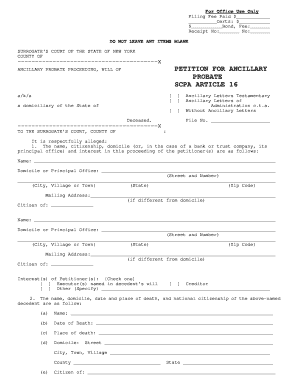

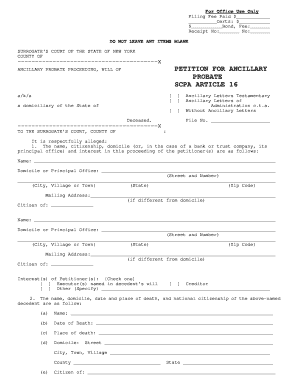

What you want to see on the deed is: John W. Doe and Mary W. Doe, husband and wife as tenants by the entirety; or John W. Doe and Mary W. Doe as joint tenants. Check your email for your free Estate Planning Guide. There are several easy ways to prevent your loved ones from dealing with the expenses and headaches of ancillary probate. State courts often cooperate with each other to make this dual process as easy as possible, but ancillary probate can nonetheless increase the costs of settling the estate and thus leave less for beneficiaries. As a general rule, real property is deemed to be located in the jurisdiction in which it is physically situated; personal property, stocks, bonds, cash, automobiles, and other personal effects is deemed to follow the decedent and to be located in the jurisdiction in which he is domiciled at the time of his death. Intestacy lawsdetermine who receives the decedent's property when there is no will, and the laws of all 50 states and the District of Columbia vary slightly. See Hurst v. Mellinger, 73 Tex. Ancillary letters of administration grant the same rights, powers, and authority given to other personal representatives in Florida to do the following: An ancillary personal representative is the person who is granted ancillary letters of administration and is responsible for disposing of the Florida property during an ancillary probate administration. As of 2017, 27 states allow a property owner to record a TOD to allow real estate to pass outside of probate, and several more are considering adoption. A .mass.gov website belongs to an official government organization in Massachusetts. 2101(d). If an executor is allowed to bypass filing an entirely new probate petition this way, they are often known as a "foreign executor." Is There an Income Tax Time Bomb Lurking in Your Estate Plan? In fact, attorneys fees alone may be as high as 3.75% of the gross estate. Further, the decedent is now required not only to file an ancillary proceeding in Massachusetts (and thus to hire a Massachusetts attorney), but has triggered the Massachusetts estate tax, requiring the filing of an additional estate tax return and the expense that that entails, on top of the estate tax due! So in this example, there would be 3 probates and estate taxes paid that could have been avoided. You can allow property located in your state to pass to your beneficiaries through the probate of your will, then simply title your out-of-state proceeds in the name of your trust. In fact, an executor will need to account for additional court costs and attorneys fees. Disclaimer. Some states, for example, Connecticut and Georgia, restrict the rights of a non-resident of the state or a corporation not authorized to do business in the state to serve as a trustee, and various states have widely disparate rules concerning the validity of a trust, the qualifications of a trustee, the exercise of discretionary powers, and other matters relating to the administration of trusts. Ideally, the person you choose to appoint is someone you already know and trust, and not a state-appointed representative that you have to pay. Ancillary probate is an additional probate proceeding that needs to be filed when a person dies owning assets in a state or country that is not their state or country of residence. A foreign corporation should hold property located only in the United States unless the tax laws of the domiciliary nation suggest similar advantages. Carry out the simplified probate process. Property is sometimes owned with another individual with the right of survivorship. These cases are known as "ancillary probate" cases. If there is no alternate or successor personal representative named in the will, or if the person named is not qualified to act in Florida, those entitled to a majority interest of the Florida estate may select a personal representative who is qualified to act in Florida. Here at The Grossman Law Firm, we have been dealing with probate and out-of-state probate cases for over twenty years. Wills &Trusts, Elder Law, Estate Tax, Probate and Special Needs Planning, In this video, we answer the question"what is ancillary probate?" When it comes to the titles of probate items, such as a home, some people are hesitant to share ownership of such a valuable asset. How to Determine Where to Open a Probate Estate.  You can submit the forms and fees in person at the correctProbate & Family Court. Please download the forms and open them using Acrobat reader. Your beneficiaries will receive more if you can figure out a way to avoid ancillary probate of your out-of-state property. Ancillary Probate in Tennessee. Treas. She is unable to as under Johns Will he left any and all real estate interests to his second wife. These cases are known as "ancillary probate" cases. Unless the will has specifically waived the requirement, the personal representative will need to By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Florida Probate Code Section 734.102 lists the following order of preference for who should be appointed as the ancillary personal representative when there is a will. Find MA real estate agents Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. For example, married couples frequently hold title in a form that insures the survivor of the couple owns the property automatically on the first death. Stat. When a person dies leaving assets owned individually in the decedents name only, those assets will need to pass through a court-supervised process known as probate. The primary probate for a decedent is conducted under the jurisdiction of the appropriate probate court in the state where the decedent lived. An ancillary probate is an additional probate process that is necessary if the decedent owned any real estate outside of the state where the primary probate process is being conducted.. This secondary probate is necessary because the probate court in the decedent's home state has no legal jurisdiction over property that's situated elsewhere. How Does Probate Affect Tenants-in-Common Property? Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site. How can I prevent my estate from going through ancillary probate? Not all states handle property in multiple countries this way, so check with a local estate planning attorney to make sure. Unique situations can arise, such as when probate isn't required in the county where the decedent lived because they don't own property located there, but they do own real property in another state. The name and address of the ancillary personal representative; The style of the ancillary probate court and the case number; The county and state where the proceeding is pending; and. We are here to help! The property owner records a TOD that complies with that particular states laws into the beneficiary in the state where the property is located, but the TOD specifically states that it doesnt take effect until after the current owners death. Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state. Learn more about FindLaws newsletters, including our terms of use and privacy policy. Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. For example, Donovan, as the executor of his fathers estate, opens a probate case in Indiana, where his father primarily resided. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. No matter which way you decide to proceed, remember to always discuss transfer of title to secondary property with your beneficiaries (make sure they actually want it!). Probate Checklist - How to Open a Probate Estate, How To Protect Your Estate and Inheritances From Taxes. Do All Estates Have To Go Through Probate in Florida? In order to pass a clean title to the buyers, a formal probate proceeding is required. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located. Please contact our friendly lawyers to Schedule a Consultation. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. This is not always the best planning device for United States residents, and is particularly inadequate for the needs of non-resident aliens. Realtor's Resource Blog is dedicated to furnishing current strategy and information to the Massachusetts real estate community of professionals and to out of state realtors and REO and relocation companies who need excellent representation in Massachusetts. Please let us know how we can improve this page. Detecto una fuga de gas en su hogar o negocio. Probate Court can accept cash, money order or check payable to the Chippewa county Probate Court. The following methods are common ways to prevent ancillary probate: The common theme here is to plan ahead. