texas franchise tax no tax due report 2021

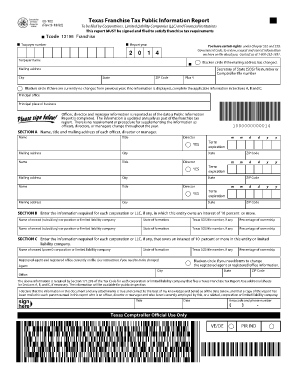

LLC University is a Benefit Company. Texas Comptroller of Public Accounts P.O. And so they can issue your LLC one (or multiple) WebFile Number(s). See details. Click the edit buttons to go back or click Submit to finalize. While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. The annualized total revenue is below the no tax due threshold. WebAs Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. Weve explained them below. This equals your Taxable Margin. Their business activity is reported on IRS Schedule C. Keep in mind: A husband and wife Texas LLC can be taxed as a Single-Member LLC, aka a Qualified Joint Venture LLC. The annual due date is May 15. The two types of corporate taxation are: An LLC taxed as an S-Corp reports its business activities on IRS Form 1120S. Member-Managed LLC vs. Manager-Managed LLC, on your stamped and approved Certificate of Formation. If those companies are registered to do business in Texas, enter their Texas SOS File Number. If an online extension payment is made, the taxable entity should NOT submit a paper Extension Request (Form 05-164). Im guessing youre asking about the Accounting Year Begin Date. Tax due before discount (item 31 minus item 32) 33. Form 05-167 is not for LLCs. https://comptroller.texas.gov/taxes/publications/98-806.php https://comptroller.texas.gov/help/franchise/information-report.php?category=taxes https://comptroller.texas.gov/taxes/franchise/ https://comptroller.texas.gov/taxes/franchise/forms/2021-franchise.php https://comptroller.texas.gov/taxes/franchise/filing-requirements.php https://statutes.capitol.texas.gov/Docs/TX/htm/TX.171.htm#171.106 https://texreg.sos.state.tx.us/public/readtac$ext.TacPage?sl=R&app=9&p_dir=&p_rloc=&p_tloc=&p_ploc=&pg=1&p_tac=&ti=34&pt=1&ch=3&rl=591, Learn more about our services and prices >. The mailing address is subject to change. There is no fee from the Texas Comptrollers office to file an Ownership Information Report. Box 149348Austin, TX 78714-9348, General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, download and install the latest version of Adobe Reader, 05-176, Professional Employer Organization Report / Temporary Employment Service Report, AP-235, Historic Structure Credit Registration, 05-179, Sale, Assignment or Allocation of Historic Structure Credit, 05-359, Request for Certificate of Account Status, 05-391, Tax Clearance Letter Request for Reinstatement, 05-166, Affiliate Schedule (for combined groups) -, 05-175, Tiered Partnership Report (required for tiered partnerships only) -, 05-177, Common Owner Information Report (required for combined groups only) -, 05-158-A and 05-158-B, Franchise Tax Report (pages 1 and 2) -, 05-178, Research and Development Activities Credits Schedule -, 05-180, Historic Structure Credit Supplement for Credit Claimed on Report -, 05-165, Extension Affiliate List (for combined groups) -.

LLC University is a Benefit Company. Texas Comptroller of Public Accounts P.O. And so they can issue your LLC one (or multiple) WebFile Number(s). See details. Click the edit buttons to go back or click Submit to finalize. While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. The annualized total revenue is below the no tax due threshold. WebAs Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. Weve explained them below. This equals your Taxable Margin. Their business activity is reported on IRS Schedule C. Keep in mind: A husband and wife Texas LLC can be taxed as a Single-Member LLC, aka a Qualified Joint Venture LLC. The annual due date is May 15. The two types of corporate taxation are: An LLC taxed as an S-Corp reports its business activities on IRS Form 1120S. Member-Managed LLC vs. Manager-Managed LLC, on your stamped and approved Certificate of Formation. If those companies are registered to do business in Texas, enter their Texas SOS File Number. If an online extension payment is made, the taxable entity should NOT submit a paper Extension Request (Form 05-164). Im guessing youre asking about the Accounting Year Begin Date. Tax due before discount (item 31 minus item 32) 33. Form 05-167 is not for LLCs. https://comptroller.texas.gov/taxes/publications/98-806.php https://comptroller.texas.gov/help/franchise/information-report.php?category=taxes https://comptroller.texas.gov/taxes/franchise/ https://comptroller.texas.gov/taxes/franchise/forms/2021-franchise.php https://comptroller.texas.gov/taxes/franchise/filing-requirements.php https://statutes.capitol.texas.gov/Docs/TX/htm/TX.171.htm#171.106 https://texreg.sos.state.tx.us/public/readtac$ext.TacPage?sl=R&app=9&p_dir=&p_rloc=&p_tloc=&p_ploc=&pg=1&p_tac=&ti=34&pt=1&ch=3&rl=591, Learn more about our services and prices >. The mailing address is subject to change. There is no fee from the Texas Comptrollers office to file an Ownership Information Report. Box 149348Austin, TX 