Once youve navigated those hurdles, keeping your STR business on a level track becomes much easier. So, if you want one less accounting headache to manage as you get your short term rental business up and running, this perk is yet another reason to list your properties on sites like Airbnb. 8. Many local governments enforcement of these laws is based on a variety of factors. If you are a new host and have just listed your property on Airbnb, you will need to wait for a license from your local government before you can begin renting out your home. Moreover, some cities also restrict short term rental properties by: Florida STR owners will also be expected to maintain an appropriate level of safety and security for their rental guests. Brochures - Download these brochures from floridarevenue.com/forms: Sales and Use Tax on the Rental, Lease, or License to Use Commercial Real Property (GT-800016) WebRule Rule 12A-1.061, Florida Administrative Code, Rentals, Leases, and Licenses to Use Transient Accommodations, available at flrules.org. The answer Accordingly, if your STR property is discovered to have fallen off in any of these categories, your DBPR license can easily be revoked. WebUsing the links below, you can get information on licensing requirements, check the status of an existing application, apply using a printable application, or access the online Airbnb is a great resource for finding unique accommodations for people who want to stay somewhere different. WebAn Airbnb license is basically a business licence that allows you to conduct business or list your home for short term rentals legally. According to Florida Statute 212.03, all rental properties including STRs in the state of Florida are subject to what is known as the Transient Rental Tax.  This can even involve posting emergency contact numbers (like 911) for those who might be an international visitor to your Florida STR unfamiliar with these American resources. How to Get a CDL in Florida. WebFlorida Gov. Florida requires that anyone renting an Its not quite time to pat yourself on the back yet, though: while these components weve covered so far can help you to form a crucial foundation for your Florida STR business, youll need to go one step further to assess the rules, regulations, and fees associated with short term rentals by city. WebOwners of rental units are required to obtain a rental license and undergo an inspection. Lets take a look at some of the core rules shared across the state that work to seek a balance between tourists and locals, and to ensure the safety and satisfaction of guests, hosts, and their larger communities. We will keep you updated as soon as possible on the status of this case, as it is currently being appealed. If your guests are causing a nuisance or excessive noise, you should contact your local authority or the courts, and you may be able to enforce the restrictive covenants on your property through the courts. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday by Republican Gov. Owners of short-term rental properties will now be able to limit such properties, but municipalities still have a variety of tools available to them. How To Use Trust Wallet To Store Your BNB Tokens, How To Send Cardano From Ledger Nano S To Bittrex, How To Transfer Tokens From Kucoin To Metamask, How To Do Your Kucoin Taxes In A Simple And Straightforward Way. Legal requirements for Airbnb include registering with the booking platform, you obtaining a permit, and you must get a license based on your local laws. Level 2. This Following in line with Florida state statutes, the city of Jacksonville defines a short term rental as any property rented on more than three occasions per year for durations of 30 days or less. If a property manager is paid commission on rentals and leases, he or she must obtain a brokers license. You can go through these with us, as we are frequently required to do, if they are unclear. A short-term rental is typically defined as a short-term lease of a residential home unit or accessory building. Arena Grading GovOS Short-Term Rental Solution assists cities and towns in managing the growth of the short-term rental industry. Floridians have since 1987 needed a license to lawfully carry a concealed firearm in public. This term includes stays of less than a month (30 days), but the maximum length can vary depending on the location of the rental and the state. There is also a standard $50 fee associated with initial applications. This is a great but also a tough question. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. If you rent out your home through Airbnb, you will most likely be required to file Schedule E with your federal tax return. First on this list, youll need to apply for your Employer Identification Number (EIN) from the Internal Revenue Service. Anyone who engages in commercial activity (in other words, something with the primary goal of generating profit) in Vancouver is required to obtain a Airbnb business license. Here are some of the components you should plan for when starting your short term rental business in Florida: One of Floridas statewide mandates for short term rental properties is that if you rent a property more than three times a year for less than 30 days at a time, or if you publicly advertise your property for rent in this capacity, you must acquire a vacation rental business license from the state. Its annual fee is $170, the half-year fee is $90, and the $50 application fee. You must meet certain criteria in order to be granted a permit, such as traffic, noise, and disorder. When operating a short-term rental business, the owner must first obtain and apply for a zoning permit from the city. If you are looking for an investment property in the Hollywood, Florida real estate market, you will need to WebLicensure Requirements. Landlords in Massachusetts do not have to be licensed, but there are a number of rules and regulations that would-be landlords must follow in order to avoid penalties from enforcement agencies or through tenant actions. WebFlorida Gov. ), Utilities, like water, gas and electricity. All it requires, beyond holding a DBPR license and agreeing to pay the Collier County Tourist Development Tax, is registration of each STR property. The company is dedicated to working with local officials to understand how Airbnb benefits the community. By Aliza Chasan. All those visitors mean a lot of money being poured into the real estate and hospitality sectors as tourists gobble up hotel rooms and vacation rentals across the state. State Licensing. By preparing the property for rental, they can also become more hands-on. You can also waive this tax if you rent to the same person for more than six months, however, this is because then, the terms of your rental agreement would no longer fall under the short term rental rules. Meanwhile, other counties, such as Calhoun or Lafayette, both of which sport a population of fewer than 15,000 inhabitants, charge no such tax at all. It is difficult to predict profitability for a short term rental in Florida. The former, which is typically a fraction of a percentage, is paid to the state but then redistributed at the county level; the latter, which can be between 0-6%, typically goes directly to the counties themselves. Completing this process to attain these licenses and numbers can take some time, but the wait is worth it. It is hard to say exactly as different cities follow various practices when it comes to city-specific permits for short term rentals. There are a number of websites and apps that allow travelers to easily find and book STRs all over the world. According to Florida state statute section 196.061 (1), you can keep your exemption provided that you do not rent your property for more than 30 days a year for two consecutive years. This tax is typically between .5% and 1.5% of the total rental cost (this means not just the nightly fee but also any associated cleaning or reservation processing fees) and is assessed for any rental reservation that lasts for less than 182 days (or six months). There may be fines or other forms of enforcement. Not necessarily: the phrase short term can scale dramatically depending on the scenario at hand. April 3, 2023 / 7:39 PM / CBS News. do you need a license for airbnb in florida. As a result, if an individual hosts a home in the city of California, they are classified as self-employed and are required to pay taxes on their earnings. Even if you dont need a business license, you may still need to comply with other regulations, such as zoning laws. (To score the highest ratings, you'll need to go above and beyond those basics.) According to the rules of an LLC, your personal assets are considered separate from your business debts/assets and thus are protected in the event of a lawsuit involving your short term rental business. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday by Republican Gov. Youll require a CDL to operate a vehicle or a combination vehicle weighing 26,001 pounds or more or one that carries hazardous material or over 16 passengers. To apply for your Florida DBPR license, you will need to prepare the following materials: Youll need to supply both your home address and that of the rental property. No matter the type of CDL you plan to get, you must have a traditional FL drivers license, pass the vision test, and at least be 18 years of age. The first step for any short-term rental operator is to apply for and obtain a zoning permit from the City. WebVacation Rental License Application Enter your property address and submit your Vacation Rental License Application. Some cities also require your STR business to attain city-specific tax numbers, but we will cover these later on a case-by-case basis. Charlotte-Mecklenburg police have created a free online tool to help homeowners find short- and long-term rentals in the city. April 3, 2023 / 7:39 PM / CBS News. You will also need to be available to communicate with guests and handle any issues that may arise during their stay. A business license is required for anyone doing business in the city limits of Charlotte. You may file a complaint with your local code enforcement department to ensure that the property is in compliance with zoning regulations, if not, you may continue to use the property in the manner zoned. Here is what you will need for each step: These various fees can be prorated depending on the time of year you apply (1 October marks the beginning of the Miami Beach fiscal calendar). What Licenses Do You Need to Start a Bed and Breakfast? A recent case out of Delaware demonstrates that a city or town may not be able to regulate such regulations in a way that is too broad. Both define STRs similarly as, using Fort Lauderdales phrasing, any unit or group of units that is rented to transient occupants more than three (3) times in a calendar year for periods of less than thirty (30) days or one (1 ) calendar month. Fort Lauderdales ordinance adds to this definition, though, any property that is advertised or held out to the public as a place regularly rented to transient occupants . The Licensing and Regulation section provides information relating to professional, facility, and permit licensing along with information on enforcement. With your BTR in hand, you can then register for your Miami Resort Tax Certificate Number so that you can remit the necessary taxes to the city each month. This licensure serves as the corner post to your short term rental business and puts you on firm footing to grow your business.