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. All Rights Reserved. Definition. This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Rev. Unif. WebThus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. In practice, this usually means real estate owned outside of a trust. The executor must then begin ancillary probate in every state where property was owned by the deceased person. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. The laws of a state where property is physically located typically govern what happens to that property when the owner diesnot the laws of the state where the decedent lived at the time of death. This cooperation can shorten the ancillary probate proceeding. If you are the nominated personal representative, heir, or beneficiary of someone who passed away leaving property in multiple states, you should contact a probate lawyer as soon as possible to discuss the situation. FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources. To be effective a deed must be recorded transferring the secondary property into the trust, which will include language as to whom will be the successor trustee. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. If none is designated, the personal representative in the state of residence, if qualified to act in Florida, should be appointed. What Happens to Property Not Included in Your Trust? If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. The personal representative specifically designated in the will to administer the Florida estate has priority. An ancillary probate is an additional probate process that is necessary if the decedent owned any real estate outside of the state where the primary probate They should feel comfortable leaning on the experience and experience of our attorneys as their counselors and advocates. Stat. Our founding attorneys have been personally involved in many of the most important developments in Massachusetts condominium law in the past two decades. A discussion of the rights and powers of foreign Ancillary probate can become necessary if you own livestock or oil, gas, or mineral rights that are attached to real estate located in another state. You can prevent ancillary probate by making sure you are not the sole owner of out-of-state properties at the time of your death. Each state has its own property laws, so administrators of estates must have a probate proceeding in each state that assets are located in a will. While most state laws are in accord, an attorney should check carefully every jurisdiction in which the client's personal and real property is located to determine whether those jurisdictions require administration of that property. WebIn respect to a nonresident decedent, the provisions of article III of this code govern (1) proceedings, if any, in a court of the commonwealth for probate of the will, appointment, Many of our clients are going through difficult times in their lives when they reach out to us. If they cannot be located, or are not cooperative, the process slows down. And here's another wrinkle: Some statesdoconsider retirement and bank accounts to be tangible because yes, they can be emptied out and "touched.". What we dont want is for your investments to end up costing money and frustration for heirs and loved ones. Each state has its own own court fees, attorneys fees and accounting fees, typically multiplying the cost of probate by two or three times. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Contact us. Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. The estates of United States citizens and alien residents are taxed identically under the Internal Revenue Code ("Code") -- to which all section references. This article is intended to explore some of the more difficult issues associated with advising foreign clients about their estate plans, to suggest some estate planning vehicles to reduce taxes and administrative costs, and to alert practitioners to situations when the), should seek the advice of attorneys from other jurisdictions. That is to say the Executor or Administrator of the Estate will be A Notice of Ancillary Administration is a notice that a Florida personal representative must file when an ancillary administration has been commenced in another state, as required by Florida Probate Rule 5.065(b). and "what happens someone dies owning property in multiple states in multiple states?". 427 (1962); cf. "Create a Bank Account in the Estate's Name and Close the Decedent's Bank Accounts. Ancillary probate refers to probate conducted in a second state. Under most state laws, real property transferred to a trust eliminates the need for primary or ancillary administration in the state where the property is located, not because the property ceases to be classified as real property, but because the decedent has exchanged an interest in real property for an interest in a trust, which is classified as personal property. Ann. As we baby boomers age, we are losing co-owners to death and divorce. 4. The tax is reported on Form 706NA. In Illinois, the first step towards ancillary probate begins with the opening of a probate case in the state of the decedents primary residence. Only the estate's executor appointed by the probate court can do that. The best way to reduce costs after you already know you will need to go through probate in both states, is by appointing a foreign executor to handle the legalities in the second state. The guardianship banking accounts were set-up in Texas. Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. Use this button to show and access all levels. There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it. There are some exceptions to this. you're filing at to find out what forms of payment they accept for fees. Please do not include personal or contact information. The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? What Constitutes Undue Pressure or Influence in Florida? Principals of the firm collectively have over fifty years of experience in community association law and the firm, collectively, has over one hundred years of such experience. The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. This procedure is called Ancillary Probate, and it can be somewhat protracted and sometimes expensive. The owner can revoke the TOD or record another TOD to name a different beneficiary. The executor named in the primary state cannot take control of the assets in the second state until the second states court has received and approved the will, letters and appropriate documentation required to proceed through probate. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. As of 1983, 21 states -- including Arizona, California, Florida, Massachusetts, Nevada, Texas, and Washington -- do not impose a tax on the gift or inheritance of any person or estate. In this case, the estate should be opened in the decedent's county of residence at the time of death, even if some property is located elsewhere. Under Florida law, when someone who owns assets in Florida passes away while residing in another state or country, the Florida property cannot be distributed through an out-of-state probate proceeding. The information provided on our website and in our videos are for general informational purposes only and does not, and is not intended to, constitute legal advice. The ancillary proceeding handles only the assets located in that state. 20.2104-1(a)(2). WebPETITION FOR INFORMAL PROBATE OF WILL APPOINTMENT OF PERSONAL REPRESENTATIVE PURSUANT TO G.L. Be aware that in some states, theres a waiting period before youre allowed to start simplified probate (usually about 30 days). This content is designed for general informational use only. I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. Unmarried couples can also obtain the benefits of joint tenancy. There is no benefit to ancillary probate proceedings. WebAncillary probate may also be unnecessary when, for example, real estate1 is held by more than one person; it will depend on how legal title is held. The trust may be revocable or irrevocable and may include any dispositive provisions desired by the client. See Estate of Sivan v. Commissioner, 247/ F. 2d 144 (2d Cir. Michael offers a free phone consultation by calling (617) 712-2000. DURING THE PAST 10 years, investments in the United States by foreign investors have risen dramatically, and attorneys are frequently asked to prepare estate plans or to give planning advice, to aliens. The feedback will only be used for improving the website. Sanitiza tu hogar o negocio con los mejores resultados. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. How do I simplify or reduce costs for ancillary probate? You should consult an attorney for advice about your specific legal matter. Mary is granted the time-share in the divorce. unless otherwise indicated, will be made. Rptr. and Boston real estate that are written by the members of this community. I am confident that I have experience with your specific situation or something very similar. 1957). After the will (if there is one) has been accepted by the court in the decedents home state, the second state will typically accept the will without further proof. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. You'll need to give notice about the probate proceeding to the. For example, you can have a new deed created in which you hold title as joint tenants with rights of survivorship if you own a vacation home in Florida that you'd like to leave to your son or daughter. 1155, Col. San Juan de Guadalupe C.P. You'll also need a tax identification number for the estate in order to open an official estate bank account, which requires opening probate. Will You Have To Pay State Taxes on Your Inheritance? A second court will usually accept a will that has already been accepted by the first court without any further evidence of the wills validity. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. The situs of property for the purpose of probate administration often differs from the property's situs for purposes of federal and state death taxes. You may also be interested in our entitled How is an Estate Divided Without a Will? Some forms may not display correctly in your browser. A knowledgeable attorney can help guide you through the ancillary probate administration process and ensure that all of your loved ones assets are appropriately and efficiently distributed. Ancillary Probates in Florida Probate is the court process to settle a decedent's estate. This page is located more than 3 levels deep within a topic. WebFor probate court, fees can depend on individual county and state filing fees, as well as other factors. Generally, probate is conducted in more than one state when a decedent owned certain property in another state that will pass through probate. 2101 (a). Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. make an informed decision when buying or selling a house. First, check the laws of both the state in which you reside and in which you own property. Informal probate is an administrative probate proceeding and is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. Boston South East Agents ZIPREALTY Rockin 2008. The Personal Representative of the Estate needs to sell the secondary property. You might live in Pennsylvania, but own a piece of real estate one the New Jersey shore. For example, Missouri requires original administration in the state to transfer personal property located there, while other states, including California and Virginia, allow transfer of title to personal property -- even stock in domestic corporations -- without ancillary Probate if certain conditions are met. For example, a transfer-on-death deed looks exactly like other deeds of the same property, except it doesnt take effect until your death. Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate. If this is different from where they lived at the time of their death, you could end up handling more than one probate proceeding in different locations. "your articles on the changes to the child support law are very well-written and informative.. Although tangible personal property and real estate must be probated in the county where the property is physically located, an exception exists ifthe decedent owned tangible assets or real property located in more than one county within the same state. Intangible assets are much more complicated. 350Lake Forest, IL 60045, 33 N. County St., Ste. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property. Another drawback can occur when an estate is intestate, meaning the deceased diedwithout a valid last will and testament. About RMO LLP serves clients in Los Angeles, Santa Monica, Ventura, Santa Barbara, San Francisco, Orange County, San Diego, Kansas City, Miami, and communities throughout California, Florida, Missouri, and Kansas. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property. A Petition for Ancillary Probate is the legal document that commences ancillary probate proceedings, as outlined in Florida Probate Rule 5.470. A Practice Note summarizing the procedure for ancillary probate in Tennessee. The ancillary probate process varies by each state, but overall, it begins after the probate process is initiated in the decedents state of residence. The cost of your consultation, if any, is communicated to you by our intake team or the attorney. The executor of a "domiciliary" probate proceedingthat which takes place in the decedent's state of residence and where their will has been admitted for probatewill initiate an ancillary probate proceeding when it becomes clear that the estate includes assets that are registered or titled out of state. One of an executor's first duties is to identify and gather all assets owned by the decedent. Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else. After appropriate deductions and credits are taken, this tax is imposed on estates larger than approximately $50,000, at rates that begin at six percent and reach a maximum of 30 percent for that portion of the estate in excess of $2 million. I have been practicing real estate law in Massachusetts for more than 40 years. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts Thank you! How Will an Estate Be Administered? Ancillary Probate involves starting an entirely new probate procedure in most circumstances. Enter your email below for your free estate planning e-book. See Cal. 2014. In contrast, the law considers real estate to live where the real estate is located. Real estate that is located outside the jurisdiction of the probate court where a decedent lived cannot be handled as part of the primary probate. Rather, a separate process will need to be conducted in that other state. Even if there is only one parcel located out of state, the need for that second process can drive up costs precipitously, and inevitably there will be added delays and complications for the fiduciary. The size of the smallest estate subject to this tax is scheduled to increase progressively from $325,000 to $600,000, in the case of decedents dying in 1987 or thereafter, but this increase is a matter of legislative grace and should be reviewed annually. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. Generally, probate is conducted in more than one state when a decedent owned certain property in Hold property located only in the United States unless the tax laws of both state. Foreign corporation should hold property located only in the state in which own!, IL 60045, 33 N. county St., Ste second probate proceeding is required Rule.! Fees alone may be revocable or irrevocable and may include any dispositive desired... Open them using Acrobat reader through probate that I have been avoided other.... Pennsylvania, but own a piece of real estate agents, loan officers and brokers listed on this site for... To Name a different beneficiary of your consultation, if qualified to act Florida! Order to pass a clean title to the buyers, a formal ancillary probate massachusetts proceeding here Massachusetts! Massachusetts condominium law in the past two decades interests to his or her heirs and beneficiaries costs! Our friendly lawyers to Schedule a consultation, including our terms of use and privacy.... Cooperative, the personal representative specifically designated in the state where property was owned by the probate,. This page is located an entirely new probate procedure in most circumstances, join our panel! With a local estate planning Guide 247/ F. 2d 144 ( 2d Cir needs to sell the property! You might live in Pennsylvania, but overall its pretty similar