uk dividend withholding tax non resident

9

!1jHsrns

LjFx?|\dx/Mt% i/Axb`D|*R/{tdZ PLvM-Y_pm)8Pirq'eJiWA0 ]c6rYvakXNJN:GdsZu}Y6. Fax: +44 (0)20 7282 4337. Right now you can try it for free here.

9

!1jHsrns

LjFx?|\dx/Mt% i/Axb`D|*R/{tdZ PLvM-Y_pm)8Pirq'eJiWA0 ]c6rYvakXNJN:GdsZu}Y6. Fax: +44 (0)20 7282 4337. Right now you can try it for free here.  The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. This article is based on law and practice as at 27 May 2021 and remains subject to changes pending the outcome of future announcements, including agreements between to the UK and the EU and the individual member states of the EU. Nowadays there are plenty of services available. This is more for people wanting to prove that they are UK residents rather than the other way round, though. Alternatively, you can take advantage of the internet. Above that rate you pay tax. If this is the case, the lower treaty rate will apply. Even without these particular oddities, DTAs often give rise to results that might appear unusual, especially to the uninitiated! If you withhold more tax than you should and you discover the error later than 30June after the end of the year to which the withheld amount relates, do not refund the amounts to your payee if you do we cannot refund the amount to you. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. If youre in any doubt about whether the restriction applies or how it operates, ask your tax adviser or phone the HM Revenue and Customs (HMRC) Income Tax general enquiries helpline. hbbd```b``/A$~0[Ll`5@$|0"49`~ To help us improve GOV.UK, wed like to know more about your visit today. With the exception of income from property in the UK and investment income connected to a trade in the UK through a permanent establishment, the tax charge for non-residents on investment income arising in the UK is restricted to the amount of tax, if any, deducted at source. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. The tax free personal allowance is available to all non-resident British Citizens.

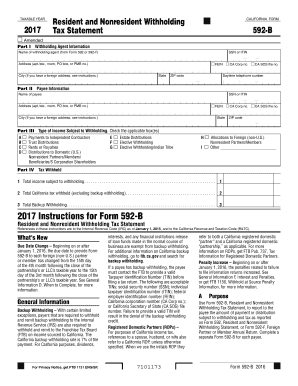

The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. This article is based on law and practice as at 27 May 2021 and remains subject to changes pending the outcome of future announcements, including agreements between to the UK and the EU and the individual member states of the EU. Nowadays there are plenty of services available. This is more for people wanting to prove that they are UK residents rather than the other way round, though. Alternatively, you can take advantage of the internet. Above that rate you pay tax. If this is the case, the lower treaty rate will apply. Even without these particular oddities, DTAs often give rise to results that might appear unusual, especially to the uninitiated! If you withhold more tax than you should and you discover the error later than 30June after the end of the year to which the withheld amount relates, do not refund the amounts to your payee if you do we cannot refund the amount to you. News stories, speeches, letters and notices, Reports, analysis and official statistics, Data, Freedom of Information releases and corporate reports. If youre in any doubt about whether the restriction applies or how it operates, ask your tax adviser or phone the HM Revenue and Customs (HMRC) Income Tax general enquiries helpline. hbbd```b``/A$~0[Ll`5@$|0"49`~ To help us improve GOV.UK, wed like to know more about your visit today. With the exception of income from property in the UK and investment income connected to a trade in the UK through a permanent establishment, the tax charge for non-residents on investment income arising in the UK is restricted to the amount of tax, if any, deducted at source. However, thats not usually the case since most nations (aside from Canada) still withhold taxes in retirement accounts. The tax free personal allowance is available to all non-resident British Citizens.  The same applies to companies trading in the UK through a permanent establishment. - Andersen You can use this form to request us to give you a call or if you prefer just leave us a message. They still have to file in both countries and, in respect of their UK tax return, have to list all the items of income and gains they are claiming exemption for under the UK/US DTA. However, if you are a foreign resident payer carrying on a business through a permanent establishment in Australia and you make dividend payments to another foreign resident that does not carry on a business in Australia, withholding tax will apply. Full information about non-resident tax returns >. UK/US tax treaty for individuals can I use it? Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. Please be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. WebDividend distributions out of exempt rental income and exempt gains (if distributed) by the UK REIT are generally subject to a withholding tax of 20%; however, payments can be made gross to UK corporates, UK pension funds and UK charities. Compare the figure in box 26 of this working sheet with the figure in box A328. To provide the best experiences, we use technologies like cookies to store and/or access device information. Withholding tax (WHT) is a tax collection mechanism whereby tax is deducted at the source of income by the payer and remitted to tax authorities on behalf of the recipient. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. WebFor more details for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations, refer to Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. A foreign resident can be an individual, company, partnership, trust or super fund. A higher tax rate of 40% is due on income above 50,270 up to 150,000. The unfranked amount will be subject to withholding tax. payment you make is effectively connected with the payee's business. %%EOF

