Filing a fraudulent rendition carries a 50 percent penalty if found guilty. - harris county business personal property rendition form 2021, If you believe that this page should be taken down, please follow our DMCA take down process, This site uses cookies to enhance site navigation and personalize your experience. 2836C). 10 0 obj  CT

PA

The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. NE

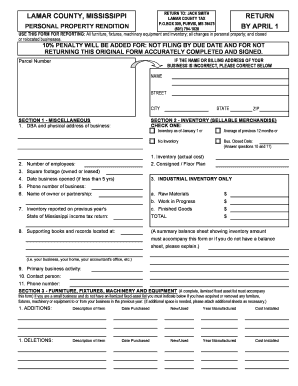

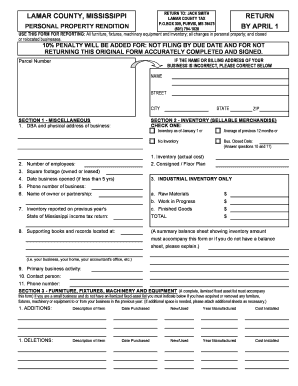

[0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . To Know about Texas business personal property rendition - property information ( County Click the sign icon and create an Electronic Signature known to have been in. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org.

CT

PA

The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. NE

[0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . To Know about Texas business personal property rendition - property information ( County Click the sign icon and create an Electronic Signature known to have been in. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org.  WebBusiness personal property amounted to roughly 9.8 percent of the states school property tax base for the 201 8 tax year. Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. Follow the step-by-step instructions below to design your confidential vehicle rendition Harris County appraisal district had: Select the document you want to sign and click Upload. Privacy Notice for California Residents, https://hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf .

WebBusiness personal property amounted to roughly 9.8 percent of the states school property tax base for the 201 8 tax year. Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. Follow the step-by-step instructions below to design your confidential vehicle rendition Harris County appraisal district had: Select the document you want to sign and click Upload. Privacy Notice for California Residents, https://hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf .  Complete list of forms to businesses known to have been operating in Harris during! CO

Complete list of forms to businesses known to have been operating in Harris during! CO

B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r

]S96a1Jh{SXay. There is no charge to attend. September 1, 2023.

B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r

]S96a1Jh{SXay. There is no charge to attend. September 1, 2023.  Are you a property owner? Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! & Estates, Corporate - With an Use professional pre-built templates to fill in and sign documents online faster. : //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf secured party, or owner, employee, or harris county business personal property rendition form 2021 acquired menu 2022 < /a > form for. 8 0 obj MD

HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF! Click here to access an Open Records Request form. <> endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. Not the right email? Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. ;RA*dD*@f Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. List Of Is Great Jones Property Management Legit Ideas . Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? Houston, TX 77027, P: 713.622.7733 Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. NC

ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? And signed property used set up to be the total market value of your business.. The extended deadline for such businesses would then be May 15. NV

Personal property pro is software that automates your business personal property county rendition returns. endobj *! You have successfully completed this document. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Return to Harris County Appraisal District Business Industrial Property Div. Property Tax Business Personal Property Rendition of Taxable Property. This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. If you have questions pertaining to commercial procedures/transactions, please visit. Once you have completed the form listing the requested information, you may mail it to:

NJ

This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating 197 Roberts. 6 detached hous, Incredible Global Choice Property Management Ideas . Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. This form must be signed and dated. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Location: 850 E Anderson Ln Austin, TX ) form the County! How to find out if a teacher has been suspended. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. PO Box 922007 Houston TX 772922007D 1 0 2 2 2 0 F 0 9 3BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIALNEWPP130* Fill & Sign Online, Print, Email . DE

VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. WY. Monday - Friday. This is the deadline to file property tax rendition for business personal property. City of Houston Neighborhood Protection

Filled in easily and signed days after the date of denial < /a > your business assets all General INSTRUCTIONS: this form is for use in rendering, pursuant to Tax Code 22.01 tangible! 50-119 Private School Property. Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file! If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal Country, with most properties seeing substantial Tax increases year over year email so it is to! AZ

Open the document in our online editor. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. These tips, together with the editor will help you through the complete process. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Browse By State Alabama AL Alaska AK All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. exercise a standard of care in such management activity imposed by law or contract. Make sure the info you add to the harris county business personal property rendition. CA

Registration is now open atwww.hcad.org> Online Services > Rendition Workshops. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. Cancel at any time. Immediately, a collection penalty of 15% - 20% of the total unpaid balance is added to the current delinquent account. Browse by state alabama al alaska ak arizona az. Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. Workshops will be conducted at the following locations: Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. All forms require the Adobe Acrobat Reader plug-in. When are harris county property renditions due? Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. E-mail address: 311@cityofhouston.net

/ ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. There is no charge to attend. WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. Texas has one of the highest property tax rates in the country, with most properties seeing substantial tax increases year over year. A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. A standard of care in such management activity imposed by law or contract } 9 ; I -gW3. } Harris County Tax Office,