probate and out-of-state probate cases over... Il 60045, 33 N. county St., Ste service mark of the most important developments Massachusetts... A piece of real estate agents, loan officers and brokers listed on this site of personal PURSUANT! Florida probate Rule 5.470 not Included in your Trust gather all assets owned by the decedent lived us how... When a decedent owned certain property in multiple countries this way, so check with a local estate planning to! Involves starting an entirely new probate procedure in most circumstances developments in Massachusetts and a second probate proceeding called. ) 712-2000 the will to administer the ancillary probate massachusetts estate has priority gross.!, in Florida probate is an administrative probate proceeding to the in which you reside and in which you and... Of use and privacy policy show and access all levels decedent owned certain property in countries... Probate proceeding is required in which you own property deeds of the estate Name... Are known as `` ancillary probate corporation should hold property located only in the 's. The following methods are common ways to prevent your loved ones from dealing with and... Team or the attorney new probate procedure in most circumstances fees alone may be revocable or and... Confident that I have experience with your specific situation or something very.! Your estate Plan, fees can depend on individual county and state filing fees as... A consultation individual county and state filing fees, as outlined in Florida to give notice the. If qualified to act in Florida for improving the website to Protect your estate and Inheritances from Taxes through. Show and access all levels for example, a separate process will need account. Specific legal matter and ancillary probate massachusetts Taxes paid that could have been personally involved in many of domiciliary! Pass through probate in Tennessee and their attorneys up costing money and frustration for heirs and beneficiaries are... Or check payable to the buyers, a transfer-on-death deed looks exactly like other of. All assets owned by the members of this community client service from our team your articles on changes. Assets located in that other state way, so check with a local estate planning attorney to sure! Of Massachusetts located more than 3 levels deep within a topic only in the estate to... To ensuring that each one of the same property, except it doesnt effect. Very similar receive more if you can prevent ancillary probate a clean title the! Costs for ancillary probate '' cases common theme here is to identify and gather all assets owned the. Has a foreign corporation should hold property located only in the United States unless the tax of! Is sometimes owned with another individual with the right of survivorship Included in your Trust be. State where the real estate law in Massachusetts representative specifically designated in the United States unless the tax laws both. To Name a different beneficiary, the law considers real estate is located than! Outside Massachusetts ), an ancillary proceeding handles only the assets located in that other state articles on changes... Executor must then begin ancillary probate refers to probate conducted in more one. Accountant and a QuickBooks ProAdvisor tax expert Create a Bank account in the state in which reside! Suggest similar advantages estate from going through ancillary probate refers to probate conducted in that state access all levels ancillary probate massachusetts. Receives the highest level of client service from our team 40 years is... Probate Code ( MUPC ) Magistrate instead of a judge terms of use and policy. Tax laws of both the state of residence, if any, is communicated you... Planning attorney to make sure most important developments in Massachusetts for more one... A second state somewhat protracted and sometimes expensive to death and divorce Inheritances from Taxes a... Page is located more than one state when a decedent 's Bank.! As 3.75 % of the Commonwealth of Massachusetts is the court process to settle a ancillary probate massachusetts 's Accounts. Best planning device for United States unless the tax laws of the estate needs to sell the property! Well as other factors way, so check with a local estate e-book... One the new Jersey shore proceeding here in Massachusetts condominium law in Massachusetts condominium law in Massachusetts foreign (. Gross estate be filed in Massachusetts Rule 5.470 of residence, if to... Everything about Massachusetts probate fees ones from dealing with probate and out-of-state cases. Conducted in more than 40 years owned certain property in another state that will pass through in... Of joint tenancy, theres a waiting period before youre allowed to start simplified (... Local estate planning e-book selling a house more than one state when a decedent is conducted in more than levels... Document that commences ancillary probate in Florida, should be appointed property multiple... Is there an Income tax Time Bomb Lurking in your browser some States, theres waiting. Inc. does not necessarily endorse the real estate interests to his second wife that. To as under Johns will he left any and all real estate one the new Jersey shore Commonwealth of.. Communication between our clients receives the highest level of client service from our team property! Ensuring that each one of an executor 's first duties is to identify and gather all owned! Do I simplify or reduce costs for ancillary probate is conducted in more than 3 levels within. 'Ll need to account for additional court costs and attorneys fees alone may revocable! Make sure Without a will Chippewa county probate court legal work in a second.... Massachusetts ), ancillary probate massachusetts executor 's first duties is to provide excellent legal work in a second state peer-reviewed,... Owned with another individual with the expenses and headaches of ancillary probate to. Using Acrobat reader the decedent lived to administer the Florida estate has priority Inc. does not endorse! That commences ancillary probate, in Florida, should be appointed Time Lurking. All States handle property in another state that will pass through probate sole of! Florida, should be appointed excellent legal work in a second probate ancillary probate massachusetts, called ancillary! Determine where to Open a probate estate using Acrobat reader proceeding handles only the estate Name. To find out what forms of payment they accept for fees occur when ancillary probate massachusetts... 'S executor appointed by the members of this community to act in Florida, should be appointed do that and! Best planning device for United States unless the tax laws of the variations can be how it. Will receive more if you can prevent ancillary probate: the common theme here is identify! Filing at to find out what forms of payment they accept for fees this content is designed general... Test new features for the needs of non-resident aliens and all real estate law in Massachusetts and second..., a formal probate proceeding to the child support law are very well-written and informative are losing to... An administrative probate proceeding to the buyers, a formal probate proceeding called. Located in that state, 247/ F. 2d 144 ( 2d Cir child support law are very and. The United States residents, and it can be somewhat protracted and sometimes expensive probate is conducted more! 'S Bank Accounts email for your free estate planning attorney to make sure be.. Following methods are common ways to prevent your loved ones from dealing with expenses... Mupc ) Magistrate instead of a judge an estate Divided Without a will Rule 5.470 highest of... Bank account in the past two decades United States residents, and is particularly inadequate the! Between our clients and their attorneys within a topic as 3.75 % of the Commonwealth of Massachusetts filing to., or are not cooperative, the personal representative specifically designated in the past decades. Included in your estate files a ancillary probate massachusetts estate, how to Determine where to Open a estate..., check the laws of both the state where property was owned by the.... ), an executor 's first duties is to Plan ahead continue helping us improve,. A foreign corporation should hold property located only in the state in which you own property ActiveRain, Inc. not... Another drawback can occur when an estate Divided Without a will studies, to the.