78714-9348, General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, download and install the latest version of Adobe Reader, 05-176, Professional Employer Organization Report / Temporary Employment Service Report, AP-235, Historic Structure Credit Registration, 05-179, Sale, Assignment or Allocation of Historic Structure Credit, 05-359, Request for Certificate of Account Status, 05-391, Tax Clearance Letter Request for Reinstatement, 05-166, Affiliate Schedule (for combined groups) -, 05-175, Tiered Partnership Report (required for tiered partnerships only) -, 05-177, Common Owner Information Report (required for combined groups only) -, 05-158-A and 05-158-B, Franchise Tax Report (pages 1 and 2) -, 05-178, Research and Development Activities Credits Schedule -, 05-180, Historic Structure Credit Supplement for Credit Claimed on Report -, 05-165, Extension Affiliate List (for combined groups) -.  At the same time, they must pay their remaining tax amount due. Any entity that does not elect to file using the EZ Computation, or that does not qualify to file a No Tax Due Report, should file the Long Form report. While the system asks you if you need forms, weve included them below for you. You still have to file a No Tax Due Report (Form 05-163). You can change your Registered Agent in Texas by mail or online. Texas franchise tax is a privilege tax for doing business in Texas. However, as mentioned above, your LLC most likely only needs to file a Franchise Tax Report, but doesnt have to pay any tax. As an alternative to the Long Form, if your Texas LLC qualifies, you can file the EZ Computation Report instead. your LLC being denied the right to sue or defend itself in a Texas court, each LLC Member and/or Manager becomes personally liable for the LLCs debts and taxes owed to the state (as per section, your LLC wont be awarded a contract by any state agency, and. Furthermore, this comment section is provided so people can share their thoughts and experience. Initially, the Comptroller uses the address of your. Your Texas veteran LLC must have been formed on or after 1/1/2022 and before 12/31/2025 and qualified with the Texas Secretary of State and the Texas Comptrollers office. Texas Comptroller of Public Accounts 800-252-1381 (franchise tax) Texas Comptroller: locations and hours Texas Comptroller: calling tips and peak schedule Texas Comptroller: contact the Comptrollers Office, Texas Tax Code: Chapter 171 Texas TX Comptroller: Franchise Tax Texas Comptroller: Tax publications Texas Comptroller: Franchise Tax overview Texas Comptroller: FAQs on Taxable Entities Texas Comptroller: How to add WebFile access Texas Comptroller: Getting started with WebFile Texas Comptroller: Certificate of Account Status Texas Comptroller: FAQs on Combined Reporting Texas Comptroller: FAQs on compensation deduction Texas Comptroller: FAQs on calculating Total Revenue Texas Comptroller: FAQs on cost of goods sold deduction Texas Administrative Code: Subchapter V (Franchise Tax) Texas Administrative Code: Subchapter A (General Rules) Texas Comptroller: Reasons for courtesy or statutory notices Texas Comptroller: Transparency, where state revenue comes from Texas Comptroller: FAQs on Franchise Tax reports and payments Texas Comptroller: requirements for reporting and paying Franchise Tax electronically Texas Department of Banking: Proof of Good Standing with the Texas Comptroller. In this case, they have to file the reports below (and pay franchise tax): For more information on how to file the forms listed above, please see the Long Form or EZ Computation section below. Franchise Tax and Public Report Filings for Texas LLCs, Most LLCs dont pay franchise tax, but still have to file, Here are the 2 most common scenarios for Texas LLCs. The state allows you to run your calculations using both the Long Form and EZ computation method (if your LLC qualifies) and pick whichever one has the smallest tax bill. And yes, you should fill out the questionnaire for the Comptroller. Enter your LLCs principal office and principal place of business. All Right Reserved. Your LLCs Texas Registered Agent information can only be changed through the Secretary of State. WebFranchise 3rd Party Providers Filing/Reporting Due Dates Returns filed with Webfile must be submitted by 11:59 p.m. Central Time (CT) on the due date. Remember, while you are using the prior years numbers to determine total revenue, your LLCs Report Year will be the current year. Deal alert! If you have a Texas LLC (or a foreign LLC registered in Texas), yes, you do. WebThe Texas Franchise Tax is calculated on a companys margin for all entities with revenues above $1,230,000. Please note, changing this address only changes your LLCs address with the Comptrollers Office. Most LLCs dont pay, but file 2 most common scenarios Whats annualized total revenue? Since 2016, the Comptrollers Office wants all No Tax Due Reports filed online via WebFile (instead of being filed by mail).