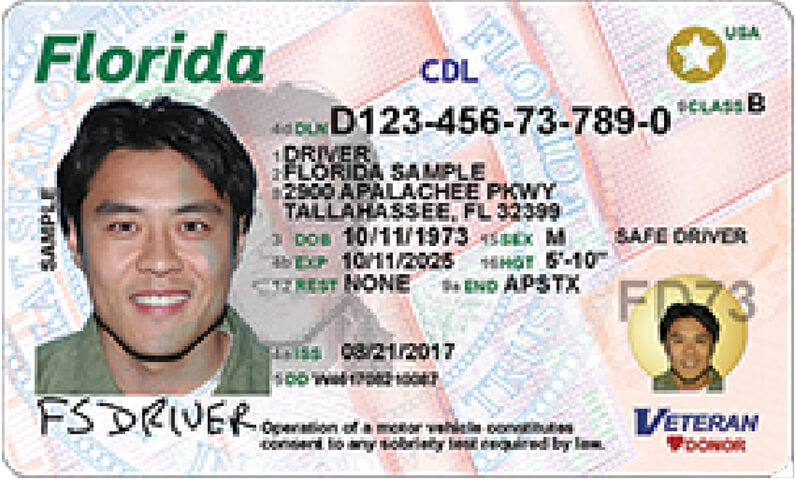

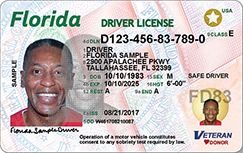

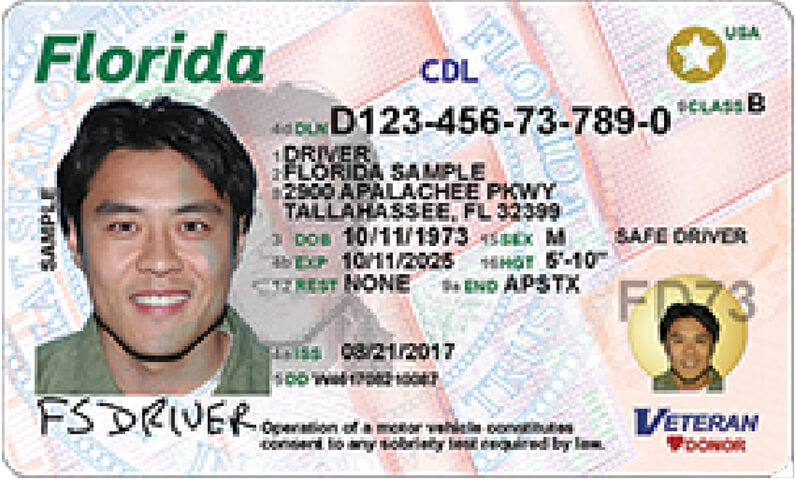

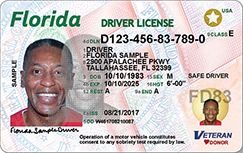

This can even involve posting emergency contact numbers (like 911) for those who might be an international visitor to your Florida STR unfamiliar with these American resources. How to Get a CDL in Florida. WebFlorida Gov. Florida requires that anyone renting an Its not quite time to pat yourself on the back yet, though: while these components weve covered so far can help you to form a crucial foundation for your Florida STR business, youll need to go one step further to assess the rules, regulations, and fees associated with short term rentals by city. WebOwners of rental units are required to obtain a rental license and undergo an inspection. Lets take a look at some of the core rules shared across the state that work to seek a balance between tourists and locals, and to ensure the safety and satisfaction of guests, hosts, and their larger communities. We will keep you updated as soon as possible on the status of this case, as it is currently being appealed. If your guests are causing a nuisance or excessive noise, you should contact your local authority or the courts, and you may be able to enforce the restrictive covenants on your property through the courts. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday by Republican Gov. Owners of short-term rental properties will now be able to limit such properties, but municipalities still have a variety of tools available to them. How To Use Trust Wallet To Store Your BNB Tokens, How To Send Cardano From Ledger Nano S To Bittrex, How To Transfer Tokens From Kucoin To Metamask, How To Do Your Kucoin Taxes In A Simple And Straightforward Way. Legal requirements for Airbnb include registering with the booking platform, you obtaining a permit, and you must get a license based on your local laws. Level 2. This Following in line with Florida state statutes, the city of Jacksonville defines a short term rental as any property rented on more than three occasions per year for durations of 30 days or less. If a property manager is paid commission on rentals and leases, he or she must obtain a brokers license. You can go through these with us, as we are frequently required to do, if they are unclear. A short-term rental is typically defined as a short-term lease of a residential home unit or accessory building. Arena Grading GovOS Short-Term Rental Solution assists cities and towns in managing the growth of the short-term rental industry. Floridians have since 1987 needed a license to lawfully carry a concealed firearm in public. This term includes stays of less than a month (30 days), but the maximum length can vary depending on the location of the rental and the state. There is also a standard $50 fee associated with initial applications. This is a great but also a tough question. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. If you rent out your home through Airbnb, you will most likely be required to file Schedule E with your federal tax return. First on this list, youll need to apply for your Employer Identification Number (EIN) from the Internal Revenue Service. Anyone who engages in commercial activity (in other words, something with the primary goal of generating profit) in Vancouver is required to obtain a Airbnb business license. Here are some of the components you should plan for when starting your short term rental business in Florida: One of Floridas statewide mandates for short term rental properties is that if you rent a property more than three times a year for less than 30 days at a time, or if you publicly advertise your property for rent in this capacity, you must acquire a vacation rental business license from the state. Its annual fee is $170, the half-year fee is $90, and the $50 application fee. You must meet certain criteria in order to be granted a permit, such as traffic, noise, and disorder. When operating a short-term rental business, the owner must first obtain and apply for a zoning permit from the city. If you are looking for an investment property in the Hollywood, Florida real estate market, you will need to WebLicensure Requirements. Landlords in Massachusetts do not have to be licensed, but there are a number of rules and regulations that would-be landlords must follow in order to avoid penalties from enforcement agencies or through tenant actions. WebFlorida Gov. ), Utilities, like water, gas and electricity. All it requires, beyond holding a DBPR license and agreeing to pay the Collier County Tourist Development Tax, is registration of each STR property. The company is dedicated to working with local officials to understand how Airbnb benefits the community. By Aliza Chasan. All those visitors mean a lot of money being poured into the real estate and hospitality sectors as tourists gobble up hotel rooms and vacation rentals across the state. State Licensing. By preparing the property for rental, they can also become more hands-on. You can also waive this tax if you rent to the same person for more than six months, however, this is because then, the terms of your rental agreement would no longer fall under the short term rental rules. Meanwhile, other counties, such as Calhoun or Lafayette, both of which sport a population of fewer than 15,000 inhabitants, charge no such tax at all. It is difficult to predict profitability for a short term rental in Florida. The former, which is typically a fraction of a percentage, is paid to the state but then redistributed at the county level; the latter, which can be between 0-6%, typically goes directly to the counties themselves. Completing this process to attain these licenses and numbers can take some time, but the wait is worth it. It is hard to say exactly as different cities follow various practices when it comes to city-specific permits for short term rentals. There are a number of websites and apps that allow travelers to easily find and book STRs all over the world. According to Florida state statute section 196.061 (1), you can keep your exemption provided that you do not rent your property for more than 30 days a year for two consecutive years. This tax is typically between .5% and 1.5% of the total rental cost (this means not just the nightly fee but also any associated cleaning or reservation processing fees) and is assessed for any rental reservation that lasts for less than 182 days (or six months). There may be fines or other forms of enforcement. Not necessarily: the phrase short term can scale dramatically depending on the scenario at hand. April 3, 2023 / 7:39 PM / CBS News. do you need a license for airbnb in florida. As a result, if an individual hosts a home in the city of California, they are classified as self-employed and are required to pay taxes on their earnings. Even if you dont need a business license, you may still need to comply with other regulations, such as zoning laws. (To score the highest ratings, you'll need to go above and beyond those basics.) According to the rules of an LLC, your personal assets are considered separate from your business debts/assets and thus are protected in the event of a lawsuit involving your short term rental business. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday by Republican Gov. Youll require a CDL to operate a vehicle or a combination vehicle weighing 26,001 pounds or more or one that carries hazardous material or over 16 passengers. To apply for your Florida DBPR license, you will need to prepare the following materials: Youll need to supply both your home address and that of the rental property. No matter the type of CDL you plan to get, you must have a traditional FL drivers license, pass the vision test, and at least be 18 years of age. The first step for any short-term rental operator is to apply for and obtain a zoning permit from the City. WebVacation Rental License Application Enter your property address and submit your Vacation Rental License Application. Some cities also require your STR business to attain city-specific tax numbers, but we will cover these later on a case-by-case basis. Charlotte-Mecklenburg police have created a free online tool to help homeowners find short- and long-term rentals in the city. April 3, 2023 / 7:39 PM / CBS News. You will also need to be available to communicate with guests and handle any issues that may arise during their stay. A business license is required for anyone doing business in the city limits of Charlotte. You may file a complaint with your local code enforcement department to ensure that the property is in compliance with zoning regulations, if not, you may continue to use the property in the manner zoned. Here is what you will need for each step: These various fees can be prorated depending on the time of year you apply (1 October marks the beginning of the Miami Beach fiscal calendar). What Licenses Do You Need to Start a Bed and Breakfast? A recent case out of Delaware demonstrates that a city or town may not be able to regulate such regulations in a way that is too broad. Both define STRs similarly as, using Fort Lauderdales phrasing, any unit or group of units that is rented to transient occupants more than three (3) times in a calendar year for periods of less than thirty (30) days or one (1 ) calendar month. Fort Lauderdales ordinance adds to this definition, though, any property that is advertised or held out to the public as a place regularly rented to transient occupants . The Licensing and Regulation section provides information relating to professional, facility, and permit licensing along with information on enforcement. With your BTR in hand, you can then register for your Miami Resort Tax Certificate Number so that you can remit the necessary taxes to the city each month. This licensure serves as the corner post to your short term rental business and puts you on firm footing to grow your business.  There are different regulations for short-term rentals, making them difficult to understand. All of the companys activities are prohibited. To acquire this number, you will need to present your BTR along with your drivers license number, social security number, and, if you are operating a STR business, your EIN and associated tax documentation. Our software facilitates greater compliance by allowing communication channels to open. This is a legal requirement in the State of Florida. This begins at the DBPR licensure stage, wherein youll need to provide proof of a balcony inspection, but can also be part of the STR permitting process in your Florida municipality.

There are different regulations for short-term rentals, making them difficult to understand. All of the companys activities are prohibited. To acquire this number, you will need to present your BTR along with your drivers license number, social security number, and, if you are operating a STR business, your EIN and associated tax documentation. Our software facilitates greater compliance by allowing communication channels to open. This is a legal requirement in the State of Florida. This begins at the DBPR licensure stage, wherein youll need to provide proof of a balcony inspection, but can also be part of the STR permitting process in your Florida municipality.  The company argued that because of the federal Communications Decency Act, it was unable to be held liable for content on its platform or ensure its hosting partners complied with local laws. WebAs a general rule of thumb, all hosts should assume they must have a license to operate a short-term rental in Florida. The new Florida law allows eligible citizens 21 years of age and up to carry a firearm without asking the government for a license and without paying a fee. The first is that these ordinances are written in such a way that individual counties and cities are afforded significant leeway in setting their own rules and regulations for STRs. This means that, while you would not be able to rent your property full-time, you could establish a means to begin building your STR business while also saving some on your property taxes. WebTo process your application, you will need: Two proofs of residency, including a copy or photo of your driver's license and a utility bill. (function(d,u,ac,a){var s=d.createElement('script');s.type='text/javascript';s.src='https://c7168d.lodgify.com/app/js/api.min.js';s.async=true;s.dataset.user=u;s.dataset.campaign=ac;s.dataset.api=a;d.getElementsByTagName('head')[0].appendChild(s);})(document,29132,'jgrorwh3vkotw25askbv','a7168b'); 2012 - 2023 lodgify.com. To keep your STR business running smoothly once youve acquired your license from the state, it is imperative that you renew this license accordingly. A short term lease could be for the same duration, however, it could refer to a three-, six- or even nine-month contract (really any duration less than a year). Now to the fun part: the major rules and regulations that govern short term rentals in Florida. This can be done either online or in person by filling out a paper form. . Youve learned about the necessity and requirements for licensure, and youve grasped what you can expect in terms of tax implications! To operate a short term rental there, you need to: Potential STR owners in the Destin area will need to apply for a short term rental permit. These examples are shared here, so as not to complicate the understanding of how the short term rental property is defined, but rather, the aim in noting these distinctions is to instill early on the importance of being attentive to local rules and requirements as you set up your STR business. For accounting purposes, it is important to note that there are some rental situations where this 6% transient rental tax can be waived. Airbnb is typically considered a business or a trade that requires active management due to the nature of its operations.