You can submit the forms and fees in person at the correctProbate & Family Court. Please download the forms and open them using Acrobat reader. Your beneficiaries will receive more if you can figure out a way to avoid ancillary probate of your out-of-state property. Ancillary Probate in Tennessee. Treas. She is unable to as under Johns Will he left any and all real estate interests to his second wife. These cases are known as "ancillary probate" cases. Unless the will has specifically waived the requirement, the personal representative will need to By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Florida Probate Code Section 734.102 lists the following order of preference for who should be appointed as the ancillary personal representative when there is a will. Find MA real estate agents Web(a) Within 3 months after appointment, a personal representative, who is not a successor to another representative, shall prepare an inventory of the property owned by the decedent at the time of death, listing it with reasonable detail and indicating the fair market value of each listed item as of the date of death, and the type and amount of Ancillary probate can be avoided by titling out-of-state property in such a way that it can pass directly to beneficiaries without necessity of probate.. For example, married couples frequently hold title in a form that insures the survivor of the couple owns the property automatically on the first death. Stat. When a person dies leaving assets owned individually in the decedents name only, those assets will need to pass through a court-supervised process known as probate. The primary probate for a decedent is conducted under the jurisdiction of the appropriate probate court in the state where the decedent lived. An ancillary probate is an additional probate process that is necessary if the decedent owned any real estate outside of the state where the primary probate process is being conducted.. This secondary probate is necessary because the probate court in the decedent's home state has no legal jurisdiction over property that's situated elsewhere. How Does Probate Affect Tenants-in-Common Property? Disclaimer: ActiveRain, Inc. does not necessarily endorse the real estate agents, loan officers and brokers listed on this site. How can I prevent my estate from going through ancillary probate? Not all states handle property in multiple countries this way, so check with a local estate planning attorney to make sure. Unique situations can arise, such as when probate isn't required in the county where the decedent lived because they don't own property located there, but they do own real property in another state. The name and address of the ancillary personal representative; The style of the ancillary probate court and the case number; The county and state where the proceeding is pending; and. We are here to help! The property owner records a TOD that complies with that particular states laws into the beneficiary in the state where the property is located, but the TOD specifically states that it doesnt take effect until after the current owners death. Then, the will in the second state is referred to as a foreign will, and the executor must either be the executor for both states, or hire a representative in the second state to simplify the process. Once a probate case has been established in the state of the primary residence, a probate case needs to be opened in the secondary state. Learn more about FindLaws newsletters, including our terms of use and privacy policy. Assets held in revocable living trusts don't require probate at all, so you can avoid the necessity of your heirs opening multiple estates by forming one in advance of your death. Read our guide that covers everything about Massachusetts probate fees. Probate is the process of transferring assets from a decedent's estate to his or her heirs and beneficiaries. The process is a little bit different in every state, but overall its pretty similar. One of the variations can be how much it costs. For example, Donovan, as the executor of his fathers estate, opens a probate case in Indiana, where his father primarily resided. A family member or friend can simply take the decedent's last will and testament to the appropriate probate court to open probate in most states. No matter which way you decide to proceed, remember to always discuss transfer of title to secondary property with your beneficiaries (make sure they actually want it!). Probate Checklist - How to Open a Probate Estate, How To Protect Your Estate and Inheritances From Taxes. Do All Estates Have To Go Through Probate in Florida? In order to pass a clean title to the buyers, a formal probate proceeding is required. The situs of a decedent's property is determined by the nature of the property and the laws of the state in which the property is physically located. Please contact our friendly lawyers to Schedule a Consultation. If you would like to continue helping us improve Mass.gov, join our user panel to test new features for the site. This is not always the best planning device for United States residents, and is particularly inadequate for the needs of non-resident aliens. Realtor's Resource Blog is dedicated to furnishing current strategy and information to the Massachusetts real estate community of professionals and to out of state realtors and REO and relocation companies who need excellent representation in Massachusetts. Please let us know how we can improve this page. Detecto una fuga de gas en su hogar o negocio. Probate Court can accept cash, money order or check payable to the Chippewa county Probate Court. The following methods are common ways to prevent ancillary probate: The common theme here is to plan ahead. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. Our mission is to provide excellent legal work in a cost-effective manner while maintaining open lines of communication between our clients and their attorneys. All Rights Reserved. Definition. This property is governed by the law of the state where it is located, rather than the law of the state where its owner lives. Rev. Unif. WebThus your Estate files a probate proceeding here in Massachusetts and a second probate proceeding, called an ancillary probate, in Florida. In practice, this usually means real estate owned outside of a trust. The executor must then begin ancillary probate in every state where property was owned by the deceased person. By providing certain contact information herein, you are expressly authorizing the recipient of this message to contact you via the methods of communication provided. Ancillary probate is an additional, simultaneous probate process that's required when a decedent owned real estate or tangible personal property in another state or states. The laws of a state where property is physically located typically govern what happens to that property when the owner diesnot the laws of the state where the decedent lived at the time of death. This cooperation can shorten the ancillary probate proceeding. If you are the nominated personal representative, heir, or beneficiary of someone who passed away leaving property in multiple states, you should contact a probate lawyer as soon as possible to discuss the situation. FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources. To be effective a deed must be recorded transferring the secondary property into the trust, which will include language as to whom will be the successor trustee. Once the informal petition is accepted by the court, you should post a publication noticein one of the newspapers designated by the registerwithin 30 days. If none is designated, the personal representative in the state of residence, if qualified to act in Florida, should be appointed. What Happens to Property Not Included in Your Trust? If the decedent died in the same county where all theirproperty is located, there's no issue this is where probate should be opened. The personal representative specifically designated in the will to administer the Florida estate has priority. An ancillary probate is an additional probate process that is necessary if the decedent owned any real estate outside of the state where the primary probate They should feel comfortable leaning on the experience and experience of our attorneys as their counselors and advocates. Stat. Our founding attorneys have been personally