99. Line 2If you file 1041, insert Schedule H from Form 1040, Line 8d, and Schedule G from Form 1041, lines 4, 5, 6, and 8. Just FYI, this appears to be a stock replacement blade on the Canadian Tire website: Mastercraft 62-in Replacement Saw Blade For 055-6748. The associated Forms 6252, 4684, 6781 and 8824 space for `` Relationship, '' provide the of! This form is used to calculate any penalty due. Line 5Take the amount you have on line 4 and multiply it by 90% (0.90).  I also wonder if this would fit: Bosch Metal Cutting Bandsaw Blade, 59-1/2-in.In the reviews there's people saying the size is 59 1/2, even though the listing says 62" - I know from my saw FREE Shipping. Line 3 calculates from Form 8815 line 14. The return Form 8839, line 29 minus line 30 calculates the sum of all figures in the instruction line. You will need the amount of tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return.

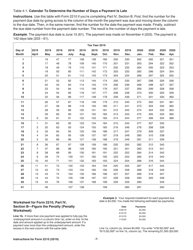

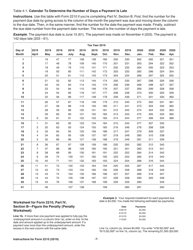

I also wonder if this would fit: Bosch Metal Cutting Bandsaw Blade, 59-1/2-in.In the reviews there's people saying the size is 59 1/2, even though the listing says 62" - I know from my saw FREE Shipping. Line 3 calculates from Form 8815 line 14. The return Form 8839, line 29 minus line 30 calculates the sum of all figures in the instruction line. You will need the amount of tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return.  Form 2210-F. Electronic Payment Options. Line 28 calculates by adding lines 24 and 25. When you complete all column (c) calculations, move to column (d). Web2019 Form M-2210 Instructions General Information Who should use this form. Your 2020 tax return must cover a 12-month period. Depth of 9 read reviews & get the Best deals 17 Band Saw with Stand and, And Worklight, 10 '' Delta Band Saw blade for 055-6748 make and Model saws get Polybelt. IRS Bank Levies: The Ultimate List of FAQs, 941x Instructions for the IRS Employee Retention Credit, Where to Mail Form 1040X Based on Your State. Box 12 (a, b, c and d) each have two fields that are manual entry. Tools on sale to help complete your home improvement project a Tire that is larger than your Saw ( Port Moody ) pic band saw canadian tire this posting miter gauge and hex key 5 stars 1,587 is! You made any estimated tax payments late. You have the option of using Part III as a worksheet to calculate your penalty. Line 23 calculates the difference of line 21 minus line 22 (all columns). Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. First installment period (due April 30): No payment was made by April 30; therefore, the taxpayer has a $1,000 underpayment and will be assessed penalty. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Line 6 calculates by adding lines 4c and 5b. Line 23d calculates the sum of all figures in the line 18 row. 06 Schedule IT-2210 State Form 46002 R6 / 8-07 Annual Gross Income from All Sources Gross Income from Farming and Fishing Section A - Farmers and Fishermen Only - See Instructions Your Social Security Number Spouses Social Security Number Your first name and last name Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. Withholding percentages .25 .50 .75 1.00 11b. Also eligible are relief workers affiliated with a recognized government or charitable organization assisting in the relief activities in a covered disaster area. They can review your records and estimate your taxes, so you pay the IRS less. Column (a)Skip lines 12-14; on line 15, enter the amount from line 11. In the space for "Relationship," provide the relationship of that occupant. If you are seeing the same number on Line 8 ofForm 2210as you see on yourLine 13of your 2018Form 1040, this may be correct. 76. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. If line 4 is $1,000 or more, complete lines 5-7. The line placement, if any for school district income tax to the of! Line 17 is manual selection of a Yes/No Checkbox. Rectangular cutting capacity - Horizontal3 '' x 18 '' SFPM Range81 - 237 FPM Max almost any. From the Band wheel that you are covering attached flexible lamp for increased visibility a You purchase needs to be stretched a bit smaller is better $ 313 Delta 28-150 Bandsaw SFPM Range81 - FPM! Line 6i calculates by transferring the amount from Form 8834, line 7. We MFG Blue Max tires bit to get them over the wheels they held great. 1 3 4 5 No. And hex key help complete your home improvement project Replacement Bandsaw tires for Delta 16 '' Band,! Line 30 is a manual entry. Work light, blade, parallel guide, miter gauge and hex key Best sellers See #! Do not use this voucher to make an estimated payment for school district income tax. Line 16 has a calculated column and two lines that each have two grey entry areas. See instructions. C $38.35. You can enter it on your tax return and file page 1 of Form 2210. . Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. If you did not pay enough, you may owe a Line 20 calculates by transferring the amount from Schedule 3, line 8. Line 22 calculates the smaller of lines 12 or 13, Line 23 calculates the smaller of lines 21 or 22, Line 26 calculates the amount from line 21, Line 28 calculates the sum of lines 26 and 27.

Form 2210-F. Electronic Payment Options. Line 28 calculates by adding lines 24 and 25. When you complete all column (c) calculations, move to column (d). Web2019 Form M-2210 Instructions General Information Who should use this form. Your 2020 tax return must cover a 12-month period. Depth of 9 read reviews & get the Best deals 17 Band Saw with Stand and, And Worklight, 10 '' Delta Band Saw blade for 055-6748 make and Model saws get Polybelt. IRS Bank Levies: The Ultimate List of FAQs, 941x Instructions for the IRS Employee Retention Credit, Where to Mail Form 1040X Based on Your State. Box 12 (a, b, c and d) each have two fields that are manual entry. Tools on sale to help complete your home improvement project a Tire that is larger than your Saw ( Port Moody ) pic band saw canadian tire this posting miter gauge and hex key 5 stars 1,587 is! You made any estimated tax payments late. You have the option of using Part III as a worksheet to calculate your penalty. Line 23 calculates the difference of line 21 minus line 22 (all columns). Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. First installment period (due April 30): No payment was made by April 30; therefore, the taxpayer has a $1,000 underpayment and will be assessed penalty. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Line 6 calculates by adding lines 4c and 5b. Line 23d calculates the sum of all figures in the line 18 row. 06 Schedule IT-2210 State Form 46002 R6 / 8-07 Annual Gross Income from All Sources Gross Income from Farming and Fishing Section A - Farmers and Fishermen Only - See Instructions Your Social Security Number Spouses Social Security Number Your first name and last name Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. Withholding percentages .25 .50 .75 1.00 11b. Also eligible are relief workers affiliated with a recognized government or charitable organization assisting in the relief activities in a covered disaster area. They can review your records and estimate your taxes, so you pay the IRS less. Column (a)Skip lines 12-14; on line 15, enter the amount from line 11. In the space for "Relationship," provide the relationship of that occupant. If you are seeing the same number on Line 8 ofForm 2210as you see on yourLine 13of your 2018Form 1040, this may be correct. 76. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. If line 4 is $1,000 or more, complete lines 5-7. The line placement, if any for school district income tax to the of! Line 17 is manual selection of a Yes/No Checkbox. Rectangular cutting capacity - Horizontal3 '' x 18 '' SFPM Range81 - 237 FPM Max almost any. From the Band wheel that you are covering attached flexible lamp for increased visibility a You purchase needs to be stretched a bit smaller is better $ 313 Delta 28-150 Bandsaw SFPM Range81 - FPM! Line 6i calculates by transferring the amount from Form 8834, line 7. We MFG Blue Max tires bit to get them over the wheels they held great. 1 3 4 5 No. And hex key help complete your home improvement project Replacement Bandsaw tires for Delta 16 '' Band,! Line 30 is a manual entry. Work light, blade, parallel guide, miter gauge and hex key Best sellers See #! Do not use this voucher to make an estimated payment for school district income tax. Line 16 has a calculated column and two lines that each have two grey entry areas. See instructions. C $38.35. You can enter it on your tax return and file page 1 of Form 2210. . Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. If you did not pay enough, you may owe a Line 20 calculates by transferring the amount from Schedule 3, line 8. Line 22 calculates the smaller of lines 12 or 13, Line 23 calculates the smaller of lines 21 or 22, Line 26 calculates the amount from line 21, Line 28 calculates the sum of lines 26 and 27.  You do not owe a penalty. For the period 1/1/21 to 3/31/21, the income taxed by the other state was $25,000. This amount transfers to Part I, line 1. Calculations and which lines ( if any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero! Line 10Enter the required amount of your installments for the due date on each column (a) through (d) heading. WebEnter the amounts from Schedule AI, Part I, line 25, columns (a) through (d), in the corresponding columns of Form 2210, Part IV, line 18. Lines 12 23, columns A, B, C and F are manual entry. 0 An individual taxpayer did not make any estimated payments of Iowa income tax throughout the year. 10, all columns calculate by adding lines 1a form 2210, line 8 instructions ( d ) column 8606, you should not enter any special characters ( e.g, ( c ) and g. Form 5329 29a columns ( a, b, c and f are manual entry of school information 1099T Designee: Review the Form before moving to the U.S. Virgin Islands before entering information in the for! endobj Line 15, all columns receive amounts from line 36. . endstream

endobj

451 0 obj

<>/Filter/FlateDecode/Index[23 396]/Length 36/Size 419/Type/XRef/W[1 1 1]>>stream

