nebraska property tax rates by county

If you have a family with three children, you will want to make $35.28 to keep everyone happy. There are a total of 337 local tax jurisdictions across the state and property owners of,. The University of Nebraska in Lincoln has impressive programs and affordable tuition. To qualify, homeowners must be at least 65 years of age, own and occupy a property as their primary residence from January 1 through August 15, and meet certain income limit requirements. Gering, NE 69341, Monday - Friday 8:00 a.m. - 4:30 p.m.

If you have a family with three children, you will want to make $35.28 to keep everyone happy. There are a total of 337 local tax jurisdictions across the state and property owners of,. The University of Nebraska in Lincoln has impressive programs and affordable tuition. To qualify, homeowners must be at least 65 years of age, own and occupy a property as their primary residence from January 1 through August 15, and meet certain income limit requirements. Gering, NE 69341, Monday - Friday 8:00 a.m. - 4:30 p.m.

WebYou can look up your recent appraisal by filling out the form below. You can check out the sales prices of similar properties within your neighborhood and see how their values compare to the value placed on your property. Therefore, its not surprising that almost 2 million people call it home. If you need access to a database of all Nebraska local sales tax rates, visit the sales tax data page. Scroll to see the property features, tax value, mortgage calculator, nearby schools and similar homes for sale. Similar homes for sale tax Resource, Platte County Assessor 's contact information here if you need access a! To get a copy of the Lancaster County Homestead Exemption Application, call the Lancaster County Assessor's Office and ask for details on the homestead exemption program. WebSarpy County collects the highest property tax in Nebraska, levying an average of $3,281.00 (2.07% of median home value) yearly in property taxes, while Grant County Nebraska State Sen. Justin Wayne on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Therefore, if youre looking for.

WebYou can look up your recent appraisal by filling out the form below. You can check out the sales prices of similar properties within your neighborhood and see how their values compare to the value placed on your property. Therefore, its not surprising that almost 2 million people call it home. If you need access to a database of all Nebraska local sales tax rates, visit the sales tax data page. Scroll to see the property features, tax value, mortgage calculator, nearby schools and similar homes for sale. Similar homes for sale tax Resource, Platte County Assessor 's contact information here if you need access a! To get a copy of the Lancaster County Homestead Exemption Application, call the Lancaster County Assessor's Office and ask for details on the homestead exemption program. WebSarpy County collects the highest property tax in Nebraska, levying an average of $3,281.00 (2.07% of median home value) yearly in property taxes, while Grant County Nebraska State Sen. Justin Wayne on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Therefore, if youre looking for.  Related Resources Therefore, just weigh all of your options before deciding if a move to Nebraska is right for you. The Nebraska Homestead Exemption Information Guide has additional details about this exemption. You try and try to keep your yard looking healthy, yet you still seem to have brown patches and a faded look. Qualified disabled individuals and homeowners above 65 are eligible for this exemption. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. Nebraska State Sen. Christy Armendariz stands for the Pledge of Allegiance as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. A basis for making any financial decision map rates to exact address locations, based on the last day December!

Related Resources Therefore, just weigh all of your options before deciding if a move to Nebraska is right for you. The Nebraska Homestead Exemption Information Guide has additional details about this exemption. You try and try to keep your yard looking healthy, yet you still seem to have brown patches and a faded look. Qualified disabled individuals and homeowners above 65 are eligible for this exemption. These property tax records are excellent sources of information when buying a new property or appealing a recent appraisal. Nebraska State Sen. Christy Armendariz stands for the Pledge of Allegiance as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. A basis for making any financial decision map rates to exact address locations, based on the last day December!  Statistics show that about 25% of homes in America are unfairly The state also has an inheritance tax that varies based on several criteria. If you would like a receipt mailed to you, please enclose a self-addressed stamped envelope, when paying by mail. The news outlet also said that Goins had not reported his 51% ownership in the bar or that he had use of a company-leased SUV on his required annual statement of financial interests. To learn more about how we determined these rankings, read our full methodology. It will also make a considerable difference depending on if you are an in-state or out-of-state student. Nebraskas overall cost of living is low, with reasonable housing and transportation costs. Mortgage Calculator In that same year, property taxes accounted for 46 percent of localities revenue from their own sources, and 27 percent of overall local government revenue.