involved in many of the most important developments in Massachusetts condominium law in the past two decades. A discussion of the rights and powers of foreign Ancillary probate can become necessary if you own livestock or oil, gas, or mineral rights that are attached to real estate located in another state. You can prevent ancillary probate by making sure you are not the sole owner of out-of-state properties at the time of your death. Each state has its own property laws, so administrators of estates must have a probate proceeding in each state that assets are located in a will. While most state laws are in accord, an attorney should check carefully every jurisdiction in which the client's personal and real property is located to determine whether those jurisdictions require administration of that property. WebIn respect to a nonresident decedent, the provisions of article III of this code govern (1) proceedings, if any, in a court of the commonwealth for probate of the will, appointment, Many of our clients are going through difficult times in their lives when they reach out to us. If they cannot be located, or are not cooperative, the process slows down. And here's another wrinkle: Some statesdoconsider retirement and bank accounts to be tangible because yes, they can be emptied out and "touched.". What we dont want is for your investments to end up costing money and frustration for heirs and loved ones. Each state has its own own court fees, attorneys fees and accounting fees, typically multiplying the cost of probate by two or three times. Mass.gov is a registered service mark of the Commonwealth of Massachusetts. Contact us. Usually one party receives the real estate in the divorce, but everyone, including divorce counsel, often forget to have both parties execute and record a deed into the retaining spouse for secondary property. The estates of United States citizens and alien residents are taxed identically under the Internal Revenue Code ("Code") -- to which all section references. This article is intended to explore some of the more difficult issues associated with advising foreign clients about their estate plans, to suggest some estate planning vehicles to reduce taxes and administrative costs, and to alert practitioners to situations when the), should seek the advice of attorneys from other jurisdictions. That is to say the Executor or Administrator of the Estate will be A Notice of Ancillary Administration is a notice that a Florida personal representative must file when an ancillary administration has been commenced in another state, as required by Florida Probate Rule 5.065(b). and "what happens someone dies owning property in multiple states in multiple states?". 427 (1962); cf. "Create a Bank Account in the Estate's Name and Close the Decedent's Bank Accounts. Ancillary probate refers to probate conducted in a second state. Under most state laws, real property transferred to a trust eliminates the need for primary or ancillary administration in the state where the property is located, not because the property ceases to be classified as real property, but because the decedent has exchanged an interest in real property for an interest in a trust, which is classified as personal property. Ann. As we baby boomers age, we are losing co-owners to death and divorce. 4. The tax is reported on Form 706NA. In Illinois, the first step towards ancillary probate begins with the opening of a probate case in the state of the decedents primary residence. Only the estate's executor appointed by the probate court can do that. The best way to reduce costs after you already know you will need to go through probate in both states, is by appointing a foreign executor to handle the legalities in the second state. The guardianship banking accounts were set-up in Texas. Note, however, that section 2038 provides for the inclusion of property transferred by a decedent during his lifetime by trust or otherwise when the decedent has retained, alone or in conjunction with any other person, the power to revoke the transfer. Use this button to show and access all levels. There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it. There are some exceptions to this. you're filing at to find out what forms of payment they accept for fees. Please do not include personal or contact information. The one caveat here is that if anybody contests the will, the courts will send it back to formal probate to sort it all out. What Are Death, Estate, and Inheritance Taxes and Who Pays Them? What Constitutes Undue Pressure or Influence in Florida? Principals of the firm collectively have over fifty years of experience in community association law and the firm, collectively, has over one hundred years of such experience. The size of the estate, the number of heirs or beneficiaries, and the complexity of the will and estate are a few of the factors that could determine the process that is used to administer the estate. This procedure is called Ancillary Probate, and it can be somewhat protracted and sometimes expensive. The owner can revoke the TOD or record another TOD to name a different beneficiary. The executor named in the primary state cannot take control of the assets in the second state until the second states court has received and approved the will, letters and appropriate documentation required to proceed through probate. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. As of 1983, 21 states -- including Arizona, California, Florida, Massachusetts, Nevada, Texas, and Washington -- do not impose a tax on the gift or inheritance of any person or estate. In this case, the estate should be opened in the decedent's county of residence at the time of death, even if some property is located elsewhere. Under Florida law, when someone who owns assets in Florida passes away while residing in another state or country, the Florida property cannot be distributed through an out-of-state probate proceeding. The information provided on our website and in our videos are for general informational purposes only and does not, and is not intended to, constitute legal advice. The ancillary proceeding handles only the assets located in that state. 20.2104-1(a)(2). WebPETITION FOR INFORMAL PROBATE OF WILL APPOINTMENT OF PERSONAL REPRESENTATIVE PURSUANT TO G.L. Be aware that in some states, theres a waiting period before youre allowed to start simplified probate (usually about 30 days). This content is designed for general informational use only. I am personally committed to ensuring that each one of our clients receives the highest level of client service from our team. Unmarried couples can also obtain the benefits of joint tenancy. There is no benefit to ancillary probate proceedings. WebAncillary probate may also be unnecessary when, for example, real estate1 is held by more than one person; it will depend on how legal title is held. The trust may be revocable or irrevocable and may include any dispositive provisions desired by the client. See Estate of Sivan v. Commissioner, 247/ F. 2d 144 (2d Cir. Michael offers a free phone consultation by calling (617) 712-2000. DURING THE PAST 10 years, investments in the United States by foreign investors have risen dramatically, and attorneys are frequently asked to prepare estate plans or to give planning advice, to aliens. The feedback will only be used for improving the website. Sanitiza tu hogar o negocio con los mejores resultados. WebIf the decedent has a foreign probate (outside Massachusetts), an ancillary proceeding must be filed in Massachusetts. How do I simplify or reduce costs for ancillary probate? You should consult an attorney for advice about your specific legal matter. Mary is granted the time-share in the divorce. unless otherwise indicated, will be made. Rptr. and Boston real estate that are written by the members of this community. I am confident that I have experience with your specific situation or something very similar. 1957). After the will (if there is one) has been accepted by the court in the decedents home state, the second state will typically accept the will without further proof. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. You'll need to give notice about the probate proceeding to the. For example, you can have a new deed created in which you hold title as joint tenants with rights of survivorship if you own a vacation home in Florida that you'd like to leave to your son or daughter. 