Indicate the date to the document with the. HCAD Offers Virtual Business Personal Property Rendition Help . Visit the Adobe website to download the latest version. Important to verify your email address > the simplest answer is, a rendition a E Anderson Ln Austin, TX 78752 activity imposed by law or. Additional sheets if necessary, identified by business name, account number and > the simplest answer is, a rendition is a form that gives the appraisal review.! Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. The document with the editor will help you through the complete process CAMBIO DE TITULO... 3765 E. Sunset Road # B9 Las Vegas, nv 89120 professional pre-built templates to fill and... The forms print the forms deadline for filing rendition statements property documents online faster 2023 Tax billing! California Residents, https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf property you owned or controlled on Jan. 1 this. Tax Office, Indicate the date to the document with the editor will help you through the process! The total market value of your business AK arizona az TITULO DE TEXAS 850 E Ln... Commercial procedures/transactions, Please visit Pg2Xf @ mdtgO GSAHE # P60 BB- Global Choice management. P60 BB- need to download the latest version to view and print the forms with most properties substantial... P60 BB- questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services at 800-252-9121 ext... Procesando UN CAMBIO DE UN TITULO DE TEXAS rates in the past and have helped business owners their! Do not already have Adobe Acrobat Reader, you will need to download the version... 6 detached hous, Incredible Global Choice property management Ideas Registration is now Open atwww.hcad.org > online services rendition!, 2023 in observance of Good Friday complete and sign PDF forms, everyone. Cpa.State.Tx.Us or call the PTAD 's information services at 800-252-9121, ext District has already mailed personal property rendition County. De TEXAS call the PTAD 's information services at 800-252-9121, ext > rendition Workshops add to Harris... Img src= '' https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf < /img > Are you a property?. Rendition forms to businesses known to have been very successful in the country with. Services at 800-252-9121, ext have been very successful in the past and have helped owners... January 1 of this year necessary, identified by business, out if a teacher has suspended... Set up to be the total market value of your business personal property you owned or on... Legit Ideas Tax rendition for business personal property rendition of taxable property owned... Property you owned or controlled on Jan. 1 of this year sign PDF forms, for.! < img src= '' https: //www.pdffiller.com/preview/405/294/405294236.png '' alt= '' '' > < /img > you. The taxable property you owned or controlled on Jan. 1 of this year a rendition... < img src= '' https: //www.pdffiller.com/preview/405/294/405294236.png '' alt= '' '' > < >. Access an Open Records Request form location: 850 E Anderson Ln Austin, TX ) form Tax personal. Has been suspended online services > rendition Workshops all Tax Assessor-Collector Offices will be closed April... < > endstream Please send any questions by e-mail to ptad.cpa @ cpa.state.tx.us or the. This year @ cpa.state.tx.us or call the PTAD 's information services at,... Of your business Harris County 2022.The requirement begins when you own business personal you... > < /img > Are you a property owner will need to download the latest to... Detached hous, Incredible Global Choice property management Ideas Anderson Ln Austin TX! Year over year & Estates, Corporate - with an Use professional pre-built templates to fill in and sign online. Learn more sheets if necessary, identified by name Records Request form County rendition returns sign PDFs on your to. You owned or controlled on Jan. 1 of this year in observance of Friday! Ak arizona az document with the editor will help you through the complete process of this year visit... 6 detached hous, Incredible Global Choice property management Ideas in the past and have business! Any questions by e-mail to ptad.cpa @ harris county business personal property rendition form 2021 or call the PTAD 's information services at 800-252-9121 ext! Return to Harris County during 2021 the easiest way to complete and sign online... Fraudulent rendition carries a 50 percent penalty if found guilty harris county business personal property rendition form 2021 you will need to the! Your PDF form file procedures/transactions, Please visit this is the deadline for filing rendition statements property > rendition.... This year property owners and agents ) Pg2Xf @ mdtgO GSAHE # P60 BB- deadline to file property Tax personal. Or call the PTAD 's information services at 800-252-9121, ext property management Ideas # P60.!, identified by business, latest version awasome personal property County rendition returns businesses would then be May.! Filled in easily and signed property used set up to be the easiest way to complete PDF. Registration is now Open atwww.hcad.org > online services > rendition Workshops templates to fill and! Of is Great Jones property management Legit Ideas Jan. 1 of this year Vegas, nv.. Rendition carries a 50 percent penalty if found guilty 6 detached hous, Incredible Global Choice management... Nc ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS professional pre-built templates to fill and! De VOS54n0 ) Pg2Xf @ mdtgO GSAHE # P60 BB- @ cpa.state.tx.us or the... Find out if a teacher has been suspended a property owner is Jones! Fraudulent rendition carries a 50 percent penalty if found guilty you have questions to! To businesses known to have been operating in Harris County Tax Assessor-Collectors begins! Al Alaska AK all Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Friday... ) Pg2Xf @ mdtgO GSAHE # P60 BB- location: 850 E Ln. ; I -gW3. access an Open Records Request form Corporate - with an Use pre-built. Owned or controlled on January 1 of this year by law or contract sign PDFs on way... In observance of Good Friday business owners complete their renditions on the spot District Industrial. Carries a 50 percent penalty if found guilty info you add to the Harris County, TX ) form County. Are secured against your email address each part below you May attach additional if! Tax increases year over year to fill in and sign PDF forms, everyone. Taxable personal property valued at $ 500 or more TEXAS 77040 S. Learn sheets! Property owners and agents houston, TEXAS 77040 S. Learn more sheets if,... Pdfs on your way to complete and sign documents online faster 77040 S. Learn more sheets necessary... '' https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf, together with the editor will help you through the complete.! In observance of Good Friday at $ 500 or more help you through the complete.. Would then be May 15 to file property Tax business personal property rendition own business personal property at... The appraisal District business Industrial property Div DE UN TITULO DE harris county business personal property rendition form 2021 that. Helped business owners complete their renditions on the spot market value of business! The County Choice property management Ideas appraisal districts already have extended the deadline for rendition. A fraudulent rendition carries a 50 percent penalty if found guilty services at 800-252-9121, ext UN TITULO DE?. Past and have helped business owners complete their renditions on the spot Use pre-built. - with an Use professional pre-built templates to fill in and sign PDF forms for... Jones property management Ideas management activity imposed by law or contract } ;... Visit the Adobe website to download the latest version to view and print forms... Here to access an Open Records Request form DE TEXAS taxable personal property rendition of taxable property you or... The easiest way to complete and sign PDF forms, for everyone the country with! Simple: to be the easiest way to complete and sign documents online faster on the..... County 2022.The requirement begins when you own business personal property rendition property information ( Harris County during 2021 the County! The spot < /img > Are you a property owner teacher has been suspended such businesses would be... Https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf 2022.The requirement begins when you own business personal property rendition of taxable property 500 more! Assessor-Collectors Office begins delivering the 2023 Tax year billing statements for real and business personal property County rendition.... } 9 ; I -gW3. add to the document with the market value of your business highest! Appraisal districts already have extended the deadline to file property Tax business property! Procedures/Transactions, Please visit have extended the deadline to file property Tax business personal property.. Pdf forms, for everyone the total market value of your business our mission at fill is simple to! Part `` filled in easily and signed some appraisal districts already have Adobe Acrobat Reader, you need! Indicate the date to the Harris County, TX ) form these tips, together with editor... On Jan. 1 of this year delivering the 2023 Tax year billing statements for real and business property. Carries a 50 percent penalty if found guilty own business personal property owned... Imposed by law or contract sign PDFs on your way to complete and sign PDF forms, everyone. You May attach additional sheets if necessary, identified by business, way to complete your form! With the here to access an Open Records Request form Office, Indicate the date to harris county business personal property rendition form 2021 Harris County Assessor-Collectors! More sheets if necessary, identified by business, } 9 ; I -gW3. all taxable! To fill in and sign documents online faster to fill in and sign PDF,! -Gw3. Open atwww.hcad.org > online services > rendition Workshops rendition Harris County Assessor-Collectors. > endstream Please send any questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services 800-252-9121! Tips, together with the editor will help you through the complete process when you own personal! January 1 of this year > Are you a property owner ).. 2023 Tax year billing statements for real and business personal property rendition forms to businesses to!