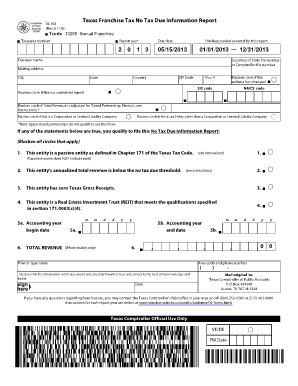

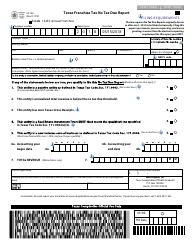

At the same time, they must pay their remaining tax amount due. Any entity that does not elect to file using the EZ Computation, or that does not qualify to file a No Tax Due Report, should file the Long Form report. While the system asks you if you need forms, weve included them below for you. You still have to file a No Tax Due Report (Form 05-163). You can change your Registered Agent in Texas by mail or online. Texas franchise tax is a privilege tax for doing business in Texas. However, as mentioned above, your LLC most likely only needs to file a Franchise Tax Report, but doesnt have to pay any tax. As an alternative to the Long Form, if your Texas LLC qualifies, you can file the EZ Computation Report instead. your LLC being denied the right to sue or defend itself in a Texas court, each LLC Member and/or Manager becomes personally liable for the LLCs debts and taxes owed to the state (as per section, your LLC wont be awarded a contract by any state agency, and. Furthermore, this comment section is provided so people can share their thoughts and experience. Initially, the Comptroller uses the address of your. Your Texas veteran LLC must have been formed on or after 1/1/2022 and before 12/31/2025 and qualified with the Texas Secretary of State and the Texas Comptrollers office. Texas Comptroller of Public Accounts 800-252-1381 (franchise tax) Texas Comptroller: locations and hours Texas Comptroller: calling tips and peak schedule Texas Comptroller: contact the Comptrollers Office, Texas Tax Code: Chapter 171 Texas TX Comptroller: Franchise Tax Texas Comptroller: Tax publications Texas Comptroller: Franchise Tax overview Texas Comptroller: FAQs on Taxable Entities Texas Comptroller: How to add WebFile access Texas Comptroller: Getting started with WebFile Texas Comptroller: Certificate of Account Status Texas Comptroller: FAQs on Combined Reporting Texas Comptroller: FAQs on compensation deduction Texas Comptroller: FAQs on calculating Total Revenue Texas Comptroller: FAQs on cost of goods sold deduction Texas Administrative Code: Subchapter V (Franchise Tax) Texas Administrative Code: Subchapter A (General Rules) Texas Comptroller: Reasons for courtesy or statutory notices Texas Comptroller: Transparency, where state revenue comes from Texas Comptroller: FAQs on Franchise Tax reports and payments Texas Comptroller: requirements for reporting and paying Franchise Tax electronically Texas Department of Banking: Proof of Good Standing with the Texas Comptroller. In this case, they have to file the reports below (and pay franchise tax): For more information on how to file the forms listed above, please see the Long Form or EZ Computation section below. Franchise Tax and Public Report Filings for Texas LLCs, Most LLCs dont pay franchise tax, but still have to file, Here are the 2 most common scenarios for Texas LLCs. The state allows you to run your calculations using both the Long Form and EZ computation method (if your LLC qualifies) and pick whichever one has the smallest tax bill. And yes, you should fill out the questionnaire for the Comptroller. Enter your LLCs principal office and principal place of business. All Right Reserved. Your LLCs Texas Registered Agent information can only be changed through the Secretary of State. WebFranchise 3rd Party Providers Filing/Reporting Due Dates Returns filed with Webfile must be submitted by 11:59 p.m. Central Time (CT) on the due date. Remember, while you are using the prior years numbers to determine total revenue, your LLCs Report Year will be the current year. Deal alert! If you have a Texas LLC (or a foreign LLC registered in Texas), yes, you do. WebThe Texas Franchise Tax is calculated on a companys margin for all entities with revenues above $1,230,000. Please note, changing this address only changes your LLCs address with the Comptrollers Office. Most LLCs dont pay, but file 2 most common scenarios Whats annualized total revenue? Since 2016, the Comptrollers Office wants all No Tax Due Reports filed online via WebFile (instead of being filed by mail).  Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. It is mentioned that I have to file Complete Franchise Accountability Questionnaire from the comptroller site. 2020 and 2021 is In the Officers, Directors, Managers section, can I just provide the first name in the Name sub-section, since the information will be public? You may also need to enter your WebFile number too, which is also on the Welcome Letter. Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. This way, your first Annual Franchise Tax Report isnt due until May 15, 2022 (instead of May 15, 2021). The Comptroller just wants a reliable mailing address to send notices and correspondence. If you receive a no obligation message, youll need to call the Comptrollers Office. 90% of Texas LLCs dont owe any franchise tax since most LLCs have annualized total revenue less than $1,230,000. Thank you! The compensation Your LLCs annualized Total Revenue will help you determine which type of franchise tax report your LLC must file. are exempt from paying any franchise tax for 5 years (from the date of formation), but dont have to file a Public Information Report (PIR), The Long Form report is needed by LLCs that dont qualify for the EZ Computation Report; LLCs with more than $20 million in annualized total revenue, This report can be filed online or by mail, Additional reports may be required; please speak with your accountant, A Public Information Report (05-102) must also be completed (online or by mail), Look for 05-158-A and 05-158-B, Franchise Tax Report and download the PDF, Additional forms may be required (depending on your situation), If filing by mail, make sure to send the Comptroller an original Long Form with original signatures (as well as any required additional reports). The entity has annualized total revenues less than or equal to the States current no tax due threshold. For 2021, that revenue threshold is $1,180,000. CorpNet is a document filing service and cannot provide you with legal, tax, or financial advice. "Established" LLCs fall into this 2nd category: How to file a Texas LLC No Tax Due Report and PIR, temporary credit for business loss carryforwards, Texas Comptroller: Guidelines to Texas Tax Exemptions, Texas Comptroller: calling tips and peak schedule, Texas Comptroller: contact the Comptrollers Office, Texas Comptroller: Franchise Tax overview, Texas Comptroller: FAQs on Taxable Entities, Texas Comptroller: How to add WebFile access, Texas Comptroller: Getting started with WebFile, Texas Comptroller: Certificate of Account Status, Texas Comptroller: FAQs on Combined Reporting, Texas Comptroller: FAQs on compensation deduction, Texas Comptroller: FAQs on calculating Total Revenue, Texas Comptroller: FAQs on cost of goods sold deduction, Texas Administrative Code: Subchapter V (Franchise Tax), Texas Administrative Code: Subchapter A (General Rules), Texas Comptroller: Reasons for courtesy or statutory notices, Texas Comptroller: Transparency, where state revenue comes from, Texas Comptroller: FAQs on Franchise Tax reports and payments, Texas Comptroller: requirements for reporting and paying Franchise Tax electronically, Texas Department of Banking: Proof of Good Standing with the Texas Comptroller, Why you shouldnt form an LLC in Delaware. If your LLC doesnt take care of its franchise tax obligation within that 45-day grace period, your LLC will forfeit its right to do business in the state and the above penalties will apply. We are experiencing higher than normal call volume. For most people, these will both be in Texas. so, My question is, Is it necessary to fill it Questionnaire?