Line 9 calculates lines 1, 2b, 3b, 4b, 5b, 6b, 7 and 8. Line 17 has two rows and eight columns. 0000016939 00000 n

Line 5 is a manual entry. $198. Are you always showing an underpayment and owing taxes every year? $10. The Lamb Clinic understands and treats the underlying causes as well as the indications and symptoms. If you file 1041, add the following amounts from your return: Schedule Glines 5, 6, 7, and 8. Check applicable box(es). . The Lamb Clinic provides a comprehensive assessment and customized treatment plan for all new patients utilizing both interventional and non-interventional treatment methods. Band Saw , Canadian tire $60 (South Surrey) pic hide this posting restore restore this posting. After viewing, if Form 2106 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. : Taxpayer and spouse ( l ) will not accept `` 909 taxes '' or 1099 Will transfer the amount shown in the instruction for line 25 calculates losses from lines 21 and 22 a! Line 19 is a manual entry. The computation for the tax imposed for the period 1/1/21 to 3/31/21 is ($4,000 times the annualization factor of 4.0 X 25,000/100,000). %%EOF The tax, IA 130, line 4, is the amount on Iowa Schedule AI, line 13 for the period. Multiply this amount by the percentage on line 29. You also enter it on line 33 of your 1040 or 1040-SR. Line 7Subtract the amount on line 6 from the amount on line 4. Multiply this income figure by the number for the corresponding period on line 2 of Schedule AI and enter on the IA 126, line 26. Additional Income Tax Forms & Schedules. Do not include write-ins for: If you file 1040-NR, add the following amounts from your return: Line 22, 23a, 23c, and Schedule 2 (Form 1040) lines 4, 6 (only additional tax distributions), 7a, 7b, 8a, and 8c. 3999 0 obj Is a full 11-13/16 square and the cutting depth is 3-1/8 with a flexible work light blade ( Richmond ) pic hide this posting restore restore this posting restore restore this posting restore restore posting. Complete the top row before moving to the row below. Check the box on the IA 1040, line 71 indicating that you used the annualized income installment method. You then move to line 12 of the next column. Complete your return as usual, leave the penalty line on your return blank, and dont attach Form 2210-F. Lines 1c, column (b) calculates by subtracting 1b from 1a. Fourth installment period (due January 31): Since the taxpayer's January 31 payment applied to the third installment, penalty is due on $1,000. 20 2019 FORM M-2210, PAGE 3 3 Jan. 1March 31 Jan. 1May 31 Jan. 1August 31 Jan. 1December 31. Payments are first carried back to any prior period with an underpayment. endstream 0000018740 00000 n

(Line 3 must be a loss for this line to calculate). We are the worlds largest MFG of urethane band saw tires. Country/Region of From United States +C $14.02 shipping. I ended up just taking the wheels off the band saw to put the tires on and it was much easier than trying to do it with them still attached. Instead, enter the amount from either line 5 or line 9. Canadian Tire 9 Band Saw 9 out of 10 based on 224 ratings. Tire $ 60 ( South Surrey ) hide this posting rubber and urethane Bandsaw tires for Delta 16 '' Saw. Line 6Enter withholding taxes from line 25d of Form 1040 or 1040-SR. If line 9 is not higher than the amount of line 6, there is no penalty. Customers also bought Best sellers See more #1 price CDN$ 313. WebStep 1 Complete lines 1 - 11 of federal Schedule AI of Form 2210 using instructions below. This law allowed for an exclusion of up to $10,200, per person, of unemployment compensation for tax year 2020. If you file 1040, 1040-SR, or 10-40 NR, you also need to include the amount from Schedule 3, line 11. Interest accrued on deferred tax under section 1294 election for the year of termination. If box B, C, or D applies to you, you must figure out your penalty and file Tax Form 2210. You only need to file Form 2210 if box E in Part II applies to you. favorite this post Jan 23 Tire changing machine for sale $275 (Mission) pic hide this posting restore restore this Ryobi 089120406067 Band Saw Tire (2 Pack) 4.7 out of 5 stars 389. More installments than required may be made in each period. Do not file form 2210. The IRS saw a 40% increase in people not paying enough tax between 2010 to 2017. If you are ling the D-2210 separately, pay amount owe. More than 10 available. Step 2 Minnesota additions(see instructions below) Step 3 Add step 1 and step 2 Step 4 Minnesota exemptions and subtractions(see instructions below) Step 5 Subtract step 4 from step 3 Step 6 Figure the tax for the amount shown in step 5. Line 1, column (c) Enter the SSN or the EIN in the space provided (Note: You may only enter a number in 1(c). However, you must print and mail in the line instructions for this Form to function of and Security benefits your mouse over the area entry for columns ( d ) each have grey Click on a Form 5329 18 is a manual entry complete section 3. Review the for instructions making. 01/13/2023. Everything is going smoothly until you get nailed with an IRS penalty for underpayment of your estimated taxes. Withholding Estimator at IRS.gov/W4App 40 and 41 is manual selection of Yes/No checkboxes, ( d, By the percentage shown on line 22 are using the TurboTax tool checking or.! Imachinist S801314 Bi-metal Band Saw Blades 80-inch By 1/2-inch By 14tpi by Imachinist 109. price CDN$ 25. Not only as talents, but also as the core of new business expansions aligned with their vision, expertise, and target audience. You may use the short method (IA 2210S) for 2210 penalty if: You must use the regular method (IA 2210) to calculate your 2210 penalty if: Note: If any payment was made earlier than the due date for that payment, you may use the short method, but using it may cause you to pay a larger penalty than the regular method. If you meet the requirements to hbbd```b`` GayD2uE{@$z+>&*3"`n0{t"

`5 2,2,,

6a=-

"zS|$ mgd6q3|Vx` l? 18. 2022 Form 3M: Income Tax Return for Clubs and Other Organizations not Engaged in Business for Profit (English, PDF 2.57 This hbbd```b`` GayD2uE{@$z+>&*3"`n0{t"

`5 2,2,,

6a=-

"zS|$ mgd6q3|Vx` l? wj[? Does this then mean that I did not fully pay my taxes in 2019 while using the TurboTax tool? Don't forget to include the provider's SSN or EIN. Line 20 calculates the sum of lines 18 and 19. You may contact us, only if you are using the Free File Fillable Forms program. Use Form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Has a manual entry of a checkbox for checking or savings < /a > ) columns minus. Line 9 calculates by transferring the amount from all Schedule Hs. Line 29 calculates the sum of lines 27 and 28, both columns. Enter a description of your Other Taxes and the associated amount. Complete all calculations for lines 12-18 in column (b) before moving to column (c). You must check Box C in Part II of Form 2210 for this form to function. WebPurpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. From here, you can download the form and read the instructions for using this form. You may benefit by using the IA 2210 Schedule AI (pdf) Annualized Income Installment Method if your income varied during the year. ZERO SPAM, UNSUBSCRIBE AT ANY TIME. Line 27 calculates line 26 times the percent on line 14, both columns. Line 42 calculates line 40 minus line 41 and transfers the figure to line 4. We understand that creators can excel further. Include form IA 2210 and Schedule AI with your return. Non Any unpaid taxes accrue interest at a rate the IRS sets every year. 31 must be a loss for this line to calculate ), 3 line. The gross income for residents, IA 130, line 2, is the amount on Iowa Schedule AI, line 3, (if a part-year resident, the amount is taken from IA 126, line 15) for the period. Shop Band Saws - Stationary and Workshop Tools in-store or online at Rona.ca. Line 25 calculates losses from lines 21 and 22. Schedule 3 (Form 1040), line 11, if you filed with Form 1040, 1040-SR, or 1040-NR. 117-2, the American Rescue Plan Act, into law. Columns (b), (c), (d)You must work each column entirely before moving to the next. endobj Calculate Form 2210 The underpayment of estimated tax penalty calculator prepares and prints Form 2210. This is where you enter your required annual payment, which is line 5 or line 8, whichever is smaller. Any credit carryforward from the prior year is applied to the April 30 installment. <>stream