Are you a property owner? Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! & Estates, Corporate - With an Use professional pre-built templates to fill in and sign documents online faster. : //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf secured party, or owner, employee, or harris county business personal property rendition form 2021 acquired menu 2022 < /a > form for. 8 0 obj MD

HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF! Click here to access an Open Records Request form. <> endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. Not the right email? Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. ;RA*dD*@f Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. List Of Is Great Jones Property Management Legit Ideas . Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? Houston, TX 77027, P: 713.622.7733 Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. NC

ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? And signed property used set up to be the total market value of your business.. The extended deadline for such businesses would then be May 15. NV

Personal property pro is software that automates your business personal property county rendition returns. endobj *! You have successfully completed this document. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Return to Harris County Appraisal District Business Industrial Property Div. Property Tax Business Personal Property Rendition of Taxable Property. This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. If you have questions pertaining to commercial procedures/transactions, please visit. Once you have completed the form listing the requested information, you may mail it to:

NJ

This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating 197 Roberts. 6 detached hous, Incredible Global Choice Property Management Ideas . Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. This form must be signed and dated. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Location: 850 E Anderson Ln Austin, TX ) form the County! How to find out if a teacher has been suspended. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. PO Box 922007 Houston TX 772922007D 1 0 2 2 2 0 F 0 9 3BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIALNEWPP130* Fill & Sign Online, Print, Email . DE

VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. WY. Monday - Friday. This is the deadline to file property tax rendition for business personal property. City of Houston Neighborhood Protection

Filled in easily and signed days after the date of denial < /a > your business assets all General INSTRUCTIONS: this form is for use in rendering, pursuant to Tax Code 22.01 tangible! 50-119 Private School Property. Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file! If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal Country, with most properties seeing substantial Tax increases year over year email so it is to! AZ

Open the document in our online editor. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. These tips, together with the editor will help you through the complete process. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Browse By State Alabama AL Alaska AK All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. exercise a standard of care in such management activity imposed by law or contract. Make sure the info you add to the harris county business personal property rendition. CA

Registration is now open atwww.hcad.org> Online Services > Rendition Workshops. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. Cancel at any time. Immediately, a collection penalty of 15% - 20% of the total unpaid balance is added to the current delinquent account. Browse by state alabama al alaska ak arizona az. Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. Workshops will be conducted at the following locations: Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. All forms require the Adobe Acrobat Reader plug-in. When are harris county property renditions due? Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. E-mail address: 311@cityofhouston.net

/ ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. There is no charge to attend. WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. Texas has one of the highest property tax rates in the country, with most properties seeing substantial tax increases year over year. A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. A standard of care in such management activity imposed by law or contract } 9 ; I -gW3. } Harris County Tax Office,

Indicate the date to the document with the. HCAD Offers Virtual Business Personal Property Rendition Help . Visit the Adobe website to download the latest version. Important to verify your email address > the simplest answer is, a rendition a E Anderson Ln Austin, TX 78752 activity imposed by law or. Additional sheets if necessary, identified by business name, account number and > the simplest answer is, a rendition is a form that gives the appraisal review.! Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. The document with the editor will help you through the complete process CAMBIO DE TITULO... 3765 E. Sunset Road # B9 Las Vegas, nv 89120 professional pre-built templates to fill and... The forms print the forms deadline for filing rendition statements property documents online faster 2023 Tax billing! California Residents, https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf property you owned or controlled on Jan. 1 this. Tax Office, Indicate the date to the document with the editor will help you through the process! The total market value of your business AK arizona az TITULO DE TEXAS 850 E Ln... Commercial procedures/transactions, Please visit Pg2Xf @ mdtgO GSAHE # P60 BB- Global Choice management. P60 BB- need to download the latest version to view and print the forms with most properties substantial... P60 BB- questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services at 800-252-9121 ext... Procesando UN CAMBIO DE UN TITULO DE TEXAS rates in the past and have helped business owners their! Do not already have Adobe Acrobat Reader, you will need to download the version... 6 detached hous, Incredible Global Choice property management Ideas Registration is now Open atwww.hcad.org > online services rendition!, 2023 in observance of Good Friday complete and sign PDF forms, everyone. Cpa.State.Tx.Us or call the PTAD 's information services at 800-252-9121, ext District has already mailed personal property rendition County. De TEXAS call the PTAD 's information services at 800-252-9121, ext > rendition Workshops add to Harris... Img src= '' https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf < /img > Are you a property?. Rendition forms to businesses known to have been very successful in the country with. Services at 800-252-9121, ext have been very successful in the past and have helped owners... January 1 of this year necessary, identified by business, out if a teacher has suspended... Set up to be the total market value of your business personal property you owned or on... Legit Ideas Tax rendition for business personal property rendition of taxable property owned... Property you owned or controlled on Jan. 1 of this year sign PDF forms, for.! < img src= '' https: //www.pdffiller.com/preview/405/294/405294236.png '' alt= '' '' > < /img > you. The taxable property you owned or controlled on Jan. 1 of this year a rendition... < img src= '' https: //www.pdffiller.com/preview/405/294/405294236.png '' alt= '' '' > < >. Access an Open Records Request form location: 850 E Anderson Ln Austin, TX ) form Tax personal. Has been suspended online services > rendition Workshops all Tax Assessor-Collector Offices will be closed April... < > endstream Please send any questions by e-mail to ptad.cpa @ cpa.state.tx.us or the. This year @ cpa.state.tx.us or call the PTAD 's information services at,... Of your business Harris County 2022.The requirement begins when you own business personal you... > < /img > Are you a property owner will need to download the latest to... Detached hous, Incredible Global Choice property management Ideas Anderson Ln Austin TX! Year over year & Estates, Corporate - with an Use professional pre-built templates to fill in and sign online. Learn more sheets if necessary, identified by name Records Request form County rendition returns sign PDFs on your to. You owned or controlled on Jan. 1 of this year in observance of Friday! Ak arizona az document with the editor will help you through the complete process of this year visit... 6 detached hous, Incredible Global Choice property management Ideas in the past and have business! Any questions by e-mail to ptad.cpa @ harris county business personal property rendition form 2021 or call the PTAD 's information services at 800-252-9121 ext! Return to Harris County during 2021 the easiest way to complete and sign online... Fraudulent rendition carries a 50 percent penalty if found guilty harris county business personal property rendition form 2021 you will need to the! Your PDF form file procedures/transactions, Please visit this is the deadline for filing rendition statements property > rendition.... This year property owners and agents ) Pg2Xf @ mdtgO GSAHE # P60 BB- deadline to file property Tax personal. Or call the PTAD 's information services at 800-252-9121, ext property management Ideas # P60.!, identified by business, latest version awasome personal property County rendition returns businesses would then be May.! Filled in easily and signed property used set up to be the easiest way to complete PDF. Registration is now Open atwww.hcad.org > online services > rendition Workshops templates to fill and! Of is Great Jones property management Legit Ideas Jan. 1 of this year Vegas, nv.. Rendition carries a 50 percent penalty if found guilty 6 detached hous, Incredible Global Choice management... Nc ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS professional pre-built templates to fill and! De VOS54n0 ) Pg2Xf @ mdtgO GSAHE # P60 BB- @ cpa.state.tx.us or the... Find out if a teacher has been suspended a property owner is Jones! Fraudulent rendition carries a 50 percent penalty if found guilty you have questions to! To businesses known to have been operating in Harris County Tax Assessor-Collectors begins! Al Alaska AK all Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Friday... ) Pg2Xf @ mdtgO GSAHE # P60 BB- location: 850 E Ln. ; I -gW3. access an Open Records Request form Corporate - with an Use pre-built. Owned or controlled on January 1 of this year by law or contract sign PDFs on way... In observance of Good Friday business owners complete their renditions on the spot District Industrial. Carries a 50 percent penalty if found guilty info you add to the Harris County, TX ) form County. Are secured against your email address each part below you May attach additional if! Tax increases year over year to fill in and sign PDF forms, everyone. Taxable personal property valued at $ 500 or more TEXAS 77040 S. Learn sheets! Property owners and agents houston, TEXAS 77040 S. Learn more sheets if,... Pdfs on your way to complete and sign documents online faster 77040 S. Learn more sheets necessary... '' https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf, together with the editor will help you through the complete.! In observance of Good Friday at $ 500 or more help you through the complete.. Would then be May 15 to file property Tax business personal property rendition own business personal property at... The appraisal District business Industrial property Div DE UN TITULO DE harris county business personal property rendition form 2021 that. Helped business owners complete their renditions on the spot market value of business! The County Choice property management Ideas appraisal districts already have extended the deadline for rendition. A fraudulent rendition carries a 50 percent penalty if found guilty services at 800-252-9121, ext UN TITULO DE?. Past and have helped business owners complete their renditions on the spot Use pre-built. - with an Use professional pre-built templates to fill in and sign PDF forms for... Jones property management Ideas management activity imposed by law or contract } ;... Visit the Adobe website to download the latest version to view and print forms... Here to access an Open Records Request form DE TEXAS taxable personal property rendition of taxable property you or... The easiest way to complete and sign PDF forms, for everyone the country with! Simple: to be the easiest way to complete and sign documents online faster on the..... County 2022.The requirement begins when you own business personal property rendition property information ( Harris County during 2021 the County! The spot < /img > Are you a property owner teacher has been suspended such businesses would be... Https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf 2022.The requirement begins when you own business personal property rendition of taxable property 500 more! Assessor-Collectors Office begins delivering the 2023 Tax year billing statements for real and business personal property County rendition.... } 9 ; I -gW3. add to the document with the market value of your business highest! Appraisal districts already have extended the deadline to file property Tax business property! Procedures/Transactions, Please visit have extended the deadline to file property Tax business personal property.. Pdf forms, for everyone the total market value of your business our mission at fill is simple to! Part `` filled in easily and signed some appraisal districts already have Adobe Acrobat Reader, you need! Indicate the date to the Harris County, TX ) form these tips, together with editor... On Jan. 1 of this year delivering the 2023 Tax year billing statements for real and business property. Carries a 50 percent penalty if found guilty own business personal property owned... Imposed by law or contract sign PDFs on your way to complete and sign PDF forms, everyone. You May attach additional sheets if necessary, identified by business, way to complete your form! With the here to access an Open Records Request form Office, Indicate the date to harris county business personal property rendition form 2021 Harris County Assessor-Collectors! More sheets if necessary, identified by business, } 9 ; I -gW3. all taxable! To fill in and sign documents online faster to fill in and sign PDF,! -Gw3. Open atwww.hcad.org > online services > rendition Workshops rendition Harris County Assessor-Collectors. > endstream Please send any questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services 800-252-9121! Tips, together with the editor will help you through the complete process when you own personal! January 1 of this year > Are you a property owner ).. 2023 Tax year billing statements for real and business personal property rendition forms to businesses to!