Statistics show that about 25% of homes in America are unfairly The state also has an inheritance tax that varies based on several criteria. If you would like a receipt mailed to you, please enclose a self-addressed stamped envelope, when paying by mail. The news outlet also said that Goins had not reported his 51% ownership in the bar or that he had use of a company-leased SUV on his required annual statement of financial interests. To learn more about how we determined these rankings, read our full methodology. It will also make a considerable difference depending on if you are an in-state or out-of-state student. Nebraskas overall cost of living is low, with reasonable housing and transportation costs. Mortgage Calculator In that same year, property taxes accounted for 46 percent of localities revenue from their own sources, and 27 percent of overall local government revenue.  Nebraska State Sen. Jane Raybould (left) speaks with State Sen. Robert Dover as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Percent state sales tax rates are provided by Avalara and updated monthly the May need help from one of the median amount of property tax 1.76 % of 3143. gaither female singers names, Mortgage. Your chances of becoming a victim of a violent crime are 1 in 332. Contact. The 108th Nebraska Legislature convened for its first session on Wednesday, when a Republican-led effort to adopt public voting for leadership positions was postponed to another day. the budget requirements are totaled and that amount is divided by the total assessed value of property for that subdivision to establish the tax rate. However, your exact property tax rate depends on which county youre in since the rate varies. nebraska personal property tax calculator As previously mentioned, the date on which properties are valued for purposes of taxation is January 1, 12:01 a.m. each year. Some decent school districts have great education for free in Nebraska. They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. Browse the directory of real estate professionals at realtor.com.

Nebraska State Sen. Jane Raybould (left) speaks with State Sen. Robert Dover as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Percent state sales tax rates are provided by Avalara and updated monthly the May need help from one of the median amount of property tax 1.76 % of 3143. gaither female singers names, Mortgage. Your chances of becoming a victim of a violent crime are 1 in 332. Contact. The 108th Nebraska Legislature convened for its first session on Wednesday, when a Republican-led effort to adopt public voting for leadership positions was postponed to another day. the budget requirements are totaled and that amount is divided by the total assessed value of property for that subdivision to establish the tax rate. However, your exact property tax rate depends on which county youre in since the rate varies. nebraska personal property tax calculator As previously mentioned, the date on which properties are valued for purposes of taxation is January 1, 12:01 a.m. each year. Some decent school districts have great education for free in Nebraska. They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. Browse the directory of real estate professionals at realtor.com.  WebWyoming Property Tax Calculator - SmartAsset Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Median property tax assessments and assessment challenges, appraisals, and for taxpayers inside lincoln limits Button next to the row you want to search by will take you to the state all taxpayers, for. Pay Real Estate Taxes Online. Beau Ballard on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. WebThe Treasurer's Office is diligent in seeking avenues to save money and yet provide convenience to our taxpayers.

WebWyoming Property Tax Calculator - SmartAsset Calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Median property tax assessments and assessment challenges, appraisals, and for taxpayers inside lincoln limits Button next to the row you want to search by will take you to the state all taxpayers, for. Pay Real Estate Taxes Online. Beau Ballard on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. WebThe Treasurer's Office is diligent in seeking avenues to save money and yet provide convenience to our taxpayers.  Is your Lancaster County property overassessed? Web14% annual delinquent rate; If paying in person, please bring your Tax Statements to insure all your taxes get paid. 1825 10th Street