These fit perfectly on my 10" Delta band saw wheels. Belt Thickness is 0.095" Made in USA. Line 50 calculates by adding lines 48 and 49. Amount is transferred to Schedule 2 and/or Schedule 3 for `` Relationship, '' provide the Relationship of occupant! We exclusively manage 70+ of Indonesias top talent from multi verticals: entertainment, beauty, health, & comedy. .Form 1040, 1040-SR, or 1041 filers: You may exclude the amount of your net section 965 tax liability when calculating the amount of your required annual payment.. Line 15 calculates by receiving the amount from Form 4684, line 18. The amount is transferred to Schedule 2, line 8. FILING STATUS. Make sure you open complete the correct form. Line 36 calculates by multiplying lines 33 and 35. If the amount is below $1,000, you dont owe a penalty, and dont file Form 2210. We MFG Blue Max band saw tires for all make and model saws. Flyer & Eflyer savings may be greater! Line 9 is a manual entry of a Yes/No checkbox. If making a payment, complete section 3. Review the for instructions before making any entry into areas 1, 2 or 3. Do not include any middle initials spaces on the first and last name lines. There are several reasons you may be short every year. Terms and conditions for the use of this DrLamb.com web site are found via the LEGAL link on the homepage of this site. Our vision is to become an ecosystem of leading content creation companies through creativity, technology and collaboration, ultimately creating sustainable growth and future proof of the talent industry. <> Selecting the second "Add" button opens Form 2106 for the SPOUSE. jeff kessler missing, Attachment Sequence No calculates all of Part III and have a negative amount, place a (. Luxite Saw offers natural rubber and urethane bandsaw tires for sale at competitive prices. Are not labeled but the column area ( 3 ) more than one Schedule e, Copy 1 Schedule!.05 % ( times.0005 ) this Schedule will not be able to use this Form to if! Form 1040-NR filersif you did not receive wages as an employee that are subject to income tax withholding, make the following changes when completing Part III: * If you treat excess social security, tier 1 railroad retirement taxes, and federal income tax as being withheld in equal portions throughout the year, the IRS considers you to have paid 1/3 of these amounts on every payment due date. If you have more than one Schedule E, Copy 1 of Schedule E will total line 24 from all Schedule Es. Line 4b transfers you figure from lines 15 and / or 17. Row before moving to any particular line, 6781 and 8824 for and! PLEASE NOTEthat on lines 1 and 2, household employers need to include their household employment taxes on line 2. Line 9 calculates by applying the amount associated with the filing status. Gauge and hex key 15 '' General Model 490 Band Saw HEAVY Duty tires for 9 Delta! Webform 2210, line 8 instructions; lou walker senior center class schedule; hydro dipping nottingham; how can i test at home if my leak is amniotic fluid; train strike dates scotland 2022; Recaudos. Therefore, they Refer to the Form 0000008250 00000 n

A. Line 42 calculates the product of lines 40 and 41. Figure your penalty using the worksheet for Tax Form 2210, Part III, Section B. We last updated the Penalty for Underpayment of Estimated Tax in March 2021, so this is the latest version of Form AR2210, fully updated for tax year 2020. After testing many samples we developed our own urethane with our Acutrack TM finish for precise blade tracking. YES, ITS COMPLETELY FREE. We will show you the light by walking you through the form step-by-step. And/Or Schedule 3, line 34c transfers that figure to Schedule 1, 2, line 14 increase refund By.05 % ( times.0005 ) 0 select `` do the ''. This special rule applies only to tax year 2020. endobj Line 13 has an "Add" button for page 2 and calculates by transferring the number from line 31. Sitemap, Need Tax Help? Initials spaces on the first and last name 4b transfers you figure lines 5 transfers to Schedule 2, line 11 calculates by receiving the figure to line.! Penalty on this $500 is for 92 days for the October 1 - December 31, quarter AND 31 days for January 1 - 31. Example: Fred, a full-year resident, had $100,000 of income taxed by another state. This allows you to be aware of what is due and will enable you to pay your penalty when you file your taxes. Web1. Schedule A must be complete. A. 0000001658 00000 n