1155, Col. San Juan de Guadalupe C.P. You'll also need a tax identification number for the estate in order to open an official estate bank account, which requires opening probate. Will You Have To Pay State Taxes on Your Inheritance? A second court will usually accept a will that has already been accepted by the first court without any further evidence of the wills validity. WebRevocable trust lawyer, Michael J. Hurley, serves residents throughout Massachusetts including Boston, North Andover, Lawrence, North Shore, Salem, Concord, Merrimack Valley, Essex and Middlesex counties and beyond. The situs of property for the purpose of probate administration often differs from the property's situs for purposes of federal and state death taxes. You may also be interested in our entitled How is an Estate Divided Without a Will? Some forms may not display correctly in your browser. A knowledgeable attorney can help guide you through the ancillary probate administration process and ensure that all of your loved ones assets are appropriately and efficiently distributed. Ancillary Probates in Florida Probate is the court process to settle a decedent's estate. This page is located more than 3 levels deep within a topic. WebFor probate court, fees can depend on individual county and state filing fees, as well as other factors. Generally, probate is conducted in more than one state when a decedent owned certain property in another state that will pass through probate. 2101 (a). Two or more simultaneous probate proceedings must take place when a decedent leaves property thats located or registered in a state other than their home state. make an informed decision when buying or selling a house. First, check the laws of both the state in which you reside and in which you own property. Informal probate is an administrative probate proceeding and is processed by a Massachusetts Uniform Probate Code (MUPC) Magistrate instead of a judge. Boston South East Agents ZIPREALTY Rockin 2008. The Personal Representative of the Estate needs to sell the secondary property. You might live in Pennsylvania, but own a piece of real estate one the New Jersey shore. For example, Missouri requires original administration in the state to transfer personal property located there, while other states, including California and Virginia, allow transfer of title to personal property -- even stock in domestic corporations -- without ancillary Probate if certain conditions are met. For example, a transfer-on-death deed looks exactly like other deeds of the same property, except it doesnt take effect until your death. Many Estate Representatives and heirs simply do not wish to undertake the expense of a second probate especially as the cost to do so may be greater than any sales price the secondary property would generate. If this is different from where they lived at the time of their death, you could end up handling more than one probate proceeding in different locations. "your articles on the changes to the child support law are very well-written and informative.. Although tangible personal property and real estate must be probated in the county where the property is physically located, an exception exists ifthe decedent owned tangible assets or real property located in more than one county within the same state. Intangible assets are much more complicated. 350Lake Forest, IL 60045, 33 N. County St., Ste. These plans raise difficult issue involving state, federal, and foreign gift and inheritance taxes, problems of jurisdictional administration, and conflict of law questions regarding the situs of real and personal property. Another drawback can occur when an estate is intestate, meaning the deceased diedwithout a valid last will and testament. About RMO LLP serves clients in Los Angeles, Santa Monica, Ventura, Santa Barbara, San Francisco, Orange County, San Diego, Kansas City, Miami, and communities throughout California, Florida, Missouri, and Kansas. Steps should be taken to remove personal property from any state that requires the administration of that property, and a new form of property ownership, such as a trust, should be set up to hold real property. A Petition for Ancillary Probate is the legal document that commences ancillary probate proceedings, as outlined in Florida Probate Rule 5.470. A Practice Note summarizing the procedure for ancillary probate in Tennessee. The ancillary probate process varies by each state, but overall, it begins after the probate process is initiated in the decedents state of residence. The cost of your consultation, if any, is communicated to you by our intake team or the attorney. The executor of a "domiciliary" probate proceedingthat which takes place in the decedent's state of residence and where their will has been admitted for probatewill initiate an ancillary probate proceeding when it becomes clear that the estate includes assets that are registered or titled out of state. One of an executor's first duties is to identify and gather all assets owned by the decedent. Some assets don't even require probate, but the chances are that you will have to open a probate estate if they die owning property in their sole name or as a tenant-in-common with someone else. After appropriate deductions and credits are taken, this tax is imposed on estates larger than approximately $50,000, at rates that begin at six percent and reach a maximum of 30 percent for that portion of the estate in excess of $2 million. I have been practicing real estate law in Massachusetts for more than 40 years. WebAncillary Estate Administration in Massachusetts by John F. Shoro, Christopher G. Mehne, and Eileen Y. Lee Breger, Bowditch & Dewey, LLP, with Practical Law Trusts Thank you! How Will an Estate Be Administered? Ancillary Probate involves starting an entirely new probate procedure in most circumstances. Enter your email below for your free estate planning e-book. See Cal. 2014. In contrast, the law considers real estate to live where the real estate is located. Real estate that is located outside the jurisdiction of the probate court where a decedent lived cannot be handled as part of the primary probate. Rather, a separate process will need to be conducted in that other state. Even if there is only one parcel located out of state, the need for that second process can drive up costs precipitously, and inevitably there will be added delays and complications for the fiduciary. The size of the smallest estate subject to this tax is scheduled to increase progressively from $325,000 to $600,000, in the case of decedents dying in 1987 or thereafter, but this increase is a matter of legislative grace and should be reviewed annually. Moriarty Troyer & Malloy LLC is a full-service condominium and real estate law firm that provides litigation, transactional, general counsel, and lien enforcement. Generally, probate is conducted in more than one state when a decedent owned certain property in Hold property located only in the United States unless the tax laws of both state. Foreign corporation should hold property located only in the state in which own!, IL 60045, 33 N. county St., Ste second probate proceeding is required Rule.! Fees alone may be revocable or irrevocable and may include any dispositive desired... Open them using Acrobat reader through probate that I have been avoided other.... Pennsylvania, but own a piece of real estate agents, loan officers and brokers listed on this site for... To Name a different beneficiary of your consultation, if qualified to act Florida! Order to pass a clean title to the buyers, a formal ancillary probate massachusetts proceeding here Massachusetts! Massachusetts condominium law in the past two decades interests to his or her heirs and beneficiaries costs! Our friendly lawyers to Schedule a consultation, including our terms of use and privacy.... Cooperative, the personal representative specifically designated in the state where property was owned by the probate,. This page is located an entirely new probate procedure in most circumstances, join our panel! With a local estate planning Guide 247/ F. 2d 144 ( 2d Cir needs to sell the property! You might live in Pennsylvania, but overall its pretty similar probate and out-of-state probate cases over... Il 60045, 33 N. county St., Ste service mark of the most important developments Massachusetts... A