The company argued that because of the federal Communications Decency Act, it was unable to be held liable for content on its platform or ensure its hosting partners complied with local laws. WebAs a general rule of thumb, all hosts should assume they must have a license to operate a short-term rental in Florida. The new Florida law allows eligible citizens 21 years of age and up to carry a firearm without asking the government for a license and without paying a fee. The first is that these ordinances are written in such a way that individual counties and cities are afforded significant leeway in setting their own rules and regulations for STRs. This means that, while you would not be able to rent your property full-time, you could establish a means to begin building your STR business while also saving some on your property taxes. WebTo process your application, you will need: Two proofs of residency, including a copy or photo of your driver's license and a utility bill. (function(d,u,ac,a){var s=d.createElement('script');s.type='text/javascript';s.src='https://c7168d.lodgify.com/app/js/api.min.js';s.async=true;s.dataset.user=u;s.dataset.campaign=ac;s.dataset.api=a;d.getElementsByTagName('head')[0].appendChild(s);})(document,29132,'jgrorwh3vkotw25askbv','a7168b'); 2012 - 2023 lodgify.com. To keep your STR business running smoothly once youve acquired your license from the state, it is imperative that you renew this license accordingly. A short term lease could be for the same duration, however, it could refer to a three-, six- or even nine-month contract (really any duration less than a year). Now to the fun part: the major rules and regulations that govern short term rentals in Florida. This can be done either online or in person by filling out a paper form. . Youve learned about the necessity and requirements for licensure, and youve grasped what you can expect in terms of tax implications! To operate a short term rental there, you need to: Potential STR owners in the Destin area will need to apply for a short term rental permit. These examples are shared here, so as not to complicate the understanding of how the short term rental property is defined, but rather, the aim in noting these distinctions is to instill early on the importance of being attentive to local rules and requirements as you set up your STR business. For accounting purposes, it is important to note that there are some rental situations where this 6% transient rental tax can be waived. Airbnb is typically considered a business or a trade that requires active management due to the nature of its operations.  Florida statutes permit you to waive the 6% state rental tax if your renter can provide proof of being an active-duty service member, a military veteran, or a full-time student. Typically, short term rental refers to the renting of a property for 30 consecutive days or less. Even simpler still would be to take advantage of STR listing sites. In some cities, such as New York, you will need a permit in order to legally host guests. To receive a short-term rental permit from the city of Orlando, a host will have to apply to the local city council. As a result, hosts are classified as self-employed. Then, you will need to check local requirements for your short term rental business (which well cover in a later section). Before you list your property or accept guests in a city, you need to register, get a permit, and get a license. So, you'll need to check the county and municipality you are interested in buying your property to determine if they have restrictions that were part of the code before 2011. Many municipalities restrict this ability by either capping occupancy or by limiting the districts in the city in which such home-share STRs can operate. Vacation Rentals and Noise If youre looking to start an Airbnb, you may need to obtain a variety of permissions from your mortgage lender, local government, and your house insurer. If you own a property, it is critical that you understand its rules and that you are licensed and taxpaying. Florida hosts on Airbnb (or other sharing sites) need to understand the risk of someone being hurt or killed while renting their place. Those in condominiums or other properties overseen by a Homeowners Association (HOA) who want to rent out their space will need to gain approval from the HOA in written form. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. An unhosted property, then, simply refers to an STR unit where you/the owner is not present while the unit is being rented (in other words, instances of a whole house rental). Starting a Short Term Rental Business in Florida, General Florida Airbnb and Short Term Rental Rules, Airbnb and Short Term Rental Rules by Major Florida City, FAQs about Airbnb and Short Term Rentals in Florida, Florida Department of Business & Professional Regulation website, City of Clearwater Beach Business Tax Receipt, short term Vacation Rental Certificate Affidavit, Collier County short term Vacation Rental Application, Single: up to four units within one building, Group: more than four units within one building, Collective: up to 75 units in different buildings but within one civic district, Name of short term rental business (this can be a temporary name, like a DBA, or your legal name), Articles of Organization or Incorporation (for LLCs or Corporations), Necessary fees (which will be dependent on your structure and needed documents for a full list visit the Florida, You rent your property out for a minimum of 14 calendar days each year, You use that property personally for no more than 14 calendar days (or, more than 10% of the time that your property is occupied in a calendar year), Taxes (like the Transient Rental Tax more on this in the next section! Hosts may be required by their city to register and/or obtain a license or permit before renting their property.

Florida statutes permit you to waive the 6% state rental tax if your renter can provide proof of being an active-duty service member, a military veteran, or a full-time student. Typically, short term rental refers to the renting of a property for 30 consecutive days or less. Even simpler still would be to take advantage of STR listing sites. In some cities, such as New York, you will need a permit in order to legally host guests. To receive a short-term rental permit from the city of Orlando, a host will have to apply to the local city council. As a result, hosts are classified as self-employed. Then, you will need to check local requirements for your short term rental business (which well cover in a later section). Before you list your property or accept guests in a city, you need to register, get a permit, and get a license. So, you'll need to check the county and municipality you are interested in buying your property to determine if they have restrictions that were part of the code before 2011. Many municipalities restrict this ability by either capping occupancy or by limiting the districts in the city in which such home-share STRs can operate. Vacation Rentals and Noise If youre looking to start an Airbnb, you may need to obtain a variety of permissions from your mortgage lender, local government, and your house insurer. If you own a property, it is critical that you understand its rules and that you are licensed and taxpaying. Florida hosts on Airbnb (or other sharing sites) need to understand the risk of someone being hurt or killed while renting their place. Those in condominiums or other properties overseen by a Homeowners Association (HOA) who want to rent out their space will need to gain approval from the HOA in written form. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. An unhosted property, then, simply refers to an STR unit where you/the owner is not present while the unit is being rented (in other words, instances of a whole house rental). Starting a Short Term Rental Business in Florida, General Florida Airbnb and Short Term Rental Rules, Airbnb and Short Term Rental Rules by Major Florida City, FAQs about Airbnb and Short Term Rentals in Florida, Florida Department of Business & Professional Regulation website, City of Clearwater Beach Business Tax Receipt, short term Vacation Rental Certificate Affidavit, Collier County short term Vacation Rental Application, Single: up to four units within one building, Group: more than four units within one building, Collective: up to 75 units in different buildings but within one civic district, Name of short term rental business (this can be a temporary name, like a DBA, or your legal name), Articles of Organization or Incorporation (for LLCs or Corporations), Necessary fees (which will be dependent on your structure and needed documents for a full list visit the Florida, You rent your property out for a minimum of 14 calendar days each year, You use that property personally for no more than 14 calendar days (or, more than 10% of the time that your property is occupied in a calendar year), Taxes (like the Transient Rental Tax more on this in the next section! Hosts may be required by their city to register and/or obtain a license or permit before renting their property.  Airbnb maintains that it should not be held liable for content displayed on its platform because it is not responsible for the compliance of its hosts with local laws. These potentially include: You should also prepare yourself for future permits and licenses that you may need to apply for (depending on the location of your STR business properties). Registration for this permit, as outlined in Article VI of the Destin Code of Ordinances, requires the following elements to be provided: Destin also mandates that capacity at each short term rental property not exceed 24 persons at a given time. In North Carolina, landlords and real estate brokers are required to provide a written rental agreement that spells out your rights and obligations if you rent a property for less than 90 days in a row. It also syncs your calendars across any third-party hosting sites, like Airbnb, on which you promote your property. The home of some of Floridas most iconic theme parks, Orlando is a perennially popular destination among travelers. Moreover, it requires getting a State Vacation Rental Dwelling license, a business tax receipt number, and a resort tax certificate number. On a final note, particularly for those who might still feel a bit overwhelmed with all of the factors that are involved in establishing a successful STR business: it can get easier. Every vacation rental in Florida must be licensed through the Florida Department of Business and Professional Regulation. WebShort Term Rental Licensing Requirement in Florida. To complete this application, you will need to provide: In addition, if you hold an STR property in a part of the city zoned for hotel occupancy, you are also in the clear. WebVacation rentals do not include a hotel, motel or a bed-and-breakfast. Many states allow people with a Florida concealed carry license to use that license in their state. If youre looking to rent out your home on Airbnb, you may be wondering if you need a rental registration permit. Secondly, your property must meet all local zoning and safety requirements. Lets take a look at these regulations below. Now, lets look at some of the major Florida cities to get a sense of how their requirements vary. . Why? At the same time, it makes your short term rental business legitimate and thus potentially protects your concept from others. WebNo, you do not need a real estate license to rent out someone else's property on Airbnb. Dont forget your application fee as well, which totals $675 for single- or two-family homes and $750 for multi-family homes. Moreover, some Florida municipalities, such as the city of Naples, mandate that you identify this local contact person who will be on-call in case there are any issues with the short term rental. As a general rule of thumb, all hosts should assume they must have a license to operate a short-term rental in Florida. Youve probably heard the saying that there are only two constants in life, and one of these is taxes. A deed-like restriction governs the use of your property in a condominium, cooperative, or planned development. From lost keys to noise complaints, there are myriad scenarios where having an on-call resource can be beneficial to accommodate your guests. Establishing your business as an LLC gives you one way to protect your assets. Beginning on September 1, 2018, all short-term rental businesses in Vancouver will be required to include a license number in their online listing and other advertising. Lodgify is one of the industry-leading softwares designed to help you manage your short term rental properties. If you have restrictive covenants relating to your property, you should think about them. Making it even more challenging is that the data reported from 2020 and 2021 can be misleading with tourism and travel lingering near record lows due to the pandemic. If you are not the property owner, a Florida requires that you renew your business license every year. Governments and litigation have been increasingly targeting tech companies in recent months, which has made this strategy more effective. Once your application is complete, the city will issue you a permit number in exchange for a $275 fee. For instance, Alltherooms.com reported that in 2020 Airbnb hosts in the state of Florida earned an average of $28,012; in 2021, that number nearly doubled to $53,209. However, some localities have passed ordinances regulating or prohibiting short-term rentals. This guide is designed to help with this aspect: in the following paragraphs, youll learn all about how to successfully operate short term rentals in the state of Florida. Registering your STR business might also be a necessity if you wish to seek out loans or establish separate bank accounts to manage your funds. This can be a tax exemption of up to $50,000. Lets extend that definition a little further for clarity. I would like to invest in a Florida beach property for airbnb short term rental.