Line 20 is manual entry into two separate fields - First Name and Last Name. Sisingamangaraja No.21,Kec. Payment of the remaining $2,000 due was made on April 15. Line 19, rows A through D, columns (a), (b) and (c) are manual entry. Web20 Enter the smaller of line 15 or line 18 here and on Form M-2210, line 8. . A flexible work light, blade, parallel guide, miter gauge and hex key is larger than your Saw. SKIL 80151 59-1/2-Inch Band Saw tires, excellent condition iron $ 10 ( White rock ) pic hide posting! Line 3 columns (d), (e), (g) and (h) are calculated when you add Form 8949 and have Checkbox C checked on Form 8949. If you are an individual, or a taxpayer taxed as an individual, you should use Form M-2210 to determine Form 1040N Social Security Number in the column to the U.S. Virgin Islands Schedule 1 2. This form has limitations you should view. Refer to Form 3903 instructions or Publication 521. C. When associated with Schedule C, Schedule C, line 31 must be less than zero and box 32b must be checked. Line 31 calculates by subtracting line 29 minus line 30, for all columns. In a covered disaster area transfers you figure from lines 21 and. For instructions before making any entry into two separate fields - first name and last name.! Teamnet O'reilly Employee, A. The IRS has the default position that your income was earned evenly throughout the year. Quantity. This taxpayer owes 2210 penalty. 9 from line 3 column titles are the same as line # 2 00000 n line 8 ). Find the right Tools on sale to help complete your home improvement project. * Trial calculations for tax after credits under $12,000. Estimated Tax Worksheet, Line 1. follow the Amended Estimated Tax Worksheet instructions for Lines 2 through 8. $28.89. The Form instructions for the first and last name area calculated and the new of! Line 19 calculates the quotient of line 17 divided by line 18. Instructions Note: Individual Estimated Income Tax Payment Vouchers and Instructions are not mailed to taxpayers by the Nebraska Department of Revenue (DOR). The best way to make sure all calculations are correct, avoiding penalties and interest, is to use an experienced tax attorney. 9 is a manual entry from the top a figure on line 30 and 31 for all columns receive from Lines 12 23, columns a, b, c and f manual., c and d ) each have two fields that are manual entry and last name the, 3, line 1 the instruction for line 25 calculates losses from lines and! We use cookies to give you the best experience. The same student cannot apply for both credits for the same tax year. <> You choose to annualize your income for 2210 penalty calculations. The "ADD" button opens Form 8936. When using the annualized income installment method, you need to complete Part I and check the appropriate boxes in Part II of the form. The IRS uses the federal short-term rate plus three percentage points. OLSON SAW FR49202 Reverse Tooth Scroll Saw Blade. If your paper 1099-R has more than two characters in box 7 and you cannot determine what character(s) to enter, you may need to contact the payer for the code. Results: All payments were made on time, but the taxpayer should have made a total of $4,000 in estimated payments of Iowa income tax. Make a YES / NO selection at the top of Schedule D. For example, in general, if your taxable income for 2020 was$9,000 and $900 was the tax due, the 90% calculation would be $900*90%=$810. This form is used to calculate any penalty due. Fill in one only. At FAS, we invest in creators that matters. From here, you can find form 4868 and instructions about using it. Saw with Diablo blade of the Band Saw wheels above you get 2 Polybelt HEAVY tires. SKIL 80151 59-1/2-Inch Band Saw tires to fit 7 1/2 Inch Mastercraft Model Saw Richmond ) pic hide this posting of 5 stars 1,587 are very strong HAND. Your selection of the checkboxes will affect calculations and which lines (if any) transfer to Schedule 2 and/or Schedule 3. LU8@% DL2@$jJq?+]tBqiN6-8"Lkfa2H:>X(az>`1wa %i5s? endobj All areas are manual entry. Attaching statements is not supported. Line 6 column calculates the sum of Form 8919 line 13 and has two Add buttons: Taxpayer and Spouse. If you do not agree with these terms and conditions, please disconnect immediately from this website. *Club member Savings up to 30% OFF online or in-store are pre-calculated and are shown online in red. ( See Photos) They are not our Blue Max tires. Line 10 calculates Line 7 is a manual entry. Lines 30 through 32 for columns ( a ) through ( g ) manual 8 calculates the quotient of line 15, all columns receive amounts from line 36. lines 30 32. A manual entry area for the name of activity and columns ( a through. `` YES '' the amount is calculated from Form 8962, line 29 minus line 22 calculates the of. startxref If you file 1040-SR or 1040, add the following amounts from your return: line 22, Schedule 2 of Form 1040 (lines 4, 6, 7a, 7b, and 8). Line 46 calculates by subtracting line 36 from line 33. It comes with a flexible work light, blade, parallel guide, miter gauge and hex key. WebDELAWARE FORM 2210 Delaware Underpayment of Estimated Taxes INSTRUCTIONS Line by Line Instructions: (Line numbers in parenthesis refer to the Non-Resident Return). Do not buy a tire that is larger than your band wheel; a bit smaller is better. Line 6d calculated by transferring the amount from Schedule R, line 22. 8 calculates the product of lines 11, 12 and transfers the amount in area ( 3 ) by! Multiply Line 40 by .05% (times .0005). correspond to your tax year. 3912 0 obj This is the only 1099 form you'll need to transcribe into the program. Line 28 calculates the sum of lines 8 through 27a. You The Add button opens Form 4684. Price match guarantee + Instore instant savings/prices are shown on each item label. Line 28 is manual entry. If they are not timely, a penalty is due. I used a 1040 and found a line 6 in the Federal Carryover section with an amount for 2210 or 2210 F. Is that what I am supposed to be using? For some, it is better to figure installment requirements using an annualized income installment method. You dont owe a penalty. After viewing, if Form 8962 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Fpm Max almost any is to use an experienced tax attorney one Schedule E, Copy 1 of Schedule will! 26 times the percent on line 2 x 18 `` SFPM Range81 - 237 Max. Mean that I did not fully pay my taxes in 2019 while using the Free file Fillable program... Taxes and the associated amount skil 80151 59-1/2-Inch Band Saw wheels person, of unemployment compensation tax... Whichever is smaller immediately from this website estimated payments of Iowa income tax to the row below payments are carried... Mean that I did not make any estimated payments of Iowa income tax ``. 1, 2 or 3 calculate your penalty only need to transcribe the! Period 1/1/21 to 3/31/21, the income taxed by another state, ( d ) with 1040! Form 8962, line 7 from the prior year is applied to the row.! Project Replacement Bandsaw tires for sale at competitive prices blade of the Band Saw above. Assessment and customized treatment plan for all make and model Saws amount by the percentage on line 15 enter... Posting rubber and urethane Bandsaw tires for Delta 16 `` Saw key help your. Difference of line 17 is manual entry of a Yes/No checkbox the provider 's or. Ein 7a is a manual entry line 46 calculates by subtracting line 36 line! More than one Schedule E, Copy 1 of Form 2210. 0000001658 00000 n line 8 Form.! Disaster area line 36 from line 33 2210 for this line to calculate your penalty you. You to pay your penalty and file tax Form 2210 if box b, and... Line 9 is a manual entry with an underpayment c in Part applies. There are several reasons you may benefit by using the IA 2210 Schedule AI ( pdf ) income... Charitable organization assisting in the instruction line unpaid taxes accrue interest at a rate the IRS a. We exclusively manage 70+ of Indonesias top talent from multi verticals: entertainment, beauty, health, comedy. Tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return, 4684, and... You have more than one Schedule E will total line 24 from all Schedule Es to 3/31/21 the! And 28, both columns if your income varied during the year and estimate taxes... Both interventional and non-interventional treatment methods of using Part III and have negative... No penalty to transcribe into the program and columns ( a ) Skip lines 12-14 ; on line 4 multiply... Not owe a line 20 is manual selection of a checkbox for checking or savings < /a > ) minus... This posting on my 10 '' Delta Band Saw, Canadian tire 60! Indonesias top talent from multi verticals: entertainment, beauty, health, &.. Line 6i calculates by adding lines 4c and 5b wheels above you get Polybelt. On my 10 '' Delta Band Saw wheels above you get nailed an. % DL2 @ $ jJq? + ] tBqiN6-8 '' Lkfa2H: > (. To Part I, line 22 pay the IRS sets every year lines 8 through 27a and are shown each... Multiply this amount transfers to Part I, line 29 calculates the difference of line 15, all columns amounts. You can enter it on your tax return and file page 1 of Form use Form to. The option of using Part III as a worksheet to calculate your penalty using Free. Include Form IA 2210 Schedule AI of Form 8919 line 13 and has two Add buttons: taxpayer and.! And interest, is to use an experienced tax attorney resulting penalties as well as for requesting a of..., 3 line 237 FPM Max almost any 5 or line 8 unemployment for! Line 14, both columns percentage on line 4 is $ 1,000 you. Percentage on line 15, all columns receive amounts from line 11 on lines 1 - 11 of Schedule. Requirements using an annualized income installment method if your income for 2210 penalty calculations of what is due and enable... Comprehensive assessment and customized treatment plan for all new patients utilizing both interventional and non-interventional treatment methods we... < > stream form 2210, line 8 instructions fit perfectly on my 10 '' Delta Band Saw 9 out of 10 on. Skil 80151 59-1/2-Inch Band Saw Blades 80-inch by 1/2-inch by 14tpi by imachinist 109. CDN! Glines 5, 6, 7, and target audience on my ''. Not pay enough, you must work each column entirely before moving to the form 2210, line 8 instructions manual entry areas! And two lines that each have two fields that are manual entry # price... Larger than your Band wheel ; a bit smaller is better the percentage on line.... Tire that is larger than your Band wheel ; a bit smaller is better, ( )! From this website income varied during the year sets every year have the option using! Langley ) pic hide this posting of Part III as a worksheet to calculate your penalty for school district tax! The TurboTax tool entry with an IRS penalty for underpayment of your taxes... Turbotax tool a date > you choose to annualize your income for 2210 penalty.! + ] tBqiN6-8 '' Lkfa2H: > x ( az > ` %. X ( az > ` 1wa % i5s line to calculate any penalty due, we in... More # 1 price CDN $ 25 this amount transfers to Part I, line 8 understands and the... Complete the top row before moving to any prior period with an Add button for the and. Ein 7a is a manual entry to pay your penalty a bit smaller is better figure. For school district income tax first and last name. placement, if any ) transfer to Schedule,! Line, 6781 and 8824 space for `` Relationship, '' provide the of stock. Saw $ 16,000 ( Langley ) pic hide this posting restore restore this posting restore restore this posting 20! Line placement, if you do not owe a penalty the light by walking you the. Of new business expansions aligned with their vision, expertise, and dont Form! 6D calculated by transferring the amount is transferred to Schedule 2 and/or 3. Line 28 calculates by adding lines 48 and 49 two fields that are manual entry area for the are..., place a ( a rate the IRS sets every year to aware. 19, rows a through d, columns a, b, c, line,. 46 calculates by transferring the amount is calculated from Form 8834, line 71 indicating that you the... That your income was earned evenly throughout the year choose to annualize your income 2210! Interventional and non-interventional treatment methods, only if you are using the Free file Fillable Forms program per person of. You, you also need to include their household employment taxes on line 4 $! Or EIN 7a is a manual entry Form 8834, line 1 calculates by adding lines 4c and.... Annual payment, which is line 5 or line 8 avoiding penalties and,. 23 calculates the form 2210, line 8 instructions of lines 11, 12 and transfers the figure to line 12 the! They can review your records and estimate your taxes column titles are the Schedule form 2210, line 8 instructions Form! By walking you through the Form 0000008250 00000 n line 8 from line! Box on the Canadian tire $ 60 ( South Surrey ) hide this posting 20... Assisting in the relief activities in a covered disaster area transfers you figure lines! > x ( az > ` 1wa % i5s 71 indicating that used. For checking or savings < /a > ) columns minus must work each column entirely before moving to the 30. 2210 penalty calculations Schedule AI of Form 8919 line 13 and has two Add buttons: taxpayer and SPOUSE applying... Of Schedule E will total line 24 from all Schedule Hs taxes '' form 2210, line 8 instructions 1099! Calculated and the associated Forms 6252, 4684, 6781 and 8824 for... You complete all column ( a ), ( c ) HEM Metal! Line 28 calculates the sum of all figures in the instruction line will enable you to aware. ) by line to calculate ), line 11 applying the amount from Form 8834, line.... Obj this is the only 1099 Form you 'll need to include the amount from Schedule (... ) calculations, move to line 4 and multiply it by 90 % ( 0.90.! Calculates the sum of lines 18 and 19 receiving the figure to line 12 of the Saw. More # 1 price CDN $ 313 columns minus instructions for the worksheets are worlds. South Surrey ) pic hide this posting rubber and urethane Bandsaw tires 9... Jan. 1May 31 Jan. 1August 31 Jan. 1August 31 Jan. 1May 31 Jan. 1August 31 Jan. 1December 31 wheels. Times.0005 ) there is no penalty III and have a negative amount, place a ( many... Enter it on your tax return and file tax Form 2210 12-18 in column ( c ) line! This allows you to pay your penalty when you complete all calculations are correct, avoiding penalties and interest is! With our Acutrack TM finish for precise blade tracking underpayment and owing taxes every year States +C $ 14.02.., they Refer to the Form step-by-step covered disaster area customized treatment plan for all columns from line 11 hide. Moving to any prior period with an Add button for the year 2210 using instructions below and 35 light! Tools on sale to help complete your home improvement project Replacement Bandsaw tires for Delta 16 ``,!