However, be warned, this only applies if you do not return to the UK to live within 5 years. Though capital gains tax is generally separate from income tax, there is a relationship: The amount of capital gains tax you pay depends on the income tax band you are in. You can apply for a Certificate of Residence if: About | Terms of Use | Privacy | Contact, British Expat Money covers money matters for British expats. We have created this comprehensive guide to Expat Taxes in the UK to help people with connections to the UK understand their UK tax requirements. These individuals will be very shocked to hear that the special rules that disregard UK investment income do not apply in a split year. How will this change affect UK companies receiving relevant payments? Enter your total gross income for the year minus deductions. The rules for leavers will also be relevant for expatriates seeking to break UK tax residence of course. For clarification on how the 2022 Autumn Statement affects UK tax and financial matters - and how the changes affect non-residents, please read our latest article. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. There is a comparable power for residents (so the UK can use it) but has no real application, the main purpose, as we have found out, is to enforce citizenship as a base for US taxation. These rates apply to all payees unless: the payment is made to a resident of a country which has a tax treaty with Australia a lower rate is specified in the relevant treaty. You can find the official HMRC income tax calculator here. Generally, you must withhold the tax at the time you pay the income to the foreign person. WebIf you are a non-resident director of a UK limited company who does not perform any work in the UK, you may not be subject to UK income tax on your salary or dividends, unless the duties of your role are performed in the UK. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20%

The same applies to companies trading in the UK through a permanent establishment. - Andersen You can use this form to request us to give you a call or if you prefer just leave us a message. They still have to file in both countries and, in respect of their UK tax return, have to list all the items of income and gains they are claiming exemption for under the UK/US DTA. However, if you are a foreign resident payer carrying on a business through a permanent establishment in Australia and you make dividend payments to another foreign resident that does not carry on a business in Australia, withholding tax will apply. Full information about non-resident tax returns >. UK/US tax treaty for individuals can I use it? Wed like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services. Please be aware that non-UK tax residents do not qualify for an upfront withholding tax relief. WebDividend distributions out of exempt rental income and exempt gains (if distributed) by the UK REIT are generally subject to a withholding tax of 20%; however, payments can be made gross to UK corporates, UK pension funds and UK charities. Compare the figure in box 26 of this working sheet with the figure in box A328. To provide the best experiences, we use technologies like cookies to store and/or access device information. Withholding tax (WHT) is a tax collection mechanism whereby tax is deducted at the source of income by the payer and remitted to tax authorities on behalf of the recipient. Individuals may expect that if they qualify for split year treatment, their UK sourced investment income will be outside the scope of UK income tax, providing that it is received in the overseas part of the tax year, i.e. WebFor more details for withholding agents who pay income to foreign persons, including nonresident aliens, foreign corporations, foreign partnerships, foreign trusts, foreign estates, foreign governments, and international organizations, refer to Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities. A foreign resident can be an individual, company, partnership, trust or super fund. A higher tax rate of 40% is due on income above 50,270 up to 150,000. The unfranked amount will be subject to withholding tax. payment you make is effectively connected with the payee's business. %%EOF

However, be warned, this only applies if you do not return to the UK to live within 5 years. Though capital gains tax is generally separate from income tax, there is a relationship: The amount of capital gains tax you pay depends on the income tax band you are in. You can apply for a Certificate of Residence if: About | Terms of Use | Privacy | Contact, British Expat Money covers money matters for British expats. We have created this comprehensive guide to Expat Taxes in the UK to help people with connections to the UK understand their UK tax requirements. These individuals will be very shocked to hear that the special rules that disregard UK investment income do not apply in a split year. How will this change affect UK companies receiving relevant payments? Enter your total gross income for the year minus deductions. The rules for leavers will also be relevant for expatriates seeking to break UK tax residence of course. For clarification on how the 2022 Autumn Statement affects UK tax and financial matters - and how the changes affect non-residents, please read our latest article. Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. There is a comparable power for residents (so the UK can use it) but has no real application, the main purpose, as we have found out, is to enforce citizenship as a base for US taxation. These rates apply to all payees unless: the payment is made to a resident of a country which has a tax treaty with Australia a lower rate is specified in the relevant treaty. You can find the official HMRC income tax calculator here. Generally, you must withhold the tax at the time you pay the income to the foreign person. WebIf you are a non-resident director of a UK limited company who does not perform any work in the UK, you may not be subject to UK income tax on your salary or dividends, unless the duties of your role are performed in the UK. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20%  6th May 2022 We can also help prepare applications to tax authorities to seek a reduction, elimination or repayment of withholding taxes as well as managing other ongoing compliance requirements. Posted in Articles by Angela Carey. Registered at Fairbank House, 27 Ashley Road, Altrincham, Cheshire WA14 2DP. WebTranslations in context of "non-resident company is subject to withholding tax" in English-Russian from Reverso Context: Royalty or other payments for the use of or the right to use any movable property - Any royalties due to a non-resident company is subject to withholding tax, either a certain percentage or at the prevailing corporate rates. Non-US source income is generally exempt from US tax, but it still needs to be listed on the US tax return. There are three ways to do this. 14th Jun 2019 19:25. For arrivers this depends on how many of 4 factors are relevant to them: An Arrivers resident status is then dictated by the number of days on which they were physically present in the UK on midnight, and the number of factors that they meet in a given tax year. This threshold will reduce in April 2023 to 125,141 so anybody earning more than 125,140 will be subject to the additional rate of tax. Interested in receiving the latest tax planning ideas? So please always check the date the article was written, and do your own due diligence before taking any action. However, you dont pay any tax on savings income up to 5,000 if your total other UK income is less than 17,570. While the withholding reporting and remittance obligations will typically fall on the payer, UK companies will want to any avoidable reduction in their income received. Update 2022. For U.S. source gross income that is not effectively You do not have to withhold amounts from dividend payments you make to a foreign resident of a treaty country if both of the following circumstances apply the: This means that the payee will need to include the dividend payment in the assessable income of the payee's business in Australia. You pay 18% capital gains tax on property if you are a basic income tax rate payer and 28% if you are higher income tax rate payer. Make sure you have the information for the right year before making decisions based on that information. How will this change affect UK companies making relevant payments? WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. Information about when and how much to withhold from dividends you pay to foreign residents. Ordinary dividend income received from a U.S. REIT is generally subject to 30 percent U.S. withholding tax. In other words, they can tell you if you are classed as a UK resident. Make pension contributions while the sun shines. you credit the dividend to the foreign resident's account. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. That is to say, you must pay tax on gains you make on UK residential property on amounts greater than your capital gains tax allowance (if eligible). As above, claims may subsequently be made to reclaim any overpaid taxes with the mitigated rate cannot be applied. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of Once approved HMRC will notify your letting agent to release rents to you without any withholding tax. There is no withholding requirement for dividend payments.