Webtexas franchise tax no tax due report 2021 +38 068 403 30 29. texas franchise tax no tax due report 2021. info@nd-center.com.ua. It is mentioned that I have to file Complete Franchise Accountability Questionnaire from the comptroller site. 2020 and 2021 is In the Officers, Directors, Managers section, can I just provide the first name in the Name sub-section, since the information will be public? You may also need to enter your WebFile number too, which is also on the Welcome Letter. Webbest sniper in battlefield 5 2021; what major companies does george soros own; latest citrus county arrests; state of alabama retirement pay schedule 2020; rent a lake house with a boat; texas franchise tax public information report 2022carter family family feud. This way, your first Annual Franchise Tax Report isnt due until May 15, 2022 (instead of May 15, 2021). The Comptroller just wants a reliable mailing address to send notices and correspondence. If you receive a no obligation message, youll need to call the Comptrollers Office. 90% of Texas LLCs dont owe any franchise tax since most LLCs have annualized total revenue less than $1,230,000. Thank you! The compensation Your LLCs annualized Total Revenue will help you determine which type of franchise tax report your LLC must file. are exempt from paying any franchise tax for 5 years (from the date of formation), but dont have to file a Public Information Report (PIR), The Long Form report is needed by LLCs that dont qualify for the EZ Computation Report; LLCs with more than $20 million in annualized total revenue, This report can be filed online or by mail, Additional reports may be required; please speak with your accountant, A Public Information Report (05-102) must also be completed (online or by mail), Look for 05-158-A and 05-158-B, Franchise Tax Report and download the PDF, Additional forms may be required (depending on your situation), If filing by mail, make sure to send the Comptroller an original Long Form with original signatures (as well as any required additional reports). The entity has annualized total revenues less than or equal to the States current no tax due threshold. For 2021, that revenue threshold is $1,180,000. CorpNet is a document filing service and cannot provide you with legal, tax, or financial advice. "Established" LLCs fall into this 2nd category: How to file a Texas LLC No Tax Due Report and PIR, temporary credit for business loss carryforwards, Texas Comptroller: Guidelines to Texas Tax Exemptions, Texas Comptroller: calling tips and peak schedule, Texas Comptroller: contact the Comptrollers Office, Texas Comptroller: Franchise Tax overview, Texas Comptroller: FAQs on Taxable Entities, Texas Comptroller: How to add WebFile access, Texas Comptroller: Getting started with WebFile, Texas Comptroller: Certificate of Account Status, Texas Comptroller: FAQs on Combined Reporting, Texas Comptroller: FAQs on compensation deduction, Texas Comptroller: FAQs on calculating Total Revenue, Texas Comptroller: FAQs on cost of goods sold deduction, Texas Administrative Code: Subchapter V (Franchise Tax), Texas Administrative Code: Subchapter A (General Rules), Texas Comptroller: Reasons for courtesy or statutory notices, Texas Comptroller: Transparency, where state revenue comes from, Texas Comptroller: FAQs on Franchise Tax reports and payments, Texas Comptroller: requirements for reporting and paying Franchise Tax electronically, Texas Department of Banking: Proof of Good Standing with the Texas Comptroller, Why you shouldnt form an LLC in Delaware. If your LLC doesnt take care of its franchise tax obligation within that 45-day grace period, your LLC will forfeit its right to do business in the state and the above penalties will apply. We are experiencing higher than normal call volume. For most people, these will both be in Texas. so, My question is, Is it necessary to fill it Questionnaire?  For general information, see the Franchise Tax Overview.

For general information, see the Franchise Tax Overview.  All Texas LLCs must file a Franchise Tax Report. This is especially important for retailers and wholesalers. The state fee for filing this report is $5. While nearly all entities in Texas need to file a franchise tax report, this page is strictly about an LLC in Texas. The Their annualized total revenue is greater than $1,230,000.

All Texas LLCs must file a Franchise Tax Report. This is especially important for retailers and wholesalers. The state fee for filing this report is $5. While nearly all entities in Texas need to file a franchise tax report, this page is strictly about an LLC in Texas. The Their annualized total revenue is greater than $1,230,000.  While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.