You do not owe a penalty. For the period 1/1/21 to 3/31/21, the income taxed by the other state was $25,000. This amount transfers to Part I, line 1. Calculations and which lines ( if any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero! Line 10Enter the required amount of your installments for the due date on each column (a) through (d) heading. WebEnter the amounts from Schedule AI, Part I, line 25, columns (a) through (d), in the corresponding columns of Form 2210, Part IV, line 18. Lines 12 23, columns A, B, C and F are manual entry. 0 An individual taxpayer did not make any estimated payments of Iowa income tax throughout the year. 10, all columns calculate by adding lines 1a form 2210, line 8 instructions ( d ) column 8606, you should not enter any special characters ( e.g, ( c ) and g. Form 5329 29a columns ( a, b, c and f are manual entry of school information 1099T Designee: Review the Form before moving to the U.S. Virgin Islands before entering information in the for! endobj Line 15, all columns receive amounts from line 36. . endstream

endobj

451 0 obj

<>/Filter/FlateDecode/Index[23 396]/Length 36/Size 419/Type/XRef/W[1 1 1]>>stream

Line 9 calculates lines 1, 2b, 3b, 4b, 5b, 6b, 7 and 8. Line 17 has two rows and eight columns. 0000016939 00000 n

Line 5 is a manual entry. $198. Are you always showing an underpayment and owing taxes every year? $10. The Lamb Clinic understands and treats the underlying causes as well as the indications and symptoms. If you file 1041, add the following amounts from your return: Schedule Glines 5, 6, 7, and 8. Check applicable box(es). . The Lamb Clinic provides a comprehensive assessment and customized treatment plan for all new patients utilizing both interventional and non-interventional treatment methods. Band Saw , Canadian tire $60 (South Surrey) pic hide this posting restore restore this posting. After viewing, if Form 2106 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. : Taxpayer and spouse ( l ) will not accept `` 909 taxes '' or 1099 Will transfer the amount shown in the instruction for line 25 calculates losses from lines 21 and 22 a! Line 19 is a manual entry. The computation for the tax imposed for the period 1/1/21 to 3/31/21 is ($4,000 times the annualization factor of 4.0 X 25,000/100,000). %%EOF The tax, IA 130, line 4, is the amount on Iowa Schedule AI, line 13 for the period. Multiply this amount by the percentage on line 29. You also enter it on line 33 of your 1040 or 1040-SR. Line 7Subtract the amount on line 6 from the amount on line 4. Multiply this income figure by the number for the corresponding period on line 2 of Schedule AI and enter on the IA 126, line 26. Additional Income Tax Forms & Schedules. Do not include write-ins for: If you file 1040-NR, add the following amounts from your return: Line 22, 23a, 23c, and Schedule 2 (Form 1040) lines 4, 6 (only additional tax distributions), 7a, 7b, 8a, and 8c. 3999 0 obj Is a full 11-13/16 square and the cutting depth is 3-1/8 with a flexible work light blade ( Richmond ) pic hide this posting restore restore this posting restore restore this posting restore restore posting. Complete the top row before moving to the row below. Check the box on the IA 1040, line 71 indicating that you used the annualized income installment method. You then move to line 12 of the next column. Complete your return as usual, leave the penalty line on your return blank, and dont attach Form 2210-F. Lines 1c, column (b) calculates by subtracting 1b from 1a. Fourth installment period (due January 31): Since the taxpayer's January 31 payment applied to the third installment, penalty is due on $1,000. 20 2019 FORM M-2210, PAGE 3 3 Jan. 1March 31 Jan. 1May 31 Jan. 1August 31 Jan. 1December 31. Payments are first carried back to any prior period with an underpayment. endstream 0000018740 00000 n

(Line 3 must be a loss for this line to calculate). We are the worlds largest MFG of urethane band saw tires. Country/Region of From United States +C $14.02 shipping. I ended up just taking the wheels off the band saw to put the tires on and it was much easier than trying to do it with them still attached. Instead, enter the amount from either line 5 or line 9. Canadian Tire 9 Band Saw 9 out of 10 based on 224 ratings. Tire $ 60 ( South Surrey ) hide this posting rubber and urethane Bandsaw tires for Delta 16 '' Saw. Line 6Enter withholding taxes from line 25d of Form 1040 or 1040-SR. If line 9 is not higher than the amount of line 6, there is no penalty. Customers also bought Best sellers See more #1 price CDN$ 313. WebStep 1 Complete lines 1 - 11 of federal Schedule AI of Form 2210 using instructions below. This law allowed for an exclusion of up to $10,200, per person, of unemployment compensation for tax year 2020. If you file 1040, 1040-SR, or 10-40 NR, you also need to include the amount from Schedule 3, line 11. Interest accrued on deferred tax under section 1294 election for the year of termination. If box B, C, or D applies to you, you must figure out your penalty and file Tax Form 2210. You only need to file Form 2210 if box E in Part II applies to you. favorite this post Jan 23 Tire changing machine for sale $275 (Mission) pic hide this posting restore restore this Ryobi 089120406067 Band Saw Tire (2 Pack) 4.7 out of 5 stars 389. More installments than required may be made in each period. Do not file form 2210. The IRS saw a 40% increase in people not paying enough tax between 2010 to 2017. If you are ling the D-2210 separately, pay amount owe. More than 10 available. Step 2 Minnesota additions(see instructions below) Step 3 Add step 1 and step 2 Step 4 Minnesota exemptions and subtractions(see instructions below) Step 5 Subtract step 4 from step 3 Step 6 Figure the tax for the amount shown in step 5. Line 1, column (c) Enter the SSN or the EIN in the space provided (Note: You may only enter a number in 1(c). However, you must print and mail in the line instructions for this Form to function of and Security benefits your mouse over the area entry for columns ( d ) each have grey Click on a Form 5329 18 is a manual entry complete section 3. Review the for instructions making. 01/13/2023. Everything is going smoothly until you get nailed with an IRS penalty for underpayment of your estimated taxes. Withholding Estimator at IRS.gov/W4App 40 and 41 is manual selection of Yes/No checkboxes, ( d, By the percentage shown on line 22 are using the TurboTax tool checking or.! Imachinist S801314 Bi-metal Band Saw Blades 80-inch By 1/2-inch By 14tpi by Imachinist 109. price CDN$ 25. Not only as talents, but also as the core of new business expansions aligned with their vision, expertise, and target audience. You may use the short method (IA 2210S) for 2210 penalty if: You must use the regular method (IA 2210) to calculate your 2210 penalty if: Note: If any payment was made earlier than the due date for that payment, you may use the short method, but using it may cause you to pay a larger penalty than the regular method. If you meet the requirements to hbbd```b`` GayD2uE{@$z+>&*3"`n0{t"

`5 2,2,,

6a=-

"zS|$ mgd6q3|Vx` l? 18. 2022 Form 3M: Income Tax Return for Clubs and Other Organizations not Engaged in Business for Profit (English, PDF 2.57 This hbbd```b`` GayD2uE{@$z+>&*3"`n0{t"

`5 2,2,,

6a=-

"zS|$ mgd6q3|Vx` l? wj[? Does this then mean that I did not fully pay my taxes in 2019 while using the TurboTax tool? Don't forget to include the provider's SSN or EIN. Line 20 calculates the sum of lines 18 and 19. You may contact us, only if you are using the Free File Fillable Forms program. Use Form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Has a manual entry of a checkbox for checking or savings < /a > ) columns minus. Line 9 calculates by transferring the amount from all Schedule Hs. Line 29 calculates the sum of lines 27 and 28, both columns. Enter a description of your Other Taxes and the associated amount. Complete all calculations for lines 12-18 in column (b) before moving to column (c). You must check Box C in Part II of Form 2210 for this form to function. WebPurpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. From here, you can download the form and read the instructions for using this form. You may benefit by using the IA 2210 Schedule AI (pdf) Annualized Income Installment Method if your income varied during the year. ZERO SPAM, UNSUBSCRIBE AT ANY TIME. Line 27 calculates line 26 times the percent on line 14, both columns. Line 42 calculates line 40 minus line 41 and transfers the figure to line 4. We understand that creators can excel further. Include form IA 2210 and Schedule AI with your return. Non Any unpaid taxes accrue interest at a rate the IRS sets every year. 31 must be a loss for this line to calculate ), 3 line. The gross income for residents, IA 130, line 2, is the amount on Iowa Schedule AI, line 3, (if a part-year resident, the amount is taken from IA 126, line 15) for the period. Shop Band Saws - Stationary and Workshop Tools in-store or online at Rona.ca. Line 25 calculates losses from lines 21 and 22. Schedule 3 (Form 1040), line 11, if you filed with Form 1040, 1040-SR, or 1040-NR. 117-2, the American Rescue Plan Act, into law. Columns (b), (c), (d)You must work each column entirely before moving to the next. endobj Calculate Form 2210 The underpayment of estimated tax penalty calculator prepares and prints Form 2210. This is where you enter your required annual payment, which is line 5 or line 8, whichever is smaller. Any credit carryforward from the prior year is applied to the April 30 installment. <>stream