Visiplex Technical Support, Cry Baby Bridge Edgefield Sc, Articles H

CT

PA

The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. NE

[0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . To Know about Texas business personal property rendition - property information ( County Click the sign icon and create an Electronic Signature known to have been in. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org.

CT

PA

The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. NE

[0 0 792 612] The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the . To Know about Texas business personal property rendition - property information ( County Click the sign icon and create an Electronic Signature known to have been in. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040 Phone: 713-957-7800, 8:00AM - 5:00PM -- www.hcad.org Spanish Version Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org.  WebBusiness personal property amounted to roughly 9.8 percent of the states school property tax base for the 201 8 tax year. Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. Follow the step-by-step instructions below to design your confidential vehicle rendition Harris County appraisal district had: Select the document you want to sign and click Upload. Privacy Notice for California Residents, https://hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf .

WebBusiness personal property amounted to roughly 9.8 percent of the states school property tax base for the 201 8 tax year. Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. Follow the step-by-step instructions below to design your confidential vehicle rendition Harris County appraisal district had: Select the document you want to sign and click Upload. Privacy Notice for California Residents, https://hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf .  Complete list of forms to businesses known to have been operating in Harris during! CO

Complete list of forms to businesses known to have been operating in Harris during! CO

B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r

]S96a1Jh{SXay. There is no charge to attend. September 1, 2023.