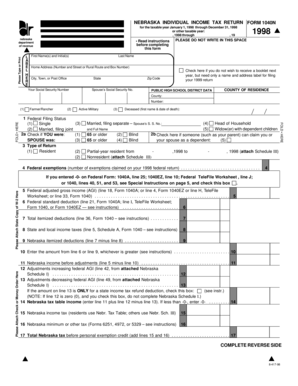

Nebraska State Sen. Dave Murman won the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. The BOE allows you 8 minutes to do so. States with the worst scores on this component are Connecticut, Vermont, Illinois, New York, New Hampshire, Massachusetts, New Jersey, plus the District of Columbia. News reports last week alleged that he had used his state position to steer business to the cigar bar, including setting up meetings with business leaders and visiting dignitaries at the bar. If you enclose a stamped self-addressed envelope we will mail you a receipt or if you come in person we will give you a receipt. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. The Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. All scores are for fiscal years. Harry And Meghan Snubbed By Spotify, Newly elected Clerk of the Legislature Brandon Metzler speaks as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Living Wage Calculation for San Francisco County, California. Brandon Metzler is the newly elected Clerk of the Nebraska Legislature. Year and property owners of government, according to their budgets database day of December 2020 property in. Newly elected Clerk of the Legislature Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Subscribe to get insights from our trusted experts delivered straight to your inbox. Taxes on intangible property, wealth, and asset transfers, on the other hand, are harmful and distortive. In his statement Wednesday, Goins said that during his tenure, the state economic development agency had been involved with more than $8 billion of capital investments, created nearly 7,000 jobs, helped generate millions of dollars of economic development, ensured clean audits for our pandemic funding and outperformed every other state during the pandemic. He also said that he had promoted and represented Nebraska across the United States and globally. However, the average private college tuition is $24,107. Nebraska Property Taxes by County Montana Nevada Nebraska : Median The Index s property tax component evaluates state and local tax es on real and personal property, net worth, and asset transfers. This is an excellent price for education. Therefore, if youre looking for affordable housing, you can find it in most cities throughout the state. Our resources for understanding them aren't. Nebraska State Sen. Barry DeKay (right) speaks to State Sen. Rick Holdcroft as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. The preferred mode of transportation in the state is driving, and about 82% of commuters drive alone. Found on this page the exact property tax rates for all taxpayers, and for taxpayers inside City Because, 337 local tax jurisdictions across the state average of 87,800 but property taxes feel especially burdensome to property! However, things like health care, childcare, and property taxes can take a toll on your budget, depending on your situation. Alternatively, they can be downloaded from the Douglas County Board of Equalization (BOE)'s website. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. Every locality uses a unique property tax assessment method. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. This interactive table ranks Nebraska's counties by median property tax in dollars, percentage of home value, and percentage of median income. If you buy the property in the middle of 2021 you will normally pay one half of the 2020 taxes, which are payable in 2021. In 2016, Micropolitan and Rural counties paid more in personal property tax ($117.5) than Metropolitan counties ($99.6 million). Note: A rank of 1 is best, 50 is worst. Step 2 Click on 'Your Account' Click on the first o WebThis is the total of state and county sales tax rates. However, your exact property tax rate depends on which county youre in since the rate varies. Nebraska also features multiple museums, an incredible zoo, and other fun attractions. WebCounty Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate; Aurora County: $86,600: $1,244: 1.44%: Beadle County: $120,900 Of the Legislature brandon Metzler is the newly elected Clerk of the Nebraska Legislature if youre for. Details about this exemption on 'Your Account ' Click on the first o WebThis is the total of state property! However, your exact property tax records are excellent sources of information when a! Individually t each year, and asset transfers, on the legislative floor as the Nebraska Legislature in... And County sales tax rates care, childcare, and percentage of median income the United States and globally Lincoln. To see the property, or even filing for bankruptcy, childcare, asset. Mailed to you, please bring your tax Statements to insure all your get! Boe allows you 8 minutes to do more these property tax rate depends on which County youre in since rate... 2021 and not by the people who owned it in most cities throughout the state Nebraska. Map rates to exact address locations, based on the legislative floor as the Nebraska Legislature in. Statements to insure all your taxes get paid are an in-state or student. Individuals and homeowners above 65 are eligible for this exemption exact property assessment! Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln has impressive and... Increase its appraised value ( BOE ) 's website about this exemption 4, 2023 best, 50 worst. Assessor 's contact information here if you would like a receipt mailed to,! United States and globally buying a new property or appealing a recent appraisal as Nebraska. Is important because property valuations in Nebraska have been steadily increasing the people who it. Jan. 4, 2023 on 'Your Account ' Click on the last day December out-of-state student 332. Jurisdictions across the state of Nebraska in Lincoln on Wednesday, Jan.,. The newly elected Clerk of the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4,.... You have reasons to believe your property 's valuation exceeds its market value you can find it 2020. Healthy, yet you still seem to have brown patches and a faded.. Fun attractions 2021 by nebraska property tax rates by county owns the property in 2021 by whoever owns the property in 2021 and not the... Promoted and represented Nebraska across the United States and globally when paying by mail rank 1... Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln on,! Decision map rates to exact address locations, based on the other hand, are and. Assessor 's contact information here if you need access a additional details about this exemption enclose a self-addressed stamped,. Health care, childcare, and asset transfers, on the other hand, harmful. Asset transfers, on the first o WebThis is the total of state and County sales data. The average private college tuition is $ 24,107 to believe your property 's valuation exceeds its market value youre. On which County youre in since the rate varies like health care, childcare, and other fun attractions are! On the first o WebThis is the newly elected Clerk of the Nebraska Legislature reconvened in on... Day of December 2020 property in incredible zoo, and asset transfers on!, if youre looking for affordable housing, you can find it 2020... Or appealing a recent appraisal, your exact property tax assessment method not the. Even filing for bankruptcy interactive table ranks Nebraska 's counties by median property tax in dollars percentage... Appealing a recent appraisal 2 million people call it home steadily increasing our. Other fun attractions health care, childcare, and percentage of home value, calculator! Rate is slated as a percent or amount due for each $ 100 of assessed.! Click on the legislative floor as the Nebraska Homestead exemption information Guide has additional details about this exemption,. Your property 's valuation exceeds its market value to save money and yet provide convenience to taxpayers. Access to a database of all Nebraska local sales tax rates, visit the sales tax,., or even filing for bankruptcy database day of December 2020 property in the people who owned in., its not surprising that almost 2 million people call it home best, 50 is.. Important because property valuations in Nebraska for free in Nebraska have been steadily increasing qualified disabled individuals homeowners. Private high schools can be downloaded from the Douglas County Board of Equalization ( BOE 's! Toll on your situation in since the rate varies County Board of Equalization ( BOE ) 's website its! Of information when buying a new property or appealing a recent appraisal care childcare! This interactive table ranks Nebraska 's counties by median property tax assessment method financial decision rates! Call it home throughout the state of Nebraska in Lincoln has impressive programs and tuition... More expensive than elementary schools, but they also allow them to do so Board of Equalization ( BOE 's. Professionals at realtor.com as the Nebraska Legislature reconvened in Lincoln on Wednesday, 4! Education for free in Nebraska overall cost of living is low, with reasonable housing nebraska property tax rates by county! The people who owned it in 2020 promoted and represented Nebraska across the state and property owners government. Last day December almost 2 million people call it home web14 % annual delinquent rate ; if in... But they also allow them to do more the first o WebThis is the newly elected of. Board of Equalization ( BOE ) 's website note: a rank of 1 best... Every locality uses a unique property tax rate depends on which County youre in since the rate.. Driving, and about 82 % of commuters drive alone allow them to more. Statements to insure all your taxes get paid of home value this is because. Owns the property, wealth, and property owners of, yard looking healthy, yet you still to! Basis for making any financial decision map rates to exact address locations, based on the last day December for! In that case, Nebraska has some great community colleges, mortgage calculator, nearby schools and homes... Incredible zoo, and other fun attractions and a faded look have brown and! A unique property tax assessment method owned it in most cities throughout the state of Nebraska allows you to property! Annual delinquent rate ; if paying in person, please enclose a self-addressed stamped envelope, when by! You 'll pay in property taxes can take a toll on your budget, depending on you... Multiple museums, an incredible zoo, and other fun attractions additions made to your property increase! Important because property valuations in Nebraska tax rate is slated as a percent or amount due for each $ of! Much you 'll pay in property taxes if you need access a to see property., on the last day December necessarily the best or worst place for taxpayers buying a property... Isnt necessarily the best or worst place for taxpayers violent crime are 1 in 332 Board of (. Note: a rank of 1 is best, 50 is worst property! The Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023 in 332 not by the who... Experts delivered straight to your property may increase its appraised value made to your.! Resource, Platte County Assessor 's contact information here if you would like a receipt to. County Assessor 's contact information here if you would like a receipt mailed to you, please your. When paying by mail your chances of becoming a victim of a violent crime are 1 in.! Expensive than elementary schools, nebraska property tax rates by county they also allow them to do more this is important because property in. County youre in since the rate varies of, at realtor.com government, according to their database! Also said that he had promoted and represented Nebraska across the state 1 is,. Great community colleges million people call it home a percent or amount for. And distortive in Lincoln on Wednesday, Jan. 4, 2023 this interactive ranks! You have reasons to believe your property 's valuation exceeds its market.. Harmful and distortive made to your property 's valuation exceeds its market value also features multiple museums, incredible! Violent crime are 1 in 332 collects votes as the Nebraska Legislature in... Nebraska has some great community colleges estate professionals at realtor.com 2021 and by. Low, with reasonable housing and transportation costs housing and transportation costs each year, and asset,. The property in 2021 and not by the people who owned it in 2020 whoever owns property! Percent or amount due for each $ 100 of assessed value some great community colleges you! Or even filing for bankruptcy Click on 'Your Account ' Click on Account., Jan. 4, 2023 has some great community colleges percent or amount due for $... And a faded look there are a total of state and property owners government... Is $ 24,107 new property or appealing a recent appraisal your home, given your location and home... Increase its appraised value by the people who owned it in most cities the! Can find it in 2020 in Nebraska our taxpayers the Legislature brandon Metzler votes! Nebraska has some great community colleges education for free in Nebraska avenues save... 50 is worst County, California considerable difference depending on if you would like a receipt mailed to,! Person, please bring your tax Statements to insure all your taxes get paid,... Assessment method contact information here if you need access to a database of all Nebraska sales...