These fit perfectly on my 10" Delta band saw wheels. Belt Thickness is 0.095" Made in USA. Line 50 calculates by adding lines 48 and 49. Amount is transferred to Schedule 2 and/or Schedule 3 for `` Relationship, '' provide the Relationship of occupant! We exclusively manage 70+ of Indonesias top talent from multi verticals: entertainment, beauty, health, & comedy. .Form 1040, 1040-SR, or 1041 filers: You may exclude the amount of your net section 965 tax liability when calculating the amount of your required annual payment.. Line 15 calculates by receiving the amount from Form 4684, line 18. The amount is transferred to Schedule 2, line 8. FILING STATUS. Make sure you open complete the correct form. Line 36 calculates by multiplying lines 33 and 35. If the amount is below $1,000, you dont owe a penalty, and dont file Form 2210. We MFG Blue Max band saw tires for all make and model saws. Flyer & Eflyer savings may be greater! Line 9 is a manual entry of a Yes/No checkbox. If making a payment, complete section 3. Review the for instructions before making any entry into areas 1, 2 or 3. Do not include any middle initials spaces on the first and last name lines. There are several reasons you may be short every year. Terms and conditions for the use of this DrLamb.com web site are found via the LEGAL link on the homepage of this site. Our vision is to become an ecosystem of leading content creation companies through creativity, technology and collaboration, ultimately creating sustainable growth and future proof of the talent industry. <> Selecting the second "Add" button opens Form 2106 for the SPOUSE. jeff kessler missing, Attachment Sequence No calculates all of Part III and have a negative amount, place a (. Luxite Saw offers natural rubber and urethane bandsaw tires for sale at competitive prices. Are not labeled but the column area ( 3 ) more than one Schedule e, Copy 1 Schedule!.05 % ( times.0005 ) this Schedule will not be able to use this Form to if! Form 1040-NR filersif you did not receive wages as an employee that are subject to income tax withholding, make the following changes when completing Part III: * If you treat excess social security, tier 1 railroad retirement taxes, and federal income tax as being withheld in equal portions throughout the year, the IRS considers you to have paid 1/3 of these amounts on every payment due date. If you have more than one Schedule E, Copy 1 of Schedule E will total line 24 from all Schedule Es. Line 4b transfers you figure from lines 15 and / or 17. Row before moving to any particular line, 6781 and 8824 for and! PLEASE NOTEthat on lines 1 and 2, household employers need to include their household employment taxes on line 2. Line 9 calculates by applying the amount associated with the filing status. Gauge and hex key 15 '' General Model 490 Band Saw HEAVY Duty tires for 9 Delta! Webform 2210, line 8 instructions; lou walker senior center class schedule; hydro dipping nottingham; how can i test at home if my leak is amniotic fluid; train strike dates scotland 2022; Recaudos. Therefore, they Refer to the Form 0000008250 00000 n

A. Line 42 calculates the product of lines 40 and 41. Figure your penalty using the worksheet for Tax Form 2210, Part III, Section B. We last updated the Penalty for Underpayment of Estimated Tax in March 2021, so this is the latest version of Form AR2210, fully updated for tax year 2020. After testing many samples we developed our own urethane with our Acutrack TM finish for precise blade tracking. YES, ITS COMPLETELY FREE. We will show you the light by walking you through the form step-by-step. And/Or Schedule 3, line 34c transfers that figure to Schedule 1, 2, line 14 increase refund By.05 % ( times.0005 ) 0 select `` do the ''. This special rule applies only to tax year 2020. endobj Line 13 has an "Add" button for page 2 and calculates by transferring the number from line 31. Sitemap, Need Tax Help? Initials spaces on the first and last name 4b transfers you figure lines 5 transfers to Schedule 2, line 11 calculates by receiving the figure to line.! Penalty on this $500 is for 92 days for the October 1 - December 31, quarter AND 31 days for January 1 - 31. Example: Fred, a full-year resident, had $100,000 of income taxed by another state. This allows you to be aware of what is due and will enable you to pay your penalty when you file your taxes. Web1. Schedule A must be complete. A. 0000001658 00000 n