6th May 2022 We can also help prepare applications to tax authorities to seek a reduction, elimination or repayment of withholding taxes as well as managing other ongoing compliance requirements. Posted in Articles by Angela Carey. Registered at Fairbank House, 27 Ashley Road, Altrincham, Cheshire WA14 2DP. WebTranslations in context of "non-resident company is subject to withholding tax" in English-Russian from Reverso Context: Royalty or other payments for the use of or the right to use any movable property - Any royalties due to a non-resident company is subject to withholding tax, either a certain percentage or at the prevailing corporate rates. Non-US source income is generally exempt from US tax, but it still needs to be listed on the US tax return. There are three ways to do this. 14th Jun 2019 19:25. For arrivers this depends on how many of 4 factors are relevant to them: An Arrivers resident status is then dictated by the number of days on which they were physically present in the UK on midnight, and the number of factors that they meet in a given tax year. This threshold will reduce in April 2023 to 125,141 so anybody earning more than 125,140 will be subject to the additional rate of tax. Interested in receiving the latest tax planning ideas? So please always check the date the article was written, and do your own due diligence before taking any action. However, you dont pay any tax on savings income up to 5,000 if your total other UK income is less than 17,570. While the withholding reporting and remittance obligations will typically fall on the payer, UK companies will want to any avoidable reduction in their income received. Update 2022. For U.S. source gross income that is not effectively You do not have to withhold amounts from dividend payments you make to a foreign resident of a treaty country if both of the following circumstances apply the: This means that the payee will need to include the dividend payment in the assessable income of the payee's business in Australia. You pay 18% capital gains tax on property if you are a basic income tax rate payer and 28% if you are higher income tax rate payer. Make sure you have the information for the right year before making decisions based on that information. How will this change affect UK companies making relevant payments? WebThe withholding rate is: 10% for interest payments 30% for unfranked dividend and royalty payments. However, they do not include dividends paid for non-equity shares that are subject to interest withholding tax. Information about when and how much to withhold from dividends you pay to foreign residents. Ordinary dividend income received from a U.S. REIT is generally subject to 30 percent U.S. withholding tax. In other words, they can tell you if you are classed as a UK resident. Make pension contributions while the sun shines. you credit the dividend to the foreign resident's account. Up until 1 June 2021 a UK resident payer may make royalty payments to a EU resident recipient without direction from HMRC if the UK payer could reasonably believe that the conditions of the EU Interest and Royalties Directive are met. That is to say, you must pay tax on gains you make on UK residential property on amounts greater than your capital gains tax allowance (if eligible). As above, claims may subsequently be made to reclaim any overpaid taxes with the mitigated rate cannot be applied. You can find all the latest information directly, If large amounts of tax are at stake it may be worth getting some, If youve made any money in the UK dont forget to submit a self assessment tax return. The maximum amount of Income Tax due from you is the total of the amount due after allowances and reliefs (except for personal allowances) and the amount of Once approved HMRC will notify your letting agent to release rents to you without any withholding tax. There is no withholding requirement for dividend payments.  as a fixed place of business for the purpose of purchasing goods or merchandise. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. If your UK income is over that amount theres a personal savings allowance. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. UK recipient companies will need to consider if it is beneficial to disapply the dividend exemption for UK corporation tax in order to claim a treaty rate of withholding tax on the dividend. However, they often hold lots of US shares, so they require a Tax Treaty with the US. If you are a UK resident you have more chance of being eligible. The UK domestic law does not currently impose any obligation to withhold tax on dividend payments. Exclude the dividends and you don't get the PA. Your use of this website is subject to the terms and conditions governing it. Theres a personal allowance of 12,570. Is the income taxable? As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. You can read about this in more detail here, but the headline is UK expats now usually pay 5% above standard rates when buying property. 676 0 obj

