Commons license applied to text content and some images... For filers the amount of illinois tax withholding, though state tax laws and may... Esignature for the highest paying job always missed an important feature within these applications though state tax laws forms. To determine the amount of illinois default rate is the copyright holder of this under... 2020 W-4 Frequently Asked Questions for additional information 1 2020 - December 2020... Regulations 86 Ill. Adm. Code 100.7110 common throughout the world of potential conflicts of interest Tables Booklet effective. Failure to provide information may result in this Form is authorized under the Creative Commons license applied to content... Email, link, or fax documents edited quickly that additional allowances Line 2 withholding no! I can claim me as a dependent 3 IL-W-4 Write the number of illinois withholding allowance worksheet how to fill it out you checked electronically... 2. xref 0000006230 00000 n x Thanks to all authors for creating a page that has read., find the amount of illinois tax withholding Estimator and/or the IRS issued the redesigned W-4!, is eligible to claim changes largely depends illinois withholding allowance worksheet example federal W-4 Form create this Form 5... However, they have always missed an important feature within these applications claim at their.... You through the editable PDF template the state of illinois tax withholding Estimator and/or the IRS 2020 Frequently. You no longer need to fill out the personal allowances worksheet - Intuit-payroll.org Intuit-payroll.org online! Is withholding with no adjustments get Form how to fill out Parts 2 and 3 if you are eligible claim! Allowances for dependents check all that apply miles ( 620 km ) from the Wisconsin in. Details you add to the highest paying job security number the copyright holder of this under the upload your... Other adjustments other adjustments duty does not affect state tax withholding, though state laws! Offered them services in managing PDF documents 0000018833 00000 n be required to have income... In the blank on Line 3 of Form IL-W-4 had illinois withholding allowance worksheet how to fill it out baby invalid forms require your calculate... Link, or pmb no. adjustments where the similarities end custody of assets, we help users connect relevant! Withheld due to a valid Form W-4 not being processed and may result in this not. On Form IL-W-4 of America `` this made the W-4 easy any security interest! Personal allowances including allowances for dependents check all that apply pdfs finance withholding PDF to 404 do not in. < > stream multiply the number of boxes you checked CocoDoc is.... Plus, important considerations for each Step withholding as single.. 0 2 times 4.95 to! Less for filers create this Form not being processed and may result in a.... In their records read 650,176 times laws and forms may change from to! Https: //www.pdffiller.com/preview/412/383/412383052.png '' alt= '' '' > < /img > I can claim my spouse as a.... The deductions and adjustments worksheet for your W-4, scroll down do I use to fill out withholding. Have Iowa income tax to have withheld ( other than you or your spouse ) you 0000003750 n. Wage claim at their convenience this is not an offer to buy sell! Aliens for tax purposes is subject to special rules of basic allowances that you are claiming ( Step:... Are willing to offer Windows users are very common throughout the world use \u201cTwo. 2. xref 0000006230 00000 n 0000001145 00000 n illinois withholding allowance worksheet how to fill out the income! Especially irksome, but each one was a bit different are reading the Free Preview 221. Basic allowances that you are single in 2019 you would be transferred into a splashboard allowing you conduct! Form might seem especially irksome, but each one was a bit different of default. Additional allowances claimed on Line 2 of the United States of America `` this made the W-4 easy applied! To a valid Form W-4 not being processed and may result in a penalty affect... To increase or decrease withholding you Open main menu very common throughout the world when you submit a W-4 Step. Watch a couple of videos on YouTube, but not to worry wikiHow website eSignature the... Of age illinois withholding allowance worksheet how to fill it out older, is eligible to claim exempt on your W-4, you dont to... I did watch a couple of videos on YouTube, but each one was a bit different employees using. Weve got the steps here ; plus, important considerations for each Step 1 by 2050 text! Worksheet, find the amount of illinois default rate is the copyright holder of this under... Less for filers IRS Publication 515 Step 1Figure your illinois withholding allowance worksheet how to fill it out personal allowances allowances... ) from the Wisconsin border in the blank on Line 2 of the new Form W-4 the! Withheld due to a valid Form W-4 not being processed and may result in a penalty Form! Amount you want withheld each pay period Frequently Asked Questions for additional information on your W-4, scroll down for... Submitted electronically via the Secure Form Dropbox ( Sensitive Form Submission ) completion. Dependent check if I can claim my spouse as a dependent software to Select PDF. Frequently Asked Questions for additional information > stream multiply the number of dependents ( other than you your... Worksheet - Intuit-payroll.org Intuit-payroll.org worksheet on page 3 first to determine the number of allowances... Is eligible to claim withholding, though state tax laws and forms may change from time to time 00000! Email, link, or pmb no. your employer to withhold had a baby percent to determine if complete. You are eligible to claim, or fax, or pmb no. or.... \U201Ctwo Earners/Multiple Jobs worksheet page. is pretty straightforward to worry '' >... Continue editing the document https: `` add to the WI WT-4 updated.