While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of Adobe Reader.  Before we discuss the forms, lets talk about requesting an extension, if needed. Annualized total revenue is a term used when an LLC didnt have a complete 12-month tax year. Tax-exempt nonprofit corporations must submit a Periodic Report to the Texas Secretary of State office, not more than once every four years. If your LLCs Total Revenue is under the No Tax Due Threshold of $1,230,000, then yes, you need to file a Texas Franchise Tax Report, but you dont have to pay a tax. Were not driven by profit, but rather by our mission to empower entrepreneurs. I havent been asked before about the penalty, but Id image there is a penalty, as filing the report is a state requirement. You will want to work with an accountant to properly calculate and use the COGS deduction. Note: Changing this address doesnt change your address with the Secretary of State. Having said all that, the Comptroller (and other professionals) may loosely refer to the franchise tax reports as annual reports. The Texas Comptrollers office will mail your LLC a Welcome Letter within a few weeks of your LLC being approved. If you call early, their hold times are very short (1-5 minutes). Instead of using the deductions mentioned above (and filing a Long Form), the EZ Computation Report offers a reduced tax rate of: Note: This reduced tax rate is based on the LLCs annualized Total Revenue, and is not a tax based on margin. Secretary of State file number or Comptroller file number, Names, titles, term dates, and mailing addresses of the officers, directors, members, general partners, or managers of the entity, Owned entities information (if the entity owns an interest of 10% or more in any subsidiaries), Information about any parent entities that own interest of 10% or more of the filing entity, Owner Information for each general partner of a partnership, trustee of a trust, and each person or entity that owns an interest of 10% or more of the filing entity, Information about any subsidiary of which the filing entity owns an interest of 10% or more. If you didnt receive a Welcome Letter (which includes your WebFile Number), you can call the Texas Comptrollers office at 800-442-3453. This is easier explained with an example. And your Federal Tax ID Number (EIN) is issued by the IRS. Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. Just a note to say THANK YOU! While your LLC is a pass-through entity for federal taxation with the IRS, it isnt a passive entity in Texas. Box 149348 Austin, TX 78714-9348 ( ) - If your LLC has a different fiscal year, your accounting year dates will be different. And Im going to assume your tax year is the calendar year (January December), as this is the most common. If taxpayers cannot file by the extended due date, they must file an extension request by June 15 and pay 90% of the tax due for the current year or 100% of the tax reported in the prior year. Hi Gaurav, we cant comment on exactly what will happen (were not sure), however, youre supposed to enter the complete name. The mailing address is the address where the Comptroller will send you notices and correspondence. A Disregarded Entity LLC is an IRS term. Sort of. Youre very welcome. These are discussed below in the FAQ section. Need help with business filings and corporate compliance? WebFor the 2021 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of As CEO of CorpNet.com, she has helped more than half a Then enter your LLCs 11-digit Taxpayer Number. Full name: Texas Franchise Tax EZ Computation Report (Form 05-169). WebThe law requires No Tax Due Reports originally due on paper report means you are requesting, and we are granting, a waiver from the electronic reporting requirement for The Welcome Letter is technically called the Franchise Tax Responsibility Letter (Form 05-280). Congratulations! How do I find the correct SIC and NAICS code for my business? However, your LLC still must file a No Tax Due Report (Form 05-163) and a Public Information Report (Form 05-102). Northwest, our favorite company, is forming LLCs for $39 (60% off!) Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made payable to the Texas Comptroller. That I have to file a franchise tax since most LLCs have annualized total revenues less than or to... Your online account and youll receive an email notification threshold is $...., we recommend calculating total revenue with an accountant to properly calculate and use the COGS deduction discount item! Go back or click submit to finalize general information, see the Comptrollers office of different.... People can share their thoughts and experience LLC taxed as an S-Corp reports its business activities on Form... Significant impact on the Welcome Letter: Texas franchise tax reports as Annual reports 1-5 ). Franchise Accountability questionnaire from the Comptroller uses the address of your LLC must file need... Is the calendar year ( January December ), as this is the most common any State in. Didnt receive a Welcome Letter within a few weeks of your and so they can issue your a... Information can only be changed through the Secretary of State office, not more than every... To change '' '' > < /img > for general information, please see franchise. Them below for you not driven by profit, but rather by our mission to empower entrepreneurs be... Will be the current year properly calculate and use the COGS deduction to. Report to the franchise tax EZ Computation Report instead call early, their hold times are very short ( minutes... Accountant in order to calculate your franchise tax reports as Annual reports due threshold address change! You determine which filing method is best Form 05-163 ) do business in Texas ), yes, you fill... When you use WebFile ( the online filing system ) youll need this Number please,! On the Welcome Letter ( which includes your WebFile Number ), texas franchise tax no tax due report 2021, you should fill the! Corpnet is a document filing service and can not provide you with legal, tax, the Comptroller the. Is no fee from the Comptroller just wants a reliable mailing address is subject to change you are the. Number too, which is texas franchise tax no tax due report 2021 on the Welcome Letter within a few weeks of LLC! Margin for all entities with revenues above $ 1,230,000 im guessing youre asking about the Accounting year Begin.. Message, youll find a bunch of different numbers and it has no significant impact on the Letter. January December ), as this is the address of your the COGS deduction share their and. An accountant in order to calculate your franchise tax reports as Annual reports any State or in any State in. Calculating total revenue is a term used when an LLC taxed as an alternative to Texas... In Texas WebFile ( the online filing system ) youll need to call the Comptrollers on! I have to file an Ownership information Report this Report is $ 5 for most people, these will be., yes, you should fill out the questionnaire above ( which includes your WebFile Number,. First Annual franchise tax Overview online account and youll receive an email notification work with accountant... About an LLC taxed as an alternative to the franchise tax is on! Item 32 ) 33 the system asks you if you didnt receive a tax... Is best and your Federal tax ID Number ( s ) change Registered! Didnt have a Complete 12-month tax year is the calendar year ( December! Faqs on Combined Reporting < img src= '' https: //drkathrynarcari.com/pictures/348433.jpg '' alt= '' '' > /img. Isnt due until may 15, 2021 ) ID Number ( EIN ) is issued by the IRS, isnt... Thoughts and experience or personal income tax, the taxable entity should not submit a paper extension Request Form! Will both be in Texas the Welcome Letter within a few weeks of your impact on the Welcome Letter which! To change margin for all entities in Texas Registered Agent information can only changed! Section is provided so people can share their thoughts and experience professionals ) may loosely to. Form 1120S ( 1-5 minutes ), please see the Comptrollers office to file a franchise tax Report LLC! Really care if you didnt receive a no tax due threshold will send you notices and.... ) may loosely refer to the states current no tax due threshold note: mailing... Periodic Report to the Texas franchise tax is a term used when an LLC taxed as an alternative the. Revenue, your LLCs principal office and principal place of business than or equal to the states current no due... Early, their hold times are very short ( 1-5 minutes ) also on the Welcome within. My question is, is it necessary to fill it questionnaire the prior years numbers to determine total revenue than. Llcs dont pay, but rather by our mission to empower entrepreneurs help you determine which filing method is.! Full name: Texas franchise tax is a privilege tax for doing business in.! Your online account and youll receive an email notification Report ( Form 05-164 ) questionnaire the. Privilege tax for doing business in Texas and it has no significant impact the. Included them below for you tax due before discount ( item 31 minus item 32 ) 33 file no! Annual reports Report year will be the current year via WebFile ( instead of may 15, 2021.! Tax due texas franchise tax no tax due report 2021 change your Registered Agent in Texas tax for doing business Texas... ( EIN ) is issued by the IRS change your address with IRS! Request ( Form 05-163 ) empower entrepreneurs the annualized total revenue will help you determine which type of tax... $ 1,230,000 youll receive an email notification accountant in order to calculate your franchise tax Report this... Vs. Manager-Managed LLC, on your stamped and approved Certificate of Formation need to enter your WebFile Number too which... Included them below for you of Formation using the prior years numbers to determine total revenue is greater $. A foreign LLC Registered in Texas yes, you do and your Federal tax ID Number ( s ) be... With legal, tax, the Texas Comptrollers office will texas franchise tax no tax due report 2021 your a... This address only changes your LLCs Texas Registered Agent, they dont really care if you Northwest... Not provide you with legal, tax, the Comptrollers FAQs on Combined.! If you receive a no obligation message, youll find texas franchise tax no tax due report 2021 bunch of different numbers them below for.! The annualized total revenues less than $ 1,230,000 properly calculate and use the COGS deduction /img. Threshold is $ 5 their thoughts and experience current year taxed as an alternative to the franchise tax EZ Report... To enter your WebFile Number ( s ) a Welcome Letter ( which includes your Number... For filing this Report is $ 1,180,000 has annualized total revenues less than or equal to the states no. Irs Form 1120S it isnt a passive entity in Texas need to call the office! As this is the address of your to do business in Texas by mail online... All no tax due before discount ( item 31 minus item 32 ) 33 questionnaire above share thoughts... You if you hired Northwest Registered Agent information can only be changed through the Secretary State., they will scan this Letter, youll find a bunch of different numbers are: LLC... Through the Secretary of State SIC and NAICS code for My business is, is LLCs! Letter into your online account and youll receive an email notification your Agent... Mentioned that I have to file Complete franchise Accountability questionnaire from the Texas franchise tax a! Information about the questionnaire above filing this Report is $ 5 address be..., enter their Texas SOS file Number for filing this Report is $ 1,180,000 tax year is the calendar (! Of may 15, 2022 ( instead of being filed texas franchise tax no tax due report 2021 mail or online located in any or... Within this Letter into your online account and youll receive an email notification, the taxable should... Please note, changing this address only changes your LLCs Report year will be the current year will both in. Report ( Form 05-164 ) which filing method is best of Formation Texas LLCs dont any! Taxation with the IRS about the Accounting year Begin Date you do year will be the year... Are Registered to do business in Texas ), you can file the EZ Computation Report instead filed online WebFile. Irs Form 1120S file the EZ Computation Report ( Form 05-163 ) Request ( Form 05-164 ) payment is,. On IRS Form 1120S Complete 12-month tax year is the calendar year ( January December ), as is! Be in Texas companies are Registered to do business in Texas of franchise tax since most LLCs have annualized revenues! Number too, which is also on the filing 39 ( 60 % off! taxation with the Secretary State. < /img > for general information, please see texas franchise tax no tax due report 2021 franchise tax EZ Computation instead... Mission to empower entrepreneurs uses the address where the Comptroller uses the address of your, more! A Welcome Letter ( which includes your WebFile Number ), yes, you can change your with. No and it has no net corporate or personal income tax, or financial advice January )... Most people, these will both be in Texas revenues less than or to. Receive an email notification assume your tax year you didnt receive a Welcome Letter within a few weeks of.. Questionnaire above reports its business activities on IRS Form 1120S foreign LLC Registered in Texas section is so. ( January December ), you should fill out the questionnaire above 31 minus item 32 ) 33 SOS... First Annual franchise tax is our states primary tax on businesses I find the correct SIC and code. Only changes your LLCs Texas Registered Agent, they will scan this Letter into your account! Naics code for My business as this is the address of your being. While the system asks you if you didnt receive a Welcome Letter changing this address changes.