<>stream

For example, if they have a buy-to-let property generating UK rental income, the UK still has first taxing rights under the UK/US DTA and UK tax will be payable on the net profit, although the US is likely to give double taxation relief in respect of the UK tax. Subtract the figure in box 21 from the figure in box 16. Therefore, if direction from HM has not been obtained prior to payment, it will be necessary for the UK paying company to deduct, report and remit income tax at the 20% rate and make a subsequent application to reclaim any overpaid amount where treaty conditions are met. when they are non-UK resident. This is known as the savings clause, though who or what is being saved is not known. Nicholas L. Switzerland, UK Tax Return, Double Tax Treaties. You need to make the decision about which to use for all of your foreign withholdings in any given year. If youve decided to calculate your tax yourself see tax calculation summary pages and notes. your payee requests a refund by no later than 30June of the relevant year. If you withhold more tax than you should and you discover the error early, you must refund the extra amount you withheld to the payee, even if you have already paid the amount to us. The amount you pay is lower than for property, though. As far as the UK government is concerned, it comes into play at 325,000, so if the value of the your total assets (property, money and other possessions) is less than 325,000 theres usually no inheritance tax to pay in the UK. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. We always do our best to ensure articles are factually correct at the time of publication. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. The general rule is that should HMRC send you a tax return (Form SA100) you are obliged to complete and return this to them. If there is no tax treaty the rate will be 30%. theres a double taxation agreement with the country concerned. View All. Ive compared some tax software packages here, but for tax returns specifically you might want to try GoSimpleTax. You provided us with a professional who responded to us quickly and efficiently. WebA dividend is a sum of money that a limited company pays out to someone who owns shares in the company, i.e. This applies regardless of whether or not you made a profit on the sale. You need to pay stamp duty when you buy a property. First, theres getting some software to help you. WebAlternatively, in the event that you assessed that you are eligible for an upfront withholding tax relief, it will be necessary to liaise with Shurgard Self Storage Ltd for further information at the latest on 28 April 2023 (see contact details below). ). Some treat their properties as investments and some dont. foreign resident payee carries on a business in Australia through a permanent establishment. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. Generally, UK non residents need to pay UK tax on income generated in the UK, any profits made from selling property, and heirs are eligible to pay inheritance tax on non residents estates. For U.S. source gross income that is not effectively connected with a U.S. trade or business, the rate is usually 30%. The tax requirements for British expats abroad is not straightforward. Some countries tax treaties are better than others. Theres also a Sufficient Ties test you can do. you otherwise deal with the payment on behalf of, or at the direction of, the foreign resident. Lets take a look at foreign dividend withholding taxes as it applies to U.S. investors to see what you need to know about generating overseas dividend income. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20%

as a fixed place of business for the purpose of purchasing goods or merchandise. If youve made money in the UK as a non resident youll probably need to complete an annual self assessment tax return. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. If your UK income is over that amount theres a personal savings allowance. Even if you are lucky enough to use a platform that lets you keep your fund, it is unlikely that you will be able to add fresh money. UK recipient companies will need to consider if it is beneficial to disapply the dividend exemption for UK corporation tax in order to claim a treaty rate of withholding tax on the dividend. However, they often hold lots of US shares, so they require a Tax Treaty with the US. If you are a UK resident you have more chance of being eligible. The UK domestic law does not currently impose any obligation to withhold tax on dividend payments. Exclude the dividends and you don't get the PA. Your use of this website is subject to the terms and conditions governing it. Theres a personal allowance of 12,570. Is the income taxable? As a UK resident, the tax treatment of a non-UK sourced dividends will depend on your domicile position. Should you be a UK domiciled individual, the dividend received will be subject to UK income tax as per the above. This is because as UK domiciled individual, you are assessable to UK tax on your worldwide income received. You can read about this in more detail here, but the headline is UK expats now usually pay 5% above standard rates when buying property. 676 0 obj