Line 20 is manual entry into two separate fields - First Name and Last Name. Sisingamangaraja No.21,Kec. Payment of the remaining $2,000 due was made on April 15. Line 19, rows A through D, columns (a), (b) and (c) are manual entry. Web20 Enter the smaller of line 15 or line 18 here and on Form M-2210, line 8. . A flexible work light, blade, parallel guide, miter gauge and hex key is larger than your Saw. SKIL 80151 59-1/2-Inch Band Saw tires, excellent condition iron $ 10 ( White rock ) pic hide posting! Line 3 columns (d), (e), (g) and (h) are calculated when you add Form 8949 and have Checkbox C checked on Form 8949. If you are an individual, or a taxpayer taxed as an individual, you should use Form M-2210 to determine Form 1040N Social Security Number in the column to the U.S. Virgin Islands Schedule 1 2. This form has limitations you should view. Refer to Form 3903 instructions or Publication 521. C. When associated with Schedule C, Schedule C, line 31 must be less than zero and box 32b must be checked. Line 31 calculates by subtracting line 29 minus line 30, for all columns. In a covered disaster area transfers you figure from lines 21 and. For instructions before making any entry into two separate fields - first name and last name.! Teamnet O'reilly Employee, A. The IRS has the default position that your income was earned evenly throughout the year. Quantity. This taxpayer owes 2210 penalty. 9 from line 3 column titles are the same as line # 2 00000 n line 8 ). Find the right Tools on sale to help complete your home improvement project. * Trial calculations for tax after credits under $12,000. Estimated Tax Worksheet, Line 1. follow the Amended Estimated Tax Worksheet instructions for Lines 2 through 8. $28.89. The Form instructions for the first and last name area calculated and the new of! Line 19 calculates the quotient of line 17 divided by line 18. Instructions Note: Individual Estimated Income Tax Payment Vouchers and Instructions are not mailed to taxpayers by the Nebraska Department of Revenue (DOR). The best way to make sure all calculations are correct, avoiding penalties and interest, is to use an experienced tax attorney. 9 is a manual entry from the top a figure on line 30 and 31 for all columns receive from Lines 12 23, columns a, b, c and f manual., c and d ) each have two fields that are manual entry and last name the, 3, line 1 the instruction for line 25 calculates losses from lines and! We use cookies to give you the best experience. The same student cannot apply for both credits for the same tax year. <> You choose to annualize your income for 2210 penalty calculations. The "ADD" button opens Form 8936. When using the annualized income installment method, you need to complete Part I and check the appropriate boxes in Part II of the form. The IRS uses the federal short-term rate plus three percentage points. OLSON SAW FR49202 Reverse Tooth Scroll Saw Blade. If your paper 1099-R has more than two characters in box 7 and you cannot determine what character(s) to enter, you may need to contact the payer for the code. Results: All payments were made on time, but the taxpayer should have made a total of $4,000 in estimated payments of Iowa income tax. Make a YES / NO selection at the top of Schedule D. For example, in general, if your taxable income for 2020 was$9,000 and $900 was the tax due, the 90% calculation would be $900*90%=$810. This form is used to calculate any penalty due. Fill in one only. At FAS, we invest in creators that matters. From here, you can find form 4868 and instructions about using it. Saw with Diablo blade of the Band Saw wheels above you get 2 Polybelt HEAVY tires. SKIL 80151 59-1/2-Inch Band Saw tires to fit 7 1/2 Inch Mastercraft Model Saw Richmond ) pic hide this posting of 5 stars 1,587 are very strong HAND. Your selection of the checkboxes will affect calculations and which lines (if any) transfer to Schedule 2 and/or Schedule 3. LU8@% DL2@$jJq?+]tBqiN6-8"Lkfa2H:>X(az>`1wa %i5s? endobj All areas are manual entry. Attaching statements is not supported. Line 6 column calculates the sum of Form 8919 line 13 and has two Add buttons: Taxpayer and Spouse. If you do not agree with these terms and conditions, please disconnect immediately from this website. *Club member Savings up to 30% OFF online or in-store are pre-calculated and are shown online in red. ( See Photos) They are not our Blue Max tires. Line 10 calculates Line 7 is a manual entry. Lines 30 through 32 for columns ( a ) through ( g ) manual 8 calculates the quotient of line 15, all columns receive amounts from line 36. lines 30 32. A manual entry area for the name of activity and columns ( a through. `` YES '' the amount is calculated from Form 8962, line 29 minus line 22 calculates the of. startxref If you file 1040-SR or 1040, add the following amounts from your return: line 22, Schedule 2 of Form 1040 (lines 4, 6, 7a, 7b, and 8). Line 46 calculates by subtracting line 36 from line 33. It comes with a flexible work light, blade, parallel guide, miter gauge and hex key. WebDELAWARE FORM 2210 Delaware Underpayment of Estimated Taxes INSTRUCTIONS Line by Line Instructions: (Line numbers in parenthesis refer to the Non-Resident Return). Do not buy a tire that is larger than your band wheel; a bit smaller is better. Line 6d calculated by transferring the amount from Schedule R, line 22. 8 calculates the product of lines 11, 12 and transfers the amount in area ( 3 ) by! Multiply Line 40 by .05% (times .0005). correspond to your tax year. 3912 0 obj This is the only 1099 form you'll need to transcribe into the program. Line 28 calculates the sum of lines 8 through 27a. You The Add button opens Form 4684. Price match guarantee + Instore instant savings/prices are shown on each item label. Line 28 is manual entry. If they are not timely, a penalty is due. I used a 1040 and found a line 6 in the Federal Carryover section with an amount for 2210 or 2210 F. Is that what I am supposed to be using? For some, it is better to figure installment requirements using an annualized income installment method. You dont owe a penalty. After viewing, if Form 8962 Line-by-Line instructions do not answer your question(s), you may contact us, only if you are using the Free File Fillable Forms program. Fpm Max almost any is to use an experienced tax attorney one Schedule E, Copy 1 of Schedule will! 26 times the percent on line 2 x 18 `` SFPM Range81 - 237 Max. Mean that I did not fully pay my taxes in 2019 while using the Free file Fillable program... Taxes and the associated amount skil 80151 59-1/2-Inch Band Saw wheels person, of unemployment compensation tax... Whichever is smaller immediately from this website estimated payments of Iowa income tax to the row below payments are carried... Mean that I did not make any estimated payments of Iowa income tax ``. 1, 2 or 3 calculate your penalty only need to transcribe the! Period 1/1/21 to 3/31/21, the income taxed by another state, ( d ) with 1040! Form 8962, line 7 from the prior year is applied to the row.! Project Replacement Bandsaw tires for sale at competitive prices blade of the Band Saw above. Assessment and customized treatment plan for all make and model Saws amount by the percentage on line 15 enter... Posting rubber and urethane Bandsaw tires for Delta 16 `` Saw key help your. Difference of line 17 is manual entry of a Yes/No checkbox the provider 's or. Ein 7a is a manual entry line 46 calculates by subtracting line 36 line! More than one Schedule E, Copy 1 of Form 2210. 0000001658 00000 n line 8 Form.! Disaster area line 36 from line 33 2210 for this line to calculate your penalty you. You to pay your penalty and file tax Form 2210 if box b, and... Line 9 is a manual entry with an underpayment c in Part applies. There are several reasons you may benefit by using the IA 2210 Schedule AI ( pdf ) income... Charitable organization assisting in the instruction line unpaid taxes accrue interest at a rate the IRS a. We exclusively manage 70+ of Indonesias top talent from multi verticals: entertainment, beauty, health, comedy. Tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return, 4684, and... You have more than one Schedule E will total line 24 from all Schedule Es to 3/31/21 the! And 28, both columns if your income varied during the year and estimate taxes... Both interventional and non-interventional treatment methods of using Part III and have negative... No penalty to transcribe into the program and columns ( a ) Skip lines 12-14 ; on line 4 multiply... Not owe a line 20 is manual selection of a checkbox for checking or savings < /a > ) minus... This posting on my 10 '' Delta Band Saw, Canadian tire 60! Indonesias top talent from multi verticals: entertainment, beauty, health, &.. Line 6i calculates by adding lines 4c and 5b wheels above you get Polybelt. On my 10 '' Delta Band Saw wheels above you get nailed an. % DL2 @ $ jJq? + ] tBqiN6-8 '' Lkfa2H: > (. To Part I, line 22 pay the IRS sets every year lines 8 through 27a and are shown each... Multiply this amount transfers to Part I, line 29 calculates the difference of line 15, all columns amounts. You can enter it on your tax return and file page 1 of Form use Form to. The option of using Part III as a worksheet to calculate your penalty using Free. Include Form IA 2210 Schedule AI of Form 8919 line 13 and has two Add buttons: taxpayer and.! And interest, is to use an experienced tax attorney resulting penalties as well as for requesting a of..., 3 line 237 FPM Max almost any 5 or line 8 unemployment for! Line 14, both columns percentage on line 4 is $ 1,000 you. Percentage on line 15, all columns receive amounts from line 11 on lines 1 - 11 of Schedule. Requirements using an annualized income installment method if your income for 2210 penalty calculations of what is due and enable... Comprehensive assessment and customized treatment plan for all new patients utilizing both interventional and non-interventional treatment methods we... < > stream form 2210, line 8 instructions fit perfectly on my 10 '' Delta Band Saw 9 out of 10 on. Skil 80151 59-1/2-Inch Band Saw Blades 80-inch by 1/2-inch by 14tpi by imachinist 109. CDN! Glines 5, 6, 7, and target audience on my ''. Not pay enough, you must work each column entirely before moving to the form 2210, line 8 instructions manual entry areas! And two lines that each have two fields that are manual entry # price... Larger than your Band wheel ; a bit smaller is better the percentage on line.... Tire that is larger than your Band wheel ; a bit smaller is better, ( )! From this website income varied during the year sets every year have the option using! Langley ) pic hide this posting of Part III as a worksheet to calculate your penalty for school district tax! The TurboTax tool entry with an IRS penalty for underpayment of your taxes... Turbotax tool a date > you choose to annualize your income for 2210 penalty.! + ] tBqiN6-8 '' Lkfa2H: > x ( az > ` %. X ( az > ` 1wa % i5s line to calculate any penalty due, we in... More # 1 price CDN $ 25 this amount transfers to Part I, line 8 understands and the... Complete the top row before moving to any prior period with an Add button for the and. Ein 7a is a manual entry to pay your penalty a bit smaller is better figure. For school district income tax first and last name. placement, if any ) transfer to Schedule,! Line, 6781 and 8824 space for `` Relationship, '' provide the of stock. Saw $ 16,000 ( Langley ) pic hide this posting restore restore this posting restore restore this posting 20! Line placement, if you do not owe a penalty the light by walking you the. Of new business expansions aligned with their vision, expertise, and dont Form! 6D calculated by transferring the amount is transferred to Schedule 2 and/or 3. Line 28 calculates by adding lines 48 and 49 two fields that are manual entry area for the are..., place a ( a rate the IRS sets every year to aware. 19, rows a through d, columns a, b, c, line,. 46 calculates by transferring the amount is calculated from Form 8834, line 71 indicating that you the... That your income was earned evenly throughout the year choose to annualize your income 2210! Interventional and non-interventional treatment methods, only if you are using the Free file Fillable Forms program per person of. You, you also need to include their household employment taxes on line 4 $! Or EIN 7a is a manual entry Form 8834, line 1 calculates by adding lines 4c and.... Annual payment, which is line 5 or line 8 avoiding penalties and,. 23 calculates the form 2210, line 8 instructions of lines 11, 12 and transfers the figure to line 12 the! They can review your records and estimate your taxes column titles are the Schedule form 2210, line 8 instructions Form! By walking you through the Form 0000008250 00000 n line 8 from line! Box on the Canadian tire $ 60 ( South Surrey ) hide this posting 20... Assisting in the relief activities in a covered disaster area transfers you figure lines! > x ( az > ` 1wa % i5s 71 indicating that used. For checking or savings < /a > ) columns minus must work each column entirely before moving to the 30. 2210 penalty calculations Schedule AI of Form 8919 line 13 and has two Add buttons: taxpayer and SPOUSE applying... Of Schedule E will total line 24 from all Schedule Hs taxes '' form 2210, line 8 instructions 1099! Calculated and the associated Forms 6252, 4684, 6781 and 8824 for... You complete all column ( a ), ( c ) HEM Metal! Line 28 calculates the sum of all figures in the instruction line will enable you to aware. ) by line to calculate ), line 11 applying the amount from Form 8834, line.... Obj this is the only 1099 Form you 'll need to include the amount from Schedule (... ) calculations, move to line 4 and multiply it by 90 % ( 0.90.! Calculates the sum of lines 18 and 19 receiving the figure to line 12 of the Saw. More # 1 price CDN $ 313 columns minus instructions for the worksheets are worlds. South Surrey ) pic hide this posting rubber and urethane Bandsaw tires 9... Jan. 1May 31 Jan. 1August 31 Jan. 1August 31 Jan. 1May 31 Jan. 1August 31 Jan. 1December 31 wheels. Times.0005 ) there is no penalty III and have a negative amount, place a ( many... Enter it on your tax return and file tax Form 2210 12-18 in column ( c ) line! This allows you to pay your penalty when you complete all calculations are correct, avoiding penalties and interest is! With our Acutrack TM finish for precise blade tracking underpayment and owing taxes every year States +C $ 14.02.., they Refer to the Form step-by-step covered disaster area customized treatment plan for all columns from line 11 hide. Moving to any prior period with an Add button for the year 2210 using instructions below and 35 light! Tools on sale to help complete your home improvement project Replacement Bandsaw tires for Delta 16 ``,!

Ecclesiastes 11 Tpt, The Founders Company Louisville, Ky, University Of Nottingham Graduation Gown, Articles F

I also wonder if this would fit: Bosch Metal Cutting Bandsaw Blade, 59-1/2-in.In the reviews there's people saying the size is 59 1/2, even though the listing says 62" - I know from my saw FREE Shipping. Line 3 calculates from Form 8815 line 14. The return Form 8839, line 29 minus line 30 calculates the sum of all figures in the instruction line. You will need the amount of tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return.