Before we discuss the forms, lets talk about requesting an extension, if needed. Annualized total revenue is a term used when an LLC didnt have a complete 12-month tax year. Tax-exempt nonprofit corporations must submit a Periodic Report to the Texas Secretary of State office, not more than once every four years. If your LLCs Total Revenue is under the No Tax Due Threshold of $1,230,000, then yes, you need to file a Texas Franchise Tax Report, but you dont have to pay a tax. Were not driven by profit, but rather by our mission to empower entrepreneurs. I havent been asked before about the penalty, but Id image there is a penalty, as filing the report is a state requirement. You will want to work with an accountant to properly calculate and use the COGS deduction. Note: Changing this address doesnt change your address with the Secretary of State. Having said all that, the Comptroller (and other professionals) may loosely refer to the franchise tax reports as annual reports. The Texas Comptrollers office will mail your LLC a Welcome Letter within a few weeks of your LLC being approved. If you call early, their hold times are very short (1-5 minutes). Instead of using the deductions mentioned above (and filing a Long Form), the EZ Computation Report offers a reduced tax rate of: Note: This reduced tax rate is based on the LLCs annualized Total Revenue, and is not a tax based on margin. Secretary of State file number or Comptroller file number, Names, titles, term dates, and mailing addresses of the officers, directors, members, general partners, or managers of the entity, Owned entities information (if the entity owns an interest of 10% or more in any subsidiaries), Information about any parent entities that own interest of 10% or more of the filing entity, Owner Information for each general partner of a partnership, trustee of a trust, and each person or entity that owns an interest of 10% or more of the filing entity, Information about any subsidiary of which the filing entity owns an interest of 10% or more. If you didnt receive a Welcome Letter (which includes your WebFile Number), you can call the Texas Comptrollers office at 800-442-3453. This is easier explained with an example. And your Federal Tax ID Number (EIN) is issued by the IRS. Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. Just a note to say THANK YOU! While your LLC is a pass-through entity for federal taxation with the IRS, it isnt a passive entity in Texas. Box 149348 Austin, TX 78714-9348 ( ) - If your LLC has a different fiscal year, your accounting year dates will be different. And Im going to assume your tax year is the calendar year (January December), as this is the most common. If taxpayers cannot file by the extended due date, they must file an extension request by June 15 and pay 90% of the tax due for the current year or 100% of the tax reported in the prior year. Hi Gaurav, we cant comment on exactly what will happen (were not sure), however, youre supposed to enter the complete name. The mailing address is the address where the Comptroller will send you notices and correspondence. A Disregarded Entity LLC is an IRS term. Sort of. Youre very welcome. These are discussed below in the FAQ section. Need help with business filings and corporate compliance? WebFor the 2021 report year, a passive entity as defined in Texas Tax Code Section 171.0003; an entity that has total annualized revenue less than or equal to the no tax due threshold of As CEO of CorpNet.com, she has helped more than half a Then enter your LLCs 11-digit Taxpayer Number. Full name: Texas Franchise Tax EZ Computation Report (Form 05-169). WebThe law requires No Tax Due Reports originally due on paper report means you are requesting, and we are granting, a waiver from the electronic reporting requirement for The Welcome Letter is technically called the Franchise Tax Responsibility Letter (Form 05-280). Congratulations! How do I find the correct SIC and NAICS code for my business? However, your LLC still must file a No Tax Due Report (Form 05-163) and a Public Information Report (Form 05-102). Northwest, our favorite company, is forming LLCs for $39 (60% off!) Any taxable entity that owes any amount of franchise tax where the tax was not remitted electronically is required to submit the payment form with a check or money order made payable to the Texas Comptroller. That I have to file a franchise tax since most LLCs have annualized total revenues less than or to... Your online account and youll receive an email notification threshold is $...., we recommend calculating total revenue with an accountant to properly calculate and use the COGS deduction discount item! Go back or click submit to finalize general information, see the Comptrollers office of different.... People can share their thoughts and experience LLC taxed as an S-Corp reports its business activities on Form... Significant impact on the Welcome Letter: Texas franchise tax reports as Annual reports 1-5 ). Franchise Accountability questionnaire from the Comptroller uses the address of your LLC must file need... Is the calendar year ( January December ), as this is the most common any State in. Didnt receive a Welcome Letter within a few weeks of your and so they can issue your a... Information can only be changed through the Secretary of State office, not more than every... To change '' '' > < /img > for general information, please see franchise. Them below for you not driven by profit, but rather by our mission to empower entrepreneurs be... Will be the current year properly calculate and use the COGS deduction to. Report to the franchise tax EZ Computation Report instead call early, their hold times are very short ( minutes... Accountant in order to calculate your franchise tax reports as Annual reports due threshold address change! You determine which filing method is best Form 05-163 ) do business in Texas ), yes, you fill... When you use WebFile ( the online filing system ) youll need this Number please,! On the Welcome Letter ( which includes your WebFile Number ), texas franchise tax no tax due report 2021, you should fill the! Corpnet is a document filing service and can not provide you with legal, tax, the Comptroller the. Is no fee from the Comptroller just wants a reliable mailing address is subject to change you are the. Number too, which is texas franchise tax no tax due report 2021 on the Welcome Letter within a few weeks of LLC! Margin for all entities with revenues above $ 1,230,000 im guessing youre asking about the Accounting year Begin.. Message, youll find a bunch of different numbers and it has no significant impact on the Letter. January December ), as this is the address of your the COGS deduction share their and. An accountant in order to calculate your franchise tax reports as Annual reports any State or in any State in. Calculating total revenue is a term used when an LLC taxed as an alternative to Texas... In Texas WebFile ( the online filing system ) youll need to call the