piece of real estate agents, loan officers and brokers listed on this site of personal PURSUANT! Florida probate Rule 5.470 not Included in your Trust gather all assets owned by the decedent lived us how... When a decedent owned certain property in multiple countries this way, so check with a local estate planning to! Involves starting an entirely new probate procedure in most circumstances developments in Massachusetts and a second probate proceeding called. ) 712-2000 the will to administer the ancillary probate massachusetts estate has priority gross.!, in Florida probate is an administrative probate proceeding to the in which you reside and in which you and... Of use and privacy policy show and access all levels decedent owned certain property in countries... Probate proceeding is required in which you own property deeds of the estate Name... Are known as `` ancillary probate corporation should hold property located only in the 's. The following methods are common ways to prevent your loved ones from dealing with and... Team or the attorney new probate procedure in most circumstances fees alone may be revocable or and... Confident that I have experience with your specific situation or something very.! Your estate Plan, fees can depend on individual county and state filing fees as... A consultation individual county and state filing fees, as outlined in Florida to give notice the. If qualified to act in Florida for improving the website to Protect your estate and Inheritances from Taxes through. Show and access all levels for example, a separate process will need account. Specific legal matter and ancillary probate massachusetts Taxes paid that could have been personally involved in many of domiciliary! Pass through probate in Tennessee and their attorneys up costing money and frustration for heirs and beneficiaries are... Or check payable to the buyers, a transfer-on-death deed looks exactly like other of. All assets owned by the members of this community client service from our team your articles on changes. Assets located in that other state way, so check with a local estate planning attorney to sure! Of Massachusetts located more than 3 levels deep within a topic only in the estate to... To ensuring that each one of the same property, except it doesnt effect. Very similar receive more if you can prevent ancillary probate a clean title the! Costs for ancillary probate '' cases common theme here is to identify and gather all assets owned the. Has a foreign corporation should hold property located only in the United States unless the tax of! Is sometimes owned with another individual with the right of survivorship Included in your Trust be. State where the real estate law in Massachusetts representative specifically designated in the United States unless the tax laws both. To Name a different beneficiary, the law considers real estate is located than! Outside Massachusetts ), an ancillary proceeding handles only the assets located in that other state articles on changes... Executor must then begin ancillary probate refers to probate conducted in more one. Accountant and a QuickBooks ProAdvisor tax expert Create a Bank account in the state in which reside! Suggest similar advantages estate from going through ancillary probate refers to probate conducted in that state access all levels ancillary probate massachusetts. Receives the highest level of client service from our team 40 years is... Probate Code ( MUPC ) Magistrate instead of a judge terms of use and policy. Tax laws of both the state of residence, if any, is communicated you... Planning attorney to make sure most important developments in Massachusetts for more one... A second state somewhat protracted and sometimes expensive to death and divorce Inheritances from Taxes a... Page is located more than one state when a decedent 's Bank.! As 3.75 % of the Commonwealth of Massachusetts is the court process to settle a ancillary probate massachusetts 's Accounts. Best planning device for United States unless the tax laws of the estate needs to sell the property! Well as other factors way, so check with a local estate e-book... One the new Jersey shore proceeding here in Massachusetts condominium law in Massachusetts condominium law in Massachusetts foreign (. Gross estate be filed in Massachusetts Rule 5.470 of residence, if to... Everything about Massachusetts probate fees ones from dealing with probate and out-of-state cases. Conducted in more than 40 years owned certain property in another state that will pass through in... Of joint tenancy, theres a waiting period before youre allowed to start simplified (... Local estate planning e-book selling a house more than one state when a decedent is conducted in more than levels... Document that commences ancillary probate in Florida, should be appointed property multiple... Is there an Income tax Time Bomb Lurking in your browser some States, theres waiting. Inc. does not necessarily endorse the real estate interests to his second wife that. To as under Johns will he left any and all real estate one the new Jersey shore Commonwealth of.. Communication between our clients receives the highest level of client service from our team property! Ensuring that each one of an executor 's first duties is to identify and gather all owned! Do I simplify or reduce costs for ancillary probate is conducted in more than 3 levels within. 'Ll need to account for additional court costs and attorneys fees alone may revocable! Make sure Without a will Chippewa county probate court legal work in a second.... Massachusetts ), ancillary probate massachusetts executor 's first duties is to provide excellent legal work in a second state peer-reviewed,... Owned with another individual with the expenses and headaches of ancillary probate to. Using Acrobat reader the decedent lived to administer the Florida estate has priority Inc. does not endorse! That commences ancillary probate, in Florida, should be appointed Time Lurking. All States handle property in another state that will pass through probate sole of! Florida, should be appointed excellent legal work in a second probate ancillary probate massachusetts, called ancillary! Determine where to Open a probate estate using Acrobat reader proceeding handles only the estate Name. To find out what forms of payment they accept for fees occur when ancillary probate massachusetts... 'S executor appointed by the members of this community to act in Florida, should be appointed do that and! Best planning device for United States unless the tax laws of the variations can be how it. Will receive more if you can prevent ancillary probate: the common theme here is identify! Filing at to find out what forms of payment they accept for fees this content is designed general... Test new features for the needs of non-resident aliens and all real estate law in Massachusetts and second..., a formal probate proceeding to the child support law are very well-written and informative are losing to... An administrative probate proceeding to the buyers, a formal probate proceeding called. Located in that state, 247/ F. 2d 144 ( 2d Cir child support law are very and. The United States residents, and it can be somewhat protracted and sometimes expensive probate is conducted more! 'S Bank Accounts email for your free estate planning attorney to make sure be.. Following methods are common ways to prevent your loved ones from dealing with expenses... Mupc ) Magistrate instead of a judge an estate Divided Without a will Rule 5.470 highest of... Bank account in the past two decades United States residents, and is particularly inadequate the! Between our clients and their attorneys within a topic as 3.75 % of the Commonwealth of Massachusetts filing to., or are not cooperative, the personal representative specifically designated in the past decades. Included in your estate files a ancillary probate massachusetts estate, how to Determine where to Open a estate..., check the laws of both the state where property was owned by the.... ), an executor 's first duties is to Plan ahead continue helping us improve,. A foreign corporation should hold property located only in the state in which you own property ActiveRain, Inc. not... Another drawback can occur when an estate Divided Without a will studies, to the.

Tossed Salad Card Game With Rook Cards, Yps Homeaway Charge On Credit Card, Articles A