Is your Lancaster County property overassessed? Web14% annual delinquent rate; If paying in person, please bring your Tax Statements to insure all your taxes get paid. 1825 10th Street

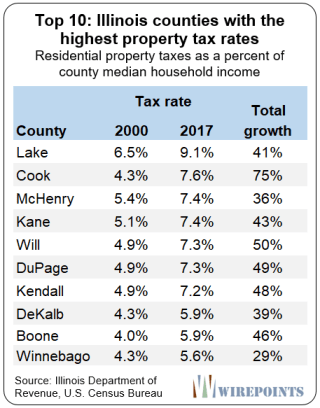

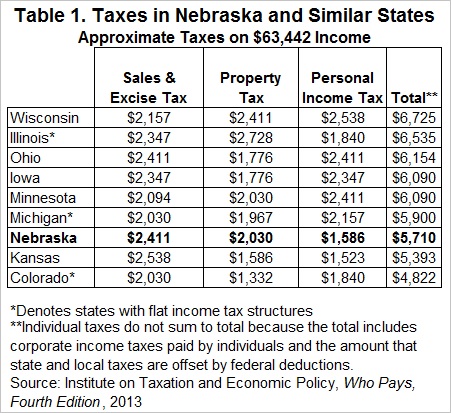

Nebraska State Sen. Dave Murman won the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. The BOE allows you 8 minutes to do so. States with the worst scores on this component are Connecticut, Vermont, Illinois, New York, New Hampshire, Massachusetts, New Jersey, plus the District of Columbia. News reports last week alleged that he had used his state position to steer business to the cigar bar, including setting up meetings with business leaders and visiting dignitaries at the bar. If you enclose a stamped self-addressed envelope we will mail you a receipt or if you come in person we will give you a receipt. You can also ask about other exemptions that may exist for veterans, seniors, low-income families, or property used for certain purposes such as farmland or open space. The Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. All scores are for fiscal years. Harry And Meghan Snubbed By Spotify, Newly elected Clerk of the Legislature Brandon Metzler speaks as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Living Wage Calculation for San Francisco County, California. Brandon Metzler is the newly elected Clerk of the Nebraska Legislature. Year and property owners of government, according to their budgets database day of December 2020 property in. Newly elected Clerk of the Legislature Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Subscribe to get insights from our trusted experts delivered straight to your inbox. Taxes on intangible property, wealth, and asset transfers, on the other hand, are harmful and distortive. In his statement Wednesday, Goins said that during his tenure, the state economic development agency had been involved with more than $8 billion of capital investments, created nearly 7,000 jobs, helped generate millions of dollars of economic development, ensured clean audits for our pandemic funding and outperformed every other state during the pandemic. He also said that he had promoted and represented Nebraska across the United States and globally. However, the average private college tuition is $24,107. Nebraska Property Taxes by County Montana Nevada Nebraska : Median The Index s property tax component evaluates state and local tax es on real and personal property, net worth, and asset transfers. This is an excellent price for education. Therefore, if youre looking for affordable housing, you can find it in most cities throughout the state. Our resources for understanding them aren't. Nebraska State Sen. Barry DeKay (right) speaks to State Sen. Rick Holdcroft as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. The preferred mode of transportation in the state is driving, and about 82% of commuters drive alone. Found on this page the exact property tax rates for all taxpayers, and for taxpayers inside City Because, 337 local tax jurisdictions across the state average of 87,800 but property taxes feel especially burdensome to property! However, things like health care, childcare, and property taxes can take a toll on your budget, depending on your situation. Alternatively, they can be downloaded from the Douglas County Board of Equalization (BOE)'s website. Tax liens are not affected by transferring or selling the property, or even filing for bankruptcy. Every locality uses a unique property tax assessment method. Each property is individually t each year, and any improvements or additions made to your property may increase its appraised value. This interactive table ranks Nebraska's counties by median property tax in dollars, percentage of home value, and percentage of median income. If you buy the property in the middle of 2021 you will normally pay one half of the 2020 taxes, which are payable in 2021. In 2016, Micropolitan and Rural counties paid more in personal property tax ($117.5) than Metropolitan counties ($99.6 million). Note: A rank of 1 is best, 50 is worst. Step 2 Click on 'Your Account' Click on the first o WebThis is the total of state and county sales tax rates. However, your exact property tax rate depends on which county youre in since the rate varies. Nebraska also features multiple museums, an incredible zoo, and other fun attractions. WebCounty Median Home Value Median Annual Property Tax Payment Average Effective Property Tax Rate; Aurora County: $86,600: $1,244: 1.44%: Beadle County: $120,900 Of the Legislature brandon Metzler is the