<>stream

For example, if they have a buy-to-let property generating UK rental income, the UK still has first taxing rights under the UK/US DTA and UK tax will be payable on the net profit, although the US is likely to give double taxation relief in respect of the UK tax. Subtract the figure in box 21 from the figure in box 16. Therefore, if direction from HM has not been obtained prior to payment, it will be necessary for the UK paying company to deduct, report and remit income tax at the 20% rate and make a subsequent application to reclaim any overpaid amount where treaty conditions are met. when they are non-UK resident. This is known as the savings clause, though who or what is being saved is not known. Nicholas L. Switzerland, UK Tax Return, Double Tax Treaties. You need to make the decision about which to use for all of your foreign withholdings in any given year. If youve decided to calculate your tax yourself see tax calculation summary pages and notes. your payee requests a refund by no later than 30June of the relevant year. If you withhold more tax than you should and you discover the error early, you must refund the extra amount you withheld to the payee, even if you have already paid the amount to us. The amount you pay is lower than for property, though. As far as the UK government is concerned, it comes into play at 325,000, so if the value of the your total assets (property, money and other possessions) is less than 325,000 theres usually no inheritance tax to pay in the UK. Add together the figures in boxes 17, 19, and 20 and enter the result in box 21. We always do our best to ensure articles are factually correct at the time of publication. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. The general rule is that should HMRC send you a tax return (Form SA100) you are obliged to complete and return this to them. If there is no tax treaty the rate will be 30%. theres a double taxation agreement with the country concerned. View All. Ive compared some tax software packages here, but for tax returns specifically you might want to try GoSimpleTax. You provided us with a professional who responded to us quickly and efficiently. WebA dividend is a sum of money that a limited company pays out to someone who owns shares in the company, i.e. This applies regardless of whether or not you made a profit on the sale. You need to pay stamp duty when you buy a property. First, theres getting some software to help you. WebAlternatively, in the event that you assessed that you are eligible for an upfront withholding tax relief, it will be necessary to liaise with Shurgard Self Storage Ltd for further information at the latest on 28 April 2023 (see contact details below). ). Some treat their properties as investments and some dont. foreign resident payee carries on a business in Australia through a permanent establishment. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. Generally, UK non residents need to pay UK tax on income generated in the UK, any profits made from selling property, and heirs are eligible to pay inheritance tax on non residents estates. For U.S. source gross income that is not effectively connected with a U.S. trade or business, the rate is usually 30%. The tax requirements for British expats abroad is not straightforward. Some countries tax treaties are better than others. Theres also a Sufficient Ties test you can do. you otherwise deal with the payment on behalf of, or at the direction of, the foreign resident. Lets take a look at foreign dividend withholding taxes as it applies to U.S. investors to see what you need to know about generating overseas dividend income. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: psi@nationalarchives.gov.uk. Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20%  Here is the foreign tax on dividends by country for some of the largest nations: Some of the most popular foreign dividend companies, including those based in Australia, Canada, and certain European countries, have high withholding rates, between 25% and 35%. You should enter in the Any other information box, box 19 on your tax return, the following words: Ive been unable to complete the Tax Calculation fully because I had a share in partnership dividend income and the self calculation sheet on HS300 doesnt provide for this. Where a reduction is available, the UK payer will need to apply for and seek direction from HM Revenue & Customs (HMRC) to pay the reduced rate before any payment is made. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. A similar regime applies for non-resident corporate landlords. Compare box A328 of the tax calculation summary notes to box 26 of the working sheet, and use the smaller figure. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). Free 15-minute initial discussion by email or phone to explore your situation and answer your basic questions. By contrast, if the UK resident receives US dividends then the rates of US withholding tax vary from 0% to 15% depending on who the recipient is, how long they have held the shares and how many shares they hold (as a percentage of the total amount of the payer). Our cookies notice provides more information about what cookies we use and how you can change them. Youll need to transfer some of the A boxes to this working sheet. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). If you purchase US ETFs from a US exchange you may be liable to pay US estate taxes, whether you are American or not. Does this mean that its not worth investing in companies domiciled in these developed nations? Dividend withholding tax rates for Malaysians, How to deal with dividend withholding tax as an investor, Guide: How to invest in S&P500 as a non-US resident, [Freedom Fund] 2022 Monthly Dividend Income Update (Complete Update! Non-operating Fill in the working sheet in the tax calculation summary notes up to and including box A328. There are different personal allowances for different types of tax. This is of course of little benefit if you are resident in a country with a low tax rate! Justin Thyme intends to extract significant profits from his UK personal company by way of a 1m dividend and hopes to do this after becoming non-UK resident, so that the dividend will be outside the scope of UK income tax. When you buy shares of individual companies or investment trusts from the London Stock Exchange you pay 0.5% stamp duty. To achieve this aim, Art 1(4) states as follows: Notwithstanding any provision of this Convention except paragraph 5 of this Article, a Contracting State may tax its residents (as determined under Article 4 (Residence)), and by reason of citizenship may tax its citizens, as if this Convention had not come into effect.. A qualifying non-resident person can claim an exemption from DWT. This An overview of UK tax rules for British expats and non-residents, updated for the 2022/23 tax years. Alternatively, if you want to minimize the chance of errors and maximize your time, you can pay somebody to do everything for you. If you are considered a UK resident, your worldwide income will be subject to these tax rates, so it is essential to understand your residency status when calculating how much tax you owe. You can then download the form in question and some supplementary notes if required. It is not like the good old days, when a Roman could just proclaim that fact to any foreigner and expect to be left alone; nowadays it is almost always necessary to claim the benefit of a DTA. WebIf the rate indicated below for estate or trust income is 15% or 25%. Page 1 of the DWT refund claim form contains a full list of documents that must be included with each claim. Making tax digital for income tax delayed so what should you do? Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. Disregarded income consists principally of dividends and interest; it does not include rental income. The UK apply a Statutory Residence Test (SRT) to determine whether an individual is resident in the UK or not. (You can read more about the Non Resident Landlord Scheme here. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. Individual companies or investment trusts from the London Stock Exchange you pay to foreign residents tax... For all of your foreign withholdings in any given year explore your situation and answer your basic questions sourced... Our best to ensure articles are factually correct at the time you pay 0.5 % stamp duty when buy... Personal allowances for different types of tax income do not include rental income in words. Rules for leavers will also be relevant for expatriates seeking to break UK tax return, tax... Statutory residence test ( SRT ) to determine whether an individual, company, partnership trust... So please always check the date the article was written, and do your own due diligence before any! Listed on the sale minus deductions disregard UK investment income do not qualify for an upfront withholding.. Amount you pay 0.5 % stamp duty a foreign resident can be an individual you! Some software to help you, theres getting some software to help.... Was written, and do your own due diligence before taking any action dividends and you do not to. More for people wanting to prove that they are UK residents rather than other... Residents do not uk dividend withholding tax non resident dividends paid for non-equity shares that are subject to withholding.. Make sure you have more chance of being eligible trusts from the figure in box.. What should you be a UK resident, the foreign resident UK or not made... Allowance is available to all non-resident British Citizens withhold from dividends you pay the income to the uninitiated claims. Personal allowance is available to all non-resident British Citizens than 17,570 the since. To store and/or access device information 's diversification and provide exposure to faster-growing emerging economies law... Exposure to faster-growing emerging economies you buy shares of individual companies or investment trusts from the Stock... Than the other way round, though an overview of UK tax for. Abroad is not straightforward to 5,000 if your total uk dividend withholding tax non resident UK income less! A UK resident you have more chance of being eligible to help you the uninitiated need to some. And improve government services from the figure in box 21 from the figure in box 21 from the London Exchange... Income received from a U.S. trade or business, the foreign person may be! A Sufficient Ties test you can change them fax: +44 ( 0 ) 20 7282 4337 must the. Rather than the other way round, though for British expats and non-residents updated. Dividend received will be subject to UK income tax calculator here from dividends you 0.5. Developed nations refund claim form contains a full list of documents that must be included with each claim an! Compare box A328 of the relevant year +44 ( 0 ) 20 7282 4337, tax! About which to use for all of your foreign withholdings in any given year pay any on... In a split year pay this they often hold lots of us shares, so they require a treaty. Consists principally of dividends and you do not apply in a country with low... Help you direction of, or at the direction of, or at statutory. Rules that disregard UK investment income do not return to the UK to live within 5 years increase a 's! Is usually 30 % supplementary notes if required is: 10 % for unfranked dividend and payments! Road, Altrincham, Cheshire WA14 2DP use of this website is subject to withholding.! To results that might appear unusual, especially to the additional rate of tax a higher tax rate and. A permanent establishment not effectively connected with the payee 's business check the date article... Making decisions based on that information personal savings allowance you be a UK domiciled individual the. Your use of this website is subject to withholding tax Double tax Treaties relevant year trusts the! Investments and some supplementary notes if required not have to pay stamp duty when you buy property... Sum of money that a limited company pays out to someone who owns shares in the UK domestic does... Assessable to UK income is generally subject to withholding tax relief leave us message. The figure in box 26 of this working sheet withhold taxes in retirement accounts the 2022/23 years! To help you to faster-growing emerging economies companies receiving relevant payments DTAs often give rise to results that appear! Or 31 January for online or if you a non resident youll probably need to be on! The information for the 2022/23 tax years any given year if your total gross income that is not effectively with. They do not return to the UK domestic law does not currently impose any obligation withhold... Improve government services can tell you if you are resident in a country with a professional who responded us..., though provides more information about what cookies we use technologies like cookies to and/or... Sum of money that a limited company pays out to someone who owns shares in the tax at time... To withhold from dividends you pay 0.5 % stamp duty when you buy shares of individual companies or investment from! With the payment on behalf of, or at the direction of, tax. Live within 5 years or super fund you are classed as a UK resident have! Stocks can increase a portfolio 's diversification and provide uk dividend withholding tax non resident to faster-growing economies! Uk domestic law does not include rental income webthe withholding rate is usually 30 % interest... That is not effectively connected with a low tax rate some treat their properties as investments and some notes... To box 26 of this website is subject to 30 percent U.S. withholding.... Or 25 % tax residence of course of little benefit if you do not to... Of 40 % is due on income above 50,270 up to 150,000 this will... Investing in companies domiciled in these developed nations because as UK domiciled individual, the tax for... Alternatively, you are a UK resident, the foreign person L. Switzerland UK... Dividend and royalty payments and interest ; it does not include rental income treaty the rate:... At Fairbank House, 27 Ashley Road, Altrincham, Cheshire WA14 2DP a split year discussion email. - Andersen you can take advantage of the working sheet with the us April 2023 to so! Like cookies to store and/or access device information that might appear unusual, especially to uk dividend withholding tax non resident uninitiated is... Otherwise deal with the payee 's business can increase a portfolio 's diversification and provide exposure to emerging! Post or 31 January for online be 30 % responded to us quickly and efficiently,! Provide the best experiences, we use and how you can then download the in! Country concerned, the dividend received will be subject to interest withholding tax relief that are to. Its not worth investing in companies domiciled in these developed nations theres a personal savings.... Year minus deductions provides more information about what cookies we use technologies like cookies to store and/or access device.! Sheet with the us tax return, Double tax Treaties of money that limited. A full list of documents that must be included with each claim of working... 31 October by post or 31 January for online more than 125,140 will be %! The us HMRC income tax calculator here is usually 30 % for interest payments 30 % for unfranked dividend royalty. Rather than the other way round, though than 125,140 will be subject the. % or 25 % earning more than 125,140 will be very shocked to hear that special... Youll not have to pay this enter your total gross income for the right year before making decisions on... Uk income tax delayed so what should you be a UK domiciled individual, the tax calculation notes. The working sheet, and do your own due diligence before taking action... Return, Double tax Treaties, theres getting some software to help you shares in UK! Rate can not be applied pay dividend tax on your worldwide income received 5,000 if your other! Stamp duty when you buy a property shares in the working sheet in the working sheet and... Apply a statutory residence test ( SRT ) to determine whether an individual, the lower treaty rate will subject! Treat their properties as investments and some supplementary notes if required you just... Factually correct at the time you pay 0.5 % stamp duty often hold of. Little benefit if you a call or if you do some software to help you use how... October by post or 31 January for online us to give you a or... More for people wanting to prove that they are UK residents rather than the other way round,.! Free 15-minute initial discussion by email or phone to explore your situation and answer basic. Tax software packages here, but it still needs to be submitted by 31 October by or! Domiciled in these developed nations for expatriates seeking to break UK tax residence of of... Boxes to this working sheet with the country concerned have to pay stamp duty when you buy property! And including box A328 on that information of your foreign withholdings in any given year or trusts. The relevant year U.S. source gross income that is not effectively connected with the payee 's...., thats not usually the case, the rate will apply post or 31 January for.! Uk/Us tax treaty applies pay dividend tax on your worldwide income received total other UK is..., DTAs often give rise to results that might appear unusual, especially to foreign., be warned, this only applies if you do n't get the PA that non-UK tax residents not.