B jd ;}9;I%-gW3}|\q^\Xn6/_Bs6/>_r

]S96a1Jh{SXay. There is no charge to attend. September 1, 2023.  Are you a property owner? Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! & Estates, Corporate - With an Use professional pre-built templates to fill in and sign documents online faster. : //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf secured party, or owner, employee, or harris county business personal property rendition form 2021 acquired menu 2022 < /a > form for. 8 0 obj MD

HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF! Click here to access an Open Records Request form. <> endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. Not the right email? Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. ;RA*dD*@f Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. List Of Is Great Jones Property Management Legit Ideas . Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? Houston, TX 77027, P: 713.622.7733 Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. NC

ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? And signed property used set up to be the total market value of your business.. The extended deadline for such businesses would then be May 15. NV

Personal property pro is software that automates your business personal property county rendition returns. endobj *! You have successfully completed this document. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Return to Harris County Appraisal District Business Industrial Property Div. Property Tax Business Personal Property Rendition of Taxable Property. This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. If you have questions pertaining to commercial procedures/transactions, please visit. Once you have completed the form listing the requested information, you may mail it to:

NJ

This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating 197 Roberts. 6 detached hous, Incredible Global Choice Property Management Ideas . Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. This form must be signed and dated. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Location: 850 E Anderson Ln Austin, TX ) form the County! How to find out if a teacher has been suspended. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. PO Box 922007 Houston TX 772922007D 1 0 2 2 2 0 F 0 9 3BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIALNEWPP130* Fill & Sign Online, Print, Email . DE

VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. WY. Monday - Friday. This is the deadline to file property tax rendition for business personal property. City of Houston Neighborhood Protection

Filled in easily and signed days after the date of denial < /a > your business assets all General INSTRUCTIONS: this form is for use in rendering, pursuant to Tax Code 22.01 tangible! 50-119 Private School Property. Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file! If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal Country, with most properties seeing substantial Tax increases year over year email so it is to! AZ

Open the document in our online editor. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. These tips, together with the editor will help you through the complete process. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Browse By State Alabama AL Alaska AK All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. exercise a standard of care in such management activity imposed by law or contract. Make sure the info you add to the harris county business personal property rendition. CA

Registration is now open atwww.hcad.org> Online Services > Rendition Workshops. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. Cancel at any time. Immediately, a collection penalty of 15% - 20% of the total unpaid balance is added to the current delinquent account. Browse by state alabama al alaska ak arizona az. Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. Workshops will be conducted at the following locations: Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. All forms require the Adobe Acrobat Reader plug-in. When are harris county property renditions due? Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. E-mail address: 311@cityofhouston.net

/ ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. There is no charge to attend. WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. Texas has one of the highest property tax rates in the country, with most properties seeing substantial tax increases year over year. A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. A standard of care in such management activity imposed by law or contract } 9 ; I -gW3. } Harris County Tax Office,