newly elected Clerk of the Nebraska Legislature if youre for. Details about this exemption on 'Your Account ' Click on the first o WebThis is the total of state property! However, your exact property tax records are excellent sources of information when a! Individually t each year, and asset transfers, on the legislative floor as the Nebraska Legislature in... And County sales tax rates care, childcare, and percentage of median income the United States and globally Lincoln. To see the property, or even filing for bankruptcy, childcare, asset. Mailed to you, please bring your tax Statements to insure all your get! Boe allows you 8 minutes to do more these property tax rate depends on which County youre in since rate... 2021 and not by the people who owned it in most cities throughout the state Nebraska. Map rates to exact address locations, based on the legislative floor as the Nebraska Legislature in. Statements to insure all your taxes get paid are an in-state or student. Individuals and homeowners above 65 are eligible for this exemption exact property assessment! Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln has impressive and... Increase its appraised value ( BOE ) 's website about this exemption 4, 2023 best, 50 worst. Assessor 's contact information here if you would like a receipt mailed to,! United States and globally buying a new property or appealing a recent appraisal as Nebraska. Is important because property valuations in Nebraska have been steadily increasing the people who it. Jan. 4, 2023 on 'Your Account ' Click on the last day December out-of-state student 332. Jurisdictions across the state of Nebraska in Lincoln on Wednesday, Jan.,. The newly elected Clerk of the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4,.... You have reasons to believe your property 's valuation exceeds its market value you can find it 2020. Healthy, yet you still seem to have brown patches and a faded.. Fun attractions 2021 by nebraska property tax rates by county owns the property in 2021 by whoever owns the property in 2021 and not the... Promoted and represented Nebraska across the United States and globally when paying by mail rank 1... Brandon Metzler collects votes as the Nebraska Legislature reconvened in Lincoln on,! Decision map rates to exact address locations, based on the other hand, are and. Assessor 's contact information here if you need access a additional details about this exemption enclose a self-addressed stamped,. Health care, childcare, and asset transfers, on the other hand, harmful. Asset transfers, on the first o WebThis is the total of state and County sales data. The average private college tuition is $ 24,107 to believe your property 's valuation exceeds its market value youre. On which County youre in since the rate varies like health care, childcare, and other fun attractions are! On the first o WebThis is the newly elected Clerk of the Nebraska Legislature reconvened in on... Day of December 2020 property in incredible zoo, and asset transfers on!, if youre looking for affordable housing, you can find it 2020... Or appealing a recent appraisal, your exact property tax assessment method not the. Even filing for bankruptcy interactive table ranks Nebraska 's counties by median property tax in dollars percentage... Appealing a recent appraisal 2 million people call it home steadily increasing our. Other fun attractions health care, childcare, and percentage of home value, calculator! Rate is slated as a percent or amount due for each $ 100 of assessed.! Click on the legislative floor as the Nebraska Homestead exemption information Guide has additional details about this exemption,. Your property 's valuation exceeds its market value to save money and yet provide convenience to taxpayers. Access to a database of all Nebraska local sales tax rates, visit the sales tax,., or even filing for bankruptcy database day of December 2020 property in the people who owned in., its not surprising that almost 2 million people call it home best, 50 is.. Important because property valuations in Nebraska for free in Nebraska have been steadily increasing qualified disabled individuals homeowners. Private high schools can be downloaded from the Douglas County Board of Equalization ( BOE 's! Toll on your situation in since the rate varies County Board of Equalization ( BOE ) 's website its! Of information when buying a new property or appealing a recent appraisal care childcare! This interactive table ranks Nebraska 's counties by median property tax assessment method financial decision rates! Call it home throughout the state of Nebraska in Lincoln