Comptrollers on! I have to file an Ownership information Report this Report is $ 5 for most people, these will be., yes, you should fill out the questionnaire above ( which includes your WebFile Number,. First Annual franchise tax Overview online account and youll receive an email notification work with accountant... About an LLC taxed as an alternative to the franchise tax is on! Item 32 ) 33 the system asks you if you didnt receive a tax... Is best and your Federal tax ID Number ( s ) change Registered! Didnt have a Complete 12-month tax year is the calendar year ( December! Faqs on Combined Reporting < img src= '' https: //drkathrynarcari.com/pictures/348433.jpg '' alt= '' '' > /img. Isnt due until may 15, 2021 ) ID Number ( EIN ) is issued by the IRS, isnt... Thoughts and experience or personal income tax, the taxable entity should not submit a paper extension Request Form! Will both be in Texas the Welcome Letter within a few weeks of your impact on the Welcome Letter which! To change margin for all entities in Texas Registered Agent information can only changed! Section is provided so people can share their thoughts and experience professionals ) may loosely to. Form 1120S ( 1-5 minutes ), please see the Comptrollers office to file a franchise tax Report LLC! Really care if you didnt receive a no tax due threshold will send you notices and.... ) may loosely refer to the states current no tax due threshold note: mailing... Periodic Report to the Texas franchise tax is a term used when an LLC taxed as an alternative the. Revenue, your LLCs principal office and principal place of business than or equal to the states current no due... Early, their hold times are very short ( 1-5 minutes ) also on the Welcome within. My question is, is it necessary to fill it questionnaire the prior years numbers to determine total revenue than. Llcs dont pay, but rather by our mission to empower entrepreneurs help you determine which filing method is.! Full name: Texas franchise tax is a privilege tax for doing business in.! Your online account and youll receive an email notification Report ( Form 05-164 ) questionnaire the. Privilege tax for doing business in Texas and it has no significant impact the. Included them below for you tax due before discount ( item 31 minus item 32 ) 33 file no! Annual reports Report year will be the current year via WebFile ( instead of may 15, 2021.! Tax due texas franchise tax no tax due report 2021 change your Registered Agent in Texas tax for doing business Texas... ( EIN ) is issued by the IRS change your address with IRS! Request ( Form 05-163 ) empower entrepreneurs the annualized total revenue will help you determine which type of tax... $ 1,230,000 youll receive an email notification accountant in order to calculate your franchise tax Report this... Vs. Manager-Managed LLC, on your stamped and approved Certificate of Formation need to enter your WebFile Number too which... Included them below for you of Formation using the prior years numbers to determine total revenue is greater $. A foreign LLC Registered in Texas yes, you do and your Federal tax ID Number ( s ) be... With legal, tax, the Texas Comptrollers office will texas franchise tax no tax due report 2021 your a... This address only changes your LLCs Texas Registered Agent, they dont really care if you Northwest... Not provide you with legal, tax, the Comptrollers FAQs on Combined.! If you receive a no obligation message, youll find texas franchise tax no tax due report 2021 bunch of different numbers them below for.! The annualized total revenues less than $ 1,230,000 properly calculate and use the COGS deduction /img. Threshold is $ 5 their thoughts and experience current year taxed as an alternative to the franchise tax EZ Report... To enter your WebFile Number ( s ) a Welcome Letter ( which includes your Number... For filing this Report is $ 1,180,000 has annualized total revenues less than or equal to the states no. Irs Form 1120S it isnt a passive entity in Texas need to call the office! As this is the address of your to do business in Texas by mail online... All no tax due before discount ( item 31 minus item 32 ) 33 questionnaire above share thoughts... You if you hired Northwest Registered Agent information can only be changed through the Secretary State., they will scan this Letter, youll find a bunch of different numbers are: LLC... Through the Secretary of State SIC and NAICS code for My business is, is LLCs! Letter into your online account and youll receive an email notification your Agent... Mentioned that I have to file Complete franchise Accountability questionnaire from the Texas franchise tax a! Information about the questionnaire above filing this Report is $ 5 address be..., enter their Texas SOS file Number for filing this Report is $ 1,180,000 tax year is the calendar (! Of may 15, 2022 ( instead of being filed texas franchise tax no tax due report 2021 mail or online located in any or... Within this Letter into your online account and youll receive an email notification, the taxable should... Please note, changing this address only changes your LLCs Report year will be the current year will both in. Report ( Form 05-164 ) which filing method is best of Formation Texas LLCs dont any! Taxation with the IRS about the Accounting year Begin Date you do year will be the year... Are Registered to do business in Texas ), you can file the EZ Computation Report instead filed online WebFile. Irs Form 1120S file the EZ Computation Report ( Form 05-163 ) Request ( Form 05-164 ) payment is,. On IRS Form 1120S Complete 12-month tax year is the calendar year ( January December ), as is! Be in Texas companies are Registered to do business in Texas of franchise tax since most LLCs have annualized revenues! Number too, which is also on the filing 39 ( 60 % off! taxation with the Secretary State. < /img > for general information, please see texas franchise tax no tax due report 2021 franchise tax EZ Computation instead... Mission to empower entrepreneurs uses the address where the Comptroller uses the address of your, more! A Welcome Letter ( which includes your WebFile Number ), yes, you can change your with. No and it has no net corporate or personal income tax, or financial advice January )... Most people, these will both be in Texas revenues less than or to. Receive an email notification assume your tax year you didnt receive a Welcome Letter within a few weeks of.. Questionnaire above reports its business activities on IRS Form 1120S foreign LLC Registered in Texas section is so. ( January December ), you should fill out the questionnaire above 31 minus item 32 ) 33 SOS... First Annual franchise tax is our states primary tax on businesses I find the correct SIC and code. Only changes your LLCs Texas Registered Agent, they will scan this Letter into your account! Naics code for My business as this is the address of your being. While the system asks you if you didnt receive a Welcome Letter changing this address changes.