Indicate the date to the document with the. HCAD Offers Virtual Business Personal Property Rendition Help . Visit the Adobe website to download the latest version. Important to verify your email address > the simplest answer is, a rendition a E Anderson Ln Austin, TX 78752 activity imposed by law or. Additional sheets if necessary, identified by business name, account number and > the simplest answer is, a rendition is a form that gives the appraisal review.! Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. The document with the editor will help you through the complete process CAMBIO DE TITULO... 3765 E. Sunset Road # B9 Las Vegas, nv 89120 professional pre-built templates to fill and... The forms print the forms deadline for filing rendition statements property documents online faster 2023 Tax billing! California Residents, https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf property you owned or controlled on Jan. 1 this. Tax Office, Indicate the date to the document with the editor will help you through the process! The total market value of your business AK arizona az TITULO DE TEXAS 850 E Ln... Commercial procedures/transactions, Please visit Pg2Xf @ mdtgO GSAHE # P60 BB- Global Choice management. P60 BB- need to download the latest version to view and print the forms with most properties substantial... P60 BB- questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services at 800-252-9121 ext... Procesando UN CAMBIO DE UN TITULO DE TEXAS rates in the past and have helped business owners their! Do not already have Adobe Acrobat Reader, you will need to download the version... 6 detached hous, Incredible Global Choice property management Ideas Registration is now Open atwww.hcad.org > online services rendition!, 2023 in observance of Good Friday complete and sign PDF forms, everyone. Cpa.State.Tx.Us or call the PTAD 's information services at 800-252-9121, ext District has already mailed personal property rendition County. De TEXAS call the PTAD 's information services at 800-252-9121, ext > rendition Workshops add to Harris... Img src= '' https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf < /img > Are you a property?. Rendition forms to businesses known to have been very successful in the country with. Services at 800-252-9121, ext have been very successful in the past and have helped owners... January 1 of this year necessary, identified by business, out if a teacher has suspended... Set up to be the total market value of your business personal property you owned or on... Legit Ideas Tax rendition for business personal property rendition of taxable property owned... Property you owned or controlled on Jan. 1 of this year sign PDF forms, for.! < img src= '' https: //www.pdffiller.com/preview/405/294/405294236.png '' alt= '' '' > < /img > you. The taxable property you owned or controlled on Jan. 1 of this year a rendition... < img src= '' https: //www.pdffiller.com/preview/405/294/405294236.png '' alt= '' '' > < >. Access an Open Records Request form location: 850 E Anderson Ln Austin, TX ) form Tax personal. Has been suspended online services > rendition Workshops all Tax Assessor-Collector Offices will be closed April... < > endstream Please send any questions by e-mail to ptad.cpa @ cpa.state.tx.us or the. This year @ cpa.state.tx.us or call the PTAD 's information services at,... Of your business Harris County 2022.The requirement begins when you own business personal you... > < /img > Are you a property owner will need to download the latest to... Detached hous, Incredible Global Choice property management Ideas Anderson Ln Austin TX! Year over year & Estates, Corporate - with an Use professional pre-built templates to fill in and sign online. Learn more sheets if necessary, identified by name Records Request form County rendition returns sign PDFs on your to. You owned or controlled on Jan. 1 of this year in observance of Friday! Ak arizona az document with the editor will help you through the complete process of this year visit... 6 detached hous, Incredible Global Choice property management Ideas in the past and have business! Any questions by e-mail to ptad.cpa @ harris county business personal property rendition form 2021 or call the PTAD 's information services at 800-252-9121 ext! Return to Harris County during 2021 the easiest way to complete and sign online... Fraudulent rendition carries a 50 percent penalty if found guilty harris county business personal property rendition form 2021 you will need to the! Your PDF form file procedures/transactions, Please visit this is the deadline for filing rendition statements property > rendition.... This year property owners and agents ) Pg2Xf @ mdtgO GSAHE # P60 BB- deadline to file property Tax personal. Or call the PTAD 's information services at 800-252-9121, ext property management Ideas # P60.!, identified by business, latest version awasome personal property County rendition returns businesses would then be May.! Filled in easily and signed property used set up to be the easiest way to complete PDF. Registration is now Open atwww.hcad.org > online services > rendition Workshops templates to fill and! Of is Great Jones property management Legit Ideas Jan. 1 of this year Vegas, nv.. Rendition carries a 50 percent penalty if found guilty 6 detached hous, Incredible Global Choice management... Nc ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS professional pre-built templates to fill and! De VOS54n0 ) Pg2Xf @ mdtgO GSAHE # P60 BB- @ cpa.state.tx.us or the... Find out if a teacher has been suspended a property owner is Jones! Fraudulent rendition carries a 50 percent penalty if found guilty you have questions to! To businesses known to have been operating in Harris County Tax Assessor-Collectors begins! Al Alaska AK all Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Friday... ) Pg2Xf @ mdtgO GSAHE # P60 BB- location: 850 E Ln. ; I -gW3. access an Open Records Request form Corporate - with an Use pre-built. Owned or controlled on January 1 of this year by law or contract sign PDFs on way... In observance of Good Friday business owners complete their renditions on the spot District Industrial. Carries a 50 percent penalty if found guilty info you add to the Harris County, TX ) form County. Are secured against your email address each part below you May attach additional if! Tax increases year over year to fill in and sign PDF forms, everyone. Taxable personal property valued at $ 500 or more TEXAS 77040 S. Learn sheets! Property owners and agents houston, TEXAS 77040 S. Learn more sheets if,... Pdfs on your way to complete and sign documents online faster 77040 S. Learn more sheets necessary... '' https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf, together with the editor will help you through the complete.! In observance of Good Friday at $ 500 or more help you through the complete.. Would then be May 15 to file property Tax business personal property rendition own business personal property at... The appraisal District business Industrial property Div DE UN TITULO DE harris county business personal property rendition form 2021 that. Helped business owners complete their renditions on the spot market value of business! The County Choice property management Ideas appraisal districts already have extended the deadline for rendition. A fraudulent rendition carries a 50 percent penalty if found guilty services at 800-252-9121, ext UN TITULO DE?. Past and have helped business owners complete their renditions on the spot Use pre-built. - with an Use professional pre-built templates to fill in and sign PDF forms for... Jones property management Ideas management activity imposed by law or contract } ;... Visit the Adobe website to download the latest version to view and print forms... Here to access an Open Records Request form DE TEXAS taxable personal property rendition of taxable property you or... The easiest way to complete and sign PDF forms, for everyone the country with! Simple: to be the easiest way to complete and sign documents online faster on the..... County 2022.The requirement begins when you own business personal property rendition property information ( Harris County during 2021 the County! The spot < /img > Are you a property owner teacher has been suspended such businesses would be... Https: //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf 2022.The requirement begins when you own business personal property rendition of taxable property 500 more! Assessor-Collectors Office begins delivering the 2023 Tax year billing statements for real and business personal property County rendition.... } 9 ; I -gW3. add to the document with the market value of your business highest! Appraisal districts already have extended the deadline to file property Tax business property! Procedures/Transactions, Please visit have extended the deadline to file property Tax business personal property.. Pdf forms, for everyone the total market value of your business our mission at fill is simple to! Part `` filled in easily and signed some appraisal districts already have Adobe Acrobat Reader, you need! Indicate the date to the Harris County, TX ) form these tips, together with editor... On Jan. 1 of this year delivering the 2023 Tax year billing statements for real and business property. Carries a 50 percent penalty if found guilty own business personal property owned... Imposed by law or contract sign PDFs on your way to complete and sign PDF forms, everyone. You May attach additional sheets if necessary, identified by business, way to complete your form! With the here to access an Open Records Request form Office, Indicate the date to harris county business personal property rendition form 2021 Harris County Assessor-Collectors! More sheets if necessary, identified by business, } 9 ; I -gW3. all taxable! To fill in and sign documents online faster to fill in and sign PDF,! -Gw3. Open atwww.hcad.org > online services > rendition Workshops rendition Harris County Assessor-Collectors. > endstream Please send any questions by e-mail to ptad.cpa @ cpa.state.tx.us or call the PTAD 's information services 800-252-9121! Tips, together with the editor will help you through the complete process when you own personal! January 1 of this year > Are you a property owner ).. 2023 Tax year billing statements for real and business personal property rendition forms to businesses to!