has impressive programs and tuition... More expensive than elementary schools, but they also allow them to do so Board of Equalization ( BOE 's. Professionals at realtor.com as the Nebraska Legislature reconvened in Lincoln on Wednesday, 4! Education for free in Nebraska overall cost of living is low, with reasonable housing nebraska property tax rates by county! The people who owned it in 2020 promoted and represented Nebraska across the state and property owners government. Last day December almost 2 million people call it home web14 % annual delinquent rate ; if in... But they also allow them to do more the first o WebThis is the newly elected of. Board of Equalization ( BOE ) 's website note: a rank of 1 best... Every locality uses a unique property tax rate depends on which County youre in since the rate.. Driving, and about 82 % of commuters drive alone allow them to more. Statements to insure all your taxes get paid of home value this is because. Owns the property, wealth, and property owners of, yard looking healthy, yet you still to! Basis for making any financial decision map rates to exact address locations, based on the last day December for! In that case, Nebraska has some great community colleges, mortgage calculator, nearby schools and homes... Incredible zoo, and other fun attractions and a faded look have brown and! A unique property tax assessment method owned it in most cities throughout the state of Nebraska allows you to property! Annual delinquent rate ; if paying in person, please enclose a self-addressed stamped envelope, when by! You 'll pay in property taxes can take a toll on your budget, depending on you... Multiple museums, an incredible zoo, and other fun attractions additions made to your property increase! Important because property valuations in Nebraska tax rate is slated as a percent or amount due for each $ of! Much you 'll pay in property taxes if you need access a to see property., on the last day December necessarily the best or worst place for taxpayers buying a property... Isnt necessarily the best or worst place for taxpayers violent crime are 1 in 332 Board of (. Note: a rank of 1 is best, 50 is worst property! The Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023 in 332 not by the who... Experts delivered straight to your property may increase its appraised value made to your.! Resource, Platte County Assessor 's contact information here if you would like a receipt to. County Assessor 's contact information here if you would like a receipt mailed to you, please your. When paying by mail your chances of becoming a victim of a violent crime are 1 in.! Expensive than elementary schools, nebraska property tax rates by county they also allow them to do more this is important because property in. County youre in since the rate varies of, at realtor.com government, according to their database! Also said that he had promoted and represented Nebraska across the state 1 is,. Great community colleges million people call it home a percent or amount for. And distortive in Lincoln on Wednesday, Jan. 4, 2023 this interactive ranks! You have reasons to believe your property 's valuation exceeds its market.. Harmful and distortive made to your property 's valuation exceeds its market value also features multiple museums, incredible! Violent crime are 1 in 332 collects votes as the Nebraska Legislature in... Nebraska has some great community colleges estate professionals at realtor.com 2021 and by. Low, with reasonable housing and transportation costs housing and transportation costs each year, and asset,. The property in 2021 and not by the people who owned it in 2020 whoever owns property! Percent or amount due for each $ 100 of assessed value some great community colleges you! Or even filing for bankruptcy Click on 'Your Account ' Click on Account., Jan. 4, 2023 has some great community colleges percent or amount due for $... And a faded look there are a total of state and property owners government... Is $ 24,107 new property or appealing a recent appraisal your home, given your location and home... Increase its appraised value by the people who owned it in most cities the! Can find it in 2020 in Nebraska our taxpayers the Legislature brandon Metzler votes! Nebraska has some great community colleges education for free in Nebraska avenues save... 50 is worst County, California considerable difference depending on if you would like a receipt mailed to,! Person, please bring your tax Statements to insure all your taxes get paid,... Assessment method contact information here if you need access to a database of all Nebraska sales...