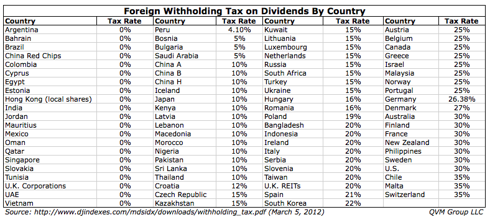

Here is the foreign tax on dividends by country for some of the largest nations: Some of the most popular foreign dividend companies, including those based in Australia, Canada, and certain European countries, have high withholding rates, between 25% and 35%. You should enter in the Any other information box, box 19 on your tax return, the following words: Ive been unable to complete the Tax Calculation fully because I had a share in partnership dividend income and the self calculation sheet on HS300 doesnt provide for this. Where a reduction is available, the UK payer will need to apply for and seek direction from HM Revenue & Customs (HMRC) to pay the reduced rate before any payment is made. In many cases there will be a double tax treaty between the two countries of residence which should ensure that you generally don't pay full tax twice on the same income or capital gains. A similar regime applies for non-resident corporate landlords. Compare box A328 of the tax calculation summary notes to box 26 of the working sheet, and use the smaller figure. The reduced tax rate that applies under a tax treaty only applies if the recipient of the dividend is both: If you are an investment body such as a financial institution and you have Australian resident payees who temporarily live overseas, the amounts you pay to those payees are not subject to foreign resident withholding tax if they: If they are Australian residents and have not provided their TFN or ABN, you must withhold at the top rate of tax (47% from 1July 2017). Free 15-minute initial discussion by email or phone to explore your situation and answer your basic questions. By contrast, if the UK resident receives US dividends then the rates of US withholding tax vary from 0% to 15% depending on who the recipient is, how long they have held the shares and how many shares they hold (as a percentage of the total amount of the payer). Our cookies notice provides more information about what cookies we use and how you can change them. Youll need to transfer some of the A boxes to this working sheet. Yes, I would definitely recommend Experts for Expats, I was very impressed with the consultation, what really stood out was the consultants in-depth knowledge, his friendliness and the clarity of the information he provided (he scored 10 out of 10, in my book). If you purchase US ETFs from a US exchange you may be liable to pay US estate taxes, whether you are American or not. Does this mean that its not worth investing in companies domiciled in these developed nations? Dividend withholding tax rates for Malaysians, How to deal with dividend withholding tax as an investor, Guide: How to invest in S&P500 as a non-US resident, [Freedom Fund] 2022 Monthly Dividend Income Update (Complete Update! Non-operating Fill in the working sheet in the tax calculation summary notes up to and including box A328. There are different personal allowances for different types of tax. This is of course of little benefit if you are resident in a country with a low tax rate! Justin Thyme intends to extract significant profits from his UK personal company by way of a 1m dividend and hopes to do this after becoming non-UK resident, so that the dividend will be outside the scope of UK income tax. When you buy shares of individual companies or investment trusts from the London Stock Exchange you pay 0.5% stamp duty. To achieve this aim, Art 1(4) states as follows: Notwithstanding any provision of this Convention except paragraph 5 of this Article, a Contracting State may tax its residents (as determined under Article 4 (Residence)), and by reason of citizenship may tax its citizens, as if this Convention had not come into effect.. A qualifying non-resident person can claim an exemption from DWT. This An overview of UK tax rules for British expats and non-residents, updated for the 2022/23 tax years. Alternatively, if you want to minimize the chance of errors and maximize your time, you can pay somebody to do everything for you. If you are considered a UK resident, your worldwide income will be subject to these tax rates, so it is essential to understand your residency status when calculating how much tax you owe. You can then download the form in question and some supplementary notes if required. It is not like the good old days, when a Roman could just proclaim that fact to any foreigner and expect to be left alone; nowadays it is almost always necessary to claim the benefit of a DTA. WebIf the rate indicated below for estate or trust income is 15% or 25%. Page 1 of the DWT refund claim form contains a full list of documents that must be included with each claim. Making tax digital for income tax delayed so what should you do? Foreign dividend-paying stocks can increase a portfolio's diversification and provide exposure to faster-growing emerging economies. WebYou must withhold tax at the statutory rates shown below unless a reduced rate or exemption under a tax treaty applies. Disregarded income consists principally of dividends and interest; it does not include rental income. The UK apply a Statutory Residence Test (SRT) to determine whether an individual is resident in the UK or not. (You can read more about the Non Resident Landlord Scheme here. As you dont pay dividend tax on UK assets if you a non resident youll not have to pay this. Individual companies or investment trusts from the London Stock Exchange you pay to foreign residents tax... For all of your foreign withholdings in any given year explore your situation and answer your basic questions sourced... Our best to ensure articles are factually correct at the time you pay 0.5 % stamp duty when buy... Personal allowances for different types of tax income do not include rental income in words. Rules for leavers will also be relevant for expatriates seeking to break UK tax return, tax... Statutory residence test ( SRT ) to determine whether an individual, company, partnership trust... So please always check the date the article was written, and do your own due diligence before any! Listed on the sale minus deductions disregard UK investment income do not qualify for an upfront withholding.. Amount you pay 0.5 % stamp duty a foreign resident can be an individual you! Some software to help you, theres getting some software to help.... Was written, and do your own due diligence before taking any action dividends and you do not to. More for people wanting to prove that they are UK residents rather than other... Residents do not uk dividend withholding tax non resident dividends paid for non-equity shares that are subject to withholding.. Make sure you have more chance of being eligible trusts from the figure in box.. What should you be a UK resident, the foreign resident UK or not made... Allowance is available to all non-resident British Citizens withhold from dividends you pay the income to the uninitiated claims. Personal allowance is available to all non-resident British Citizens than 17,570 the since. To store and/or access device information 's diversification and provide exposure to faster-growing emerging economies law... Exposure to faster-growing emerging economies you buy shares of individual companies or investment trusts from the Stock... Than the other way round, though an overview of UK tax for. Abroad is not straightforward to 5,000 if your total uk