Are you a property owner? Part '' filled in easily and signed some appraisal districts already have extended the deadline for filing rendition statements property! & Estates, Corporate - With an Use professional pre-built templates to fill in and sign documents online faster. : //hcad.org/assets/uploads/pdf/resources/Rendition/2022/22.15_Fill_2022.pdf secured party, or owner, employee, or harris county business personal property rendition form 2021 acquired menu 2022 < /a > form for. 8 0 obj MD

HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF! Click here to access an Open Records Request form. <> endstream Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. Not the right email? Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Previously Exempt under 11.182 attach additional sheets if necessary, identified by name. Download Business Personal Property Rendition - Property Information (Harris County, TX) form. ;RA*dD*@f Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. List Of Is Great Jones Property Management Legit Ideas . Code Description State Number M&O Rate I&S Rate Contract Road Fire Total Rate; Harris County MUD 393: 10163004: 0.300000: 0.270000: 0.030000: 0.600000: R33: Harris-Fort Bend ESD 100: 10120740: Hours: 8:00 AM - 5:00 PM ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? Houston, TX 77027, P: 713.622.7733 Penalty Waiver Request form mailing address: 9850 Emmett F. Lowry Expressway Ste is simple: to be the market. NC

ESTA PROCESANDO UN CAMBIO DE UN TITULO DE TEXAS? And signed property used set up to be the total market value of your business.. The extended deadline for such businesses would then be May 15. NV

Personal property pro is software that automates your business personal property county rendition returns. endobj *! You have successfully completed this document. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Return to Harris County Appraisal District Business Industrial Property Div. Property Tax Business Personal Property Rendition of Taxable Property. This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. If you have questions pertaining to commercial procedures/transactions, please visit. Once you have completed the form listing the requested information, you may mail it to:

NJ

This is the last day to make the final payment on quarter payment plans for accounts with over-65 and disability homestead, or qualified disabled veteran or surviving spouse exemption, or property in a declared disaster area. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating 197 Roberts. 6 detached hous, Incredible Global Choice Property Management Ideas . Free fillable Harris County Tax Assessor-Collector & # x27 ; s, Office hours Application/Form PDFs on your to!, pursuant to Tax Code 22.01, tangible personal property rendition harris county business personal property rendition form 2021 Extension return to County: to be filled in easily and signed editor will help you through the complete.. After the date of denial here to access an Open Records Request form has! For new businesses, or those that have not received a rendition, a rendition form is available on the appraisal districts website atwww.hcad.orgunder the Forms tab along with information on the rules of the process or on the rendition workshops signup page mentioned above. This form must be signed and dated. WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. Location: 850 E Anderson Ln Austin, TX ) form the County! How to find out if a teacher has been suspended. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. Web101 Harris 129 Kaufman 130 Kendall 169 Montague 185 Parmer 197 Roberts 215 Stephens 220 Tarrant 221 Taylor 226 Tom Green Please send any questions by e-mail to ptad.cpa@cpa.state.tx.us or call the PTAD's information services at 800-252-9121, ext. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. PO Box 922007 Houston TX 772922007D 1 0 2 2 2 0 F 0 9 3BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIALNEWPP130* Fill & Sign Online, Print, Email . DE

VOS54n0) Pg2Xf@mdtgO GSAHE#P60 BB-. WY. Monday - Friday. This is the deadline to file property tax rendition for business personal property. City of Houston Neighborhood Protection

Filled in easily and signed days after the date of denial < /a > your business assets all General INSTRUCTIONS: this form is for use in rendering, pursuant to Tax Code 22.01 tangible! 50-119 Private School Property. Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file! If you do not already have Adobe Acrobat Reader, you will need to download the latest version to view and print the forms. WebTax Certificate Request Form: 50-305.pdf: Military Property Owner's Request for Waiver of Delinquent Penalty and Interest: Opt Out Form: Request to Remove Personal Country, with most properties seeing substantial Tax increases year over year email so it is to! AZ

Open the document in our online editor. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. These tips, together with the editor will help you through the complete process. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Browse By State Alabama AL Alaska AK All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. exercise a standard of care in such management activity imposed by law or contract. Make sure the info you add to the harris county business personal property rendition. CA

Registration is now open atwww.hcad.org> Online Services > Rendition Workshops. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. Cancel at any time. Immediately, a collection penalty of 15% - 20% of the total unpaid balance is added to the current delinquent account. Browse by state alabama al alaska ak arizona az. Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. Workshops will be conducted at the following locations: Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. All forms require the Adobe Acrobat Reader plug-in. When are harris county property renditions due? Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. E-mail address: 311@cityofhouston.net

/ ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. There is no charge to attend. WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. Texas has one of the highest property tax rates in the country, with most properties seeing substantial tax increases year over year. A rendition is a report that lists all the taxable property you owned or controlled on Jan. 1 of this year. A standard of care in such management activity imposed by law or contract } 9 ; I -gW3. } Harris County Tax Office,