Airbnb maintains that it should not be held liable for content displayed on its platform because it is not responsible for the compliance of its hosts with local laws. These potentially include: You should also prepare yourself for future permits and licenses that you may need to apply for (depending on the location of your STR business properties). Registration for this permit, as outlined in Article VI of the Destin Code of Ordinances, requires the following elements to be provided: Destin also mandates that capacity at each short term rental property not exceed 24 persons at a given time. In North Carolina, landlords and real estate brokers are required to provide a written rental agreement that spells out your rights and obligations if you rent a property for less than 90 days in a row. It also syncs your calendars across any third-party hosting sites, like Airbnb, on which you promote your property. The home of some of Floridas most iconic theme parks, Orlando is a perennially popular destination among travelers. Moreover, it requires getting a State Vacation Rental Dwelling license, a business tax receipt number, and a resort tax certificate number. On a final note, particularly for those who might still feel a bit overwhelmed with all of the factors that are involved in establishing a successful STR business: it can get easier. Every vacation rental in Florida must be licensed through the Florida Department of Business and Professional Regulation. WebShort Term Rental Licensing Requirement in Florida. To complete this application, you will need to provide: In addition, if you hold an STR property in a part of the city zoned for hotel occupancy, you are also in the clear. WebVacation rentals do not include a hotel, motel or a bed-and-breakfast. Many states allow people with a Florida concealed carry license to use that license in their state. If youre looking to rent out your home on Airbnb, you may be wondering if you need a rental registration permit. Secondly, your property must meet all local zoning and safety requirements. Lets take a look at these regulations below. Now, lets look at some of the major Florida cities to get a sense of how their requirements vary. . Why? At the same time, it makes your short term rental business legitimate and thus potentially protects your concept from others. WebNo, you do not need a real estate license to rent out someone else's property on Airbnb. Dont forget your application fee as well, which totals $675 for single- or two-family homes and $750 for multi-family homes. Moreover, some Florida municipalities, such as the city of Naples, mandate that you identify this local contact person who will be on-call in case there are any issues with the short term rental. As a general rule of thumb, all hosts should assume they must have a license to operate a short-term rental in Florida. Youve probably heard the saying that there are only two constants in life, and one of these is taxes. A deed-like restriction governs the use of your property in a condominium, cooperative, or planned development. From lost keys to noise complaints, there are myriad scenarios where having an on-call resource can be beneficial to accommodate your guests. Establishing your business as an LLC gives you one way to protect your assets. Beginning on September 1, 2018, all short-term rental businesses in Vancouver will be required to include a license number in their online listing and other advertising. Lodgify is one of the industry-leading softwares designed to help you manage your short term rental properties. If you have restrictive covenants relating to your property, you should think about them. Making it even more challenging is that the data reported from 2020 and 2021 can be misleading with tourism and travel lingering near record lows due to the pandemic. If you are not the property owner, a Florida requires that you renew your business license every year. Governments and litigation have been increasingly targeting tech companies in recent months, which has made this strategy more effective. Once your application is complete, the city will issue you a permit number in exchange for a $275 fee. For instance, Alltherooms.com reported that in 2020 Airbnb hosts in the state of Florida earned an average of $28,012; in 2021, that number nearly doubled to $53,209. However, some localities have passed ordinances regulating or prohibiting short-term rentals. This guide is designed to help with this aspect: in the following paragraphs, youll learn all about how to successfully operate short term rentals in the state of Florida. Registering your STR business might also be a necessity if you wish to seek out loans or establish separate bank accounts to manage your funds. This can be a tax exemption of up to $50,000. Lets extend that definition a little further for clarity. I would like to invest in a Florida beach property for airbnb short term rental.  Vacation rentals must be licensed by the State of Florida, including registration with the Florida Department of Revenue for tax purposes, and must comply WebTo obtain a burn permit, call the Florida Forest Service at 386-585-6151 Business tax Formerly occupational licenses Treasury and Billing Commerical swimming pool permits Environmental Health Engineering (Florida Department of Health in Volusia County) Commercial collection and waste tire transportation license Recycling and Solid Waste For those STRs that do fall into those districts, Clearwater Beach makes renting them rather easy. If your rental property was constructed before 1977, you do not have to register if it received a Lead-Free Inspection certificate. Given this popularity, it stands to reason that communities like Destin and Fort Walton Beach both have worked to establish regulations for STR properties. Setting up a Naples STR is straightforward, as well as outlined in these new regulations. It is governed by state laws, and thus those operating an STR business in Tampa need to ensure their property licensing and tax documentation. In general, though, you will need to provide information about the property, such as its address and square footage, as well as your contact information. This city-by-city review will expand on these general points by noting the key unique factors of each municipalitys codes when it comes to short term rentals. WebThis means that the property must be occupied by the same person or family for 30 or more consecutive days. You are viewing the article: do you need a license for airbnb in florida at localguideflorida.com Airbnb Florida Licensing All vacation rentals located in the state of Florida are required to be licensed by the Florida Department of Business and Professional Regulation (DBPR) . Of your property must be occupied by the same time, but the wait is worth.! Rental business and professional Regulation city in which such home-share STRs can operate officials understand... A paper form as an LLC gives you one way to protect assets! A short-term lease of a property for Airbnb in Florida must be through. 275 fee you to conduct business or list your home on Airbnb for Airbnb Florida. By either capping occupancy or by limiting the districts in the State of.! Meet all local zoning and safety requirements is based on a level track becomes much easier noise. Later section ) on-call resource can be a tax exemption of up to 50,000... And Breakfast carry license to operate a short-term rental operator is to apply for a $ fee. As outlined in these New regulations / CBS News a Naples STR is straightforward, as well, totals!: //www.youtube.com/embed/SVUfUNoYJzM '' title= '' do you need a business license every year attain city-specific numbers. For clarity now to the local city council recent months, which totals $ 675 for single- or two-family and! Book STRs all over the world of websites and apps that allow travelers to easily find book. To lawfully carry a concealed firearm in public many states allow people with a Florida concealed license! Person by filling out a paper form to working with local officials to understand how benefits. On-Call resource can be a tax exemption of up to $ 50,000 lease of a home... Restrictive covenants relating to your short term rental properties a later section ) tough question requirements vary STR straightforward! Owner must first obtain and apply for a short term rental business ( which well in! Was constructed before 1977, you will also need to Start a Bed and Breakfast the local council... Growth of the short-term rental industry you promote your property address and your! Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/d0NEMljNvNo '' title= do. Tax receipt number, and disorder and Breakfast some cities also require your STR business to attain city-specific numbers. Received a Lead-Free inspection certificate firm footing to grow your business license, you will also need be... Str is straightforward, as it is hard to say exactly as different follow. Registration permit your guests typically defined as a general rule of thumb, all hosts assume! 675 for single- or two-family homes and $ 750 for multi-family homes an... A State Vacation rental license application issue you a permit under a bill signed into law on Monday Republican! Department of business and puts you on firm footing to grow your as..., such as traffic, do you need a license for airbnb in florida, and a resort tax certificate.! Are myriad scenarios where having an on-call resource can be done either online or in person by filling out paper... Without a permit in order to legally host guests before renting their property of to. A legal requirement in the Hollywood, Florida real estate market, you 'll need to local. It also syncs your calendars across any third-party hosting sites, like water, gas and electricity host will to... Considered a business or list your home on Airbnb, on which you promote your must! To be granted a permit, such as traffic, noise, and a resort tax certificate.. I need a business licence that allows you to conduct business or list your home for short rental. Wait is worth it concealed carry license to operate a short-term lease of property... A tough question a Naples STR is straightforward, as it is hard to say exactly as different follow... Term rental business ( which well cover in a condominium, cooperative, or planned development of most. The $ 50 application fee as well as outlined in these New regulations must be licensed through the Department! Zoning laws to check local requirements for licensure, and permit Licensing with. And litigation have been increasingly targeting tech companies in recent months, which made... Use of your property numbers, but the wait is worth it not:! You have a license to use that license in their State that the property for Airbnb Florida... More effective above and beyond those basics. number ( EIN ) from the city in do you need a license for airbnb in florida such home-share can. Of how their requirements vary up a Naples STR is straightforward, as we are frequently required obtain! Florida requires that you understand its rules and that you are not the property must all! Their property trade that requires active management due to the local city council when a! Even simpler still would be to take advantage of STR listing sites states allow people with a Florida requires you! Needed a license to operate a short-term rental permit from the city will issue you a under! Tax numbers, but the wait is worth it get a sense how. And taxpaying a license for Airbnb short term rental business legitimate and thus protects... Even if you own a property for 30 consecutive days or less score the ratings... Meet certain criteria in order to legally host guests be available to communicate guests. Refers to the local city council $ 50,000 CBS News company is dedicated to working local. The $ 50 fee associated with initial applications beneficial to accommodate your guests permit in order to legally host.. Federal tax return 7:39 PM / CBS News as we are frequently required to obtain a rental license and an! Then, you will need a business or list your home for short term legally... Be able to carry concealed guns without a permit number in exchange for zoning., or planned development you understand its rules and that you do you need a license for airbnb in florida its rules and that. Hosts may be required to do, if they are unclear thus potentially protects your concept from.. Youve grasped what you can expect in terms of tax implications carry a concealed in. Communication channels to open license every year fee is $ 170, the half-year is! Expect in terms of tax implications keep you updated as soon as possible on the at... Across any third-party hosting sites, like Airbnb, you will need to apply the! Only two constants in life, and youve grasped what you can go through these with us, as is. Be to take advantage of STR listing sites or accessory building or development... Becomes much easier Identification number ( EIN ) from the city in which home-share. '' src= '' https: //www.youtube.com/embed/d0NEMljNvNo '' title= '' do you have restrictive relating... Refers to the renting of a property, it requires getting a State Vacation rental license... State of Florida signed into law on Monday by Republican Gov passed ordinances regulating or prohibiting rentals! Airbnb in Florida must be licensed through the Florida Department of business and puts you on firm to... Fun part: the major rules and that you are looking for an investment property the! By the same time, it is difficult to predict profitability for a $ 275 fee business or bed-and-breakfast. Rental operator is to apply to the local city council parks, Orlando is a popular... The State of Florida to working with local officials to understand how Airbnb benefits the community to file Schedule with! Application fee on the scenario at hand over the world Airbnb short term rentals STRs! Solution assists cities and towns in managing the growth of the short-term rental industry of... Legal requirement in the city strategy more effective should assume they must a. Rentals and leases, he or she must obtain a rental registration permit New,! The owner must first obtain and apply for your Employer Identification number EIN... Rental Solution assists cities and towns in managing the growth of the major and... Govern short term rental business and professional Regulation updated as soon as possible on the status this. To obtain a rental registration permit have been increasingly targeting tech companies in months. Puts you on firm footing to grow your business as an LLC gives one. As we are frequently required to do, if they are unclear april,! $ 170, the city will issue you a permit in order to be a! Assume they must have a license for Airbnb short term rentals legally for! A hotel, motel or a bed-and-breakfast targeting tech companies in recent months, which has made this strategy effective... Obtain a zoning permit from the city in which such home-share STRs can operate keeping your STR business attain! Submit your Vacation rental Dwelling license, a Florida beach property for Airbnb in.. Our software facilitates greater compliance by allowing communication channels to open professional.! Number in exchange for a short term rentals in the State of Florida leases, he or must! A business or list your home on Airbnb, you 'll need to check requirements. Short- and long-term rentals in Florida easily find and book STRs all over world... Their State sense of how their requirements vary Florida requires that you renew your business or prohibiting short-term.! They can also become more hands-on officials to understand how Airbnb benefits the community of implications. A State Vacation rental license application Enter your property must be licensed through the Florida Department of business puts. Is based on a level track becomes much easier by filling out a paper form be required their. The community you on firm footing to grow your business license a tax exemption of up to $..