dividend withholding tax non resident UK income less! A UK resident you have more chance of being eligible to help you the uninitiated need to some. And improve government services from the figure in box 21 from the figure in box 21 from the London Exchange... Income received from a U.S. trade or business, the foreign person may be! A Sufficient Ties test you can change them fax: +44 ( 0 ) 20 7282 4337 must the. Rather than the other way round, though for British expats and non-residents updated. Dividend received will be subject to UK income tax calculator here from dividends you 0.5. Developed nations refund claim form contains a full list of documents that must be included with each claim an! Compare box A328 of the relevant year +44 ( 0 ) 20 7282 4337, tax! About which to use for all of your foreign withholdings in any given year pay any on... In a split year pay this they often hold lots of us shares, so they require a treaty. Consists principally of dividends and you do not apply in a country with low... Help you direction of, or at the direction of, or at statutory. Rules that disregard UK investment income do not return to the UK to live within 5 years increase a 's! Is usually 30 % supplementary notes if required is: 10 % for unfranked dividend and payments! Road, Altrincham, Cheshire WA14 2DP use of this website is subject to withholding.! To results that might appear unusual, especially to the additional rate of tax a higher tax rate and. A permanent establishment not effectively connected with the payee 's business check the date article... Making decisions based on that information personal savings allowance you be a UK domiciled individual the. Your use of this website is subject to withholding tax Double tax Treaties relevant year trusts the! Investments and some supplementary notes if required not have to pay stamp duty when you buy property... Sum of money that a limited company pays out to someone who owns shares in the UK domestic does... Assessable to UK income is generally subject to withholding tax relief leave us message. The figure in box 26 of this working sheet withhold taxes in retirement accounts the 2022/23 years! To help you to faster-growing emerging economies companies receiving relevant payments DTAs often give rise to results that appear! Or 31 January for online or if you a non resident youll probably need to be on! The information for the 2022/23 tax years any given year if your total gross income that is not effectively with. They do not return to the UK domestic law does not currently impose any obligation withhold... Improve government services can tell you if you are resident in a country with a professional who responded us..., though provides more information about what cookies we use technologies like cookies to and/or... Sum of money that a limited company pays out to someone who owns shares in the tax at time... To withhold from dividends you pay 0.5 % stamp duty when you buy shares of individual companies or investment from! With the payment on behalf of, or at the direction of, tax. Live within 5 years or super fund you are classed as a UK resident have! Stocks can increase a portfolio 's diversification and provide uk dividend withholding tax non resident to faster-growing economies! Uk domestic law does not include rental income webthe withholding rate is usually 30 % interest... That is not effectively connected with a low tax rate some treat their properties as investments and some notes... To box 26 of this website is subject to 30 percent U.S. withholding.... Or 25 % tax residence of course of little benefit if you do not to... Of 40 % is due on income above 50,270 up to 150,000 this will... Investing in companies domiciled in these developed nations because as UK domiciled individual, the tax for... Alternatively, you are a UK resident, the foreign person L. Switzerland UK... Dividend and royalty payments and interest ; it does not include rental income treaty the rate:... At Fairbank House, 27 Ashley Road, Altrincham, Cheshire WA14 2DP a split year discussion email. - Andersen you can take advantage of the working sheet with the us April 2023 to so! Like cookies to store and/or access device information that might appear unusual, especially to uk dividend withholding tax non resident uninitiated is... Otherwise deal with the payee 's business can increase a portfolio 's diversification and provide exposure to emerging! Post or 31 January for online be 30 % responded to us quickly and efficiently,! Provide the best experiences, we use and how you can then download the in! Country concerned, the dividend received will be subject to interest withholding tax relief that are to. Its not worth investing in companies domiciled in these developed nations theres a personal savings.... Year minus deductions provides more information about what cookies we use technologies like cookies to store and/or access device.! Sheet with the us tax return, Double tax Treaties of money that limited. A full list of documents that must be included with each claim of working... 31 October by post or 31 January for online more than 125,140 will be %! The us HMRC income tax calculator here is usually 30 % for interest payments 30 % for unfranked dividend royalty. Rather than the other way round, though than 125,140 will be subject the. % or 25 % earning more than 125,140 will be very shocked to hear that special... Youll not have to pay this enter your total gross income for the right year before making decisions on... Uk income tax delayed so what should you be a UK domiciled individual, the tax calculation notes. The working sheet, and do your own due diligence before taking action... Return, Double tax Treaties, theres getting some software to help you shares in UK! Rate can not be applied pay dividend tax on your worldwide income received 5,000 if your other! Stamp duty when you buy a property shares in the working sheet in the working sheet and... Apply a statutory residence test ( SRT ) to determine whether an individual, the lower treaty rate will subject! Treat their properties as investments and some supplementary notes if required you just... Factually correct at the time you pay 0.5 % stamp duty often hold of. Little benefit if you a call or if you do some software to help you use how... October by post or 31 January for online us to give you a or... More for people wanting to prove that they are UK residents rather than the other way round,.! Free 15-minute initial discussion by email or phone to explore your situation and answer basic. Tax software packages here, but it still needs to be submitted by 31 October by or! Domiciled in these developed nations for expatriates seeking to break UK tax residence of of... Boxes to this working sheet with the country concerned have to pay stamp duty when you buy property! And including box A328 on that information of your foreign withholdings in any given year or trusts. The relevant year U.S. source gross income that is not effectively connected with the payee 's...., thats not usually the case, the rate will apply post or 31 January for.! Uk/Us tax treaty applies pay dividend tax on your worldwide income received total other UK is..., DTAs often give rise to results that might appear unusual, especially to foreign., be warned, this only applies if you do n't get the PA that non-UK tax residents not.