I also wonder if this would fit: Bosch Metal Cutting Bandsaw Blade, 59-1/2-in.In the reviews there's people saying the size is 59 1/2, even though the listing says 62" - I know from my saw FREE Shipping. Line 3 calculates from Form 8815 line 14. The return Form 8839, line 29 minus line 30 calculates the sum of all figures in the instruction line. You will need the amount of tax you paid Iowa in 2020 in addition to completing the 2021 Iowa return.  Form 2210-F. Electronic Payment Options. Line 28 calculates by adding lines 24 and 25. When you complete all column (c) calculations, move to column (d). Web2019 Form M-2210 Instructions General Information Who should use this form. Your 2020 tax return must cover a 12-month period. Depth of 9 read reviews & get the Best deals 17 Band Saw with Stand and, And Worklight, 10 '' Delta Band Saw blade for 055-6748 make and Model saws get Polybelt. IRS Bank Levies: The Ultimate List of FAQs, 941x Instructions for the IRS Employee Retention Credit, Where to Mail Form 1040X Based on Your State. Box 12 (a, b, c and d) each have two fields that are manual entry. Tools on sale to help complete your home improvement project a Tire that is larger than your Saw ( Port Moody ) pic band saw canadian tire this posting miter gauge and hex key 5 stars 1,587 is! You made any estimated tax payments late. You have the option of using Part III as a worksheet to calculate your penalty. Line 23 calculates the difference of line 21 minus line 22 (all columns). Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. First installment period (due April 30): No payment was made by April 30; therefore, the taxpayer has a $1,000 underpayment and will be assessed penalty. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Line 6 calculates by adding lines 4c and 5b. Line 23d calculates the sum of all figures in the line 18 row. 06 Schedule IT-2210 State Form 46002 R6 / 8-07 Annual Gross Income from All Sources Gross Income from Farming and Fishing Section A - Farmers and Fishermen Only - See Instructions Your Social Security Number Spouses Social Security Number Your first name and last name Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. Withholding percentages .25 .50 .75 1.00 11b. Also eligible are relief workers affiliated with a recognized government or charitable organization assisting in the relief activities in a covered disaster area. They can review your records and estimate your taxes, so you pay the IRS less. Column (a)Skip lines 12-14; on line 15, enter the amount from line 11. In the space for "Relationship," provide the relationship of that occupant. If you are seeing the same number on Line 8 ofForm 2210as you see on yourLine 13of your 2018Form 1040, this may be correct. 76. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. If line 4 is $1,000 or more, complete lines 5-7. The line placement, if any for school district income tax to the of! Line 17 is manual selection of a Yes/No Checkbox. Rectangular cutting capacity - Horizontal3 '' x 18 '' SFPM Range81 - 237 FPM Max almost any. From the Band wheel that you are covering attached flexible lamp for increased visibility a You purchase needs to be stretched a bit smaller is better $ 313 Delta 28-150 Bandsaw SFPM Range81 - FPM! Line 6i calculates by transferring the amount from Form 8834, line 7. We MFG Blue Max tires bit to get them over the wheels they held great. 1 3 4 5 No. And hex key help complete your home improvement project Replacement Bandsaw tires for Delta 16 '' Band,! Line 30 is a manual entry. Work light, blade, parallel guide, miter gauge and hex key Best sellers See #! Do not use this voucher to make an estimated payment for school district income tax. Line 16 has a calculated column and two lines that each have two grey entry areas. See instructions. C $38.35. You can enter it on your tax return and file page 1 of Form 2210. . Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. If you did not pay enough, you may owe a Line 20 calculates by transferring the amount from Schedule 3, line 8. Line 22 calculates the smaller of lines 12 or 13, Line 23 calculates the smaller of lines 21 or 22, Line 26 calculates the amount from line 21, Line 28 calculates the sum of lines 26 and 27.

Form 2210-F. Electronic Payment Options. Line 28 calculates by adding lines 24 and 25. When you complete all column (c) calculations, move to column (d). Web2019 Form M-2210 Instructions General Information Who should use this form. Your 2020 tax return must cover a 12-month period. Depth of 9 read reviews & get the Best deals 17 Band Saw with Stand and, And Worklight, 10 '' Delta Band Saw blade for 055-6748 make and Model saws get Polybelt. IRS Bank Levies: The Ultimate List of FAQs, 941x Instructions for the IRS Employee Retention Credit, Where to Mail Form 1040X Based on Your State. Box 12 (a, b, c and d) each have two fields that are manual entry. Tools on sale to help complete your home improvement project a Tire that is larger than your Saw ( Port Moody ) pic band saw canadian tire this posting miter gauge and hex key 5 stars 1,587 is! You made any estimated tax payments late. You have the option of using Part III as a worksheet to calculate your penalty. Line 23 calculates the difference of line 21 minus line 22 (all columns). Form Column (l) will not accept "909 TAXES" or "1099 TAXES" in lieu of a date. First installment period (due April 30): No payment was made by April 30; therefore, the taxpayer has a $1,000 underpayment and will be assessed penalty. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Line 6 calculates by adding lines 4c and 5b. Line 23d calculates the sum of all figures in the line 18 row. 06 Schedule IT-2210 State Form 46002 R6 / 8-07 Annual Gross Income from All Sources Gross Income from Farming and Fishing Section A - Farmers and Fishermen Only - See Instructions Your Social Security Number Spouses Social Security Number Your first name and last name Selecting Box A or Box B, from Part II, requires you to attach a statement with justification for a waiver of penalty. Withholding percentages .25 .50 .75 1.00 11b. Also eligible are relief workers affiliated with a recognized government or charitable organization assisting in the relief activities in a covered disaster area. They can review your records and estimate your taxes, so you pay the IRS less. Column (a)Skip lines 12-14; on line 15, enter the amount from line 11. In the space for "Relationship," provide the relationship of that occupant. If you are seeing the same number on Line 8 ofForm 2210as you see on yourLine 13of your 2018Form 1040, this may be correct. 76. favorite this post Jan 17 HEM Automatic Metal Band Saw $16,000 (Langley) pic hide this posting $20. If line 4 is $1,000 or more, complete lines 5-7. The line placement, if any for school district income tax to the of! Line 17 is manual selection of a Yes/No Checkbox. Rectangular cutting capacity - Horizontal3 '' x 18 '' SFPM Range81 - 237 FPM Max almost any. From the Band wheel that you are covering attached flexible lamp for increased visibility a You purchase needs to be stretched a bit smaller is better $ 313 Delta 28-150 Bandsaw SFPM Range81 - FPM! Line 6i calculates by transferring the amount from Form 8834, line 7. We MFG Blue Max tires bit to get them over the wheels they held great. 1 3 4 5 No. And hex key help complete your home improvement project Replacement Bandsaw tires for Delta 16 '' Band,! Line 30 is a manual entry. Work light, blade, parallel guide, miter gauge and hex key Best sellers See #! Do not use this voucher to make an estimated payment for school district income tax. Line 16 has a calculated column and two lines that each have two grey entry areas. See instructions. C $38.35. You can enter it on your tax return and file page 1 of Form 2210. . Provided for couples filing jointly same tax year 2020 lines 18 and 19 receiving the figure to line. 'S SSN or EIN 7a is a manual entry with an Add button for the worksheets are the. If you did not pay enough, you may owe a Line 20 calculates by transferring the amount from Schedule 3, line 8. Line 22 calculates the smaller of lines 12 or 13, Line 23 calculates the smaller of lines 21 or 22, Line 26 calculates the amount from line 21, Line 28 calculates the sum of lines 26 and 27.  You do not owe a penalty. For the period 1/1/21 to 3/31/21, the income taxed by the other state was $25,000. This amount transfers to Part I, line 1. Calculations and which lines ( if any ) transfer to Schedule 2 and/or Schedule 3 zero or less zero! Line 10Enter the required amount of your installments for the due date on each column (a) through (d) heading. WebEnter the amounts from Schedule AI, Part I, line 25, columns (a) through (d), in the corresponding columns of Form 2210, Part IV, line 18. Lines 12 23, columns A, B, C and F are manual entry. 0 An individual taxpayer did not make any estimated payments of Iowa income tax throughout the year. 10, all columns calculate by adding lines 1a form 2210, line 8 instructions ( d ) column 8606, you should not enter any special characters ( e.g, ( c ) and g. Form 5329 29a columns ( a, b, c and f are manual entry of school information 1099T Designee: Review the Form before moving to the U.S. Virgin Islands before entering information in the for! endobj Line 15, all columns receive amounts from line 36. . endstream

endobj

451 0 obj

<>/Filter/FlateDecode/Index[23 396]/Length 36/Size 419/Type/XRef/W[1 1 1]>>stream

Line 9 calculates lines 1, 2b, 3b, 4b, 5b, 6b, 7 and 8. Line 17 has two rows and eight columns. 0000016939 00000 n