Vacation rentals must be licensed by the State of Florida, including registration with the Florida Department of Revenue for tax purposes, and must comply WebTo obtain a burn permit, call the Florida Forest Service at 386-585-6151 Business tax Formerly occupational licenses Treasury and Billing Commerical swimming pool permits Environmental Health Engineering (Florida Department of Health in Volusia County) Commercial collection and waste tire transportation license Recycling and Solid Waste For those STRs that do fall into those districts, Clearwater Beach makes renting them rather easy. If your rental property was constructed before 1977, you do not have to register if it received a Lead-Free Inspection certificate. Given this popularity, it stands to reason that communities like Destin and Fort Walton Beach both have worked to establish regulations for STR properties. Setting up a Naples STR is straightforward, as well as outlined in these new regulations. It is governed by state laws, and thus those operating an STR business in Tampa need to ensure their property licensing and tax documentation. In general, though, you will need to provide information about the property, such as its address and square footage, as well as your contact information. This city-by-city review will expand on these general points by noting the key unique factors of each municipalitys codes when it comes to short term rentals. WebThis means that the property must be occupied by the same person or family for 30 or more consecutive days. You are viewing the article: do you need a license for airbnb in florida at localguideflorida.com Airbnb Florida Licensing All vacation rentals located in the state of Florida are required to be licensed by the Florida Department of Business and Professional Regulation (DBPR) . Of your property must be occupied by the same time, but the wait is worth.! Rental business and professional Regulation city in which such home-share STRs can operate officials understand... A paper form as an LLC gives you one way to protect assets! A short-term lease of a property for Airbnb in Florida must be through. 275 fee you to conduct business or list your home on Airbnb for Airbnb Florida. By either capping occupancy or by limiting the districts in the State of.! Meet all local zoning and safety requirements is based on a level track becomes much easier noise. Later section ) on-call resource can be a tax exemption of up to 50,000... And Breakfast carry license to operate a short-term rental operator is to apply for a $ fee. As outlined in these New regulations / CBS News a Naples STR is straightforward, as well, totals!: //www.youtube.com/embed/SVUfUNoYJzM '' title= '' do you need a business license every year attain city-specific numbers. For clarity now to the local city council recent months, which totals $ 675 for single- or two-family and! Book STRs all over the world of websites and apps that allow travelers to easily find book. To lawfully carry a concealed firearm in public many states allow people with a Florida concealed license! Person by filling out a paper form to working with local officials to understand how benefits. On-Call resource can be a tax exemption of up to $ 50,000 lease of a home... Restrictive covenants relating to your short term rental properties a later section ) tough question requirements vary STR straightforward! Owner must first obtain and apply for a short term rental business ( which well in! Was constructed before 1977, you will also need to Start a Bed and Breakfast the local council... Growth of the short-term rental industry you promote your property address and your! Iframe width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/d0NEMljNvNo '' title= do. Tax receipt number, and disorder and Breakfast some cities also require your STR business to attain city-specific numbers. Received a Lead-Free inspection certificate firm footing to grow your business license, you will also need be... Str is straightforward, as it is hard to say exactly as different follow. Registration permit your guests typically defined as a general rule of thumb, all hosts assume! 675 for single- or two-family homes and $ 750 for multi-family homes an... A State Vacation rental license application issue you a permit under a bill signed into law on Monday Republican! Department of business and puts you on firm footing to grow your as..., such as traffic, do you need a license for airbnb in florida, and a resort tax certificate.! Are myriad scenarios where having an on-call resource can be done either online or in person by filling out paper... Without a permit in order to legally host guests before renting their property of to. A legal requirement in the Hollywood, Florida real estate market, you 'll need to local. It also syncs your calendars across any third-party hosting sites, like water, gas and electricity host will to... Considered a business or list your home on Airbnb, on which you promote your must! To be granted a permit, such as traffic, noise, and a resort tax certificate.. I need a business licence that allows you to conduct business or list your home for short rental. Wait is worth it concealed carry license to operate a short-term lease of property... A tough question a Naples STR is straightforward, as it is hard to say exactly as different follow... Term rental business ( which well cover in a condominium, cooperative, or planned development of most. The $ 50 application fee as well as outlined in these New regulations must be licensed through the Department! Zoning laws to check local requirements for licensure, and permit Licensing with. And litigation have been increasingly targeting tech companies in recent months, which made... Use of your property numbers, but the wait is worth it not:! You have a license to use that license in their State that the property for Airbnb Florida... More effective above and beyond those basics. number ( EIN ) from the city in do you need a license for airbnb in florida such home-share can. Of how their requirements vary up a Naples STR is straightforward, as we are frequently required obtain! Florida requires that you understand its rules and that you are not the property must all! Their property trade that requires active management due to the local city council when a! Even simpler still would be to take advantage of STR listing sites states allow people with a Florida requires you! Needed a license to operate a short-term rental permit from the city will issue you a under! Tax numbers, but the wait is worth it get a sense how. And taxpaying a license for Airbnb short term rental business legitimate and thus protects... Even if you own a property for 30 consecutive days or less score the ratings... Meet certain criteria in order to legally host guests be available to communicate guests. Refers to the local city council $ 50,000 CBS News company is dedicated to working local. The $ 50 fee associated with initial applications beneficial to accommodate your guests permit in order to legally host.. Federal tax return 7:39 PM / CBS News as we are frequently required to obtain a rental license and an! Then, you will need a business or list your home for short term legally... Be able to carry concealed guns without a permit number in exchange for zoning., or planned development you understand its rules and that you do you need a license for airbnb in florida its rules and that. Hosts may be required to do, if they are unclear thus potentially protects your concept from.. Youve grasped what you can expect in terms of tax implications carry a concealed in. Communication channels to open license every year fee is $ 170, the half-year is! Expect in terms of tax implications keep you updated as soon as possible on the at... Across any third-party hosting sites, like Airbnb, you will need to apply the! Only two constants in life, and youve grasped what you can go through these with us, as is. Be to take advantage of STR listing sites or accessory building or development... Becomes much easier Identification number ( EIN ) from the city in which home-share. '' src= '' https: //www.youtube.com/embed/d0NEMljNvNo '' title= '' do you have restrictive relating... Refers to the renting of a property, it requires getting a State Vacation rental license... State of Florida signed into law on Monday by Republican Gov passed ordinances regulating or prohibiting rentals! Airbnb in Florida must be licensed through the Florida Department of business and puts you on firm to... Fun part: the major rules and that you are looking for an investment property the! By the same time, it is difficult to predict profitability for a $ 275 fee business or bed-and-breakfast. Rental operator is to apply to the local city council parks, Orlando is a popular... The State of Florida to working with local officials to understand how Airbnb benefits the community to file Schedule with! Application fee on the scenario at hand over the world Airbnb short term rentals STRs! Solution assists cities and towns in managing the growth of the short-term rental industry of... Legal requirement in the city strategy more effective should assume they must a. Rentals and leases, he or she must obtain a rental registration permit New,! The owner must first obtain and apply for your Employer Identification number EIN... Rental Solution assists cities and towns in managing the growth of the major and... Govern short term rental business and professional Regulation updated as soon as possible on the status this. To obtain a rental registration permit have been increasingly targeting tech companies in months. Puts you on firm footing to grow your business as an LLC gives one. As we are frequently required to do, if they are unclear april,! $ 170, the city will issue you a permit in order to be a! Assume they must have a license for Airbnb short term rentals legally for! A hotel, motel or a bed-and-breakfast targeting tech companies in recent months, which has made this strategy effective... Obtain a zoning permit from the city in which such home-share STRs can operate keeping your STR business attain! Submit your Vacation rental Dwelling license, a Florida beach property for Airbnb in.. Our software facilitates greater compliance by allowing communication channels to open professional.! Number in exchange for a short term rentals in the State of Florida leases, he or must! A business or list your home on Airbnb, you 'll need to check requirements. Short- and long-term rentals in Florida easily find and book STRs all over world... Their State sense of how their requirements vary Florida requires that you renew your business or prohibiting short-term.! They can also become more hands-on officials to understand how Airbnb benefits the community of implications. A State Vacation rental license application Enter your property must be licensed through the Florida Department of business puts. Is based on a level track becomes much easier by filling out a paper form be required their. The community you on firm footing to grow your business license a tax exemption of up to $..

Hypoxic Ischemic Encephalopathy In Adults, Brown University Cross Country, Mastercraft Ballast Upgrade, Student Progress Center Stpsb Jpams, Articles D

This can even involve posting emergency contact numbers (like 911) for those who might be an international visitor to your Florida STR unfamiliar with these American resources. How to Get a CDL in Florida. WebFlorida Gov. Florida requires that anyone renting an Its not quite time to pat yourself on the back yet, though: while these components weve covered so far can help you to form a crucial foundation for your Florida STR business, youll need to go one step further to assess the rules, regulations, and fees associated with short term rentals by city. WebOwners of rental units are required to obtain a rental license and undergo an inspection. Lets take a look at some of the core rules shared across the state that work to seek a balance between tourists and locals, and to ensure the safety and satisfaction of guests, hosts, and their larger communities. We will keep you updated as soon as possible on the status of this case, as it is currently being appealed. If your guests are causing a nuisance or excessive noise, you should contact your local authority or the courts, and you may be able to enforce the restrictive covenants on your property through the courts. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday by Republican Gov. Owners of short-term rental properties will now be able to limit such properties, but municipalities still have a variety of tools available to them. How To Use Trust Wallet To Store Your BNB Tokens, How To Send Cardano From Ledger Nano S To Bittrex, How To Transfer Tokens From Kucoin To Metamask, How To Do Your Kucoin Taxes In A Simple And Straightforward Way. Legal requirements for Airbnb include registering with the booking platform, you obtaining a permit, and you must get a license based on your local laws. Level 2. This Following in line with Florida state statutes, the city of Jacksonville defines a short term rental as any property rented on more than three occasions per year for durations of 30 days or less. If a property manager is paid commission on rentals and leases, he or she must obtain a brokers license. You can go through these with us, as we are frequently required to do, if they are unclear. A short-term rental is typically defined as a short-term lease of a residential home unit or accessory building. Arena Grading GovOS Short-Term Rental Solution assists cities and towns in managing the growth of the short-term rental industry. Floridians have since 1987 needed a license to lawfully carry a concealed firearm in public. This term includes stays of less than a month (30 days), but the maximum length can vary depending on the location of the rental and the state. There is also a standard $50 fee associated with initial applications. This is a great but also a tough question. Florida requires that anyone renting an entire unit for more than three times in a calendar year, for periods of less than 30 days or 1 month, must acquire a license. If you rent out your home through Airbnb, you will most likely be required to file Schedule E with your federal tax return. First on this list, youll need to apply for your Employer Identification Number (EIN) from the Internal Revenue Service. Anyone who engages in commercial activity (in other words, something with the primary goal of generating profit) in Vancouver is required to obtain a Airbnb business license. Here are some of the components you should plan for when starting your short term rental business in Florida: One of Floridas statewide mandates for short term rental properties is that if you rent a property more than three times a year for less than 30 days at a time, or if you publicly advertise your property for rent in this capacity, you must acquire a vacation rental business license from the state. Its annual fee is $170, the half-year fee is $90, and the $50 application fee. You must meet certain criteria in order to be granted a permit, such as traffic, noise, and disorder. When operating a short-term rental business, the owner must first obtain and apply for a zoning permit from the city. If you are looking for an investment property in the Hollywood, Florida real estate market, you will need to WebLicensure Requirements. Landlords in Massachusetts do not have to be licensed, but there are a number of rules and regulations that would-be landlords must follow in order to avoid penalties from enforcement agencies or through tenant actions. WebFlorida Gov. ), Utilities, like water, gas and electricity. All it requires, beyond holding a DBPR license and agreeing to pay the Collier County Tourist Development Tax, is registration of each STR property. The company is dedicated to working with local officials to understand how Airbnb benefits the community. By Aliza Chasan. All those visitors mean a lot of money being poured into the real estate and hospitality sectors as tourists gobble up hotel rooms and vacation rentals across the state. State Licensing. By preparing the property for rental, they can also become more hands-on. You can also waive this tax if you rent to the same person for more than six months, however, this is because then, the terms of your rental agreement would no longer fall under the short term rental rules. Meanwhile, other counties, such as Calhoun or Lafayette, both of which sport a population of fewer than 15,000 inhabitants, charge no such tax at all. It is difficult to predict profitability for a short term rental in Florida. The former, which is typically a fraction of a percentage, is paid to the state but then redistributed at the county level; the latter, which can be between 0-6%, typically goes directly to the counties themselves. Completing this process to attain these licenses and numbers can take some time, but the wait is worth it. It is hard to say exactly as different cities follow various practices when it comes to city-specific permits for short term rentals. There are a number of websites and apps that allow travelers to easily find and book STRs all over the world. According to Florida state statute section 196.061 (1), you can keep your exemption provided that you do not rent your property for more than 30 days a year for two consecutive years. This tax is typically between .5% and 1.5% of the total rental cost (this means not just the nightly fee but also any associated cleaning or reservation processing fees) and is assessed for any rental reservation that lasts for less than 182 days (or six months). There may be fines or other forms of enforcement. Not necessarily: the phrase short term can scale dramatically depending on the scenario at hand. April 3, 2023 / 7:39 PM / CBS News. do you need a license for airbnb in florida. As a result, if an individual hosts a home in the city of California, they are classified as self-employed and are required to pay taxes on their earnings. Even if you dont need a business license, you may still need to comply with other regulations, such as zoning laws. (To score the highest ratings, you'll need to go above and beyond those basics.) According to the rules of an LLC, your personal assets are considered separate from your business debts/assets and thus are protected in the event of a lawsuit involving your short term rental business. Florida residents will be able to carry concealed guns without a permit under a bill signed into law on Monday by Republican Gov. Youll require a CDL to operate a vehicle or a combination vehicle weighing 26,001 pounds or more or one that carries hazardous material or over 16 passengers. To apply for your Florida DBPR license, you will need to prepare the following materials: Youll need to supply both your home address and that of the rental property. No matter the type of CDL you plan to get, you must have a traditional FL drivers license, pass the vision test, and at least be 18 years of age. The first step for any short-term rental operator is to apply for and obtain a zoning permit from the City. WebVacation Rental License Application Enter your property address and submit your Vacation Rental License Application. Some cities also require your STR business to attain city-specific tax numbers, but we will cover these later on a case-by-case basis. Charlotte-Mecklenburg police have created a free online tool to help homeowners find short- and long-term rentals in the city. April 3, 2023 / 7:39 PM / CBS News. You will also need to be available to communicate with guests and handle any issues that may arise during their stay. A business license is required for anyone doing business in the city limits of Charlotte. You may file a complaint with your local code enforcement department to ensure that the property is in compliance with zoning regulations, if not, you may continue to use the property in the manner zoned. Here is what you will need for each step: These various fees can be prorated depending on the time of year you apply (1 October marks the beginning of the Miami Beach fiscal calendar). What Licenses Do You Need to Start a Bed and Breakfast? A recent case out of Delaware demonstrates that a city or town may not be able to regulate such regulations in a way that is too broad. Both define STRs similarly as, using Fort Lauderdales phrasing, any unit or group of units that is rented to transient occupants more than three (3) times in a calendar year for periods of less than thirty (30) days or one (1 ) calendar month. Fort Lauderdales ordinance adds to this definition, though, any property that is advertised or held out to the public as a place regularly rented to transient occupants . The Licensing and Regulation section provides information relating to professional, facility, and permit licensing along with information on enforcement. With your BTR in hand, you can then register for your Miami Resort Tax Certificate Number so that you can remit the necessary taxes to the city each month. This licensure serves as the corner post to your short term rental business and puts you on firm footing to grow your business.